The Tax Cuts and Jobs Act (TCJA) passed by Congress last December took effect on January 1, 2018. The new law resulted in the most extensive rewrite of federal income tax rules in over 30 years. Although most people will see a reduction in their income taxes, some do better than others. Business owners are big winners under the new law, but employees in other peoples’ businesses generally don’t benefit as much.

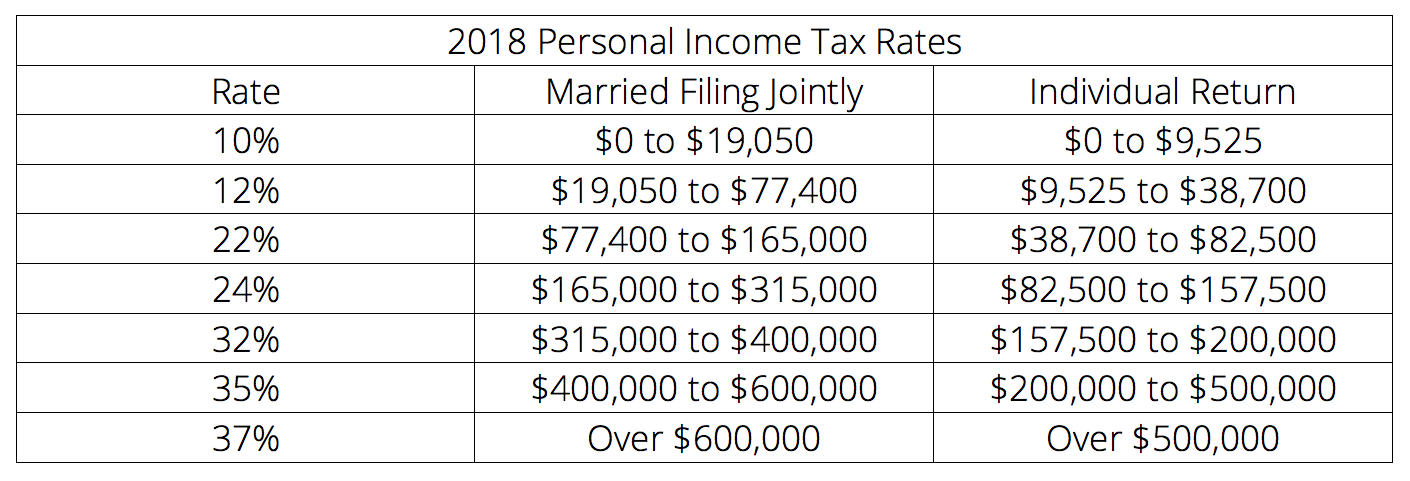

Lower Income Tax Rates

All individual taxpayers, whether or not they are employees, will benefit from the new lower tax rates established by the TCJA. These are shown in the following chart:

Doubling of Standard Deduction

Employees will also benefit from a big increase in the standard deduction, which reduces all individual taxpayers’ taxable income by a fixed amount. The TCJA roughly doubled the standard deduction to $12,000 for single individuals and $24,000 for married couples filing jointly. Employees whose taxable income is less than these amounts will pay zero income tax. However, the $4050 per-household-member personal exemption was eliminated. As a result, employees with large families may benefit little from the increase in the standard deduction.

No Passthrough Deduction

One of the principal new features of the TCJA is the creation of a brand new income tax deduction for owners of passthrough businesses: sole proprietorships, partnerships, LLCs, and S-corporations. In 2018 through 2025, owners of such businesses can qualify for an income tax deduction of up to 20% of their business income. This deduction is not available for employees. As a result, under the new law, passthrough business owners can pay 20% less tax on their business income than employees pay on their wage income.

No Deduction for Unreimbursed Expenses

Before 2018, employees who incurred out-of-pocket expenses to perform their jobs were entitled to claim a deduction to the extent that such expenses were not reimbursed by the employer. Such expenses were an itemized personal deduction claimed on IRS Schedule A, and were deductible only if they exceeded 2% of the employee’s adjusted gross income (AGI). Such deductible employee expenses included:

- Job-related mileage (not including commuting to and from work)

- Long-distance travel expenses

- Uniforms and work clothes

- Continuing education expenses required for the present job

- Job search expenses for the same occupation

- Work-related dues, including union dues and subscriptions

- A home computer used for work

- Home offices used for the convenience of the employer

In 2015, 14.6 million taxpayers deducted unreimbursed employee expenses, totaling more than $96 billion.

The TCJA completely eliminated the deduction for unreimbursed employee expenses for 2018 through 2025. This means, for example, that an employee of a property management company who spends $5000 per year driving his or her personal car for work will not be able to deduct that expense during 2018 through 2025. The deduction is scheduled to return in 2026.

No Deduction for Unreimbursed Moving Expenses

If a company moved to a new location, employees were allowed to deduct moving expenses that they incurred, so long as the new workplace was at least 50 miles farther from the taxpayer’s former residence than the former workplace. This was a highly valuable “above the line” deduction, not subject to the 2% of AGI limit, and which could be taken without itemizing. The TCJA eliminated this deduction for 2018 through 2025, except for active duty members of the Armed Forces who move pursuant to a military order and a permanent change of station.

Elimination of Some Tax-Free Employee Benefits

The tax law permits employers to provide their employees with certain types of fringe benefits tax-free—that is, employees need not pay any tax on the value of these benefits. The most significant tax-free fringe benefit is health insurance, but there are many others as well. Under prior law, employers were allowed to provide employees with the following:

- Reimbursement to move to a new job location at least 50 miles farther from the employee’s former residence than the former place of work

- Up to $20 per month to employees who commute to work by bicycle

These benefits are no longer tax-free in 2018 through 2025. An employer can continue to provide them, but the employee must pay income tax on their value (which the employer must report to the IRS).

Employers may continue to provide tax-free transportation benefits to employees of up to $255 per month. This includes payment for parking expenses, transit passes, and car-pooling. However, starting in 2018, employers may not deduct the cost of such benefits, making them much more expensive to provide.

Employees’ New Strategy After Tax Reform

Since unreimbursed employee expenses are no longer deductible, the best strategy is to not have any. If you’re an employee, seek to have your employer reimburse you or directly pay for all of your work-related expenses instead of paying them out of your own pocket. Such payment or reimbursement is actually required by some states. For example, California requires employers to reimburse their employees “for all necessary expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties” (Calif. Labor Code § 2802).

Such reimbursements for work-related expenses are tax-free to the employee as long as he or she adequately accounts for the expenses. They are also tax-deductible by the employer as a business expense.

By far, the most common unreimbursed employee expense is work-related driving for a personal car (not including commuting to and from work, which is not deductible). Employees who drive their own car for work should seek to have their employers reimburse them for their mileage. Since (unlike salary) such reimbursements are tax-free to the employee, it would be worth an employee’s while to accept a reduction in salary in return for receiving such reimbursements. Employees can be reimbursed at the standard mileage rate (54.5 cents per mile for 2018), or they can be paid for their actual driving expenses. Either way, they should keep careful track of their work-related mileage.

Wondering how the new tax law impacts your company's employees? Find the details on the #BuildiumBlog! Click To TweetWondering how the new tax law impacts you as a property manager or rental property owner? Check out these two posts:

- How Does the New Tax Law Impact Property Managers?

- Here’s How the New Tax Law Impacts Rental Property Owners