Property management companies remain determined to expand in 2024—but new tactics may be required than they’ve used in previous years

This focus on growth is a familiar story in Buildium’s annual survey of thousands of property management professionals: Growth remains property management companies’ #1 priority for the sixth year in a row.

But in 2024, we see signs that this growth will play out in a greater variety of ways than it has in the past, including acquisition strategies that may not have been front-of-mind prior to now.

In this post, we’ll talk about property management companies’ plans for portfolio and revenue growth in the new year, with data pulled directly from our 2024 Property Management Industry Report. Be sure to check out the full report for more data and insights to help your company plan for the opportunities and challenges that lie ahead in the new year.

How Property Managers Plan to Grow Their Portfolios—Even as Rental Owners Pull Back

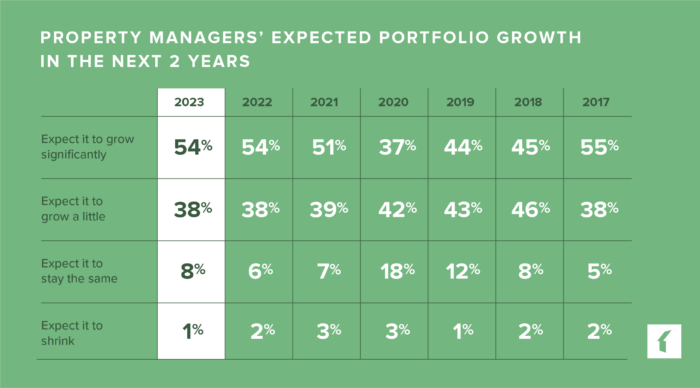

92% of third-party property management companies have announced their intentions to grow their portfolios in 2024 and ‘25. This marks the third year in a row that more than 9 in 10 respondents plan to expand their portfolios in the coming twenty-four months.

So, what’s changed in comparison with previous years? For third-party property management companies, it’s important to know that just 35% of small-portfolio rental owners plan to acquire new properties during the same time period.

This means two things: First, companies will be exerting more effort to attract growth-minded investor clients, with 71% of respondents reporting that they planned to seek out new clients in 2024 and ‘25.

And second, companies will be searching for alternative ways to grow. These growth tactics include the following:

- Acquiring other companies’ or investors’ portfolios – 35% of PMCs plan to do this

- Expanding the types of properties they manage – 33%

- Purchasing or building new properties – 32%

- Expanding to new geographic territories – 26%

How Property Managers Plan to Increase Their Revenue in the Face of Still-Rising Costs

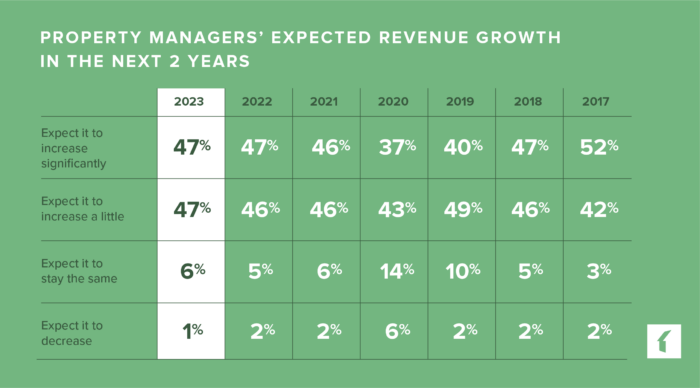

94% of third-party property management companies expect their revenue to increase in the next two years—a rate that’s on par with 2022.

But with rising costs continuing to strain property managers and their clients, they’re heavily focused on operating as efficiently as possible, as well as finding new sources of revenue—for example, by finding the right technology to run their business, and by expanding their services to accommodate their clients’ shifting needs.

Here’s how third-party property management companies plan to increase their revenue over the next two years:

- Increasing rents/resident-paid fees (where allowed) – 62% of PMCs plan to do this

- Leveraging technology to drive efficiency – 48%

- Expanding their service offerings – 40%

- Making value-add updates to properties – 39%

- Increasing rates/client-paid fees – 38%

40% of property management companies plan to expand their services in the next two years, and an additional 33% plan to expand the types of properties they manage to generate additional revenue and grow their portfolios. The most common services and property types they plan to add are the following:

- Cleaning services

- Commercial property management

- Community association management

- Construction project management

- In-house maintenance services

- Outdoor services

- Vacation rental management

How Property Management Companies Are Contending with the Labor Shortage As They Grow

For companies that are rapidly expanding their portfolios, customer service is a common concern. This has been a particular source of stress during the labor shortage, which has eased since the height of the pandemic, but continues to be a recurring challenge for many property management companies.

Technologies like property management software and artificial intelligence—in addition to the availability of virtual assistants—are helping growing teams to bridge the gaps as they operate with a smaller team than their workload may require.

Property Management Software

Property management leaders emphasized throughout our 2024 Industry Survey how critical the right technology has been to their ability to compensate for the labor shortage, particularly for growing businesses. Property management software is something many companies find they can’t live without, giving teams the ability to spend less time processing payments, leases, maintenance requests, and reports so they can focus on portfolio growth and meaningful customer interactions instead.

Artificial Intelligence

When it comes to the use of artificial intelligence in the property management space, innovation is still in the early stages. Already, however, industry professionals are finding that tools like ChatGPT are helping them to generate text quickly for use in the following areas:

- Templates for emails, letters, and notices

- Rental listings

- Social media posts

- Website Q&A sections

Virtual Assistants

Our 2024 Industry Survey found that 25% of property management companies currently employ virtual assistants—contractors who offer administrative services from a remote location—to extend the capabilities of their team. The most common virtual roles involve:

- Leasing coordination

- Accounting and bookkeeping

- Administrative assistance

- Maintenance coordination

- Marketing

The 2024 State of the Property Management Industry Report

There’s so much more research packed into our 2024 Property Management Industry Report. This year’s report talks about the challenges that companies face in growing their portfolios in a time when rental owners aren’t as interested in acquiring new properties, competition has increased, and current team members are overburdened.

But it also shares the opportunities that industry professionals have discovered to differentiate themselves from the competition by better serving their customers’ needs—and how technology is making it possible for companies to grow without compromising the level of service they deliver.

Download your free copy of the Property Management Industry Report now.

Read more on Uncategorized