Illinois Rental Market Trends in 2025

Illinois is the sixth-most populous state in the U.S., mostly thanks to Chicago, the third-largest metro area in the country. However, this list will focus on the 5 best rental markets in Illinois outside of Chicago—from college town Champaign in the south to Rockford in the north, and everywhere in between.

Illinois has a diverse and resilient economy anchored by industries like manufacturing, agriculture, finance, healthcare, and logistics. The state benefits from its central location as a national transportation hub. While the state has faced challenges, such as fiscal pressures and deindustrialization, recent investments in infrastructure, technology, and workforce development are helping Illinois to revitalize its economy and attract new business.

One trend to be aware of in Illinois is population loss. The state has experienced consistent net outmigration since 2015, particularly in small towns and rural areas, a trend that only accelerated during the pandemic. The reasons attributed to this trend are complex and contentious, with opposing factions pointing to high taxes or underfunded infrastructure, while others reference the state’s aging population, the decline in manufacturing, and “brain drain.”

If you’re looking to expand your real estate portfolio or property management services within Illinois, this post will guide you through evaluating 5 up-and-coming real estate markets there. We’ll share rental market statistics for each city, including inventory growth, rent growth, vacancy rates, cap rates, and property price appreciation. We’ll also highlight economic and demographic trends in each market.

Top 5 Rental Markets in Illinois for 2025

Without further ado, here are 5 Illinois rental markets where our research indicates growth opportunities lie in 2025.

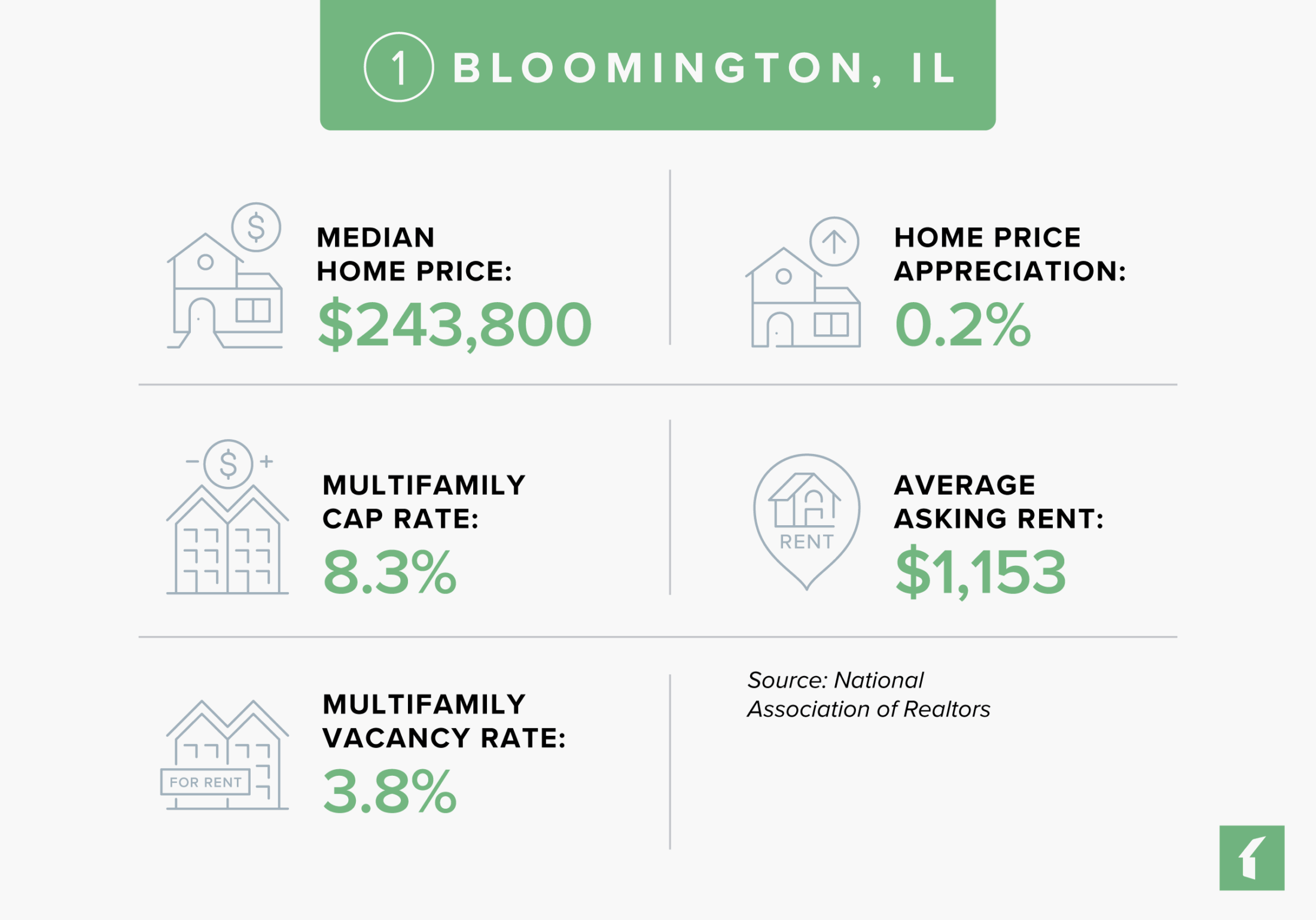

Market #1: Bloomington, IL

170,441 residents live in the Bloomington metro area, which it shares with Normal, its “twin city.” Bloomington is located roughly two and a half hours from both Chicago and St. Louis, and is considered a transportation hub within central Illinois due to the number of interstates that pass through the area.

Insurance company State Farm has been based in Bloomington for more than a century, and it remains the city’s top employer to this day, followed by fellow insurance company Country Financial. Two universities—Illinois Wesleyan University and Illinois State University—are located in the Bloomington–Normal metro area as well. Other top employers in Bloomington include Carle Bromenn Medical Center, OSF St. Joseph Medical Center, the city and county governments, and the local school districts.

Bloomington offers residents and visitors a number of cultural opportunities. The Bloomington Center for the Performing Arts is a great place to catch a concert or theatrical production, while the Miller Park Zoo is a family-friendly destination for both education and leisure. Historical attractions located in the city include the McLean County Museum of History, as well as Davis Mansion, a site offering a glimpse into the life of a past Supreme Court Justice. Bloomington residents can also enjoy walking, jogging, and cycling on the Constitution Trail, which winds through the city’s parks and neighborhoods. In addition, a number of golf courses and country clubs are located within the metro area.

Bloomington ranked in position #18 on Buildium’s list of up-and-coming real estate markets in 2025 due to its strong rent growth, vacancy rate, cap rate, and property price appreciation throughout 2023 and 2024. One trend to watch, as with other Illinois cities, is population and job loss: Bloomington’s resident base and employment growth have both trended slightly negative in recent years. However, its affordability makes it appealing for residents and investors alike, and its strong multifamily metrics warrant attention as well.

Bloomington, Illinois Rental Market Statistics

- Rental Inventory (Q3-’24): 9,797

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 2.3%

- Asking Rent (Q3-’24): $1,153

- Effective Rent (Q3-’24): $1,147

- Multifamily Vacancy Rate (Q3-’24): 3.8%

- Multifamily Cap Rate (Q3-’24): 8.3%

Source: National Association of Realtors

Bloomington, Illinois Housing Market Statistics

- Median Home Price (Q3-’24): $243,800

- Home Price Appreciation Since Q3-’23: 0.2%

Source: National Association of Realtors

Bloomington, Illinois Economic Statistics

- Population Growth (2022): -0.4%

- GDP Growth (2022): 4.4%

- Job Growth (Q3-’24): -0.4%

Source: National Association of Realtors

Lists That Mention Bloomington, Illinois

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #61

- Best Places to Live (U.S. News): #168

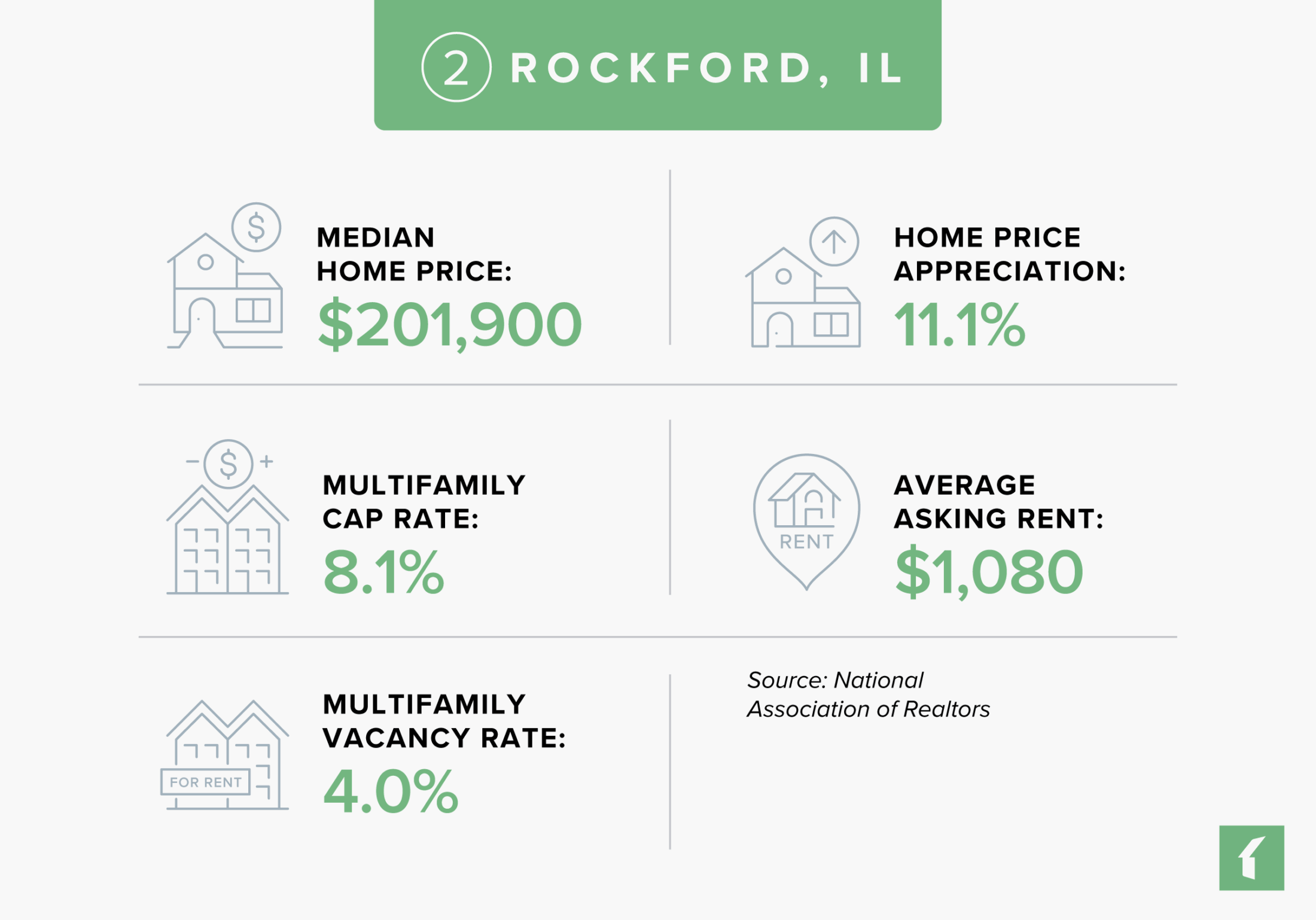

Market #2: Rockford, IL

334,124 residents call the Rockford metro area home, making it the fifth-most populous city in Illinois overall, and the largest city outside of the Chicago metro area. Rockford can be found along the Rock River in northern Illinois, approximately an hour and a half west of Chicago, and an hour and a half south of Madison, WI.

Rockford’s economy has revolved around manufacturing since the 1850s, when the city was first connected to other cities by rail, enabling companies to ship agricultural machinery and furniture to other markets. This manufacturing boom continued through the mid-20th century, with Rockford being further connected to other cities by Interstate 90. In 1963, the metro area was chosen by Chrysler (now Stellantis) as the location for the Belvidere Assembly plant, which remains a major employer there to this day.

Like other Rust Belt cities, Rockford was impacted by deindustrialization and population loss throughout the 1970s and ‘80s. The city was challenged further by the Great Recession, the loss of Amtrak rail service, and multiple flooding events in the early 21st century. In recent years, however, Rockford has worked hard to diversify its industrial economy and restore its downtown neighborhood.

Today, the city is known for manufacturing fasteners as well as parts for the automotive and aerospace industries, with plants for Collins Aerospace, Woodward Inc., and Stellantis located here. In addition, there are several healthcare companies—UW Health, Mercy Health, and OSF Healthcare—located in Rockford. Other top employers in the area include Rockford Public School District, UPS, Amazon, and Walmart. Several higher educational institutions, including Rockford University and Rock Valley College, can also be found here.

Rockford boasts a number of cultural attractions, including the Anderson Japanese Gardens, the Discovery Center Museum, the Burpee Museum of Natural History, Nicholas Conservatory & Gardens, Rockford Art Museum, and Coronado Performing Arts Center. The city also has a number of green spaces where residents can spend time outdoors, such as Sinnissippi Park and Riverwalk, Rock Cut State Park, and Rockwood Park.

Rockford’s strong multifamily rent growth, occupancy rate, and cap rate helped it rank in position #31 on Buildium’s list of up-and-coming real estate markets in 2025, along with its impressive home price appreciation. In spite of this growth, properties remain very affordable in Rockford, creating an opportunity for investors to get their foot in the door in the Illinois real estate market. As with other Illinois cities, Rockford’s population growth is trending slightly negative; however, unlike Bloomington, Rockford is seeing positive employment growth.

Rockford, Illinois Rental Market Statistics

- Rental Inventory (Q3-’24): 8.971

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 5.3%

- Asking Rent (Q3-’24): $1,080

- Effective Rent (Q3-’24): $1,076

- Multifamily Vacancy Rate (Q3-’24): 4.0%

- Multifamily Cap Rate (Q3-’24): 8.1%

Source: National Association of Realtors

Rockford, Illinois Housing Market Statistics

- Median Home Price (Q3-’24): $201,900

- Home Price Appreciation Since Q3-’23: 11.1%

Source: National Association of Realtors

Rockford, Illinois Economic Statistics

- Population Growth (2022): -0.4%

- GDP Growth (2022): 6.1%

- Job Growth (Q3-’24): 0.8%

Source: National Association of Realtors

Lists That Mention Rockford, Illinois

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #13

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #1

- Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #8

- Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #7

- Best Real Estate Markets – Small Cities (WalletHub): #94

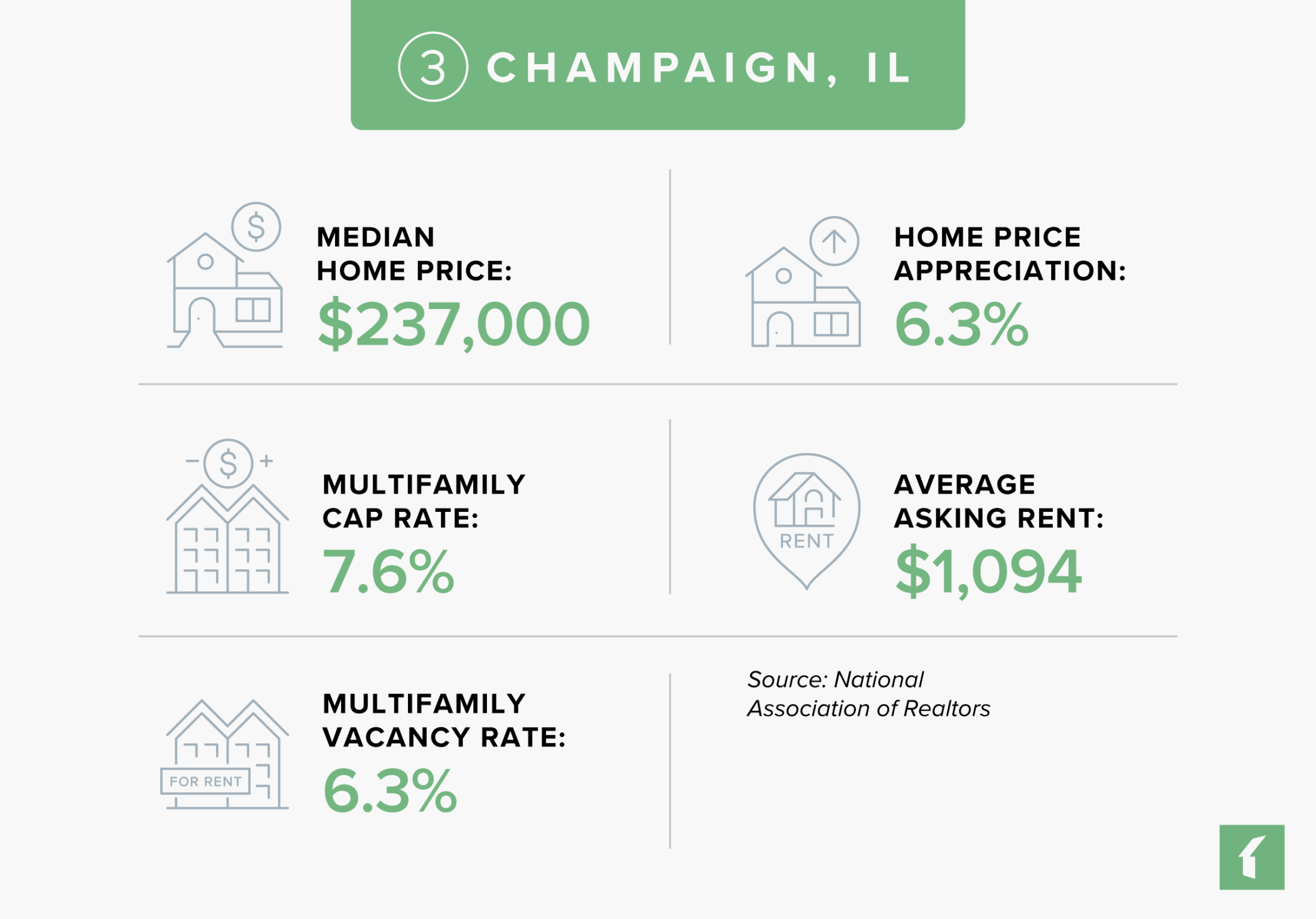

Market #3: Champaign, IL

Located approximately two hours from Chicago and two and a half hours from St. Louis, the Champaign metro area is home to 237,052 residents. Together with Urbana, its twin city, Champaign has been a college town since 1867, when the University of Illinois was founded here.

Champaign got its start as a railroad town in the 1850s, with the arrival of Illinois Central Railroad transforming the area into a regional hub for trade and agriculture. By the early twentieth century, manufacturing and light industry began to take root. However, the city faced the economic headwinds of suburbanization and deindustrialization during the mid-1900s. In response to this economic stagnation and urban disinvestment, Champaign has devoted many resources to downtown redevelopment and public infrastructure in recent years. The city has seen a resurgence in downtown activity, featuring new restaurants, housing, and cultural venues.

Today, several Fortune 500 companies have offices in Champaign, including IBM, John Deere, Dow Chemical Company, Caterpillar, and State Farm. In addition, Jimmy John’s is headquartered in the city. Champaign is also part of a region known as the Silicon Prairie, with the University of Illinois’ research ecosystem helping to create an atmosphere conducive to the formation of tech startups, particularly in the software, agriculture, and clean energy fields.

UIUC also contributes to Champaign’s rich cultural landscape. Residents and visitors enjoy the University of Illinois Arboretum, Krannert Art Museum, Spurlock Museum, Virginia Theatre, Hessel Park, and (in nearby Urbana) Meadowbrook Park. Downtown Champaign, once impacted by urban disinvestment, is now known for blending small-town charm with urban energy. Particularly vibrant in the warmer months, the city features sidewalk cafes, street fairs, art walks, and live music.

Champaign ranked in position #46 on Buildium’s list of up-and-coming real estate markets in 2025 due to its strong multifamily rent growth and moderately strong vacancy rates and cap rates over the last two years. In addition, properties in Champaign are relatively affordable and have shown strong price appreciation in recent years, making this another great market for investors to consider—particularly with the population and employment growth that this college town is seeing in comparison with other Illinois rental markets.

Champaign, Illinois Rental Market Statistics

- Rental Inventory (Q3-’24): 16,525

- Units Added Since Q3-’23: +107

- Asking Rent Growth Since Q3-’23: 5.2%

- Asking Rent (Q3-’24): $1,094

- Effective Rent (Q3-’24): $1,090

- Multifamily Vacancy Rate (Q3-’24): 6.3%

- Multifamily Cap Rate (Q3-’24): 7.6%

Source: National Association of Realtors

Champaign, Illinois Housing Market Statistics

- Median Home Price (Q3-’24): $237,000

- Home Price Appreciation Since Q3-’23: 6.3%

Source: National Association of Realtors

Champaign, Illinois Economic Statistics

- Population Growth (2022): 6.2%

- GDP Growth (2022): 7.4%

- Job Growth (Q3-’24): 1.7%

Source: National Association of Realtors

Lists That Mention Champaign, Illinois

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #60

Market #4: Peoria, IL

Peoria is located in central Illinois, a little under three hours from Chicago and two and a half hours from St. Louis. This four-time winner of the All-America City Award has 361,989 residents living in its metro area.

Prior to Prohibition, Peoria’s early economy was shaped by the liquor industry thanks to its abundant corn supply and location along the Illinois River. Following its reign as a distilling powerhouse, Peoria reinvented itself as a manufacturing hub. For much of the twentieth century, Caterpillar formed the economic backbone of the region, employing tens of thousands of workers there; and though it moved its headquarters to Deerfield in 2017, Caterpillar remains Peoria’s second-highest employer.

As was the case for other Rust Belt cities, Peoria’s economy had to adjust as deindustrialization and automation reduced manufacturing jobs in the second half of the twentieth century. Since then, Peoria has worked hard to diversify its economy. Today, top employers (besides Caterpillar) include healthcare companies OSF Healthcare and Carle Health, along with Peoria Public Schools District 150, Vonachen Services, and Bradley University.

Peoria is also working hard to enhance its livability, including improving housing affordability and quality, expanding economic opportunity, and revitalizing neighborhoods and public infrastructure. Peoria’s investment in downtown improvements have resulted in an influx of new business and foot traffic to the city center.

Residents and visitors to Peoria can enjoy a host of cultural attractions that reflect the city’s industrial heritage and natural beauty, including the Peoria Riverfront Museum, Caterpillar Visitors Center, Luthy Botanical Garden, and Forest Park Nature Center. Peoria also hosts the Heart of Illinois Fair each summer, as well as the renowned Annual Art Fair. Sports fans can catch a baseball game at Dozer Park, while families may particularly enjoy the Peoria PlayHouse Children’s Museum and Peoria Zoo. In addition, Peoria’s Grand View Drive was dubbed the “World’s Most Beautiful Drive” by President Theodore Roosevelt, offering panoramic views of the Illinois River as well as historic homes.

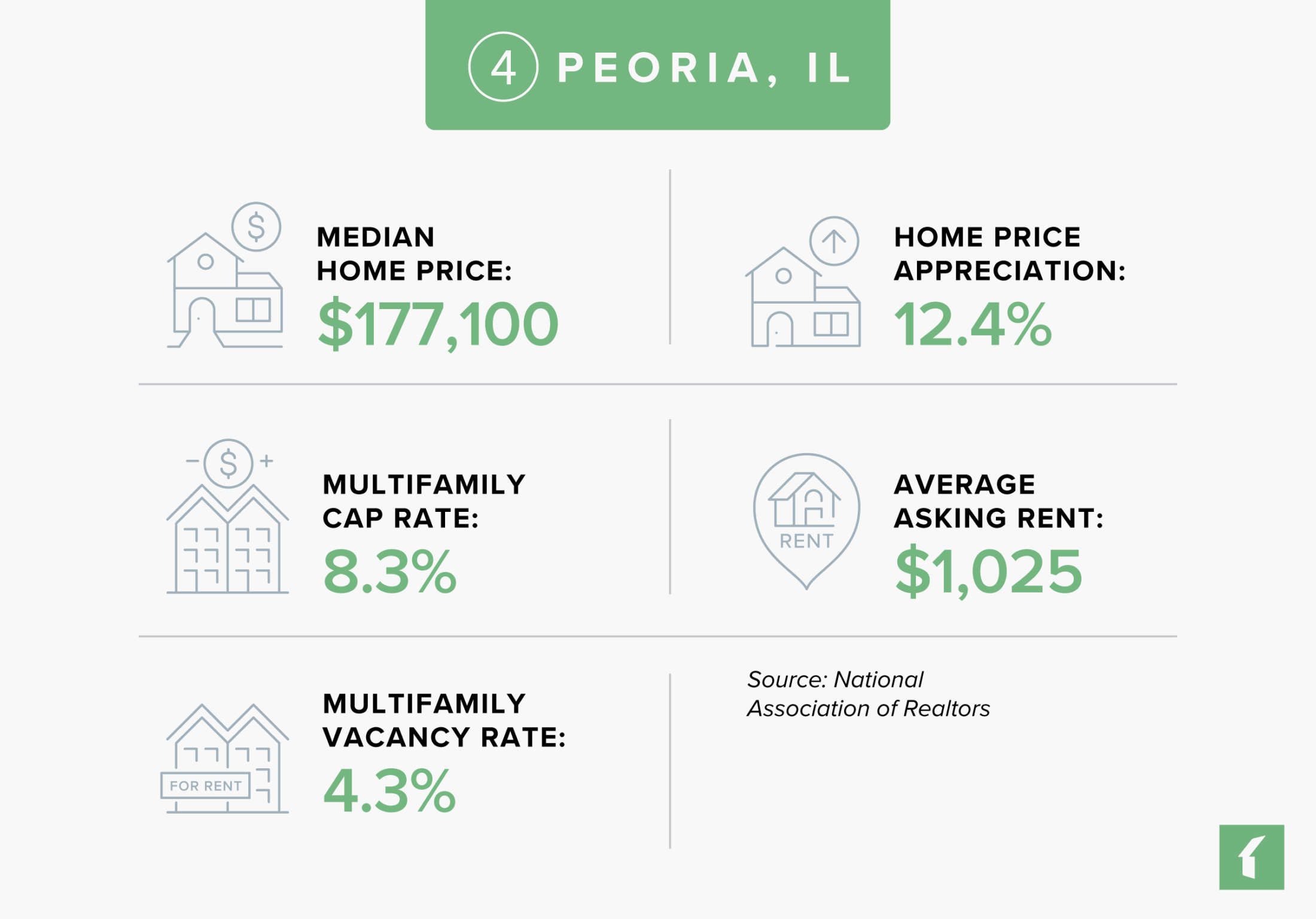

Peoria was ranked in position #48 on Buildium’s list of up-and-coming real estate markets in 2025 thanks to its strong multifamily cap rates, occupancy rates, and property price appreciation over the last two years. Weighing on Peoria’s score was its negative population growth and employment growth. However, its affordability sets it apart—even in a region that tends to have a lower cost of living than much of the rest of the U.S.—and its property price appreciation and multifamily metrics make it worth considering for investors in 2025.

Peoria, Illinois Rental Market Statistics

- Rental Inventory (Q3-’24): 12,524

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 2.8%

- Asking Rent (Q3-’24): $1,025

- Effective Rent (Q3-’24): $1,021

- Multifamily Vacancy Rate (Q3-’24): 4.3%

- Multifamily Cap Rate (Q3-’24): 8.3%

Source: National Association of Realtors

Peoria, Illinois Housing Market Statistics

- Median Home Price (Q3-’24): $177,100

- Home Price Appreciation Since Q3-’23: 12.4%

Source: National Association of Realtors

Peoria, Illinois Economic Statistics

- Population Growth (2022): -8.8%

- GDP Growth (2022): 5.7%

- Job Growth (Q3-’24): -1.0%

Source: National Association of Realtors

Lists That Mention Peoria, Illinois

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #102

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #59

- Best Real Estate Markets – Small Cities (WalletHub): #132

Market #5: Kankakee, IL

Kankakee has 105,940 residents living in its metro area, making it the smallest city highlighted in our post on Illinois rental markets. What sets it apart is its affordability in comparison with other Chicago-area metros, with Kankakee being located just an hour south of Chicago.

Like Champaign, the arrival of the Illinois Central Railroad in the mid-nineteenth century was a turning point for Kankakee. By making large-scale agricultural exports possible, the area was transformed into a commercial hub, particularly for grains and dairy. Kankakee’s economy experienced another boom following World War II, with growth in the automotive, chemical, and pharmaceutical sectors, among others.

Economic headwinds during the 1980s and ‘90s led to factory closures, population decline, and urban disinvestment—trends that still persist today in the form of elevated unemployment and poverty levels. However, recent decades have seen efforts to stabilize and diversify Kankakee’s economy. Today, major employers in Kankakee include healthcare companies like Riverside Healthcare and Ascension Saint Mary, as well as manufacturing companies like CSL Behring, Armstrong World Industries, Nuctor Steel Kankakee, and Van Drunen Farms. Additionally, Kankakee’s proximity to Chicago and major highways have made it a smart location for logistics and warehousing operations.

Residents and visitors to Kankakee can learn about its history at attractions like the Kankakee County Museum, French Heritage Museum, Kankakee Railroad Museum, and B. Harley Bradley House (designed by Frank Lloyd Wright). Families can visit Exploration Station, a children’s museum. Those who enjoy outdoor recreation can appreciate the city’s location along the banks of the Kankakee River at the Kankakee Riverfront Trail, Kankakee River State Park, Bird Park, and Perry Farm Park. Downtown revitalization projects also aim to attract residents and businesses back to Kankakee’s urban core, resulting in a neighborhood that blends historic charm with modern amenities such as shops, restaurants, and entertainment venues.

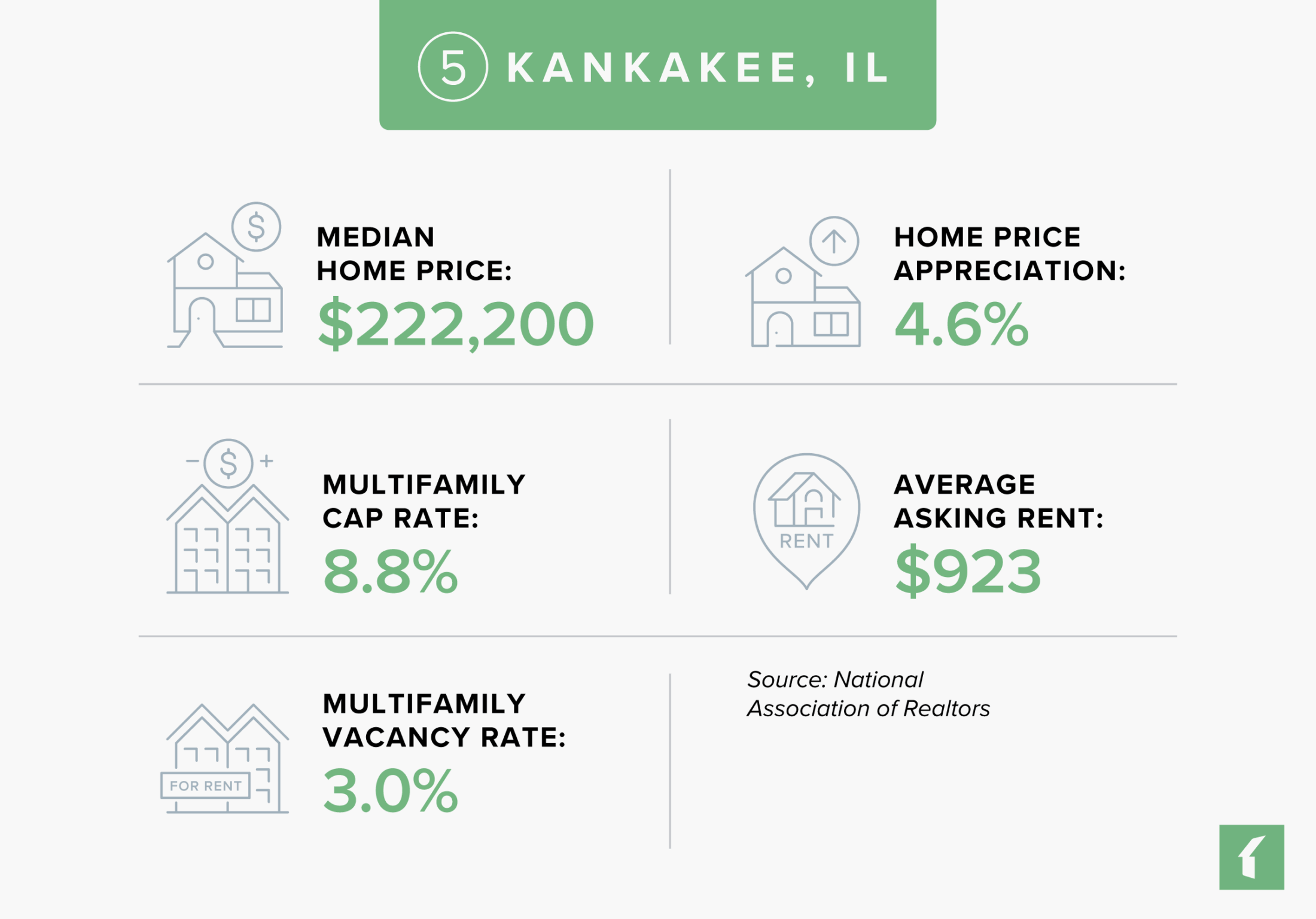

Kankakee’s main draw for investors is its affordability, enabling strong cap rates for multifamily properties in the city, and relatively strong price appreciation on single-family homes. Vacancy rates are low, with no new properties being built within the city limits over the previous year. As a result, it ranked in position #58 on Buildium’s list of up-and-coming real estate markets in 2025. Investors and property managers should keep in mind that with unemployment and poverty rates remaining elevated in Kankakee, they could face tenant quality challenges. In addition, a higher crime rate in comparison with other Illinois rental markets emphasizes the importance of finding the right property in the right neighborhood and hiring a professional to care for it.

Kankakee, Illinois Rental Market Statistics

- Rental Inventory (Q3-’24): 1,579

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 1.3%

- Asking Rent (Q3-’24): $923

- Effective Rent (Q3-’24): $918

- Multifamily Vacancy Rate (Q3-’24): 3.0%

- Multifamily Cap Rate (Q3-’24): 8.8%

Source: National Association of Realtors

Kankakee, Illinois Housing Market Statistics

- Median Home Price (Q3-’24): $222,200

- Home Price Appreciation Since Q3-’23: 4.6%

Source: National Association of Realtors

Kankakee, Illinois Economic Statistics

- Population Growth (2022): -0.1%

- GDP Growth (2022): 3.0%

- Job Growth (Q3-’24): 0.2%

Source: National Association of Realtors

Lists That Mention Kankakee, Illinois

- None – this is an under-the-radar pick

How Do We Identify the Best Rental Markets in Illinois?

We use the following sources to help us ascertain the best rental markets in the U.S. across five different categories.

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home price appreciation, as measured by the National Association of Realtors

- Markets with affordable monthly mortgage payments relative to income, as measured by the National Association of Realtors

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

- States with the most economic activity, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the National Association of Realtors

- The fastest-growing real estate markets, as measured by U.S. News

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News

Climate Indicators

Measures of climate vulnerability:

- Markets with the lowest risk of natural disasters and extreme conditions, as measured by the Federal Emergency Management Agency

60 Up-and-Coming Real Estate Markets in 2025

In Buildium’s annual Up-and-Coming Real Estate Markets list, we analyzed 175 metro areas across the U.S. to determine which cities show promise for rental investors and property managers in the year ahead. Wondering where else can rental investors and property managers find more growth opportunities in 2025? View the full list of emerging markets we’ve identified across the country.

Read more on Industry Research