In years past, our annual list of up-and-coming real estate markets has been dominated by Sun Belt cities such as Austin, Raleigh, Charlotte, and Nashville.

That’s about to change.

Record numbers of apartments have come online in many of our top real estate market picks from previous years, causing rent growth to slow and vacancy rates to rise.

In response, we’re looking toward smaller cities in new regions for a combination of growth and affordability heading into the new year.

Where are 2024’s up-and-coming real estate markets located? In the Midwest, Mid-Atlantic, New England, and South Central regions of the U.S.

Frequently mentioned states in this year’s list include Pennsylvania, Wisconsin, Ohio, and Michigan.

How Do We Identify Up-and-Coming Real Estate Markets?

So, how did we arrive at these results?

First, we examined tried-and-true lists of top-performing and emerging real estate markets from the Wall Street Journal, Realtor.com, PricewaterhouseCoopers, the Urban Land Institute, and U.S. News.

Second, we dove into thousands of data points from the National Association of Realtors to analyze every rental market across the country on measures of rent growth, occupancy, property price appreciation, population growth, and more.

With that said, here’s what you’ll find in this post:

- Best Real Estate Markets in Each Category: The top 5 cities when it comes to cap rates, rent growth, vacancy rates, and home price appreciation

- Top 60 Up-and-Coming Real Estate Markets 2024: Stats on each of our picks to help you assess the opportunity in each city

- Methodology: The sources from which all of our data was derived, plus a full list of the measures included in our analysis

Cheers to your growth in 2024!

Best Real Estate Markets in Each Category

Dive into data-backed insights for the best real estate markets when it comes to cap rates, rent growth, vacancy rates, and home price appreciation.

Note: These rankings apply solely to the markets on our list.

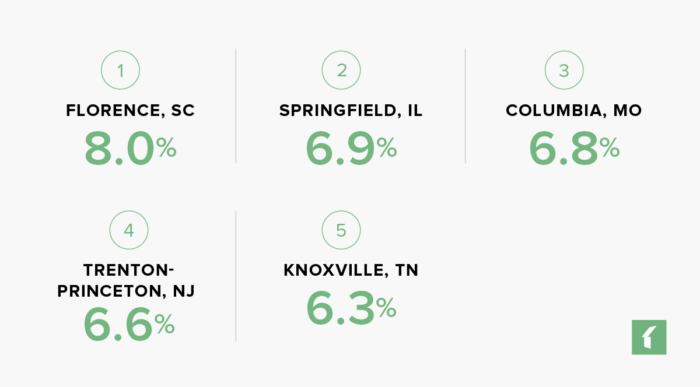

Rental Markets with the Most Rent Growth in 2023

Source: National Association of Realtors – asking rent growth in market-rate multifamily units between Q2-2022 and Q2-2023

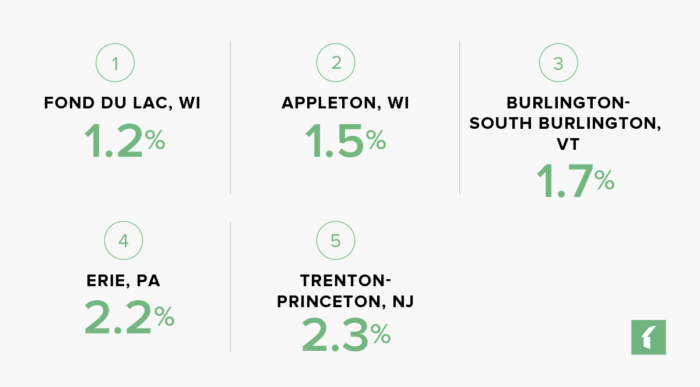

Rental Markets with the Lowest Vacancy Rates in 2023

Source: National Association of Realtors – multifamily vacancy rate as of Q2-2023

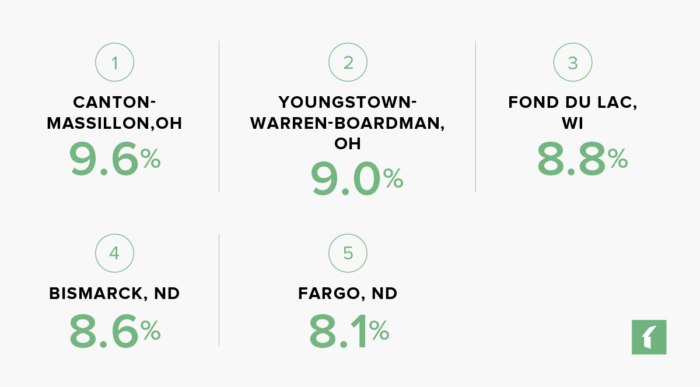

Rental Markets with the Highest Cap Rates in 2023

Source: National Association of Realtors – cap rate in market-rate multifamily units as of Q2-2023

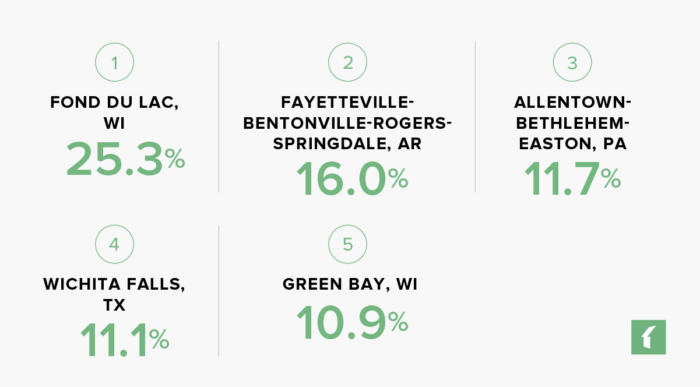

Real Estate Markets with the Most Home Price Growth in 2023

Source: National Association of Realtors – median home price appreciation between Q2-2022 and Q2-2023

Top 60 Up-and-Coming Real Estate Markets 2024

#1: Fayetteville, AR

Fayetteville-Springdale-Rogers, AR Metro Area Population: 576,724

Fayetteville, AR Rental Market Statistics:

Rental Inventory (Q2-‘23): 39,250

Units Added Since Q2-‘22: +1,663

Asking Rent Growth Since Q2-‘22: 4.6%

Asking Rent (Q2-‘23): $1,038

Effective Rent (Q2-‘23): $1,032

Multifamily Vacancy Rate (Q2-‘23): 5.5%

Multifamily Cap Rate (Q2-‘23): 5.8%

Source: National Association of Realtors

Fayetteville, AR Housing Market Statistics:

Median Home Price (Q2-‘23): $356,000

Home Price Appreciation Since Q2-‘22: 16%

Source: National Association of Realtors

Lists That Mention Fayetteville, AR:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #163

Best Places to Live – 2023-2024 (U.S. News): #10

Fastest-Growing Real Estate Markets – 2023-2024 (U.S. News): #15

#2: Fargo, ND

Fargo, ND-MN Metro Area Population: 258,663

Fargo, ND Rental Market Statistics:

Rental Inventory (Q2-‘23): 37,281

Units Added Since Q2-‘22: +394

Asking Rent Growth Since Q2-‘22: 5.6%

Asking Rent (Q2-‘23): $979

Effective Rent (Q2-‘23): $975

Multifamily Vacancy Rate (Q2-‘23): 5.2%

Multifamily Cap Rate (Q2-‘23): 8.1%

Source: National Association of Realtors

Fargo, ND Housing Market Statistics:

Median Home Price (Q2-‘23): $300,800

Home Price Appreciation Since Q2-‘22: 3.9%

Source: National Association of Realtors

Lists That Mention Fargo, ND:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #253

#3: Knoxville, TN

Knoxville, TN Metro Area Population: 906,674

Knoxville, TN Rental Market Statistics:

Rental Inventory (Q2-‘23): 41,571

Units Added Since Q2-‘22: +624

Asking Rent Growth Since Q2-‘22: 6.3%

Asking Rent (Q2-‘23): $1,376

Effective Rent (Q2-‘23): $1,370

Multifamily Vacancy Rate (Q2-‘23): 4.8%

Multifamily Cap Rate (Q2-‘23): 5.8%

Source: National Association of Realtors

Knoxville, TN Housing Market Statistics:

Median Home Price (Q2-‘23): $342,400

Home Price Appreciation Since Q2-‘22: 1.9%

Source: National Association of Realtors

Lists That Mention Knoxville, TN:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #61

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #18

Best Places to Live – 2023-2024 (U.S. News): #21

Fastest-Growing Real Estate Markets – 2023-2024 (U.S. News): #16

Top-Rated Cities for Multifamily Investment 2024 (PwC/ULI): #4

#4: Sioux Falls, SD

Sioux Falls, SD Metro Area Population: 289,295

Sioux Falls, SD Rental Market Statistics:

Rental Inventory (Q2-‘23): 26,191

Units Added Since Q2-‘22: +1,028

Asking Rent Growth Since Q2-‘22: 1.8%

Asking Rent (Q2-‘23): $1,077

Effective Rent (Q2-‘23): $1,067

Multifamily Vacancy Rate (Q2-‘23): 11.1%

Multifamily Cap Rate (Q2-‘23): 6.8%

Source: National Association of Realtors

Sioux Falls, SD Housing Market Statistics:

Median Home Price (Q2-‘23): $341,400

Home Price Appreciation Since Q2-‘22: 4.7%

Source: National Association of Realtors

Lists That Mention Sioux Falls, SD:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #197

#5: Youngstown, OH

Youngstown-Warren-Boardman, OH-PA Metro Area Population: 535,499

Youngstown, OH Rental Market Statistics:

Rental Inventory (Q2-‘23): 17,998

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 5.3%

Asking Rent (Q2-‘23): $782

Effective Rent (Q2-‘23): $780

Multifamily Vacancy Rate (Q2-‘23): 5.0%

Multifamily Cap Rate (Q2-‘23): 9.0%

Source: National Association of Realtors

Youngstown, OH Housing Market Statistics:

Median Home Price (Q2-‘23): $157,300

Home Price Appreciation Since Q2-‘22: 9.8%

Source: National Association of Realtors

Lists That Mention Youngstown, OH:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #82

Best Places to Live – 2023-2024 (U.S. News): #62

#6: Lincoln, NE

Lincoln, NE Metro Area Population: 341,229

Lincoln, NE Rental Market Statistics:

Rental Inventory (Q2-‘23): 30,705

Units Added Since Q2-‘22: +293

Asking Rent Growth Since Q2-‘22: 6.1%

Asking Rent (Q2-‘23): $1,110

Effective Rent (Q2-‘23): $1,104

Multifamily Vacancy Rate (Q2-‘23): 4.5%

Multifamily Cap Rate (Q2-‘23): 7.1%

Source: National Association of Realtors

Lincoln, NE Housing Market Statistics:

Median Home Price (Q2-‘23): $292,700

Home Price Appreciation Since Q2-‘22: 4.2%

Source: National Association of Realtors

Lists That Mention Lincoln, NE:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #138

Best Places to Live – 2023-2024 (U.S. News): #32

#7: Manchester, NH

Manchester-Nashua, NH Metro Area Population: 426,594

Manchester, NH Rental Market Statistics:

Rental Inventory (Q2-‘23): 22,514

Units Added Since Q2-‘22: +90

Asking Rent Growth Since Q2-‘22: 2.8%

Asking Rent (Q2-‘23): $1,919

Effective Rent (Q2-‘23): $1,913

Multifamily Vacancy Rate (Q2-‘23): 3.0%

Multifamily Cap Rate (Q2-‘23): 5.8%

Source: National Association of Realtors

Manchester, NH Housing Market Statistics:

Median Home Price (Q2-‘23): $489,500

Home Price Appreciation Since Q2-‘22: 0.8%

Source: National Association of Realtors

Lists That Mention Manchester, NH:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #7

Best Places to Live – 2023-2024 (U.S. News): #51

#8: Fort Wayne, IN

Fort Wayne, IN Metro Area Population: 426,076

Fort Wayne, IN Rental Market Statistics:

Rental Inventory (Q2-‘23): 23,502

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 0.2%

Asking Rent (Q2-‘23): $1,004

Effective Rent (Q2-‘23): $999

Multifamily Vacancy Rate (Q2-‘23): 5.7%

Multifamily Cap Rate (Q2-‘23): 6.6%

Source: National Association of Realtors

Fort Wayne, IN Housing Market Statistics:

Median Home Price (Q2-‘23): $236,600

Home Price Appreciation Since Q2-‘22: 5.9%

Source: National Association of Realtors

Lists That Mention Fort Wayne, IN:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #4

Best Places to Live – 2023-2024 (U.S. News): #33

#9: Columbia, MO

Columbia, MO Metro Area Population: 214,749

Columbia, MO Rental Market Statistics:

Rental Inventory (Q2-‘23): 11,416

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 6.8%

Asking Rent (Q2-‘23): $1,007

Effective Rent (Q2-‘23): $1,003

Multifamily Vacancy Rate (Q2-‘23): 2.7%

Multifamily Cap Rate (Q2-‘23): 7.7%

Source: National Association of Realtors

Columbia, MO Housing Market Statistics:

Median Home Price (Q2-‘23): $310,100

Home Price Appreciation Since Q2-‘22: 2.0%

Source: National Association of Realtors

Lists That Mention Columbia, MO:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #53

#10: Ann Arbor, MI

Ann Arbor, MI Metro Area Population: 366,376

Ann Arbor, MI Rental Market Statistics:

Rental Inventory (Q2-‘23): 30,978

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 4.4%

Asking Rent (Q2-‘23): $1,508

Effective Rent (Q2-‘23): $1,498

Multifamily Vacancy Rate (Q2-‘23): 4.9%

Multifamily Cap Rate (Q2-‘23): 6.1%

Source: National Association of Realtors

Ann Arbor, MI Housing Market Statistics:

Median Home Price (Q2-‘23): $428,500

Home Price Appreciation Since Q2-‘22: 4.8%

Source: National Association of Realtors

Lists That Mention Ann Arbor, MI:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #56

Best Places to Live – 2023-2024 (U.S. News): #14

#11: Trenton, NJ

Trenton-Princeton, NJ Metro Area Population: 380,688

Trenton, NJ Rental Market Statistics:

Rental Inventory (Q2-‘23): 20,247

Units Added Since Q2-‘22: +820

Asking Rent Growth Since Q2-‘22: 6.6%

Asking Rent (Q2-‘23): $2,038

Effective Rent (Q2-‘23): $2,031

Multifamily Vacancy Rate (Q2-‘23): 2.3%

Multifamily Cap Rate (Q2-‘23): 5.0%

Source: National Association of Realtors

Trenton, NJ Housing Market Statistics:

Median Home Price (Q2-‘23): $409,400

Home Price Appreciation Since Q2-‘22: 10.5%

Source: National Association of Realtors

Lists That Mention Trenton, NJ:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #38

Best Places to Live – 2023-2024 (U.S. News): #71

#12: Green Bay, WI

Green Bay, WI Metro Area Population: 330,292

Green Bay, WI Rental Market Statistics:

Rental Inventory (Q2-‘23): 21,429

Units Added Since Q2-‘22: +88

Asking Rent Growth Since Q2-‘22: 5.5%

Asking Rent (Q2-‘23): $1,010

Effective Rent (Q2-‘23): $1,006

Multifamily Vacancy Rate (Q2-‘23): 2.6%

Multifamily Cap Rate (Q2-‘23): 7.7%

Source: National Association of Realtors

Green Bay, WI Housing Market Statistics:

Median Home Price (Q2-‘23): $296,400

Home Price Appreciation Since Q2-‘22: 10.9%

Source: National Association of Realtors

Lists That Mention Green Bay, WI:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #143

Best Places to Live – 2023-2024 (U.S. News): #1

#13: Fond du Lac, WI

Fond du Lac, WI Metro Area Population: 103,836

Fond du Lac, WI Rental Market Statistics:

Rental Inventory (Q2-‘23): 4,492

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 2.4%

Asking Rent (Q2-‘23): $908

Effective Rent (Q2-‘23): $906

Multifamily Vacancy Rate (Q2-‘23): 1.2%

Multifamily Cap Rate (Q2-‘23): 8.8%

Source: National Association of Realtors

Fond du Lac, WI Housing Market Statistics:

Median Home Price (Q2-‘23): $243,400

Home Price Appreciation Since Q2-‘22: 25.3%

Source: National Association of Realtors

#14: Cincinnati, OH

Cincinnati, OH-KY-IN Metro Area Population: 2,268,393

Cincinnati, OH Rental Market Statistics:

Rental Inventory (Q2-‘23): 137,755

Units Added Since Q2-‘22: +778

Asking Rent Growth Since Q2-‘22: 4.6%

Asking Rent (Q2-‘23): $1,202

Effective Rent (Q2-‘23): $1,194

Multifamily Vacancy Rate (Q2-‘23): 5.7%

Multifamily Cap Rate (Q2-‘23): 7.0%

Source: National Association of Realtors

Cincinnati, OH Housing Market Statistics:

Median Home Price (Q2-‘23): $294,200

Home Price Appreciation Since Q2-‘22: 5.9%

Source: National Association of Realtors

Lists That Mention Cincinnati, OH:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #66

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #31

Best Places to Live – 2023-2024 (U.S. News): #50

#15: Cape Coral, FL

Cape Coral-Fort Myers, FL Metro Area Population: 822,453

Cape Coral, FL Rental Market Statistics

Rental Inventory (Q2-‘23): 29,114

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 0.5%

Asking Rent (Q2-‘23): $1,878

Effective Rent (Q2-‘23): $1,853

Multifamily Vacancy Rate (Q2-‘23): 8.3%

Multifamily Cap Rate (Q2-‘23): 4.9%

Source: National Association of Realtors

Cape Coral, FL Housing Market Statistics:

Median Home Price (Q2-‘23): $439,000

Home Price Appreciation Since Q2-‘22: -4.6%

Source: National Association of Realtors

Lists That Mention Cape Coral, FL:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #44

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #277

Fastest-Growing Real Estate Markets – 2023-2024 (U.S. News): #3

#16: Madison, WI

Madison, WI Metro Area Population: 687,077

Madison, WI Rental Market Statistics:

Rental Inventory (Q2-‘23): 69,657

Units Added Since Q2-‘22: +1,246

Asking Rent Growth Since Q2-‘22: 6.2%

Asking Rent (Q2-‘23): $1,470

Effective Rent (Q2-‘23): $1,464

Multifamily Vacancy Rate (Q2-‘23): 3.4%

Multifamily Cap Rate (Q2-‘23): 5.8%

Source: National Association of Realtors

Madison, WI Housing Market Statistics:

Median Home Price (Q2-‘23): $429,200

Home Price Appreciation Since Q2-‘22: 4.7%

Source: National Association of Realtors

Lists That Mention Madison, WI:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #79

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #61

Best Places to Live – 2023-2024 (U.S. News): #11

Top-Rated Cities for Multifamily Investment 2024 (PwC/ULI): #2

#17: Portland, ME

Portland-South Portland, ME Metro Area Population: 561,576

Portland, ME Rental Market Statistics:

Rental Inventory (Q2-‘23): 16,067

Units Added Since Q2-‘22: +36

Asking Rent Growth Since Q2-‘22: 3.7%

Asking Rent (Q2-‘23): $1,785

Effective Rent (Q2-‘23): $1,779

Multifamily Vacancy Rate (Q2-‘23): 3.0%

Multifamily Cap Rate (Q2-‘23): 6.7%

Source: National Association of Realtors

Portland, ME Housing Market Statistics:

Median Home Price (Q2-‘23): $538,700

Home Price Appreciation Since Q2-‘22: 9.1%

Source: National Association of Realtors

Lists That Mention Portland, ME:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #74

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #22

Best Places to Live – 2023-2024 (U.S. News): #7

Fastest-Growing Real Estate Markets – 2023-2024 (U.S. News): #24

#18: Worcester, MA

Worcester, MA-CT Metro Area Population: 980,836

Worcester, MA Rental Market Statistics:

Rental Inventory (Q2-‘23): 29,861

Units Added Since Q2-‘22: +159

Asking Rent Growth Since Q2-‘22: 4.7%

Asking Rent (Q2-‘23): $1,849

Effective Rent (Q2-‘23): $1,837

Multifamily Vacancy Rate (Q2-‘23): 3.5%

Multifamily Cap Rate (Q2-‘23): 5.8%

Source: National Association of Realtors

Worcester, MA Housing Market Statistics:

Median Home Price (Q2-‘23): $452,000

Home Price Appreciation Since Q2-‘22: 6.3%

Source: National Association of Realtors

Lists That Mention Worcester, MA:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #20

Best Places to Live – 2023-2024 (U.S. News): #77

#19: Albany, NY

Albany-Schenectady-Troy, NY Metro Area Population: 904,617

Albany, NY Rental Market Statistics:

Rental Inventory (Q2-‘23): 55,500

Units Added Since Q2-‘22: +331

Asking Rent Growth Since Q2-‘22: 4.3%

Asking Rent (Q2-‘23): $1,515

Effective Rent (Q2-‘23): $1,508

Multifamily Vacancy Rate (Q2-‘23): 4.4%

Multifamily Cap Rate (Q2-‘23): 6.7%

Source: National Association of Realtors

Albany, NY Housing Market Statistics:

Median Home Price (Q2-‘23): $296,300

Home Price Appreciation Since Q2-‘22: 3.7%

Source: National Association of Realtors

Lists That Mention Albany, NY:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #223

Best Places to Live – 2023-2024 (U.S. News): #17

#20: Syracuse, NY

Syracuse, NY Metro Area Population: 653,633

Syracuse, NY Rental Market Statistics:

Rental Inventory (Q2-‘23): 33,290

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 4.9%

Asking Rent (Q2-‘23): $1,179

Effective Rent (Q2-‘23): $1,173

Multifamily Vacancy Rate (Q2-‘23): 4.5%

Multifamily Cap Rate (Q2-‘23): 7.2%

Source: National Association of Realtors

Syracuse, NY Housing Market Statistics:

Median Home Price (Q2-‘23): $211,600

Home Price Appreciation Since Q2-‘22: 7.8%

Source: National Association of Realtors

Lists That Mention Syracuse, NY:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #170

Best Places to Live – 2023-2024 (U.S. News): #22

#21: Mobile, AL

Mobile, AL Metro Area Population: 428,780

Mobile, AL Rental Market Statistics:

Rental Inventory (Q2-‘23): 21,211

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 5.0%

Asking Rent (Q2-‘23): $1,052

Effective Rent (Q2-‘23): $1,046

Multifamily Vacancy Rate (Q2-‘23): 7.7%

Multifamily Cap Rate (Q2-‘23): 6.2%

Source: National Association of Realtors

Mobile, AL Housing Market Statistics:

Median Home Price (Q2-‘23): $228,700

Home Price Appreciation Since Q2-‘22: 4.2%

Source: National Association of Realtors

Lists That Mention Mobile, AL:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #129

Best Places to Live – 2023-2024 (U.S. News): #115

#22: Tallahassee, FL

Tallahassee, FL Metro Area Population: 391,680

Tallahassee, FL Rental Market Statistics:

Rental Inventory (Q2-‘23): 22,142

Units Added Since Q2-‘22: +264

Asking Rent Growth Since Q2-‘22: 1.9%

Asking Rent (Q2-‘23): $1,309

Effective Rent (Q2-‘23): $1,300

Multifamily Vacancy Rate (Q2-‘23): 8.6%

Multifamily Cap Rate (Q2-‘23): 5.9%

Source: National Association of Realtors

Tallahassee, FL Housing Market Statistics:

Median Home Price (Q2-‘23): $332,000

Home Price Appreciation Since Q2-‘22: 7.1%

Source: National Association of Realtors

Lists That Mention Tallahassee, FL:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #59

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #114

Best Places to Live – 2023-2024 (U.S. News): #60

#23: Sherman, TX

Sherman-Denison, TX Metro Area Population: 143,131

Sherman, TX Rental Market Statistics:

Rental Inventory (Q2-‘23): 5,856

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 6.2%

Asking Rent (Q2-‘23): $1,098

Effective Rent (Q2-‘23): $1,092

Multifamily Vacancy Rate (Q2-‘23): 5.8%

Multifamily Cap Rate (Q2-‘23): 5.7%

Source: National Association of Realtors

Sherman, TX Housing Market Statistics:

Median Home Price (Q2-‘23): $296,200

Home Price Appreciation Since Q2-‘22: 2.7%

Source: National Association of Realtors

#24: Gainesville, FL

Gainesville, FL Metro Area Population: 350,903

Gainesville, FL Rental Market Statistics:

Rental Inventory (Q2-‘23): 25,364

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 4.0%

Asking Rent (Q2-‘23): $1,397

Effective Rent (Q2-‘23): $1,389

Multifamily Vacancy Rate (Q2-‘23): 6.7%

Multifamily Cap Rate (Q2-‘23): 5.6%

Source: National Association of Realtors

Gainesville, FL Housing Market Statistics:

Median Home Price (Q2-‘23): $366,000

Home Price Appreciation Since Q2-‘22: 2.4%

Source: National Association of Realtors

Lists That Mention Gainesville, FL:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #78

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #214

#25: Pittsburgh, PA

Pittsburgh, PA Metro Area Population: 2,349,172

Pittsburgh, PA Rental Market Statistics:

Rental Inventory (Q2-‘23): 103,444

Units Added Since Q2-‘22: +901

Asking Rent Growth Since Q2-‘22: 2.2%

Asking Rent (Q2-‘23): $1,295

Effective Rent (Q2-‘23): $1,283

Multifamily Vacancy Rate (Q2-‘23): 6.3%

Multifamily Cap Rate (Q2-‘23): 6.9%

Source: National Association of Realtors

Pittsburgh, PA Housing Market Statistics:

Median Home Price (Q2-‘23): $225,900

Home Price Appreciation Since Q2-‘22: 0.3%

Source: National Association of Realtors

Lists That Mention Pittsburgh, PA:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #42

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #231

Best Places to Live – 2023-2024 (U.S. News): #47

Top-Rated Cities for Multifamily Investment 2024 (PwC/ULI): #5

#26: Rochester, NY

Rochester, NY Metro Area Population: 1,081,152

Rochester, NY Rental Market Statistics:

Rental Inventory (Q2-‘23): 56,767

Units Added Since Q2-‘22: +65

Asking Rent Growth Since Q2-‘22: 4.6%

Asking Rent (Q2-‘23): $1,331

Effective Rent (Q2-‘23): $1,325

Multifamily Vacancy Rate (Q2-‘23): 3.8%

Multifamily Cap Rate (Q2-‘23): 7.0%

Source: National Association of Realtors

Rochester, NY Housing Market Statistics:

Median Home Price (Q2-‘23): $240,600

Home Price Appreciation Since Q2-‘22: 8%

Source: National Association of Realtors

Lists That Mention Rochester, NY:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #33

Best Places to Live – 2023-2024 (U.S. News): #26

#27: Allentown, PA

Allentown-Bethlehem-Easton, PA-NJ Metro Area Population: 871,229

Allentown, PA Rental Market Statistics:

Rental Inventory (Q2-‘23): 34,586

Units Added Since Q2-‘22: +180

Asking Rent Growth Since Q2-‘22: 2.9%

Asking Rent (Q2-‘23): $1,582

Effective Rent (Q2-‘23): $1,574

Multifamily Vacancy Rate (Q2-‘23): 3.5%

Multifamily Cap Rate (Q2-‘23): 6.3%

Source: National Association of Realtors

Allentown, PA Housing Market Statistics:

Median Home Price (Q2-‘23): $330,700

Home Price Appreciation Since Q2-‘22: 11.7%

Source: National Association of Realtors

Lists That Mention Allentown, PA:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #52

Best Places to Live – 2023-2024 (U.S. News): #109

#28: Springfield, MO

Springfield, MO Metro Area Population: 484,613

Springfield, MO Rental Market Statistics:

Rental Inventory (Q2-‘23): 24,016

Units Added Since Q2-‘22: +314

Asking Rent Growth Since Q2-‘22: 3.3%

Asking Rent (Q2-‘23): $867

Effective Rent (Q2-‘23): $864

Multifamily Vacancy Rate (Q2-‘23): 3.5%

Multifamily Cap Rate (Q2-‘23): 7.1%

Source: National Association of Realtors

Springfield, MO Housing Market Statistics:

Median Home Price (Q2-‘23): $247,000

Home Price Appreciation Since Q2-‘22: 1.4%

Source: National Association of Realtors

Lists That Mention Springfield, MO:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #46

Best Places to Live – 2023-2024 (U.S. News): #57

#29: Bloomington, IL

Bloomington, IL Metro Area Population: 171,141

Bloomington, IL Rental Market Statistics:

Rental Inventory (Q2-‘23): 9,465

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 5.6%

Asking Rent (Q2-‘23): $1,042

Effective Rent (Q2-‘23): $1,038

Multifamily Vacancy Rate (Q2-‘23): 3.2%

Multifamily Cap Rate (Q2-‘23): 7.3%

Source: National Association of Realtors

Bloomington, IL Housing Market Statistics:

Median Home Price (Q2-‘23): $239,000

Home Price Appreciation Since Q2-‘22: 9.0%

Source: National Association of Realtors

Lists That Mention Bloomington, IL:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #29

#30: Canton, OH

Canton-Massillon, OH Metro Area Population: 399,316

Canton, OH Rental Market Statistics:

Rental Inventory (Q2-‘23): 12,679

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 3.7%

Asking Rent (Q2-‘23): $874

Effective Rent (Q2-‘23): $870

Multifamily Vacancy Rate (Q2-‘23): 5.3%

Multifamily Cap Rate (Q2-‘23): 9.6%

Source: National Association of Realtors

Canton, OH Housing Market Statistics:

Median Home Price (Q2-‘23): $188,800

Home Price Appreciation Since Q2-‘22: 5.2%

Source: National Association of Realtors

Lists That Mention Canton, OH:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #17

#31: Hagerstown, MD

Hagerstown-Martinsburg, MD-WV Metro Area Population: 303,665

Hagerstown, MD Rental Market Statistics:

Rental Inventory (Q2-‘23): 10,301

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 4.4%

Asking Rent (Q2-‘23): $1,295

Effective Rent (Q2-‘23): $1,285

Multifamily Vacancy Rate (Q2-‘23): 4.4%

Multifamily Cap Rate (Q2-‘23): 6.9%

Source: National Association of Realtors

Hagerstown, MD Housing Market Statistics:

Median Home Price (Q2-‘23): $293,200

Home Price Appreciation Since Q2-‘22: 4.8%

Source: National Association of Realtors

Lists That Mention Hagerstown, MD:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #164

#32: Champaign-Urbana, IL

Champaign-Urbana, IL Metro Area Population: 223,265

Champaign-Urbana, IL Rental Market Statistics:

Rental Inventory (Q2-‘23): 16,272

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 4.3%

Asking Rent (Q2-‘23): $1,034

Effective Rent (Q2-‘23): $1,029

Multifamily Vacancy Rate (Q2-‘23): 5.8%

Multifamily Cap Rate (Q2-‘23): 7.1%

Source: National Association of Realtors

Champaign-Urbana, IL Housing Market Statistics:

Median Home Price (Q2-‘23): $211,900

Home Price Appreciation Since Q2-‘22: 3.7%

Source: National Association of Realtors

Lists That Mention Champaign-Urbana, IL:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #79

#33: Oshkosh, WI

Oshkosh-Neenah, WI Metro Area Population: 170,718

Oshkosh, WI Rental Market Statistics:

Rental Inventory (Q2-‘23): 10,642

Units Added Since Q2-‘22: +207

Asking Rent Growth Since Q2-‘22: 4.4%

Asking Rent (Q2-‘23): $927

Effective Rent (Q2-‘23): $922

Multifamily Vacancy Rate (Q2-‘23): 4.6%

Multifamily Cap Rate (Q2-‘23): 7.2%

Source: National Association of Realtors

Oshkosh, WI Housing Market Statistics:

Median Home Price (Q2-‘23): $251,400

Home Price Appreciation Since Q2-‘22: 9.4%

Source: National Association of Realtors

Lists That Mention Oshkosh, WI:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #3

#34: Cumberland, MD

Cumberland, MD-WV Metro Area Population: 94,122

Cumberland, MD Rental Market Statistics:

Rental Inventory (Q2-‘23): 929

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 1.1%

Asking Rent (Q2-‘23): $764

Effective Rent (Q2-‘23): $760

Multifamily Vacancy Rate (Q2-‘23): 3.2%

Multifamily Cap Rate (Q2-‘23): 7.2%

Source: National Association of Realtors

Cumberland, MD Housing Market Statistics:

Median Home Price (Q2-‘23): $145,400

Home Price Appreciation Since Q2-‘22: 4.6%

Source: National Association of Realtors

#35: Appleton, WI

Appleton, WI Metro Area Population: 244,845

Appleton, WI Rental Market Statistics:

Rental Inventory (Q2-‘23): 12,265

Units Added Since Q2-‘22: +66

Asking Rent Growth Since Q2-‘22: 4.7%

Asking Rent (Q2-‘23): $1,068

Effective Rent (Q2-‘23): $1,065

Multifamily Vacancy Rate (Q2-‘23): 1.5%

Multifamily Cap Rate (Q2-‘23): 7.0%

Source: National Association of Realtors

Appleton, WI Housing Market Statistics:

Median Home Price (Q2-‘23): $284,700

Home Price Appreciation Since Q2-‘22: 3.1%

Source: National Association of Realtors

Lists That Mention Appleton, WI:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #44

#36: Omaha, NE

Omaha-Council Bluffs, NE-IA Metro Area Population: 976,875

Omaha, NE Rental Market Statistics:

Rental Inventory (Q2-‘23): 80,795

Units Added Since Q2-‘22: +1,057

Asking Rent Growth Since Q2-‘22: 5.1%

Asking Rent (Q2-‘23): $1,147

Effective Rent (Q2-‘23): $1,141

Multifamily Vacancy Rate (Q2-‘23): 6.0%

Multifamily Cap Rate (Q2-‘23): 6.4%

Source: National Association of Realtors

Omaha, NE Housing Market Statistics:

Median Home Price (Q2-‘23): $297,500

Home Price Appreciation Since Q2-‘22: 5.8%

Source: National Association of Realtors

Lists That Mention Omaha, NE:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #64

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #173

Best Places to Live – 2023-2024 (U.S. News): #46

#37: Columbus, OH

Columbus, OH Metro Area Population: 2,161,511

Columbus, OH Rental Market Statistics:

Rental Inventory (Q2-‘23): 208,825

Units Added Since Q2-‘22: +2,669

Asking Rent Growth Since Q2-‘22: 3.7%

Asking Rent (Q2-‘23): $1,252

Effective Rent (Q2-‘23): $1,241

Multifamily Vacancy Rate (Q2-‘23): 7.4%

Multifamily Cap Rate (Q2-‘23): 6.2%

Source: National Association of Realtors

Columbus, OH Housing Market Statistics:

Median Home Price (Q2-‘23): $327,500

Home Price Appreciation Since Q2-‘22: 1.6%

Source: National Association of Realtors

Lists That Mention Columbus, OH:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #53

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #9

Best Places to Live – 2023-2024 (U.S. News): #69

Top-Rated Cities for Multifamily Investment 2024 (PwC/ULI): #3

#38: Oklahoma City, OK

Oklahoma City, OK Metro Area Population: 1,459,380

Oklahoma City, OK Rental Market Statistics:

Rental Inventory (Q2-‘23): 96,145

Units Added Since Q2-‘22: -314

Asking Rent Growth Since Q2-‘22: 1.5%

Asking Rent (Q2-‘23): $942

Effective Rent (Q2-‘23): $932

Multifamily Vacancy Rate (Q2-‘23): 9.9%

Multifamily Cap Rate (Q2-‘23): 6.7%

Source: National Association of Realtors

Oklahoma City, OK Housing Market Statistics:

Median Home Price (Q2-‘23): $247,600

Home Price Appreciation Since Q2-‘22: 6.8%

Source: National Association of Realtors

Lists That Mention Oklahoma City, OK:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #65

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #241

Best Places to Live – 2023-2024 (U.S. News): #106

Top-Rated Cities for Multifamily Investment 2024 (PwC/ULI): #10

#39: Hartford, CT

Hartford-East Hartford-Middletown, CT Metro Area Population: 1,221,303

Hartford, CT Rental Market Statistics:

Rental Inventory (Q2-‘23): 65,828

Units Added Since Q2-‘22: +111

Asking Rent Growth Since Q2-‘22: 4.4%

Asking Rent (Q2-‘23): $1,570

Effective Rent (Q2-‘23): $1,560

Multifamily Vacancy Rate (Q2-‘23): 4.5%

Multifamily Cap Rate (Q2-‘23): 6.4%

Source: National Association of Realtors

Hartford, CT Housing Market Statistics:

Median Home Price (Q2-‘23): $357,800

Home Price Appreciation Since Q2-‘22: 6.0%

Source: National Association of Realtors

Lists That Mention Hartford, CT:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #80

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #19

Best Places to Live – 2023-2024 (U.S. News): #56

#40: Winston-Salem, NC

Winston-Salem, NC Metro Area Population: 688,471

Winston-Salem, NC Rental Market Statistics:

Rental Inventory (Q2-‘23): 33,071

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 1.7%

Asking Rent (Q2-‘23): $1,145

Effective Rent (Q2-‘23): $1,134

Multifamily Vacancy Rate (Q2-‘23): 8.5%

Multifamily Cap Rate (Q2-‘23): 5.7%

Source: National Association of Realtors

Winston-Salem, NC Housing Market Statistics:

Median Home Price (Q2-‘23): $292,200

Home Price Appreciation Since Q2-‘22: 0.8%

Source: National Association of Realtors

Lists That Mention Winston-Salem, NC:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #92

Best Places to Live – 2023-2024 (U.S. News): #41

#41: Harrisburg, PA

Harrisburg-Carlisle, PA Metro Area Population: 603,493

Harrisburg, PA Rental Market Statistics:

Rental Inventory (Q2-‘23): 31,316

Units Added Since Q2-‘22: +368

Asking Rent Growth Since Q2-‘22: 2.0%

Asking Rent (Q2-‘23): $1,288

Effective Rent (Q2-‘23): $1,282

Multifamily Vacancy Rate (Q2-‘23): 5.1%

Multifamily Cap Rate (Q2-‘23): 6.0%

Source: National Association of Realtors

Harrisburg, PA Housing Market Statistics:

Median Home Price (Q2-‘23): $250,700

Home Price Appreciation Since Q2-‘22: 0%

Source: National Association of Realtors

Lists That Mention Harrisburg, PA:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #63

Best Places to Live – 2023-2024 (U.S. News): #38

#42: Reading, PA

Reading, PA Metro Area Population: 430,449

Reading, PA Rental Market Statistics:

Rental Inventory (Q2-‘23): 9,691

Units Added Since Q2-‘22: +20

Asking Rent Growth Since Q2-‘22: 3.2%

Asking Rent (Q2-‘23): $1,312

Effective Rent (Q2-‘23): $1,308

Multifamily Vacancy Rate (Q2-‘23): 2.3%

Multifamily Cap Rate (Q2-‘23): 6.8%

Source: National Association of Realtors

Reading, PA Housing Market Statistics:

Median Home Price (Q2-‘23): $267,500

Home Price Appreciation Since Q2-‘22: 10.1%

Source: National Association of Realtors

Lists That Mention Reading, PA:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #57

Best Places to Live – 2023-2024 (U.S. News): #88

#43: Burlington, VT

Burlington-South Burlington, VT Metro Area Population: 228,270

Burlington, VT Rental Market Statistics:

Rental Inventory (Q2-‘23): 6,473

Units Added Since Q2-‘22: +49

Asking Rent Growth Since Q2-‘22: 5.3%

Asking Rent (Q2-‘23): $1,751

Effective Rent (Q2-‘23): $1,745

Multifamily Vacancy Rate (Q2-‘23): 1.7%

Multifamily Cap Rate (Q2-‘23): 6.9%

Source: National Association of Realtors

Burlington, VT Housing Market Statistics:

Median Home Price (Q2-‘23): $486,500

Home Price Appreciation Since Q2-‘22: 5.1%

Source: National Association of Realtors

Lists That Mention Burlington, VT:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #28

#44: Wichita Falls, TX

Wichita Falls, TX Metro Area Population: 149,299

Wichita Falls, TX Rental Market Statistics:

Rental Inventory (Q2-‘23): 6,287

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 5.1%

Asking Rent (Q2-‘23): $848

Effective Rent (Q2-‘23): $844

Multifamily Vacancy Rate (Q2-‘23): 8.9%

Multifamily Cap Rate (Q2-‘23): 7.2%

Source: National Association of Realtors

Wichita Falls, TX Housing Market Statistics:

Median Home Price (Q2-‘23): $193,300

Home Price Appreciation Since Q2-‘22: 11.1%

Source: National Association of Realtors

Lists That Mention Wichita Falls, TX:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #118

#45: Pittsfield, MA

Pittsfield, MA Metro Area Population: 127,859

Pittsfield, MA Rental Market Statistics:

Rental Inventory (Q2-‘23): 2,006

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 5.1%

Asking Rent (Q2-‘23): $1,169

Effective Rent (Q2-‘23): $1,164

Multifamily Vacancy Rate (Q2-‘23): 3.4%

Multifamily Cap Rate (Q2-‘23): 7.6%

Source: National Association of Realtors

Pittsfield, MA Housing Market Statistics:

Median Home Price (Q2-‘23): $287,400

Home Price Appreciation Since Q2-‘22: -11.3%

Source: National Association of Realtors

Lists That Mention Pittsfield, MA:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #127

#46: Lansing, MI

Lansing-East Lansing, MI Metro Area Population: 540,870

Lansing, MI Rental Market Statistics:

Rental Inventory (Q2-‘23): 31,746

Units Added Since Q2-‘22: +218

Asking Rent Growth Since Q2-‘22: 4.8%

Asking Rent (Q2-‘23): $1,117

Effective Rent (Q2-‘23): $1,111

Multifamily Vacancy Rate (Q2-‘23): 7.1%

Multifamily Cap Rate (Q2-‘23): 6.6%

Source: National Association of Realtors

Lansing, MI Housing Market Statistics:

Median Home Price (Q2-‘23): $226,100

Home Price Appreciation Since Q2-‘22: 4.5%

Source: National Association of Realtors

Lists That Mention Lansing, MI:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #42

Best Places to Live – 2023-2024 (U.S. News): #83

#47: Lexington, KY

Lexington-Fayette, KY Metro Area Population: 517,916

Lexington, KY Rental Market Statistics:

Rental Inventory (Q2-‘23): 38,330

Units Added Since Q2-‘22: +202

Asking Rent Growth Since Q2-‘22: 4.8%

Asking Rent (Q2-‘23): $1,107

Effective Rent (Q2-‘23): $1,100

Multifamily Vacancy Rate (Q2-‘23): 6.6%

Multifamily Cap Rate (Q2-‘23): 6.2%

Source: National Association of Realtors

Lexington, KY Housing Market Statistics:

Median Home Price (Q2-‘23): $261,300

Home Price Appreciation Since Q2-‘22: 4.1%

Source: National Association of Realtors

Lists That Mention Lexington, KY:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #42

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #213

Best Places to Live – 2023-2024 (U.S. News): #34

#48: Montgomery, AL

Montgomery, AL Metro Area Population: 388,243

Montgomery, AL Rental Market Statistics:

Rental Inventory (Q2-‘23): 20,570

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 2.1%

Asking Rent (Q2-‘23): $977

Effective Rent (Q2-‘23): $972

Multifamily Vacancy Rate (Q2-‘23): 10.6%

Multifamily Cap Rate (Q2-‘23): 6.6%

Source: National Association of Realtors

Montgomery, AL Housing Market Statistics:

Median Home Price (Q2-‘23): $214,200

Home Price Appreciation Since Q2-‘22: 2.9%

Source: National Association of Realtors

Lists That Mention Montgomery, AL:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #139

Best Places to Live – 2023-2024 (U.S. News): #94

#49: Erie, PA

Erie, PA Metro Area Population: 267,689

Erie, PA Rental Market Statistics:

Rental Inventory (Q2-‘23): 6,575

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 5.0%

Asking Rent (Q2-‘23): $1,050

Effective Rent (Q2-‘23): $1,047

Multifamily Vacancy Rate (Q2-‘23): 2.2%

Multifamily Cap Rate (Q2-‘23): 7.8%

Source: National Association of Realtors

Erie, PA Housing Market Statistics:

Median Home Price (Q2-‘23): $169,000

Home Price Appreciation Since Q2-‘22: 5.8%

Source: National Association of Realtors

Lists That Mention Erie, PA:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #81

#50: York, PA

York-Hanover, PA Metro Area Population: 461,058

York, PA Rental Market Statistics:

Rental Inventory (Q2-‘23): 11,498

Units Added Since Q2-‘22: +461

Asking Rent Growth Since Q2-‘22: 3.2%

Asking Rent (Q2-‘23): $1,405

Effective Rent (Q2-‘23): $1,398

Multifamily Vacancy Rate (Q2-‘23): 6.5%

Multifamily Cap Rate (Q2-‘23): 6.5%

Source: National Association of Realtors

York, PA Housing Market Statistics:

Median Home Price (Q2-‘23): $265,800

Home Price Appreciation Since Q2-‘22: 6.9%

Source: National Association of Realtors

Lists That Mention York, PA:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #130

Best Places to Live – 2023-2024 (U.S. News): #78

#51: Grand Rapids, MI

Grand Rapids-Kentwood, MI Metro Area Population: 1,094,198

Grand Rapids, MI Rental Market Statistics:

Rental Inventory (Q2-‘23): 51,161

Units Added Since Q2-‘22: +72

Asking Rent Growth Since Q2-‘22: 3.3%

Asking Rent (Q2-‘23): $1,353

Effective Rent (Q2-‘23): $1,347

Multifamily Vacancy Rate (Q2-‘23): 4.7%

Multifamily Cap Rate (Q2-‘23): 5.8%

Source: National Association of Realtors

Grand Rapids, MI Housing Market Statistics:

Median Home Price (Q2-‘23): $330,300

Home Price Appreciation Since Q2-‘22: 4.8%

Source: National Association of Realtors

Lists That Mention Grand Rapids, MI:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #68

Best Places to Live – 2023-2024 (U.S. News): #20

#52: Springfield, MA

Springfield, MA Metro Area Population: 694,523

Springfield, MA Rental Market Statistics:

Rental Inventory (Q2-‘23): 23,436

Units Added Since Q2-‘22: +90

Asking Rent Growth Since Q2-‘22: 4.4%

Asking Rent (Q2-‘23): $1,365

Effective Rent (Q2-‘23): $1,361

Multifamily Vacancy Rate (Q2-‘23): 2.6%

Multifamily Cap Rate (Q2-‘23): 7.3%

Source: National Association of Realtors

Springfield, MA Housing Market Statistics:

Median Home Price (Q2-‘23): $336,000

Home Price Appreciation Since Q2-‘22: 0.4%

Source: National Association of Realtors

Lists That Mention Springfield, MA:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #25

Best Places to Live – 2023-2024 (U.S. News): #108

#53: Norwich, CT

Norwich-New London, CT Metro Area Population: 269,902

Norwich, CT Rental Market Statistics:

Rental Inventory (Q2-‘23): 10,761

Units Added Since Q2-‘22: +50

Asking Rent Growth Since Q2-‘22: 3.3%

Asking Rent (Q2-‘23): $1,542

Effective Rent (Q2-‘23): $1,536

Multifamily Vacancy Rate (Q2-‘23): 4.4%

Multifamily Cap Rate (Q2-‘23): 6.3%

Source: National Association of Realtors

Norwich, CT Housing Market Statistics:

Median Home Price (Q2-‘23): $345,900

Home Price Appreciation Since Q2-‘22: 3.9%

Source: National Association of Realtors

Lists That Mention Norwich, CT:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #27

#54: Topeka, KS

Topeka, KS Metro Area Population: 231,783

Topeka, KS Rental Market Statistics:

Rental Inventory (Q2-‘23): 9,689

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 3.9%

Asking Rent (Q2-‘23): $838

Effective Rent (Q2-‘23): $834

Multifamily Vacancy Rate (Q2-‘23): 9.1%

Multifamily Cap Rate (Q2-‘23): 7.6%

Source: National Association of Realtors

Topeka, KS Housing Market Statistics:

Median Home Price (Q2-‘23): $194,600

Home Price Appreciation Since Q2-‘22: 2.6%

Source: National Association of Realtors

Lists That Mention Topeka, KS:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #1

#55: Indianapolis, IN

Indianapolis-Carmel-Anderson, IN Metro Area Population: 2,142,193

Indianapolis, IN Rental Market Statistics:

Rental Inventory (Q2-‘23): 162,903

Units Added Since Q2-‘22: +1,078

Asking Rent Growth Since Q2-‘22: 3.6%

Asking Rent (Q2-‘23): $1,217

Effective Rent (Q2-‘23): $1,207

Multifamily Vacancy Rate (Q2-‘23): 8.4%

Multifamily Cap Rate (Q2-‘23): 5.9%

Source: National Association of Realtors

Indianapolis, IN Housing Market Statistics:

Median Home Price (Q2-‘23): $311,200

Home Price Appreciation Since Q2-‘22: 2.6%

Source: National Association of Realtors

Lists That Mention Indianapolis, IN:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #22

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #98

Best Places to Live – 2023-2024 (U.S. News): #68

#56: Des Moines, IA

Des Moines-West Des Moines, IA Metro Area Population: 729,053

Des Moines, IA Rental Market Statistics:

Rental Inventory (Q2-‘23): 56,888

Units Added Since Q2-‘22: +192

Asking Rent Growth Since Q2-‘22: 3.5%

Asking Rent (Q2-‘23): $1,105

Effective Rent (Q2-‘23): $1,097

Multifamily Vacancy Rate (Q2-‘23): 6.5%

Multifamily Cap Rate (Q2-‘23): 7.1%

Source: National Association of Realtors

Des Moines, IA Housing Market Statistics:

Median Home Price (Q2-‘23): $296,600

Home Price Appreciation Since Q2-‘22: 3.0%

Source: National Association of Realtors

Lists That Mention Des Moines, IA:

Markets to Watch – Overall Real Estate Prospects 2024 (PwC/ULI): #69

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #287

Best Places to Live – 2023-2024 (U.S. News): #19

#57: Spartanburg, SC

Spartanburg, SC Metro Area Population: 345,831

Spartanburg, SC Rental Market Statistics:

Rental Inventory (Q2-‘23): 14,776

Units Added Since Q2-‘22: +132

Asking Rent Growth Since Q2-‘22: 3.9%

Asking Rent (Q2-‘23): $1,220

Effective Rent (Q2-‘23): $1,204

Multifamily Vacancy Rate (Q2-‘23): 16.6%

Multifamily Cap Rate (Q2-‘23): 5.1%

Source: National Association of Realtors

Spartanburg, SC Housing Market Statistics:

Median Home Price (Q2-‘23): $291,100

Home Price Appreciation Since Q2-‘22: 5.5%

Source: National Association of Realtors

Lists That Mention Spartanburg, SC:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #199

Best Places to Live – 2023-2024 (U.S. News): #43

Fastest-Growing Real Estate Markets – 2023-2024 (U.S. News): #12

#58: Springfield, IL

Springfield, IL Metro Area Population: 205,513

Springfield, IL Rental Market Statistics:

Rental Inventory (Q2-‘23): 7,312

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 6.9%

Asking Rent (Q2-‘23): $893

Effective Rent (Q2-‘23): $890

Multifamily Vacancy Rate (Q2-‘23): 8.0%

Multifamily Cap Rate (Q2-‘23): 7.2%

Source: National Association of Realtors

Springfield, IL Housing Market Statistics:

Median Home Price (Q2-‘23): $162,600

Home Price Appreciation Since Q2-‘22: 5.0%

Source: National Association of Realtors

Lists That Mention Springfield, IL:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #40

#59: Florence, SC

Florence, SC Metro Area Population: 199,119

Florence, SC Rental Market Statistics:

Rental Inventory (Q2-‘23): 5,548

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 8.0%

Asking Rent (Q2-‘23): $1,079

Effective Rent (Q2-‘23): $1,074

Multifamily Vacancy Rate (Q2-‘23): 6.8%

Multifamily Cap Rate (Q2-‘23): 6.5%

Source: National Association of Realtors

Florence, SC Housing Market Statistics:

Median Home Price (Q2-‘23): $208,200

Home Price Appreciation Since Q2-‘22: 1.6%

Source: National Association of Realtors

Lists That Mention Florence, SC:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #160

#60: Bismarck, ND

Bismarck, ND Metro Area Population: 134,427

Bismarck, ND Rental Market Statistics:

Rental Inventory (Q2-‘23): 6,679

Units Added Since Q2-‘22: +0

Asking Rent Growth Since Q2-‘22: 5.1%

Asking Rent (Q2-‘23): $1,070

Effective Rent (Q2-‘23): $1,067

Multifamily Vacancy Rate (Q2-‘23): 4.7%

Multifamily Cap Rate (Q2-‘23): 8.6%

Source: National Association of Realtors

Bismarck, ND Housing Market Statistics:

Median Home Price (Q2-‘23): $277,400

Home Price Appreciation Since Q2-‘22: -3.0%

Source: National Association of Realtors

Lists That Mention Bismarck, ND:

Emerging Housing Markets Index – Fall 2023 (WSJ/Realtor.com): #190

Methodology: How Do We Calculate Our Rankings of Up-and-Coming Real Estate Markets?

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Markets with the best multifamily investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home price appreciation, as measured by the National Association of Realtors

- Markets with affordable home prices relative to income, as measured by the National Association of Realtors

- Markets with affordable monthly mortgage payments relative to income, as measured by the National Association of Realtors

- Markets that present the best value for residents, as measured by U.S. News

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

- Cities with the strongest job markets, as measured by U.S. News

- States with the most economic activity, as measured by the National Association of Realtors

- Markets with a high rate of inbound business moves relative to outbound moves, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the National Association of Realtors

- The fastest-growing real estate markets, as measured by U.S. News

- Markets with a high rate of inbound moves relative to outbound moves, as measured by the National Association of Realtors

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News