The Science of Growing Your Portfolio

Learn the steps to get your property management company's portfolio growth down to a science.

Get the GuideIf you’ve worked in property management over the past few years, you’re no stranger to uncertainty in the rental market. Growing your portfolio traditionally—either through finding new owners to do business with or taking on more doors from your existing clients—isn’t always an option.

Finding additional revenue streams takes creativity, but it’s essential if you want to build a resilient and ultimately more profitable business. In our free guide, Generate More Revenue—Without Adding New Doors, we’ll walk you through every aspect of unlocking new sources of revenue and getting the most value out of the services you already offer.

Read on for a preview of these insights, or jump right into the full guide here.

5 Reasons to Find New Property Management Revenue Sources

![]()

There are several reasons why getting the most out of the revenue streams available to you is essential. If you’re strategic about how you charge for particular services and clear about the value each adds, you can expect the following benefits:

1. Diversification: Much like any business, diversifying income streams can provide more financial stability for your business. Real estate markets can be volatile, so having additional revenue streams can help property managers navigate these fluctuations more successfully. By generating revenue through multiple channels, you can mitigate the risks inherent to the industry.

2. Softening the Impact of Vacancies: It’s an unavoidable fact: no tenant means no management fee. By finding additional sources of revenue, property managers can offset the income lost during periods of vacancy.

3. Happier Tenants: Additional sources of revenue often come from offering value-added services such as maintenance and repairs, renovation management, or financial reporting. Not only do these services generate income, but they also provide more value for residents, which can lead to more long-term renters and fewer vacancies.

4. A Competitive Edge: Value-added services aren’t just attractive to renters. Rental owners are also drawn to property management companies with services that can distinguish their properties from the competition and provide greater stability by keeping their units filled.

5. Business Growth: Additional revenue streams can provide more capital for reinvestment into your business, whether that takes the form of new technology to improve efficiency, expanding your team, ramping up marketing efforts, or any other initiative you choose.

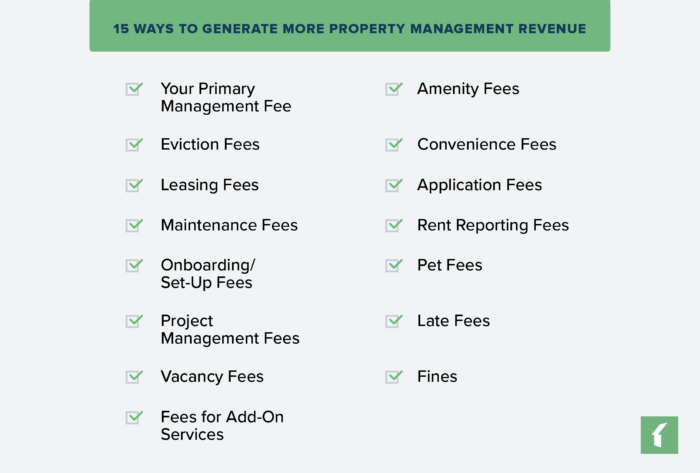

15 Ways to Generate More Property Management Revenue

Managing a portfolio of properties requires a long list of tasks everyday. Be sure that you’re setting the right fee for each of those tasks and getting compensated for the value you bring to your clients and tenants.

Here are 15 types of fees you should be generating revenue from:

1. Your Primary Management Fee: As a general rule, the more value that you add to property owners’ portfolios through higher monthly rents and other revenue opportunities, the higher the fee you can justify when your contract comes up for renewal. You can set this fee in a variety of ways, including

- A flat rate or percentage-based rate (the most common)

- A hybrid rate where collect a percentage of the rent for your monthly management fee, then charge a flat rate for services that your clients can elect to use

- Pricing tiers that scale up according to the level of service a client wants

- Variable rates that derive from the number of units that they manage per building or per owner, the unit’s rent, or its location

2. Eviction Fees: Set these in accordance with your state and local laws for the time that it takes them to process, remediate, or execute the eviction.

3. Leasing Fees: These cover any costs incurred during the leasing process, including advertising vacancies, turning over units, showing rental properties, and screening applicants.

4. Maintenance Fees: These fees cover the cost of maintenance services. As an added bonus, if your staff can take care of maintenance issues in-house rather than calling in sub-contractors, you can save clients money and create an additional revenue stream for your business.

5. Onboarding / Set-Up Fees: This is a one-time fee to set up a new client in your systems that varies based on portfolio size.

6. Project Management Fees: You can charge project management fees to your clients, which will vary depending on the project’s cost and duration.

7. Vacancy Fees: Since you’re still managing your clients’ properties even when a unit is vacant, you may want to charge a monthly vacancy fee until the unit is occupied.

8. Fees for Add-On Services: You can introduce fees to tenants based on the services you provide them, including anything from outdoor maintenance and priority repair queues to exclusive event access, moving services and the ability to transfer between properties. These can either be offered individually or together as part of a resident benefits package. Our full guide breaks down which of these services can provide the most value for your property management company.

9. Amenity Fees: These fees charge tenants for valuable offerings, such as a pool, gym, parking garage, or storage area. Like add-on services, these can provide an additional sense of comfort and value for your tenants and attract more renters to your properties. Explore the full guide to learn which amenities tenants desire most.

10. Convenience Fees: These are for things like payment methods that take extra effort for your team. They can discourage residents from paying in a particular way, so you’ll need to balance the dampening effect of these fees with the revenue that they can bring in.

11. Application Fees: Application fees are a smart way to discourage rental applicants who aren’t serious from wasting your time. They can also be a reliable way to earn extra revenue for your business. You can implement these strategies to avoid getting pushback from tenants.

12. Rent Reporting Fees: Rent reporting adds value for tenants, while incentivizing responsible and reliable payment habits. By opting into the service, tenants can have their on-time payments positively impact the credit score.

13. Pet Fees: 66% of households have at least one pet, meaning pet fees are a smart way to bring in additional revenue while attracting a wider pool of potential tenants. Many pet owners are willing to pay more to live in a pet-friendly community.

14. Late Fees: While late fees are a common tool in the industry to incentivize on-time payments, always take a cautious approach when implementing them. If you have a resident who’s consistently late on their rent payments, there may be a deeper issue at play that late fees will only worsen. Start by initiating an amicable conversation with residents who can’t seem to pay on time.

15. Fines: Use fines to offset expenses incurred by your staff, such as the cost of repairing damage to a unit. Be sure to set them at a rate that accounts for the resources and time needed to handle violations, too.

How Much Potential Property Management Revenue Are You Leaving on the Table?

Every property management business has a different approach to their operations and how they approach growth but, in any business, there’s room to improve profit margins. Fine tuning your existing fees for any of the services above, or introducing new ones that are a good fit for your clientele and business model will make your business more resilient and profitable in the long run.

If you want to discover how to unlock new revenue streams in greater detail, take a look at our full guide: Generate More Money—Without Adding New Doors.

Read more on Growth