The U.S. hit a grim milestone in the COVID-19 pandemic this week: 100,000 deaths—a staggering number that experts believe is a vast underestimation of the true impact of the virus so far. At the same time, more than 40 million Americans have lost their jobs; though for the first time since the crisis began, continuing claims fell slightly last week as local economies began to reopen.

Chart of Accounts

Want clearer, cleaner books? What about a more useful view into your properties or just easier accounting in general?

Get the GuideThis is the tenth weekly COVID-19 digest that Buildium has published; and even as May turns to June, it’s still not clear what form the recovery will take, or on what timeline. HousingWire raised the pessimistic possibility of an O-shaped recovery this week, “where a new wave of coronavirus infections disrupts the return to normalcy and brings the country back to where it started.”

In this week’s post, we’ll dig in deeper than usual on May rent payments, unemployment rates, and rent growth—from how unemployment has impacted collections in different cities, to where rent growth has slowed most during the crisis.

Headlines: New Perspectives on May Rents, Unemployment Rates, and Rent Growth

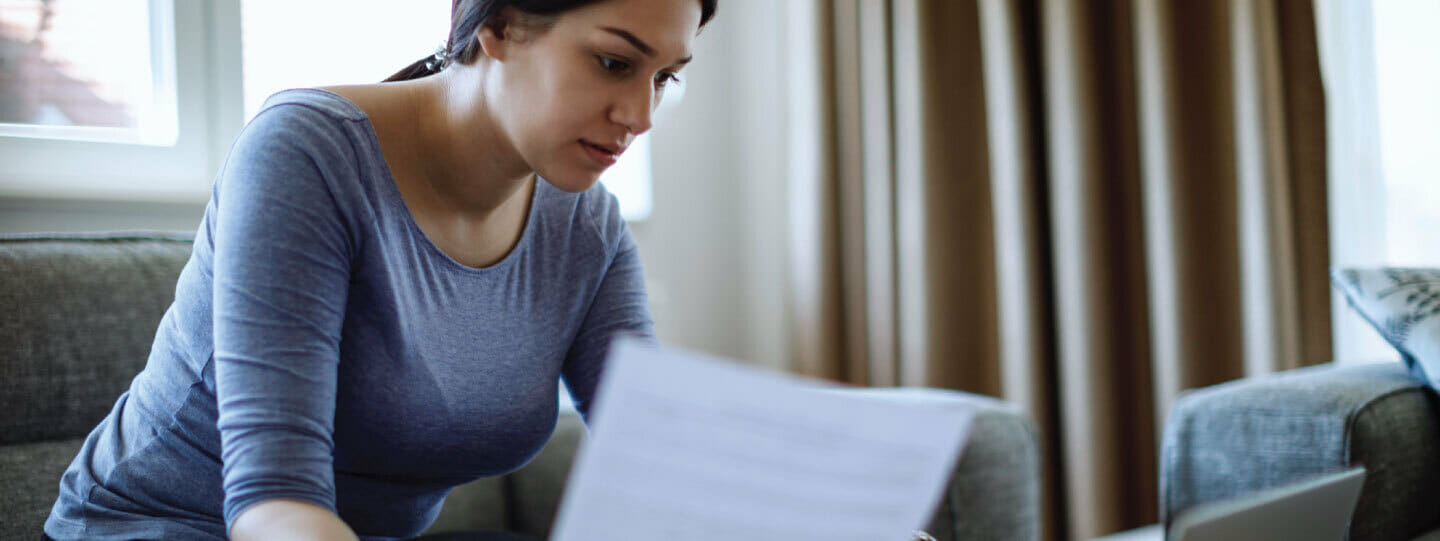

93.3% of residents paid their rent by May 27—but other metrics tell a more nuanced story. The National Multifamily Housing Council’s payment tracker doesn’t specify how many renters made full versus partial payments, or how payment rates vary (often drastically) between property types. In mid-May, a Census Bureau survey that included a wider range of rental properties than the NMHC tracker found that 1 in 5 residents either deferred their rent, made a partial payment, or failed to pay at all in April. Even more concerning is that 1 in 3 residents have little to no confidence in their ability to pay rent in June.

Rent payment rates tend to mirror unemployment and infection rates in cities across the country. So far this month, collections have been strong in Austin, Dallas, Denver, and Phoenix—four cities whose economies have fared relatively well in the course of the pandemic. New York City lost 1.4 million jobs in April as the pandemic raged, causing rent payments to lag; but in May, as the city initiated a slow recovery, the payment rate reached the national average. Meanwhile, payments have fallen behind in Baltimore, where case rates have jumped in recent weeks, while Maryland has been slow to process unemployment claims. Payments have stayed below the national average in Las Vegas and New Orleans, which lost a disproportionate number of leisure and hospitality jobs; and are slightly behind in Los Angeles, where nearly 660,000 jobs disappeared in April.

The number of workers on unemployment declined for the first time in 10 weeks. Though a staggering 21 million Americans received unemployment benefits last week, the number of new claims fell in 38 states. However, another 2.1 million workers filed first-time claims. This brings the total to 40.8 million people who have lost their jobs since the start of the crisis, representing 1 in 4 American workers.

Rent growth decreased year-over-year in 33 of 35 of the largest markets in the U.S. last month. Rents were just 2.9% higher in April 2020 than in 2019, compared with March, when rents were 3.4% higher than the previous year. This represents the largest single-month decrease in rent growth since Zillow began tracking the trend in 2014, and clearly reflects the rapid shift in what renters could afford to pay for housing as the economy ground to a halt. Though cities like Baltimore, New York City, Houston, and San Jose saw asking rents rise by a paltry 1.5% year-over-year, rents were 5 to 7% higher than 2019 in Phoenix, Seattle, and Cincinnati. Between March and April, asking rents dropped slightly in 16 of the 35 largest markets, including San Jose, Austin, and Los Angeles.

Industry organizations continue to urge Congress to provide assistance for renters, rental owners, and multifamily businesses as eviction moratoriums, increased unemployment benefits, and other programs come to an end. The HEROES Act—which would provide a second round of stimulus checks and extend federal unemployment benefits into 2021—passed the House in mid-May, but a vote has yet to be scheduled in the Senate. (You can learn more about the National Apartment Association’s suggestions for federal aid here.)

This Week’s Best COVID-19 Resources for Property Managers

- Communication is King as Renters Face Financial Strain (Multifamily Executive)

- Business Un-usual: Communications Accelerated [Video Series] (Buildium)

- Onboarding During a Pandemic (National Apartment Association)

- 8 Reopening Strategies Businesses Are Embracing (U.S. Chamber of Commerce)

- How to Address Employee Fear When Returning to the Workplace (National Apartment Association)

- The Newfound Importance of Technology in Property Management (National Real Estate Investor)

- C.D.C. Recommends Sweeping Changes to American Offices (The New York Times)

- COVID-19: Impact on Apartment Marketing (RealPage)

- New Paycheck Protection Program Guidance Allays Borrower Concerns (National Apartment Association)

- The Market for Flexible Rentals Sees Unprecedented Surge (Forbes)

Wondering how things have changed? Jump forward one week to 6/6/20, or jump back one week to 5/23/20.

Read more on Uncategorized