Rental income is the revenue engine for your portfolio, so the tools you use to track it matter. With an effective rent tracker app, you can move past just logging payments to automate communication and reminders, sync with the rest of your bookkeeping and spot trends in collections so you can act before issues ripple across owner payouts. But how do you choose the right software?

This post will lay out the features that separate top performers, and compare seven options to choose the best fit for your business.

What Is a Rent Tracker App?

A rent tracker app helps property managers and residents monitor rent activity across a portfolio. At its core, it records payments, tracks balances, and applies charges such as rent, fees, and deposits.

Most platforms also automate reminders and late fees, accept online payments, and generate reports that summarize performance by unit, property, owner, or portfolio. Many tools now include resident portals and integrated accounting, so receivables flow directly into financial statements without manual entry.

Features to Look for in a Rent Tracker App

Before you compare products,make sure you have a list of your must-have capabilities. The features below appear again and again in tools that work well for property managers.

User-Friendly Interface

If software is easy to navigate, adoption climbs and training time falls. Look for clean dashboards, intuitive ledger views, and clear receipt histories so staff can resolve questions quickly.

Accessibility Across Devices

Teams and tenants both benefit—and often expect—access on the device of their choice. That means, you should look for software with full functionality on desktop and mobile. Native apps or responsive web portals should let residents view balances, pay, and message; staff should see unit ledgers, notes, and tasks on the go.

An Integrated Accounting System

Rent tracking is only half the job if you still move numbers into accounting by hand. Prioritize platforms with true general ledger accounting, bank reconciliation, and owner reporting so rent activity syncs automatically. That linkage is what speeds month-end close and improves accuracy.

Easy Payments and Communication for Residents

Residents should be able to pay by ACH, credit, or debit, set up autopay, receive reminders, and view receipts in a single portal. Bonus points if communications, documents, and maintenance live in the same place to keep messages and money in one thread.

Time-Saving Analytics and Reporting Capabilities

Dashboards showing collections by property, delinquency aging, and month-over-month trends give both you and your clients the context they need to make important property decisions. Exportable and shareable reports make owner meetings smoother and help you allocate staff time where it matters.Bonus points if there’s a channel that owners can use to access the details they need without having to contact your team directly.

Top Contenders for the Best Rent Tracker App

Once you know what to look for, the next step is finding a platform that fits your portfolio and budget. The best rent tracker apps make collections easier for residents while giving managers real-time visibility into payments, balances, and trends. They also connect directly to accounting and reporting so every transaction is accurate and traceable.

The tools below represent a range of solutions built for property managers of different sizes and styles. Each offers a slightly different approach to rent tracking, payment flexibility, and automation, giving you several strong options to compare before choosing the right fit for your business.

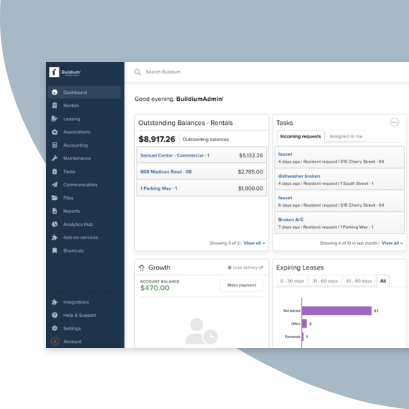

1. Buildium

Rent Tracking Integrated with Comprehensive Property Management Software

Buildium is a comprehensive property management platform designed to handle every part of the rent cycle—from billing and payments to reconciliation and reporting. Its rent tracking tools give managers a clear view of every charge, payment, and balance across units and portfolios. Real-time ledgers update automatically as payments post, so teams always see accurate data without manual entry or spreadsheet work.

The online rent payment system is one of the most robust on the market, offering secure, automated rent collection that integrates seamlessly with its accounting tools.

The software does the heavy lifting at every step of the lead-to-lease cycle, helping landlords and property managers simplify rent tracking, reduce late payments, and automate financial workflows. The Resident Center app allows tenants to make rent payments with just a few taps and includes autopay features with support for multiple payments options, such as credit, debit, and ACH.

Because Buildium is a comprehensive platform, it works well for multiple portfolio types, including single and multifamily residential properties and associations and can handle everything from lead-to-lease workflows, maintenance tracking, analytics, and more. This makes it the ideal choice for property managers who need a fully integrated platform.

Features

Buildium has an array of features that cover rent tracking and broader property management tasks, including:

- Lead-to-lease tools that streamline your workflow from accepting applicants all the way to signing the lease.

- Free website creator and listing syndication to market your listings.

- Automated electronic payments and accounting including 1099 eFiling.

- Analytics and insights tools to measure and report your business growth.

- Tenant and owner portals with online payment, maintenance reporting and tracking, and notification capabilities.

- Top-rated mobile apps (for both your team and your tenants) that allow you to communicate with your renters, manage work orders, and collect payments.

If Buildium doesn’t have a tool you need, one of their Marketplace partners almost likely does. The Marketplace is an ecosystem of apps and digital services that integrate seamlessly with your Buildium account. This sampling of popular partner solutions allows you to:

- Offer incentives for on-time payments

- Streamline collections for HOAs and condo associations

- Get direct survey feedback from your residents

- Easily manage deposits and set up deposit-free alternatives

Pricing

Buildium offers three tiers of pricing, each tailored to different business needs. Each of these plans include core property management and rent payment features such as:

- Online Rent Payment System

- Complete Lead-To-Lease Management

- Accounting

- Maintenance

- Task Management

- Online Portals

- Resident Communications

The pricing tiers scale with your business, depending on the size of your needs.

- Essential: Starts at $58/month and includes Buildium’s core features, including accounting and task management tools.

- Growth: Starts at $183/month and includes reduced incoming ACH fees, unlimited eSignatures, and actionable insights in Analytics Hub.

- Premium: Starts at $375/month for property managers who want to automate their workflows. It includes everything in Growth, unlimited incoming ACH (fees waived), plus access to Buildum’s Open API and Priority Support.

Buildium includes two mobile rent payment apps, one for property managers and Resident Center, a separate app where tenants can make rent payments, maintenance requests and more, available on the Apple App Store and Google Play.

2. Propertyware

Customizable Property Management Software with Rent Tracking

Propertyware® is a fully customizable property management tool designed by property managers specifically to meet the unique needs of the industry. Its platform supports some of the industry’s largest and most successful property management companies, and it’s backed by the security of RealPage, which processes more than $11 billion in payments annually.

Propertyware allows property managers to control every aspect of how they manage their properties and run their business.

Features

Propertyware’s rent-tracking capabilities stand out for their depth of customization and the range of tools available to manage payments and reporting.

- Online rent collection and configurable late-fee rules

- Customizable dashboards and reports for receivables

- Resident and owner portals with payment history

- API and integrations to fit specific operational needs

Pricing

Propertyware has three pricing tiers:

- Basic starts at $1 per unit per month, with a $250 minimum

- Plus starts at $1.50, with a $350 minimum

- Premium starts at $2 with a $450 minimum

All plans charge 2x the monthly subscription price for implementation.

Propertyware includes a mobile app available on the Apple App Store and Google Play with online rent payment functionality.

3. Rentec Direct

A Basic App that Covers Rent Tracking and Accounting Fundamentals

Rentec Direct® focuses on the essentials for smaller portfolios and landlords. If you need solid online collection, simple ledgers, and basic accounting rather than an enterprise toolset, it’s worth a look.

Features

Rentec Direct has a handful of useful tools for tracking rent and related property management tasks. The platform:

- provides full accounting-grade rent tracking with live ledgers and built-in reports such as Rent Roll, Owner Statement, and Category Ledger .

- supports recurring and one-time ACH, debit, or credit payments with same-day posting to ledgers.

- supports configurable late-fee automation, rent reminders, and email/SMS notifications for upcoming or missed payments.

- contains tenant and owner portals that show balances, receipts, and payment histories in real time.

- syncs transactions directly to general-ledger accounts and exports data for tax and owner reporting.

- integrates with partner tools for rent reporting, vendor payments, and e-filing 1099s.

Pricing

Rentec Direct has two pricing plans, Rentec Pro for landlords and investors and Rentec PM for property managers. Both are based on the number of units managed.

The base price for less than 10 units is $45 per month, or $41 if you choose an annual subscription. You can use the price calculator on their site to determine the cost of a subscription based on the number of units you enter.

4. RentRedi

A Tenant-Centric Rent Tracking App

RentRedi® emphasizes resident experience with mobile-first payments and simple rent visibility. It can be attractive for PMs who want a lightweight, tenant-friendly front end.

Features

The app can simplify rent tracking, especially on the tenant side of the house with software that:

- consolidates rent activity from cash, ACH, debit, and credit into unified property ledgers.

- accepts cash payments at 90,000 retail locations through its Chime partnership, with automatic reconciliation.

- offers partial, block, and scheduled payments plus autopay and instant payment receipts.

- tracks rent status, delinquencies, and trends via exportable accounting reports.

- connects rent tracking with leasing, maintenance, and tenant screening in one dashboard.

Pricing

RentRedi offers a simple pricing structure. There’s a monthly pay-as-you-go option priced at $29.95 per month. You can opt for a recurring 6-month plan that breaks down to $19.50 a month, or you can choose an annual plan for $12 a month.

RentRedi includes a mobile app available on the Apple App Store and Google Play with online rent payment functionality.

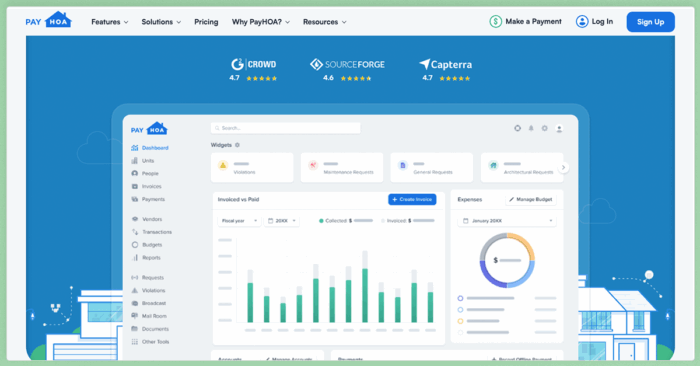

5. PayHOA

A Rent Tracking App for Community Associations

Although tailored to HOAs and community associations, PayHOA® has dues and assessment workflows that line up closely with rent-tracking needs in association contexts.

Features

Some rent-tracking and financial tools make PayHOA a solid option for associations. Its core capabilities include:

- automated invoicing for dues, fees, and late charges with real-time posting to association ledgers.

- online ACH and credit-card payments and lets homeowners enable autopay.

- synced collections directly to PayHOA’s integrated accounting system and budget reports.

- conversions for paper checks into digital deposits and tracks every transaction in one ledger.

- dashboards for board, owner, and vendor communications with full financial transparency.

Pricing

PayHOA plans are priced by number of units starting at $49 per month for up to 25 units. The highest pricing tier is $249 per month for 401-500 units, so if you have a larger HOA management business, PayHOA may not be the right fit. In addition, there are charges to process credit card transactions (3.25% plus 50 cents) and eChecks ($1.95 per check).

Bonus: Obligo and Gravy

Focused Apps That Make Rental Revenue More Reliable and Keep Tenants Happy

While they’re not as broadly focused as other entries on this list, two additional apps deserve a special mention because they directly influence on-time payment behavior and resident satisfaction. They’re focused on improving your bottom line by making your rental income more reliable and both integrate with Buildium so you can add them seamlessly into your tech stack.

Obligo

Obligo® helps simplify move-in and move-out by replacing cash security deposits with deposit alternatives. That shift can remove barriers for qualified applicants and smooth cash flow during turnover periods.

Features

Obligo’s tools simplify deposit management and improve visibility for both residents and managers by:

- providing a deposit-free move-in solution that replaces cash deposits with secure, credit-based authorizations.

- tracking deposit obligations and settlements digitally, syncing data to your property-management ledger.

- integrating directly with property-management systems, including Buildium via the Marketplace.

- keeping a transparent record of charges and repayments for both managers and residents.

- speeding up leasing and improves conversion by lowering upfront move-in costs.

Pricing

Obligo operates on a service-fee model rather than a subscription structure. Property managers can offer residents deposit-free leasing, with Obligo charging a small fee based on a percentage of the traditional security deposit amount.

Fees are typically paid upfront for the initial lease term (up to twelve months). Program terms and costs vary depending on implementation and participation structure.

Gravy

Gravy® incentivizes on-time payments by rewarding residents who pay through the Resident Center each month. Rewards can be redeemed for gift cards, rent credits, or saved for move-out costs. The aim is simple: nudge better payment habits and reduce delinquency without extra admin.

Features

Gravy encourages on-time payments while reducing administrative work for property managers. It does this by:

- Rewarding residents for paying rent on time—typically up to 5% back in gift cards, rent credits, or savings.

- Automatically tracking rent-payment behavior and applying rewards without extra admin work.

- Integrating with Buildium through the Marketplace, syncing payment and reward data with resident ledgers.

- Providing dashboards for both managers and residents to view payment histories and reward balances.

Pricing

Gravy’s pricing is partnership-based and depends on your property management software and portfolio size—with fees typically linked to reward funding and integration level. Managers can contact Gravy directly through the Buildium Marketplace for current rates and setup details.

How to Choose the Best Rent Tracker App for You

Every portfolio has different priorities. Use this quick framework to make the best choice.

1: Assess Your Specific Needs

List out your must-haves across payments, accounting, communications, maintenance, and reporting. Note regulatory considerations, portfolio mix, and staffing. If you manage multiple property types or markets, favor tools with flexible configuration and strong reporting.

2: Consider Your Budget

Price alone doesn’t tell the whole story. Compare what each plan includes, whether payment processing fees differ by method, and how add-ons might affect your total cost of ownership. Value comes from features your team will actually use week in and week out.

3: Check Reviews and Ratings

Peer feedback is useful, especially on onboarding, support quality, and reliability. Focus on reviews from PMs with similar door counts and property types to yours.

4: Prioritize Flexibility and Scalability

Pick a platform that can grow with you. That includes open integrations, marketplace partners, and analytics that move beyond basic ledgers to portfolio performance metrics. Renting doesn’t stand still, and your software shouldn’t either.

Get Started with Software that Covers All Your Bases

When it comes to rent tracking, the right platform can help you manage the financial health of your entire portfolio. A strong rent tracker app gives you real-time visibility into every transaction, reduces manual bookkeeping, and ensures owners and residents stay informed.

Key Takeaways

- Rent tracking tools should centralize payments, balances, and reporting in one connected system.

- Look for automation features that handle reminders, late fees, and reconciliations without manual entry.

- Resident portals and mobile access are essential for timely, transparent payments and communications.

- Integration with accounting and owner reporting ensures every dollar is accounted for across your portfolio.

- Marketplace add-ons—such as Obligo and Gravy—can help you improve on-time payments and resident satisfaction.

For property managers ready to simplify rent tracking and strengthen financial performance, Buildium brings everything together in one intuitive platform. Real-time ledgers, automated workflows, and flexible payment options make it easy to keep your books accurate and your residents happy. Plus, Marketplace integrations expand what you can do, from deposit-free leasing to resident rewards that encourage on-time rent.

You can explore all of Buildium’s rent tracking and management features for yourself with a free 14-day trial, or see how it works for your business in a personalized guided demo.

Frequently Asked Questions

What features should I look for in a rent tracker app for property managers?

Look for software that centralizes payments, balances, and reporting in one platform. The best rent tracker apps include automated rent reminders, late-fee settings, and recurring charge schedules. They also connect directly to accounting and owner reporting tools so every transaction is recorded accurately. Mobile access, resident portals, and integration with your existing systems (maintenance, communications, or leasing) can keep operations running smoothly.

How can a rent tracker app help reduce back-office work?

Rent tracking software replaces spreadsheets and manual data entry with automation. By linking payments directly to ledgers and accounting reports, property managers no longer need to reconcile transactions by hand. Automatic reminders, recurring rent charges, and late-fee rules keep collections consistent without constant monitoring. Many apps also generate performance dashboards, so teams can focus on strategy instead of administrative cleanup.

Are there rent tracker apps that integrate with other property management tools?

Yes. Leading platforms include open APIs and marketplace integrations that extend functionality without extra logins. For instance, Buildium’s Marketplace connects with tools such as Obligo and Gravy, which enhance move-in flexibility and on-time payment incentives. Integrations like these ensure your rent tracking, accounting, and resident experience tools all share the same data, reducing errors and improving reporting accuracy.

How secure are rent tracker apps with sensitive financial and tenant information?

The best rent tracker apps use advanced encryption, secure payment gateways, and role-based access controls to protect sensitive information. Reputable providers undergo regular security audits and comply with financial data standards. When comparing options, look for platforms that clearly outline their security practices and allow you to control who can view or modify ledgers, payments, and resident records.

What are some of the top-rated rent tracker apps recommended for property managers?

Some of the top solutions include Buildium, Propertyware, Rentec Direct, RentRedi, and PayHOA, each offering different strengths for various portfolio sizes. Add-on tools such as Obligo and Gravy further improve collection reliability and resident satisfaction. The right choice depends on how deeply you want rent tracking tied to your accounting, reporting, and tenant engagement workflows.