When most people think of rental scams, they picture the prospective tenant as the victim. Property managers, however, are vulnerable to scams, as well.

Chart of Accounts

Want clearer, cleaner books? What about a more useful view into your properties or just easier accounting in general?

Get the GuideIn this article, we’ll explore three common rental scams that target property managers and owners and give you the tools you need to protect yourself, and your owners.

3 Common Rental Scams to Look Out For

Protecting yourself against rental scams starts with knowing what behavior look out for from potential scammers. As a property manager, here are three common scams that should be on your radar.

1) False Refunds Scam

In this scam, an individual will send you more funds than they owe using a fraudulent cashier’s check or money order. Then, they will reach out to you asking for a refund, usually before the bank has a chance to realize that the check is a fake. Usually, the individual will claim that their bank made a mistake with the payment amount.

Rather than issue a refund, the better thing to do is stop payment on the original check, notify the individual that you have done so and ask for funds in the correct amount. Then, notify the bank that the original payment may be fraudulent.

If you do issue a refund, it’s unlikely that you’ll never hear from the individual again, especially if the transaction was for an application fee, security deposit, or similar upfront charge before becoming a resident.

Making online payments the norm for your business can help you avoid these scams in the first place.

2) Smoke and Mirrors Scam

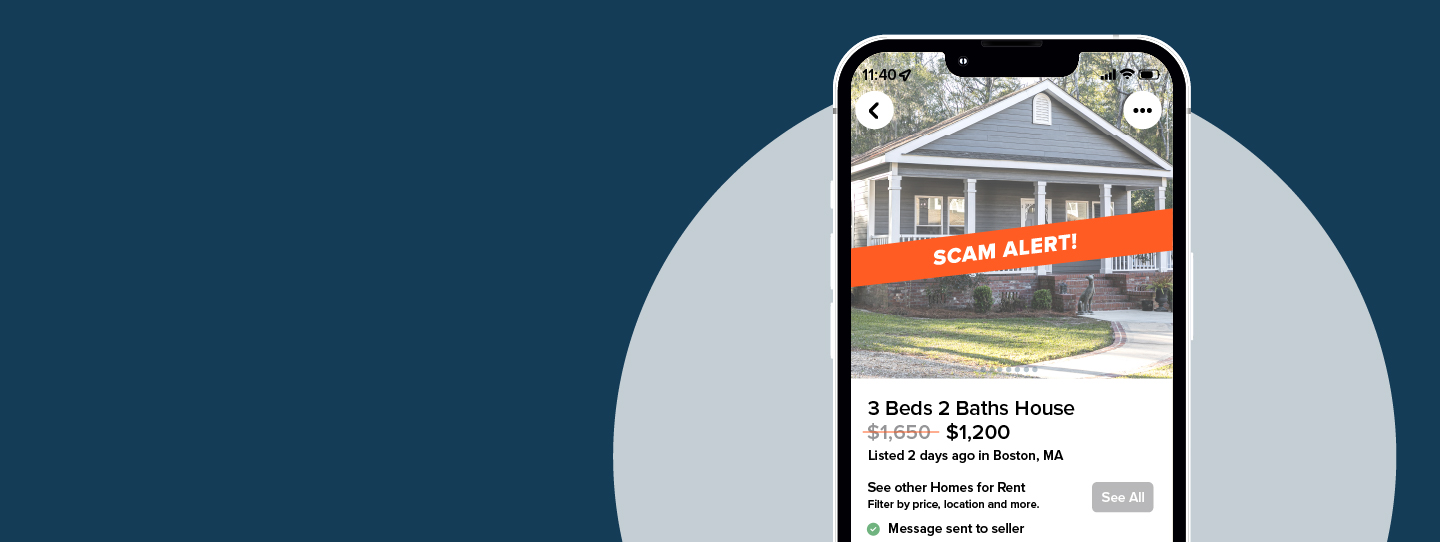

This type of scam occurs when the scammer duplicates a listing that they found online and lists it for a much lower price. Their goal is to use the duplicate listing to scam renters into handing over the funds for the security deposit and other fees.

If one of your listings gets used in a scam like this, you could get caught up in the mess. Your original listing could also be flagged as suspicious and taken down. If it escalates, your account on that listing site could even be suspended.

In this case, the best defense is watermarking your photos so they cannot be used by would-be-scammers.

3) Lawsuit Scam

As the name suggests, lawsuit scams occur when a resident comes up with a fake reason to sue the property management company. Typically, these suits are thrown out. That can take months, however, and, in the meantime, the property management company is often not allowed to evict the resident, which allows them to live in the property rent free.

While it can be hard to imagine all of the reasons that people can come up with for a lawsuit, it’s best to try and keep the properties you manage in good shape. Often, these lawsuits are over health and safety concerns like mold or an unsafe stairways. The better shape your property is in, the harder it will be to prove injury.

A thorough and efficient tenant screening process can help you find and build strong relationships with trustworthy renters who won’t have ulterior motives when moving into your property.

6 Ways to Give Renters Peace of Mind Against Rental Scams

Now that you’re aware of some of the more common scams out there, it’s time to take steps to protect your residents. After all, they’re relying on you to provide them with a worry-free renting experience. Being able to list their property without getting scammed is part of that.

1) Write Great Listings

Believe it or not, this process starts with writing top-notch listings. Too often, scammers’ descriptions are riddled with errors that are easy to spot. Renters are also trained to look for those errors as red flags for a potential scam. Having polished listings with well-written descriptions will signal to potential residents that your company is legitimate.

2) Have a Thorough Tenant Screening Process

Next, it’s important to have a thorough tenant screening process and to stick with it for every applicant. Most scammers won’t want to jump through the hoops of getting on a pre-screening phone call or undergoing a credit or background check.

With that in mind, following specific screening procedures is a great way to weed out anyone who is not genuinely interested in renting the property and to prove legitimacy to those that are.

The screening process shouldn’t always end once renters have moved in. It’s good practice to conduct minor, non-intrusive renewal screenings in between lease terms to discover any red flags or issues that might have popped up over the course of their lease.

3) Securely Collect Security Deposits

Handing over the money for a security deposit is one of the most nerve-wracking parts of being a tenant. Instead of having your renters send you checks in the mail, consider using a third-party application like Obligo. It frees you from worrying about managing security deposits while giving renters peace of mind knowing that their money is protected.

Technology is important, but should be part of a larger security deposit process to keep transactions transparent and compliant with local laws.

4) Educate Your Owners and Your Team

Often, knowing how to protect yourself against scams starts with education. Take the time to educate yourself and your staff on the red flags that usually come along with common rental scams. Once everyone has the same knowledge base, they’ll be able to keep a watchful eye out for potential scammers.

Share that knowledge and the tools you have in place with owners to reassure them that their properties are well-managed and protected around the clock.

5) Maintain Proper Insurance Coverage

Almost every business needs errors and omissions (E&O) insurance to protect them in the event of a lawsuit. Property management is no different. If you ever get sued, you want to have that security on your side. It’s a good idea to call your provider and see what your current policy covers so that you can be sure you’re well protected..

6) Use the Right Technology

Finally, scams usually happen when proper application and leasing processes—such as tenant screening—aren’t air-tight. If your team is stretched thin, it’s even easier for things to fall through the cracks. Property management software can automate certain procedures and give you an easy-to-access record of interactions with renters, so you can spot any red flags early on, and avoid most of them entirely.

The bottom line on protecting against rental scams

Dealing with rental scams is an unfortunate reality of working in property management. However, if you take the time to educate yourself on these scams and take the right steps to prevent them, you can minimize their impact on your day-to-day operations. Use the information above as a guide to help you get started. Armed with this knowledge, you should have a much better understanding of how to keep your properties and your residents safe.

Read more on Legal Considerations