We’ve all heard it more times than we can count. Since the early days of the pandemic, online payments for everything have taken over, and they’re not going away. Americans now expect to pay for everything online—including their rent.

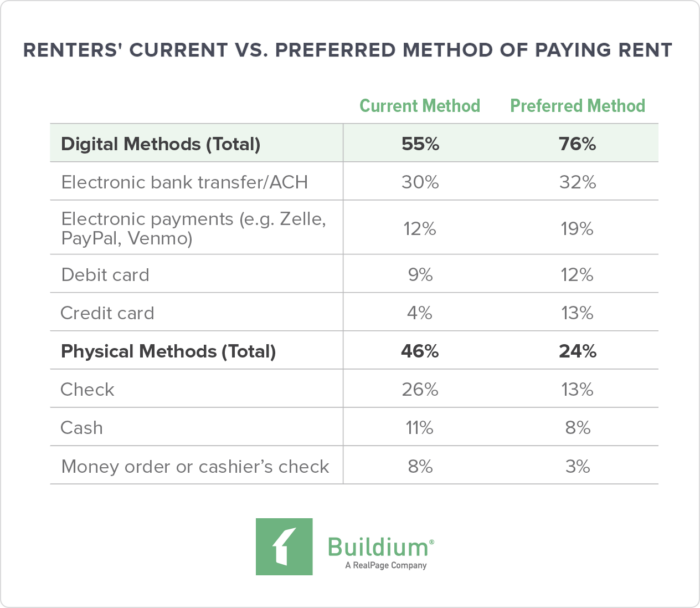

In fact, 76% of tenants—across a full spectrum of regions and demographics—prefer to make rent payments online. That number has grown 26 percentage points since 2021. And yet, based on the 2023 Property Management Industry Report, only 55% of renters are currently able to make payments digitally.

Property management companies and landlords that address that gap have a lot to gain, from attracting more tenants to reducing late rent payments to saving massive amounts of admin time and unlocking new, recurring revenue streams.

This guide (and the video below) will define the features in online rent payment systems that offer property managers and landlords the most benefit. We’ll also compare the leading solutions on the market to help you find the best rent payment app for your business.

Why Online Rent Collection Is an Absolute Must

In many ways, online rent collection is already the norm, as reflected in the attitudes of both renters and owners.

For example, in 2023, 95% of rental owners we surveyed reported being comfortable doing business online. That figure is likely to grow over the coming years.

Let’s take a look at the specific reasons why property managers and landlords are turning to rent payment apps.

If you’re already convinced, jump right to our list of the top online rent payment systems.

Online Rent Payments Are What Renters Want

The convenience of using a mobile app or online portal and the ability to set up autopay are becoming table stakes for property managers hoping to compete in an evolving industry. But, these basic features are far from the only benefits tenants expect.

The best rent payment apps will let you send payment reminders before they’re due, on the due date, and after deadlines have passed. That keeps you and your residents on the same page and helps you give the right nudge when needed. Tenants can track their online payments easily and see when you received their rent.

A digital record can help tenants build credit over time, as well. Recently, companies have rolled out a variety of rent reporting tools that renters can opt into and link a renter’s online payment history to their credit record, so they can improve their credit by paying rent on time consistently.

Other rent collection apps, such as Gravy, give renters even more incentive to make on-time payments, with perks like 5% back on rent each month. More on those solutions in the review section of this post.

An online rent payment system also allows you to give your tenants greater flexibility in how they make payments, so that they’re less likely to miss a payment. For example, with an online payment portal, you can set up alternative payment schedules, whether that’s different deadlines, multiple installments throughout the month, or any other arrangement that makes sense for a tenant’s situation.

It Saves Property Managers Time

Online rent collection software eliminates the need for physical checks, trips to the bank, or any other time-consuming manual processes. Property managers can simply set up an online rent collection system and tenants can pay their rent through a secure online platform using their credit or debit card, bank account, or other electronic payment methods.

“We stopped taking rent payments and applications in our office and do it all electronically, and this has saved us so much time. We now can focus on relationships and have found that we are attracting better long-term clients and tenants.” (Real estate broker in Grand Junction, CO—2023 Industry Report)

Using a rent payment app allows you to connect your payment tools with your accounting system, as well. That makes it easier to keep accurate records of all your payments in the context of your broader business and property finances, which can be useful for tax purposes, lease renewals, and other administrative tasks.

Storing all rental payments online has the added benefit of better overall transparency. Both property managers and owners can access real-time financial data and easily monitor rent payments. You can identify delinquencies early on and have a full digital record at the ready to support any action the situation calls for.

Automated EFT allows us to save time from processing monthly rent payments, then taking the trip to the bank for deposit, and then confirming several days later that the payments have been posted or if they have been returned due to [insufficient funds]. ePay takes all these worries away. (Office Manager in New York, NY,—2023 Industry Report)

Property managers are even able to generate new revenue streams by using online payments. By setting up a credit card payment option, they can charge a small convenience fee (just make sure it’s allowed in your state). They can also offer tenants new payment-related services, such as an alternative to security deposits or a payment guarantee to owners.

The Best Rent Payment App: Features to Look For

Knowing the top features to look for in a rent payment app starts with spotting the methods that tenants favor when making payments.

Here’s a breakdown of how renters currently pay rent and how they would prefer to, according to our Industry Report:

The industry research highlights a clear gap between current and preferred rent payment methods: 76% of renters prefer digital options, yet only 55% use them, with physical payments still accounting for 46% of our survey responses. Landlords and property managers should prioritize digital payment systems to align with tenant preferences and streamline operations.

Choosing the payment methods you want to support comes down to your comfort level and your budget…Be aware that many third-party apps charge service fees on each transaction and may not offer adequate protection against making payments to the wrong account.

There are pros and cons to accepting each kind of payment—a topic you can explore in more detail here—but, in general, a platform that lets you support multiple payment methods using a single piece of rent collection software is the ideal option for most businesses.

The must-have features of that software include:

Security

If there’s any feature you shouldn’t compromise on, it’s security. As a property manager, you’re handling sensitive financial information for your tenants, your clients, and your own business. There’s no room for error when it comes to protecting your payment processes.

Despite the hesitation you might have about handling payments entirely online, the best payment software is secure, and actually can be a safer alternative to manual methods. With digital payments you eliminate the chance of a lost or stolen check and have a digital record of each transaction.

Be sure that the software you’re considering has a clearly outlined security policy that prioritizes the safety of sensitive payment information.

Mobile Payments

There’s no greater convenience than being able to handle important, time-sensitive transactions from anywhere. In your search for the best online payment app, look for a secure solution that features a mobile app or, at the very least, a mobile-friendly payment feature through a browser.

A mobile app is ideal. It gives residents a more complete experience and can often feel more professional and be more secure than making payments through a third-party browser. The convenience of a mobile is also a two-way street. Tenants can make and track payments on the go and you can check on a unit’s rent status and send reminders in a timely manner. Speaking of reminders…

Automated Rent Payments and Due Date Reminders

Automated reminders are one of the most surefire ways to increase on-time payments without spending additional time monitoring each of your leases. Combined with push notifications made possible in a mobile app, you’ll be able to communicate directly with your tenants in a way that feels helpful instead of intrusive.

Most rental payment software includes an option to set up automatic payments, as well, which makes it even easier for your tenants to avoid missing a due date. With many systems you can send auto-notifications to tenants that confirm that their payment has been received and processed.

Flexible Payment Plans and Other Incentives

You should be able to customize due dates and amounts as you see fit in a way that’s clear to both the tenant and your team.

You can take that customization a step further with tools that let you set up a rewards program or help residents build stronger credit through online rent reporting, which allows residents to opt into their rent payments being reported to the major credit bureaus. Look for features that are easy to set up, come at low or no cost to you, and provide real value to tenants. Depending on the state you live in, you may even be able to charge a small fee and gain some additional recurring revenue.

Integration with Your Accounting Software

You’ll want the online payment tools you use to integrate seamlessly with your accounting software. Aside from saving you time moving records over manually, this will also reduce the chance of bookkeeping errors and ensure that your revenue is air-tight come tax season.

Having your numbers automatically stored in one place also means that you’ll be able to share accurate reports with owners and identify exactly where your revenue is coming from and how it contributes to your bottom line.

Integration with Tenant Communication Tools

Just like with your accounting software, it pays to consolidate your tenant communications into one platform. A portal that your tenants can access to not only reach out to you and request services, but also make a payment and receive important reminders about their rent and lease makes life easier for everyone.

A resident center connected directly to your rent payment system cuts down on the number of text and email exchanges you need to engage in and speeds up response times. You can simply share updates through the portal and tenants can check the status of payments at their convenience.

But if you do need to send out texts for late payments, let’s say, you should be able to do that, too. Bulk texting to multiple recipients and tracking are also must-have features.

How the Software Processes Payments

While many online payment solutions rely on a third party to facilitate online payments made through their platforms, other solutions—such as Buildium®—act as their own payment facilitator (payfac). This creates a more smooth and consistent experience for your team, especially with onboarding. Additionally, you can work directly with your software provider to address limit violations and increase requests, chargebacks, funding holds, and other changes to your account—avoiding the hassle of resolving payment issues through an unreliable third party.

Support for Other Apps

Once you’ve checked the boxes for the features above, determine if the software you’re considering gives you the option to add on other tools and apps over time. A platform of fully integrated apps, such as Buildium’s Marketplace, will help you accomplish more in a single dashboard, for example. To keep up with changing renter expectations, you may want to introduce tools for providing security deposit alternatives or fine-tuning your payment system for associations or a particular portfolio type.

A rent payment system with an open API or, better yet, one that comes included in comprehensive property management software, gives you the flexibility to stay competitive with your service offerings and meet the changing needs of your business.

The 8 Best Online Rent Payment Systems

You’ve learned the benefits of online rent collection. You know what to look for in an effective rent payment app. Now, let’s look at the leading software solutions and how their online rent payment features stack up.

We’ve included our top picks for different categories, along with details on features and pricing to help start you on your search.

1. Buildium

Leading Rent Payment App Capabilities Combined with All-Around Property Management

Buildium is a comprehensive property management software solution, serving multiple portfolio types, including single and multifamily residential properties and associations.

Buildium’s online rent payment system is one of the most robust on the market, offering secure, automated rent collection that integrates seamlessly with its accounting tools. . The software does the heavy lifting at every step of the lead-to-lease cycle, helping landlords and property managers simplify rent tracking, reduce late payments, and automate financial workflows. The Resident Center app allows tenants to make rent payments with just a few taps and includes autopay features with support for multiple payments options, such as credit, debit, and ACH.

But Buildium doesn’t stop at rent collection – it’s a comprehensive property management software solution, serving multiple portfolio types, including single and multifamily residential properties and associations. It handles everything from lead-to-lease workflows, maintenance tracking, analytics, and more. This makes it the ideal choice for property managers who need a fully integrated platform.

Features

Buildium has an array of features that cover both rent collection and broader property management tasks, including:

- Lead-to-lease tools that streamline your workflow from accepting applicants all the way to signing the lease.

- Free website creator and listing syndication to market your listings.

- Automated electronic payments and accounting including 1099 eFiling.

- Analytics and insights tools to measure and report your business growth.

- Tenant and owner portals with online payment, maintenance reporting and tracking, and notification capabilities.

- Top-rated mobile apps (for both your team and your tenants) that allow you to communicate with your renters, manage work orders, and collect payments.

If Buildium doesn’t have a tool you need, one of their Marketplace partners almost likely does. The Marketplace is an ecosystem of apps and digital services that integrate seamlessly with your Buildium account. This sampling of popular partner solutions allows you to:

- Offer incentives for on-time payments

- Streamline collections for HOAs and condo associations

- Get direct survey feedback from your residents

- Easily manage deposits and set up deposit-free alternatives

Pricing

Buildium offers three tiers of pricing, each tailored to different business needs. Each of these plans include core property management and rent payment features such as:

- Online Rent Payment System

- Complete Lead-To-Lease Management

- Accounting

- Maintenance

- Task Management

- Online Portals

- Resident Communications

The pricing tiers scale with your business, depending on the size of your needs.

- Essential: Starts at $58/month and includes Buildium’s core features, including accounting and task management tools.

- Growth: Starts at $183/month and includes reduced incoming ACH fees, unlimited eSignatures, and actionable insights in Analytics Hub.

- Premium: Starts at $375/month for property managers who want to automate their workflows. It includes everything in Growth, unlimited incoming ACH (fees waived), plus access to Buildum’s Open API and Priority Support.

Buildium includes two mobile rent payment apps, one for property managers and Resident Center, a separate app where tenants can make rent payments, maintenance requests and more, available on the Apple App Store and Google Play.

2. Propertyware

A Secure, Highly-Customizable Online Rent Payment System

Propertyware® is a fully customizable property management tool designed by property managers specifically to meet the unique needs of the industry. Its platform supports some of the industry’s largest and most successful property management companies, and it’s backed by the security of RealPage, which processes more than $11 billion in payments annually.

Propertyware allows property managers to control every aspect of how they manage their properties and run their business.

Features

With Propertyware’s online payment system, you can:

- Pay rent from anywhere via credit or debit card, e-check or ACH, and even cash using its RentMoney service, reducing processing time by up to 42%

- Enable check scanning, which automatically matches to your tenants and validates checks digitally

- Automate alerts to remind tenants when their monthly rent is due

- Integrate your payment system with owner and renter portals, with real-time visibility from anywhere

Propertyware makes it easy to create custom fields, dashboards, and reports. It also features a two-way open API, which allows property management companies to integrate other property management apps or even build their own and connect it to Propertyware.

This customization is built on a suite of tools that automate accounting, maintenance, lead-to-lease, multi-location management. It also includes owner and resident insurance.

Pricing

Propertyware has three pricing tiers:

- Basic starts at $1 per unit per month, with a $250 minimum

- Plus starts at $1.50, with a $350 minimum

- Premium starts at $2 with a $450 minimum

All plans charge 2x the monthly subscription price for implementation.

Propertyware includes a mobile app available on the Apple App Store and Google Play with online rent payment functionality.

3. PayYourRent

Software with Primarily Rent Collection Features

If you’re looking for software that’s mostly focused on online rent payments, without other property management features attached, PayYourRent® can be an effective choice.

PayYourRent is designed to improve the rent payment process and takes a mobile-first approach with an app that comes equipped with all the software’s major features.

Features

The full PayYourRent software features include:

- Online rent payments via ACH or credit card with a zero-day hold

- Payment accounting to reconcile deposit batches

- Integration with other accounting software

- Announcement and notification features

- A dashboard to track the status of payments for all your properties

- Rent reporting with Equifax, Experian, and TransUnion

While the software’s primary focus is on rent collection, additional property management features such as maintenance requests, tenant screening, and rental applications are available as part of each pricing plan.

Pricing

PayYourRent’s pricing is broken down into three pricing plans based on the number of units in your portfolio.

The Rental Plan is $9.95 per month and covers up to five units with one ACH transaction included per month.

The Landlord Plan is $19.95 per month and covers up to 50 units. Under the plan, you’ll have access to 10 ACH transactions each month.

The Corporate Plan is the highest tier for 50 or more units, with a rate that’s determined on a case-by-case basis. ACH fees vary for this plan.

Beyond each plan’s allotted ACH transactions, you’ll have to pay an additional $2.50 per ACH payment. Credit card payments are paid for by residents.

PayYourRent includes a mobile app available on the Apple App Store and Google Play for online rent payments.

4. TenantCloud

Online Rent Payments with à la Carte Features

If you want to start with some basic property management features with some add-on options, TenantCloud® might be a good fit. It’s another app with an approach that can benefit smaller property managers that aren’t quite looking for some of the more comprehensive packages on this list right out of the gate.

Features

TenantCloud includes some standard property management software features, including leasing tools, listing management, maintenance and vendor network services, and screenings. You have access to automatic payments and online debit and credit card rent collection.

You’ll have to upgrade to more expensive plans if you want to support these features with more robust accounting tools such as tax report creation and the ability to sync with Quickbooks. You’ll also need a higher-level plan if you want to set up ACH payments, something that’s available in starting plans of other solutions such as Buildium.

What makes TenantCloud slightly different is its à la carte options that you can add onto your plan:

- Roommates: Roommates is a feature that allows you to screen, approve, and generate a lease for each roommate. Once they’re moved in, you can accept payments for each roommate’s portion of the rent. There’s no additional fee listed for this service.

- Rentability Report: Landlords can compare listings similar to their own and look at rent trends in their market to determine just how much they should charge to stay competitive. Each report costs $19.95.

- Rent Reporting: Tenants can turn on rent reporting for any lease and every payment will be added to their credit report within 30 days. The service costs $6.95 per lease per month, which can be slightly more than some other solutions, depending on how you use the feature (Buildium, for example, charges $4.99 per month per resident).

Pricing

TenantCloud is available in four pricing tiers: Starter, Growth, Pro, and Business.

The Starter plan is $15.60/month and includes features such as lead gen and lead tracking, e-signature, and accounting reports.

The Growth plan costs $29.30 per month and includes more sophisticated tools for creating and storing leases and other landlord forms, lead tracking CRM and access to owner portals and property message boards.

The Pro plan, costs $50.40 per month is the most popular option and adds in tax reports, application customizations, Google calendar sync, syncing with Quickbooks, and vendor network management.

The highest tier Business plan is customized to meet specific clients’ needs and includes team and task management tools, and auto-refresh for listings.

The Starter, Growth, and Pro plans allow for 10, 15, and 20 lead text responses per month, respectively. TenantCloud’s more expensive plan includes a custom number of text at “volume pricing.”

Ticketing support is accessible through the Starter plan, while phone support is only offered in the Pro plan.

TenantCloud includes a mobile app available on the Apple App Store and Google Play with online rent payment functionality

5. RentRedi

A Stripped-Down Rent Payment App Focused on Tenants

RentRedi® is similar to TenantCloud in that it offers several leasing and online rent collection features.

The platform focuses on providing the tools and incentives for your tenants to pay their rent on time, with some added features to help you find and keep quality tenants.

Features

RentRedi’s software is built around a core set of features for rent payments. These include:

- Support for several payment methods, including cash, credit, debit, ACH or ACH-only payment options

- The option for tenants to deposit cash at over 90,000 designated retail locations

- Auto-pay to collect mobile payments on-time

- Flexible payment plans, such as partial or block payments

- Access to unlimited payment account connections & reports

- 4 to 5 days to processing on most payments

RentRedi also includes property management tools to support the rest of the lease lifecycle:

- Maintenance request and coordination

- Listing and marketing tools

- Tenant screening and applications

- Teammate accounts and tenant push notifications

If you’re looking for more comprehensive communication portals or an accounting system to manage your entire business, however, this software might not be the best fit. Larger property management companies or businesses with diverse portfolios might need a broader set of features.

Pricing

RentRedi offers a simple pricing structure. There’s a monthly pay-as-you-go option priced at $29.95 per month. You can opt for a recurring 6-month plan that breaks down to $19.50 a month, or you can choose an annual plan for $12 a month.

RentRedi includes a mobile app available on the Apple App Store and Google Play with online rent payment functionality.

6. Rentec Direct

Online Payments Backed by Accounting Features

Rentec Direct® offers a property management solution with a focus on accounting, work order and vendor management, and listing tools. The software can be useful to businesses of various sizes, from individual landlords to large property management companies.

If accounting is your priority (instead of a broader set of property management features) this option may be worth exploring.

Features

Rentec Direct’s most useful set of features are geared toward accounting. Users can track and manage their portfolio from the platform, import data into Quickbooks, and choose from a selection of reports to share with owners. You can set up general ledger and trust accounts to keep your books in order and sync transactions between Rentec Direct and your bank.

This accounting system also connects to payment tools that include the ability to:

- Set up both one-time and recurring, automatic payments by credit card, debit card, or ACH (credit and debit cards have a 2.95% transaction fee)

- Pay rent through a dedicated tenant portal

- Set full or partial payment schedules for tenants

- Create multiple merchant accounts to stay organized

- Have same-day access to payments, depending on your bank

- Offer tenants rent reporting through a RentReporters partner integration

Aside from accounting and payment features, you’ll also have access to an owner portal, a work order management and vendor payment system and leasing features such as listing syndication, electronic signatures, tenant screening, lead tracking, and a website to help market your company.

Pricing

Rentec Direct has two pricing plans, Rentec Pro for landlords and investors and Rentec PM for property managers. Both are based on the number of units managed.

The base price for less than 10 units is $45 per month, or $41 if you choose an annual subscription. You can use the price calculator on their site to determine the cost of a subscription based on the number of units you enter.

Rentec Direct includes a mobile app available on the Apple App Store and Google Play with online rent payment functionality.

7. PayHOA

Specialized Software for Association Payments

PayHOA® is a cloud-based software built specifically for association management. The tools included in the platform solution help with the essential operations for HOAs, condos, and other residential associations. With automated fee collection and secure payment options, PayHOA makes it easy for community managers to collect dues and other fees directly from homeowners. The platform supports multiple payment methods, including ACH and credit cards, and offers autopay features to reduce late payments and simplify fee tracking.

PayHOA only covers community managers with 500 doors or less, so it won’t be a good fit for businesses with larger portfolios. If you’re focused on growing your portfolio or expanding beyond community associations, another option on this list might be a better choice.

Features

The PayHOA dashboard lets you track most of the activities within an association to stay on top of maintenance requests, board, homeowner, and tenant communication, and association finances.

The dashboard also connects to an effective online payment system, so you can:

- Collect digital payments by ACH or credit card securely

- Set up autopay that owners can enroll in

- Sync payments directly to your ledger and a fully-integrated accounting system

- Route paper checks to PayHOA processing centers to be deposited electronically

- Create professional invoices that PayHOA will print and mail through USPS

Pricing

PayHOA plans are priced by number of units starting at $49 per month for up to 25 units and capping a

The highest pricing tier is t $249 per month for 401-500 units, so, i you have a larger HOA management business, PayHOA may not be the right fit. In addition, there are charges to process credit card transactions (3.25% plus 50 cents) and eChecks ($1.95 per check).

PayHOA does not include a mobile app for online rent payments.

8.eRentPayment

A Basic Option for a Low Price

With eRentPayment®, you can set up an online rent payment system at a low cost and still provide tenants with payment flexibility and some of the features that other software on this list offers.

Features

eRentPayment includes several rent collection features for property managers with various-sized portfolios, such as:

- Automatic late fees

- Rent reporting

- Payment notifications and late payment reminders

- The ability to block out partial payment and set up recurring payments

- Invoice management and separate accounts for security deposits and applications

- Payment history tracking and built-in reports

In addition to online payment features, you can conduct tenant screenings for an additional $30.

eRentPayment does not include a mobile app for online rent payments.

Pricing

With eRentPayment you can select one of two pricing options. The Standard plan is $3 per transaction and is limited to 3 transactions per month.

The more common (and recommended) Plus plan is $10 per month for the first five transactions, and then $1 for each additional transaction. With both plans there are no set-up or activation fees.

Find the Best Rent Payment App for You

Choosing the best online rent payment system can take trial and error. At first, you might be tempted to use a general payment app, like Zelle® or Venmo®, but hopefully, with this guide in hand, you’ll be able to see the clear benefits that a tool designed specifically for online rent collection can offer your business.

When connected with a full suite of property management software, those benefits only multiply. But you don’t have to take our word for it. Many of the apps we covered above offer a demo or trial period so you can test out the tools for yourself.

At Buildium, we offer a free 14-day trial with no credit card required. It’s a no-risk next step toward finding the best possible solution for your tenants and your business.

Frequently Asked Questions

What features should I look for in a rent payment app?

Look for apps that support various payment methods like ACH transfers, credit/debit cards, and digital wallets. It’s helpful if the app provides a user-friendly interface, automated payment reminders, and clear reporting tools. Integrations with accounting software can also save you time. Buildium is one example of comprehensive property management software that connects in-app payments to other important property management workflows.

Are rent payment apps secure?

Most rent payment apps use advanced encryption and secure servers to protect your data. However, always take the extra step to confirm the app that you’re considering prioritizes safety with strong security measures. Read reviews to see if other property managers have had positive experiences.

How do rent payment apps handle late fees?

Many apps allow you to set up automatic late fees, which can be charged if a tenant misses the payment deadline. This feature simplifies the process and means you don’t have to handle late fees manually.

Can tenants set up automatic payments?

Yes, most rent payment apps offer the option for tenants to set up automatic payments. This helps reduce late payments and saves your tenants the hassle of remembering due dates.

How do I track payments and generate reports?

The best rent payment apps include built-in reporting tools that help you track payments, generate financial reports, and view transaction histories. These tools simplify your bookkeeping and make it easier to manage your properties efficiently.

Can I use rent payment apps for multiple properties?

Yes! Many apps are designed to handle multiple properties and tenants, making it easy to manage all your rent payments in one place. Look for apps that offer scalable solutions to grow with your portfolio.