Buildium has added a cash flow statement to our Reports page. In this article, I’ll talk about what it is and why it’s important, show you how to set it up, and how to use it.

What is a cash flow statement, anyway?

When it comes to accounting, there are a set of statements that I like to refer to as the “Big Three.” Here they are:

- The balance sheet: A statement that shows what’s owned and what’s owed as of a specific date

- The income statement (a.k.a. Profit & Loss, or P&L for short): These statements show what’s been earned and lost over a period of time.

- The cash flow statement: This statement shows the change in cash over a period of time.

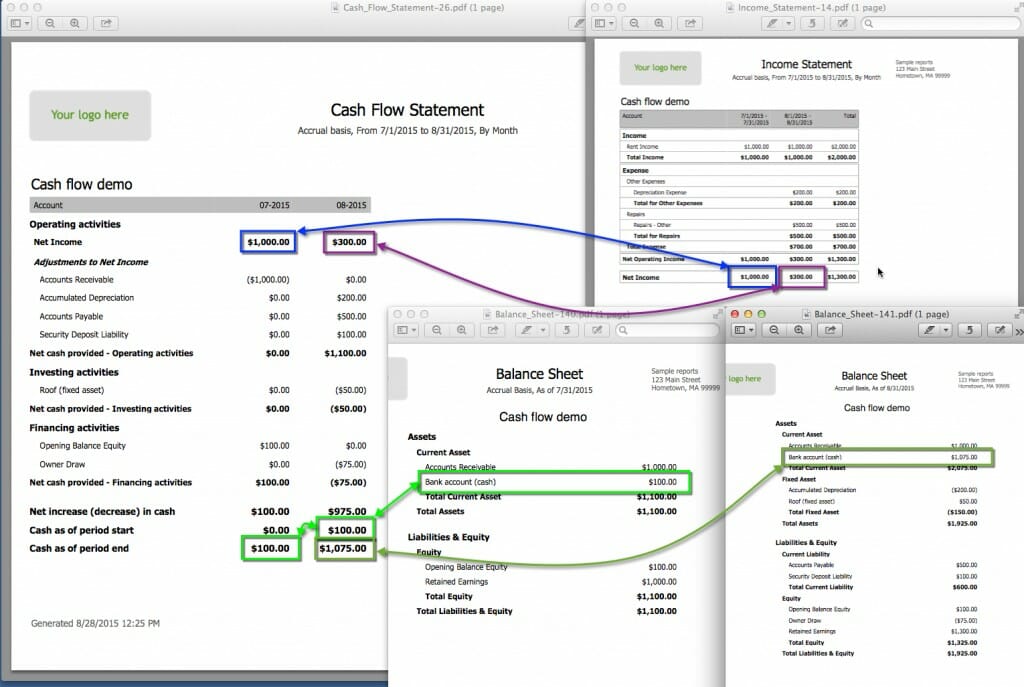

For a lot of businesses, income statements and cash flow statements might look really similar, and we’ll dig into the differences below.

A Cash Flow Crash Course for Property Managers

You’ve heard it before: “Cash is king.” And as such, the cash flow statement is a key report for you to understand.

Cash flow statements are helpful because they include all the cash coming in and going out of the business. Most of the time when money comes in, it’s income, like when your company earns its management fee each month; and when it goes out, it’s an expense, like when you pay the electric bill to keep on the lights or pay your employees for a job well done. But sometimes, cash comes in or goes out for other reasons, like when you bought that piece of equipment. Big investments are usually booked as a fixed assets, and don’t show up as income on an income statement. However, all of this does show up on the cash flow statement.

The cash flow statement is particularly important in accrual basis accounting. Here, you’ll recognize income when it’s earned and expenses when they’re owed. Cash doesn’t need to be exchanged. The cash flow statement brings real-world financial sanity to the table.

For example, Tim Tenant owes $1000 rent on the 1st. He (finally) pays his rent on the 14th. On a cash basis, you recognize the income on the 14th; that’s when the money came in. On an accrual basis, you recognize the income on the 1st; that’s when the rent was “earned.”

On a cash accounting basis, your income statement and cash flow statement show the same thing: rent on the 14th. On an accrual accounting basis, the income statement shows the income on the 1st. The cash flow statement shows it on the 14th. That could be the difference between writing a check that’d clear the bank and one that’d bounce!

When Should I Use a Cash Flow Statement?

Cash flow statements are really important in three situations:

- When you’re keeping your company books on an accrual basis (or your clients’).

- If your clients ask for one. This will happen most often when your rental owner or board member is an accounting and finance geek like me.

- When you’re investing a lot in the business, buying equipment and making other capital improvements.

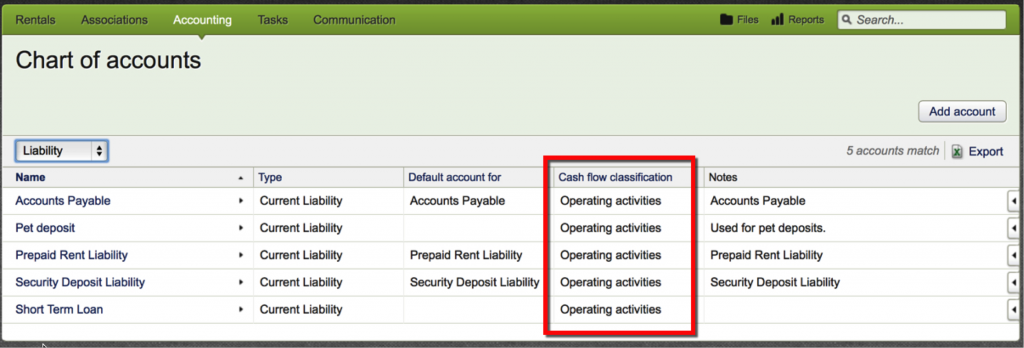

How Do I Set Up My Accounts?

We’ve updated your chart of accounts to use cash flow statements out of the box. We’ve mapped all of the existing accounts to the correct cash flow classifications. In most cases, you won’t have to do a thing.

You or your accountant should still review our mappings, just to be safe. Not sure how to start? See our help article!

Read more on Accounting & Reporting