Disclaimer: This blog post is meant for informational purposes only and does not constitute legal advice. Consult with a licensed attorney in Washington for specific legal guidance.

If you manage rental properties in Washington, having a lease that’s straightforward and dependable can save you hours of staff time. In this post, we’ll give you clear guidance on what you’ll need to include to protect your interests, support tenants, and avoid unexpected headaches along the way.

Once you’ve reviewed all the details, download our free Washington lease agreement template at the top of this post. It has all the basics to help you get started.

What Is a Washington Lease Agreement?

A Washington lease agreement is a legally binding contract that outlines the terms and conditions for renting a residential property. It spells out the rights and responsibilities of both landlords and tenants and lays the groundwork for a positive rental experience.

For property management companies, this agreement acts as a key document that keeps expectations clear and protects everyone involved.

Who Needs a Washington Lease Agreement?

Any individual or business renting out residential property in Washington should use a lease agreement. If the rental term lasts more than one year, state law requires the agreement to be in writing and signed by both parties.

For property managers and landlords, this agreement adds a layer of protection by clarifying terms from the start. Without a written lease, landlords risk facing disputes or legal complications down the line.

A Washington lease agreement benefits:

- Property managers who oversee multiple units or buildings

- Landlords who want to avoid misunderstandings

- Tenants who appreciate knowing what to expect

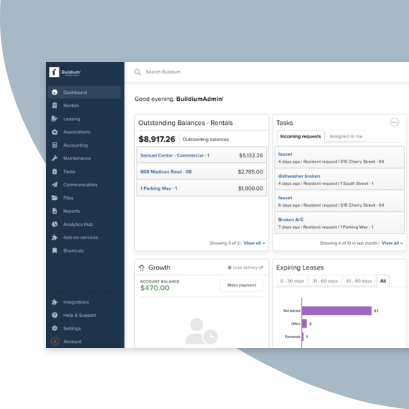

Pro Tip: Buildium’s purpose-built leasing software can help you get even more efficient with your leasing process.

Types of Washington Lease Agreements

Washington lease agreements come in several forms to match different rental situations:

- Fixed-Term Lease Agreement: Typically used for long-term rentals (usually 12 months), this document includes rent terms, duration, and rules

- Month-to-Month Lease Agreement: Offers flexibility with a shorter commitment, allowing either party to end the lease with proper notice

- Sublease Agreement: Lets a current tenant rent part or all of the property to another person while maintaining responsibility under the original lease

- Roommate Agreement: Sets expectations for tenants sharing a property, covering topics like utilities and cleaning duties

What Should a Washington Lease Agreement Include?

Every lease agreement in Washington should include basic information to prevent confusion later. Here’s what to cover:

Parties Involved

The lease should clearly identify the property management company or landlord and the tenant(s). Include full names and contact details for everyone involved. Accurate contact information helps keep communication flowing throughout the lease term.

Lease Duration Dates

Define the type of lease: short-term or long-term. Make sure to include the lease start and end dates, monthly rent amount, due date, and how the tenant should pay (check, online payment, direct deposit, etc.). If rent increases are possible, outline the procedure and notice period required.

Rent and Security Deposit Information

Include the monthly rent amount, payment methods, late fees, and when rent is due. Washington doesn’t cap rent but does regulate security deposits. Clearly outline the amount collected, where it’s held (in a trust or escrow account), and the timeline for returning it once the lease ends.

Occupancy Limits

State how many people may live in the unit. Usually, this means only the listed tenants and their children. This clause helps prevent overcrowding and long-term guests who haven’t been approved. If tenants violate this rule, landlords may pursue eviction.

Property Management Company & Tenant Responsibilities

Make responsibilities clear to avoid future issues.

Landlords or property managers should:

- Maintain working plumbing, heat, and electricity

- Keep common areas safe and clean

- Take care of garbage collection facilities

Tenants should:

- Use appliances and fixtures responsibly

- Avoid loud or disruptive behavior

- Maintain a tidy living space

Add any property-specific rules to the lease to keep expectations realistic.

Pet Policies

Clarify whether pets are allowed. If pets are permitted, outline restrictions such as the number, size, or breed of pets. If you prohibit pets, include a no-pets policy. Also mention the tenant’s duty to clean up after pets and cover any damages caused.

Washington Lease Agreement Addenda and Disclosures

Washington law requires landlords to include specific addenda and disclosures in rental agreements. These help inform tenants and protect landlords from liability.

Note that this list is not exhaustive, so consult a legal professional if you’re unsure about what to include in your own agreements.

Lead-Based Paint Disclosure

Federal law mandates this disclosure for any rental property built before 1978. Landlords must:

- Fill out a lead-based paint disclosure form

- Provide tenants with an EPA-approved pamphlet

- Share records of any known lead hazards

Fire & Smoke Detector Notice

Under RCW 59.18.060(12), landlords must confirm that the property includes functioning smoke detectors. They also need to disclose:

- Fire alarms and sprinkler systems

- Emergency notification procedures

- Evacuation or relocation plans

- Smoking policy for the building

Tenants are responsible for maintaining detectors, and failing to do so could lead to penalties (RCW 43.44.110(3)).

Mold Disclosure

State law requires landlords to give tenants a pamphlet about mold. This guide explains how to spot and prevent mold and how tenants should respond if they notice it. This disclosure supports tenant health and reduces disputes.

Move‑In Condition Checklist

Before collecting any deposit, landlords must follow RCW 59.18.260 by offering a written checklist that documents the condition of the unit. Both landlord and tenant must sign it, and tenants are entitled to one free copy. This helps protect both parties if there’s a disagreement over security deposit deductions.

Ownership or Agent Identity Disclosure

RCW 59.18.060(15) requires that leases include the name and address of the property owner or their in-state agent. This ensures tenants know who to contact for repairs, legal matters, or emergencies. If this information changes, the lease must be updated.

Deposit Receipt & Escrow Disclosure

Under RCW 59.18.270, landlords must place tenant deposits in a trust or escrow account and provide a written receipt. If the account changes, tenants must receive written notice. If the property is sold, deposits must transfer to the new owner.

Non‑Refundable Fee Disclosure

RCW 59.18.285 states that any fee labeled as “nonrefundable” must be clearly identified in the lease. Otherwise, it is considered refundable by law. Always specify if a fee is nonrefundable to avoid legal confusion.

Optional Disclosures & Addenda

Although not required by law, many property managers add disclosures for topics such as:

- Asbestos

- Bed bugs

- Mold

- Structural or plumbing issues

- Smoking rules

- Medical marijuana use

- Pool safety

- Non-refundable fees

These help clarify tenant expectations and reduce your legal exposure.

Consequences for Not Including Mandatory Disclosures

If landlords skip required disclosures, they could face legal trouble, including:

- Fines

- Tenant lawsuits

- Lease clauses being ruled unenforceable

Avoid these problems by staying on top of both federal and Washington-specific disclosure rules.

Washington Lease Agreement Laws and Regulations

Here’s a look at the laws that shape how lease agreements work in Washington state. Again, it’s always recommended to speak with a local legal professional for the most complete and detailed list of regulations.

Security Deposits

Washington does not set a limit on deposit amounts. However, landlords may only collect a deposit if they follow these regulations:

- Have a written rental agreement

- Provide a signed move-in checklist

- Place the funds in a trust or escrow account

- Give tenants a receipt that includes the account location

Once the lease ends, landlords must return any remaining deposit within 30 days. If deductions are made for unpaid rent or damage, an itemized statement must be sent to the tenant. Landlords who ignore these rules may owe the tenant up to twice the withheld deposit amount.

Right of Entry

Under RCW 59.18.150, landlords must give:

- Two days’ written notice for inspections or repairs

- One day’s notice for showings to new tenants or buyers

They can only enter during reasonable hours unless there’s an emergency or the tenant has abandoned the unit.

Grace Period

Washington law gives tenants a five-day grace period after rent is due before landlords can charge a late fee. Rent is officially considered late after the fifth day, and only then can late fees be applied.

Late Fees

Late fees in Washington must comply with RCW 59.18.170 and RCW 19.150.150. Landlords may charge:

- $20 or

- 20% of the monthly rent

Whichever is greater, as long as the lease includes this detail. Fees cannot be charged until rent is more than five days late.

Taking the Next Steps with Your Washington Lease Agreement

For Washington property managers, staying compliant with lease laws is all about building trust and maintaining successful, stable tenant relationships. Take this overview as a starting point and use our free lease template at the top of this post to help you get started on the right foot.

For a faster leasing process, consider testing out Buildium’s comprehensive property management software. You can give it a try with a 14-day free trial or by signing up for a guided demo.