According to the most recent report from the National Multifamily Housing Council, 92% of renters pay their rent on time, and yet, for most renters, those on-time payments aren’t reflected in their credit score.

Rent is the largest payment that millions of Americans make each month. What if you can offer residents a way to report that rent, unlocking the door not only better credit, but also a better quality of life?

In this post, we’ll walk through how to do just that, and show how rent reporting tools can give property managers a competitive edge, not to mention new sources of revenue.

What Are Rent Reporting Services?

Put simply, rent reporting is a service that reports a resident’s rent payment activity to credit bureaus in order to affect the resident’s creditworthiness and credit score. Rent reporting tools typically capture and report rental payment habits to the “big three” credit agencies: TransUnion, Experian, and Equifax.

Rent reporting has steadily gained traction over the past few years. California even passed a bill that requires landlords of multifamily properties that receive local, state, or federal subsidies to report their residents’ rent payments.

Rent reporting offers a powerful incentive to make payments on time. The boost to their credit score over time opens the door to lower interest rates, better standing when applying for larger purchases, and all-around greater financial freedom.

On top of that, rent reporting services such as the one offered by Buildium only report on-time payment activity, so tenants won’t have to worry about late or missed payments negatively affecting their credit. Property managers benefit from that consistency and can meaningfully recognize good financial habits without putting residents at risk if they’re struggling with a particular payment.

A handful of startups have also begun developing stand-alone solutions to report rent directly, but few of the tools out there actually integrate rent reporting with the rest of the renting experience, effectively making reporting automatic. This can make it difficult for property management companies to offer the service as a benefit to their residents.

Luckily, there are already services out there that come integrated with existing property management software, so that both property managers and residents can start using the feature quickly, with less of a learning curve.

4 Ways Rent Reporting Services Benefit Tenants

Fundamentally, rent reporting is a service that can improve your tenants lives and financial prospects by rewarding the habits they likely already have. Here are some of the major benefits renters can expect:

#1: It Can Boost Credit Scores in a Short Amount of Time

Rent reporting can benefit residents years and even decades into the future. Reporting on-time rent payments consistently can potentially boost credit scores by 60 points in 24 months. A credit boost opens the door to all kinds of opportunities, from easier approval for credit cards, to more favorable loans for vehicles, to greater access to housing options at lower rates.

#2: It Can Help Younger Renters Start to Build Credit

For younger tenants, the benefits can be even more meaningful. 40% of “credit invisible” individuals are under the age of 25. That means that they simply do not have enough credit history for reporting agencies to assign them a score. Rent reporting makes it easier to start building credit, so they no longer have to rely on co-signers when sending in a rental application or taking out a loan.

#3: It Won’t Negatively Affect Tenants’ Credit

As mentioned earlier, rent reporting services such as the one offered by Buildium only report on-time payments. If you choose a service that takes this approach, tenants can only benefit from signing up. They won’t have to worry if unexpected difficulties cause them to miss a due date, which can incentivize more renters to start opting in and strengthens the relationship and trust between your business and your tenants.

#4: It Doesn’t Take Much Effort to Subscribe

A rent reporting feature built into comprehensive property management software such as Buildium can make subscribing to the service easy. Tenants can receive instructions through the same channels they normally use to communicate with their property manager and can sign up in just a couple steps (more on how to do this later). From there, renters just have to keep up their payment habits to start to see benefits.

This all adds up to greater financial stability for tenants, along with the ability to save money through lower interest rates and grow wealth over time. It’s an incentive that an increasing number of companies and landlords are getting behind, with 80% of property managers surveyed by Buildium saying their top reason for offering rent reporting is to help residents build credit.

4 Ways Rent Reporting Services Benefit Your Property Management Business

Rent reporting benefits more than just residents. Here are four ways it can also help you grow your property management business.

#:1 It Saves Your Team Time

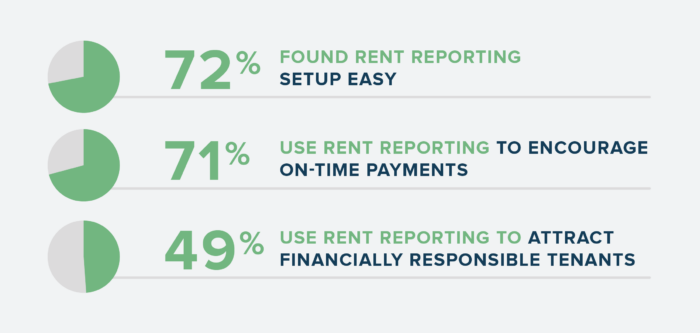

With platforms such as Buildium, rent reporting comes already integrated within your property management software. 72% of property managers surveyed by Buildium found the process easy, with minimal effort and additional staff time needed. Tenants can simply subscribe to the service, so you won’t waste time with setting up the service for each tenant and can direct your team’s resources to more proactive work that grows your business.

#2: It Gives You an Edge with Younger Tenants

Younger renters—many of whom may also be new to renting entirely—are already accustomed to using digital tools for managing their financial habits. These younger, more tech and financially-savvy tenants see a service such as rent reporting as a clear asset. In fact, 60% of Gen Z and 56% of Millennials surveyed prefer property managers who offer an option to report their rent payments, according to TransUnion.

#3: It Attracts Responsible Tenants and Incentivizes On-Time Payments

Rent reporting also helps attract residents that are diligent about paying rent while incentivizing on-time payments. According to TransUnion, 71% of property managers shared that a top reason for using rent reporting is to help residents pay rent on time, while 49% of respondents said they’re using the service to attract financially responsible tenants.

Some might be concerned that giving residents a path to better credit might inadvertently cause them to stop renting altogether. While it’s true that good credit health makes homeownership more attainable, the benefits extend beyond applying for a home loan, and include everything from cheaper phone plans to higher limits on credit cards.

Taking that into consideration, rent reporting attracts a wider range of tenants than those focused on home ownership This is especially true when considering all the other factors that have more of an impact on such a big life decision, like family commitments, personal and professional priorities, and broader economic conditions.

#4: It Can Help You Market to New Clients

Having a service that helps to attract responsible renters and makes consistent, on-time payments more likely also means that you’ll be able to pass on those benefits to the owners that you work with. For both existing owners and prospective clients, you can point to rent reporting as a concrete example of how you are using technology and your management expertise to reliably keep their units filled and protect their investment.

How to Introduce Rent Reporting to Tenants in 5 Steps

Once you’ve made the choice to offer (and start benefiting from) rent reporting, it’s time to get the word out. Since the service is gaining traction in the industry and among renters, it’s important to market rent reporting both in each of your rental listings and as part of your overall company marketing. Here are some steps to get started:

1. Decide which rent reporting service you’ll offer tenants. If possible, you should choose a service that’s already integrated within your property management software and one that only reports on-time payments, such as the feature available in Buildium. This will make the next steps easier for you and your team.

2. Get the rest of your team familiar with the new feature and how it works. While many rent reporting services are tenant-facing and require little to know extra coordination on the part of your business, familiarizing your team with the feature can help them express those benefits to both existing and prospective tenants.

3. Introduce rent reporting to your residents. The most important step is ensuring your tenants know the benefits of rent reporting and how to use the new feature. This is where a resident portal can come in handy, giving you a way to quickly share the details on how to sign up and respond to any questions your residents might have. A fully integrated rent reporting option like the one offered through Buildium, simplifies the process even further, letting residents sign up or opt out of the service in a matter of minutes.

You can even share our one-pager on the service or this video with tenants on the benefits of rent reporting and how to use the feature in Buildium:

If you’re going the fully-integrated route with Buildium, be sure to share the benefits with your tenants and remind them that there’s no effort on their part and that missing a payment won’t be reported, so their credit will never be negatively affected. You can also bundle rent reporting with other offerings in your resident benefits package.

To help residents see rent reporting in action, you can recommend that they check their credit score on any of the three major credit agencies’ sites, or through their credit card company’s banking app.

4. Include rent reporting on your company’s website and any marketing materials you have for attracting prospective tenants to your property. Rent reporting can be a compelling perk that helps your listings stand out to many renters, so be sure to highlight the benefits wherever appropriate. You can even repurpose some of the messaging you created for existing tenants to send to prospects.

5. Get tenant feedback on rent reporting. To ensure that tenants are getting the most out of rent reporting, and that it remains a valuable service, ask them about their thoughts through short surveys. You can include a question or two on rent reporting within a long list of questions about their overall experience renting from you. This is also a chance to get testimonials you can use when marketing to prospective owners and tenants. You can conduct these surveys quickly by using services like Opiniion.

How to Set Up Rent Reporting in Buildium

Rent reporting in Buildium costs tenants $4.99 per month to report all future payments on a month-to-month basis (past payments cannot be reported).

Tenants can subscribe to the service with just a few clicks from the resident portal. From their account, they simply have to navigate to “Rent Reporting” under “Resident Services” in the sidebar. This will take them to a page describing the service and prompting them to sign up.

Each individual on a lease will need to subscribe to the service separately to report their rent and start seeing an impact on the credit score in as little as 30 days.

At a time when so many individuals struggle with building credit and finding financial stability, rent reporting can be more than just another source of revenue or a perk to offer tenants. It’s a service that can fundamentally improve the lives of your residents, and a chance to show them that their efforts to make such an important payment on time each month has value beyond a simple transaction. You’ll be able to nurture a reputation defined by that important recognition, shared respect, and a strong relationship with residents.

Read more on Leasing