Disclaimer: While this post is intended to provide general information about community association taxes, please note that the information provided here is for general informational purposes only and should not be construed as legal or tax advice. Tax laws and regulations vary by jurisdiction and individual circumstances, so please consult with a qualified tax professional for personalized advice tailored to your specific situation.

Automated Accounting

Follow every transaction and reconcile your books automatically on one platform.

Learn MorePrepping your association’s books for tax season is an important priority for HOA managers, but, with the right planning and know-how, it doesn’t have to be a burden.

In this article, we’ll demystify HOA management taxes, covering what you need to know to prepare effectively, and present a solution to streamline your HOA bookkeeping process.

HOA Taxes: What You Need to Know

Like any other business, HOAs must file tax returns at the federal and state level—even if you have $0 in taxable income. Most HOAs will most likely not have any tax liability as they qualify as a non-profit, but situations can vary and applicable tax rules at the federal and state level can have varying effects on your tax situation.

Differences Between HOA Taxes and Condo Association Taxes

There is little to no difference in tax treatment for HOAs and condominium associations. A majority of both file either Form 1120 or Form 1120-H, depending on their source of income and expenses dedicated to maintaining the property.

Are HOAs Tax Exempt?

HOAs are classified as not-for-profit businesses, but that doesn’t necessarily mean they’re fully tax exempt. Every HOA and Condo Association still needs to report and file their tax returns and pay any applicable taxes accordingly—unless the HOA has qualified for 501(c)(4) or 501(c)(7) status, which requires them to pass strict not-for-profit guidelines.

What’s the Difference between Sections 501(c)(4)s and 501(c)(7)?

HOAs that qualify for 501(c)(4)s are “social welfare organizations,” which operate for the benefit of the general public. At least 51% of their resources must go toward their primary purpose of benefiting its community, which often includes political lobbying and environmental work.

Although extremely rare, some HOAs may qualify as “social clubs” and meet the 501(c)(7) criteria. This includes golf courses, marinas, parks, or tennis clubs that the IRS describes as “promoting pleasure, social activities, and entertainment.” These tax-exempt HOAs often realize tax benefits that relieve them from tax risks associated with filing Federal Tax Form 1120 and the related state equivalent (more on this later).

Since tax laws around tax-exempt qualification can be vague, it’s best to check with a certified tax professional with expertise in HOA and COA taxes for clarification.

What Tax Forms Should an HOA File?

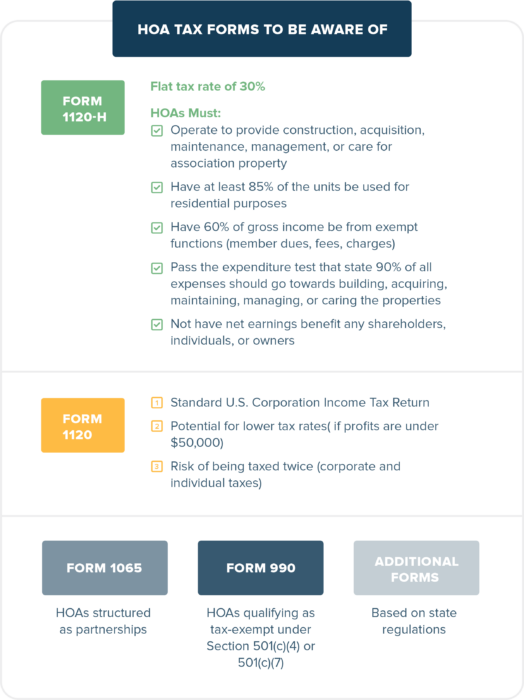

Luckily, at the federal level, there aren’t too many forms to choose from. While most HOAs file Form 1120-H, there are few exceptions.

Form 1120-H

Form 1120-H is a simple, one-page return. It imposes a flat tax rate of 30% on net taxable income. To qualify, the HOA must:

- Operate to provide construction, acquisition, maintenance, management, or care for association property

- Have at least 85% of its units earmarked for residential purposes

- Have 60% of gross income be from exempt functions (member dues, fees, charges)

- Pass the expenditure test that states that 90% of all expenses should go toward building, acquiring, maintaining, managing, or caring the properties

- Not have net earnings benefit any shareholders, individuals, or owners

Form 1120-H has no tax on exempt income, no alternative minimum tax (AMT), and not every HOA will owe taxes. However, there are some drawbacks in filing the 1120-H, such as, the tax rates are higher than Form 1120, you can’t recognize a net operating loss or carryforward if unable to use the loss in the current year, and organizational costs cannot be written off.

Form 1120

Form 1120 is a more complex form to complete, because it is the standard U.S. Corporation Income Tax Return, which isn’t specifically tailored to HOAs. However, tax rates may be much lower, or even halved compared to 1120-H if reported profits are under $50,000. Although there is more flexibility in deductions, there is also a risk of potential double taxation on the corporate and individual level.

Additional forms

HOAs structured as partnerships must file Form 1065. If the HOA qualifies as a tax-exempt nonprofit under Section 501(c)(4) or 501(c)(7), it may need to file Form 990. Finally, on top of federal tax forms, HOA may be required to file more forms depending on their respective state regulations.

What Are the Deadlines for Filing HOA Taxes?

Tax returns are due by the 15th of the fourth month after your fiscal year-end, which means April 15th for calendar-year organizations. For HOAs with a fiscal year ending on June 30th, taxes must be filed on the 15th day of the third month after the end of the tax year.

If you miss a tax deadline without filing an extension, you may be charged interest and penalties for failure to file and failure to pay. Here’s a rundown directly from the IRS:

Interest. Interest is charged on taxes paid late even if an extension of time to file is granted. Interest is also charged on penalties imposed for failure to file, negligence, fraud, substantial valuation misstatements, substantial understatements of tax, and reportable transaction understatements from the due date (including extensions) to the date of payment. The interest charge is figured at a rate determined under section 6621.

Late filing of return. In addition to losing the right to elect to file Form 1120-H, a homeowners association that doesn’t file its tax return by the due date, including extensions, may be penalized 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax. The minimum penalty for a return that is over 60 days late is the smaller of the tax due or $485. The penalty will not be imposed if the association can show that the failure to file on time was due to reasonable cause.

Late payment of tax. An association that doesn’t pay the tax when due may generally be penalized ½ of 1% of the unpaid tax for each month or part of a month the tax isn’t paid, up to a maximum of 25% of the unpaid tax. The penalty will not be imposed if the association can show that the failure to pay on time was due to reasonable cause.

Reasonable-cause determinations. If the association receives a notice about a penalty after it files its return, send the IRS an explanation and we will determine if the association meets the reasonable-cause criteria. Do not attach an explanation when the association’s return is filed.

Other penalties. Other penalties can be imposed for negligence, substantial understatement of tax, reportable transaction understatements, and fraud. See sections 6662, 6662A, and 6663.

If you miss a deadline, determine how long it’s been since you last filed your tax return. Then, complete your tax return immediately. Once complete, contact the IRS and see if you’re eligible to file Form 1120-H for every missed year. Then file the rest of your missing tax returns from previous years.

Association Manager Responsibilities for HOA Taxes

Managing finances is an important part of being an association manager. General responsibilities usually include:

- Collecting dues and making payments: Manage association due collection along with fees and any other charges to members of the HOA or the HOA board.:.

- Filing HOA taxes: Collaborate with a tax professional (typically a CPA) who specializes in HOA taxation to prep and file your association taxes

- Year-Round bookeeeping: maintaining accurate financial records throughout the year, including income and expenses, along with records all receipts, bank statements, and invoices

- Communicating with board: Pass on crucial information to board of directors through regular meetings and reports to improve transparency and address any financial concerns.

For more ways to help property managers manage HOA taxes, we’ve prepared a general tax guide that covers top tax deductions, how to report expenses paid through PPP loans, important calendar dates, and more.

Tips to Stay Prepared for HAO Taxes Year-Round

Waiting until April to get your finances in order only sets yourself up for unnecessary stress, avoidable errors, and costly fines. . Instead, make it a habit to keep a detailed record of your finances throughout the year and prep your taxes well ahead of deadlines.

On a day-to-day level, this involves recording all income, expenses, and transactions , planning deductions, and reconciling bank statements regularly. We recommend using accounting software that’s built specifically for association and property businesses to help streamline the process. You’ll save time and minimize human error with pre-built templates, customizable fields, and tax filing tools for forms relevant to your company.

Here are some additional ways to stay prepared year-round.

Prepare For HOA Taxes Early

The first and most obvious way to get ahead on tax season is to prepare well before the filing deadline. An organized bookkeeping system will help avoid last-minute mistakes and penalties. Keep your important financial records and documents in a secure location. Similarly, keep your digital files on a secured server or software with safeguards in place.

Be Familiar with Tax Laws

Federal, state, and local tax laws can change. For example, the minimum penalty for HOAs that fail to file their taxes within 60 days of the deadline increased to $485 in 2024. Stay up-to-date and stay compliant by reading the latest documentation on IRS.gov or speaking with a certified tax professional.

Hold Regular Board Meetings on HOA Taxes

Hold regular board meetings and ensure tax preparation and finances are a priority. Learn the ins and outs of your HOA’s governing documents and bylaws and ensure your association is adhering to them.

Use Tax-Advantaged Accounts

Tax-advantaged accounts like reserved funds or capital improvement funds to address unexpected expenses, make significant improvements, and lower your tax liability. Consult with a certified tax professional to determine the best options available to you.

Technology to Help with HOA Taxes

As we’ve covered in this article, filing your HOA management taxes is more than bookkeeping. It’s about building a system to manage your HOA effectively. HOA management software can help you streamline and automate most of those mundane processes. Here are a few features you should consider when shopping for one.

Communication Tools

Effective HOA management software automates and tracks communication with homeowners, non-owner residents, and board members in one platform. Whether it be email, mail, and text, it’s important that your software can merge all your communication in one place, while being able to organize and share documents securely.

Accessible Libraries

It’s important that your board members can find your by-laws, policies, and meeting minutes easily. An effective software can help you manage permissions that allow specific individuals to access sensitive information, like financial reports and legal documents.

Automated Bookkeeping

Collecting rent and association fees online can cut payment processing time up to 70 percent. Having an all-in-one property accounting solution also helps you categorize expenses, track payments, and reconcile your accounts all in one platform. Be sure you can also itemize your expenses so you know which ones are tax deductible come tax season.

Get Ahead on Tax Season

Being proactive with your taxes helps you avoid penalties and audits, and gives you peace of mind knowing you’ve taken advantage of all possible tax-saving opportunities.

As we covered in this article, streamlining your HOA operations plays a critical role in that. Whether it’s collecting rent online or communicating more effectively with your board, HOA management software like Buildium can help you prepare for tax season and stay confident about your books year round.

Not a Buildium customer? Get started with a 14-day free trial today – no credit card required.

Read more on Accounting & Reporting