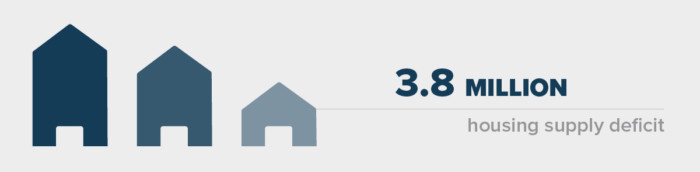

Inflation, stagflation, bear market, shrinkflation—you’ve probably heard all these words tossed around to describe the current U.S. economy conditions. The housing market hasn’t escaped those conditions. It’s estimated that the U.S. had a housing supply deficit of 3.8 million units in 2021.

2023 Property Management Industry Report

It's here! Read our definitive guide on the property management industry and how to succeed in 2023.

Get the GuideHome prices have risen 20.6% from March 2021 to March 2022, affecting all Americans one way or another. Even in the rental market, suburban rental properties are booming and applicants are engaging in bidding wars across the country.

What does this all mean for property managers? And how can property managers protect their owners and tenants as home prices remain unpredictable amid wider economic uncertainty?

In this post, we will explore the causes of the current housing crisis, explain why investors aren’t actually the ones to blame, and—most importantly—explain what you, as a property manager, can do to prepare for the future.

What’s Causing the Crisis?

A staggering 74% of Americans currently consider homeownership to be a hallmark of achieving the American dream.

There are several factors standing in the way of potential buyers from achieving that dream. Underbuilding, supply chain issues, and movement away from urban areas are just a few of the reasons why more and more Americans are being squeezed out of the housing market.

Let’s take a closer look at each of these reasons and how you can respond to the ever-changing market conditions.

Fact or Fiction: Institutional Investors Are to Blame

Before we dig deep into the research, let’s first dispel the myth that institutional investors are to blame.

There’s no denying the influence of Wall Street on the housing market. There are multiple reports of investors out-bidding potential buyers with all-cash offers. Looking back at the Great Recession, institutional investors purchased distressed properties to help steady the housing market. After the economy stabilized, they began to turn them into rental properties, causing uproar in formerly middle-income neighborhoods.

Are investors purchasing homes? Yes, but the actual number of homes only accounts for a small fraction of the total market, and the number has actually declined over the past year.

Even at its peak during the recession, investors only reached 29% of total sales. In 2021, investors accounted for 20% of sales, with the majority of them being high-yield apartment units and not single-family homes.

The Pandemic’s Impact on Supply Chain, Labor, and Lending

After losing 1.5 million workers in the Great Recession between 2007 and 2009, the home-building industry has been suffering from a labor shortage ever since. Add to that COVID-19’s impact on the global supply chain, and you’re left with a shortage of land, labor, and materials around the world. Lockdowns disrupted manufacturing and increased risk for all businesses, driving costs higher.

In 2021, the National Association of Home Builders (NAHB) announced that “shortages of materials are now more widespread than at any time since NAHB began tracking the issue in the 1990s, with more than 90% of builders reporting shortages of appliances, framing lumber and OSB.”

Trickle Down: First-Time Homebuyers Struggling

First-time homebuyers can receive help from state programs through tax breaks and federally backed loans. In today’s market, where homes routinely sell above asking price within days—sometimes in the form of all-cash offers—it’s not enough.

In 2010, 50% of new home purchases were made by first-time home buyers. The rate dropped down to 34% in 2021 and is projected to decrease even further. Lack of inventory, rising prices, stagnant wages, and spiraling student debt are keeping Millennials and Gen Zers from owning a home, even as demand remains high.

However, the data paints a different picture for affluent American households. Demand for second homes reached more than double pre-pandemic levels. Buyers who locked in historically low mortgage rates increased 178% in 2021 compared to the previous year. In the same vein, demand for vacation homes continued to grow as market conditions became increasingly favorable for wealthier Americans.

How Has This Affected the Rental Market?

Prospective buyers being priced out of purchasing homes has led to an even more bizarre rental market. At the beginning of lockdowns, owners and property managers slashed rent by offering up to six months off to attract new renters. The combination of high property prices, the rise of remote work, and low inventory resulted in a wildly competitive rental market.

For example, bidding wars in urban areas like New York City became the norm as median asking rent rose 30% in 2022 where renters began paying above asking price.

Movement from High-Cost Cities to Suburban Neighborhoods

The precipitous home-buying frenzy, catalyzed by lockdowns and remote work policies, moved demand away from densely populated cities and into spacious suburban neighborhoods. As a result, single-family, suburban rentals are flourishing due to the rising cost of homes.

“What once seemed a blue-state coastal problem has increasingly become a national one, with consequences for the quality of life of American families, the health of the national economy, and the politics of housing construction,” Emily Badger from the New York Times wrote.

How Should Property Managers Adapt Their Business?

Despite an unpredictable and demanding year, property managers are determined to grow their portfolios more than ever before. Some rental owners have left the market due to financial and legal concerns, but most investors still see much higher rates for residential rentals going forward.

Property managers are focusing on attracting and retaining exceptional residents. Here are the four most common ways we’ve found how property managers are adapting their business today:

- Go digital: The industry is now widely accepting online payments, email and text communication, electronic rental applications, and e-signing of leases, as well as online maintenance requests as the norm. Property managers can leverage technology to seamlessly communicate with tenants, while keeping a complete record of payments, complaints, repairs, and more. Knowing that you’re easily accessible can give your residents much needed peace of mind during periods of broader uncertainty. (Read more)

- A bigger toolkit: A number of tools have gained popularity this year, including utility management & billing, virtual showings, property inspection tools, self-service showings coordination, amenity booking tools, CRM software, and HOA voting tools. Property managers can utilize these tools to attract more tenants, and also better streamline the management process from end to end. Having these digital tool on hand makes it easier to handle the constantly changing demands of property management, without relying on ramping up staff time or search for new team members. (Read more)

- Easier management: Increasingly, owners, property managers, and renters are using owner and renter portals to manage their rental properties in a time-saving, convenient way. Property managers can provide owners with a birds-eye view of how the property is being run. They’ll be able to stay informed and connected to their properties, without getting tangled up in the day to day. (Read more)

- Smarter screening: It has become absolutely imperative to verify the income stability of rental applicants during the pandemic via online screening software. Property managers can now protect owners by ensuring they’re bringing in the most qualified applicants. You’ll be more likely to avoid the costly, time-consuming mistakes of picking the wrong applicant or missing out on your best options. (Read more)

Your Differentiator: Resident Management and Empathy

Attracting and retaining great residents is key to sustaining your business in the long-run. The rise of single-family rentals allows smaller property owners to compete with institutional investors and large firms, solely because they are able to provide personalized customer service.

Building a personal relationship with your residents grounded in empathy—especially during this time of uncertainty—helps build trust in the long run.

Learn what they prioritize and value from property managers. Consider using property management software to better communicate with your residents and meet them on their terms. Doing so can also help you manage your properties more easily—and help you to grow your portfolio.

Discover More Ways Property Managers Are Navigating the Housing Crisis

The lingering pandemic has placed property managers at the center of a rapidly evolving industry, rife with financial pressures and regulatory changes. Take the next step of growing your portfolio the way you want by understanding the trends in property management. Our free copy of the 2022 State of the Property Management Industry Report can fill you in on what you need to know.

Read more on Industry Research