Collecting a traditional security deposit has always just been a part of the leasing process. But today, that upfront cost can be out of reach for many renters.

Start your free trial today!

Try Buildium for free for 14 days. No credit card needed.

Start Your TrialTo get more residents through the door, some property managers offer security deposit alternatives. Here’s how these programs work, and why they might be a smart move for your business.

What Are Security Deposit Alternatives?

Security deposit alternatives are financial programs that replace the traditional lump-sum deposit with a more flexible option—usually smaller monthly payments spread out over the lease term.

They’re designed to ease the financial burden on renters while still offering protection for property managers in case of damage or missed rent. And in many cases, they come with added perks for both sides.

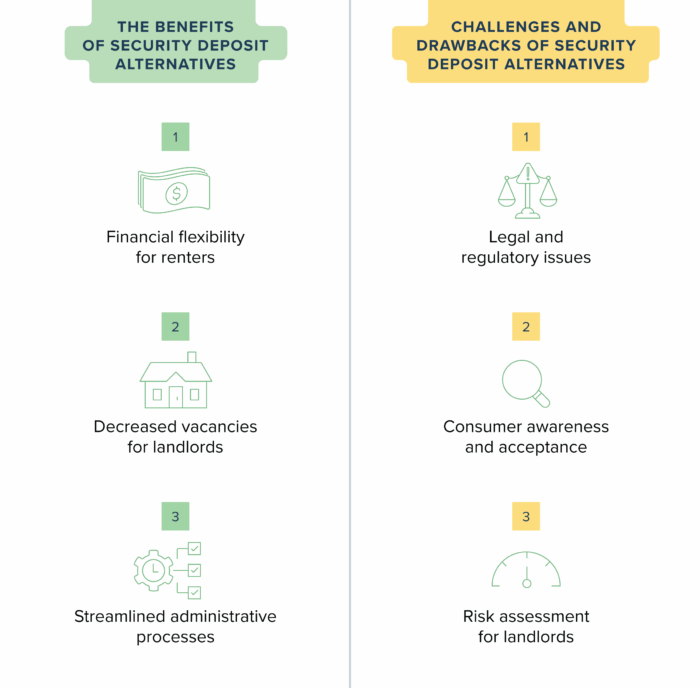

The Benefits of Security Deposit Alternatives

There are many benefits to going with security deposit alternatives, including:

- Financial flexibility for renters: Some renters will appreciate having the ability to budget around a smaller, recurring payment rather than making a prohibitively-large one upfront. Others will like the idea of being able to let more of their money earn interest in their own accounts rather than someone else’s escrow account.

- Decreased vacancies for landlords: Offering flexible options can open the door to more qualified applicants, especially those who might be held back by a large upfront deposit. With a wider pool of renters, you’re more likely to fill units faster and keep vacancy rates low.

- Streamlined administrative processes: Since third-party providers typically handle these programs, property managers can skip the hassle of collecting, holding, and refunding deposits—and focus on other parts of the business.

Challenges and Drawbacks of Security Deposit Alternatives

However, like any financial decision, offering security deposit alternatives can also come with a few drawbacks, including:

- Legal and regulatory issues: Security deposit alternatives are relatively new. It’s important to make sure any alternative program you choose complies with your state and local regulations. Some areas may limit use. You’ll also likely have to have a separate agreement on file outlining your relationship with the third-party provider, as well as the tenants.

- Consumer awareness and acceptance: Since these arrangements are newer, renters may not be as aware of them and hesitant to accept them as a viable alternative to a traditional security deposit.

- Risk assessment for landlords: There is still some inherent risk with these programs. For example, an insurance policy may find a reason to deny the claim if there is damage to the unit. Be sure to read the terms and conditions of any alternative program you’re considering very carefully and to explain the potential risks to your landlords.

Types of Security Deposit Alternatives

So, what are the different types of alternative programs available to you? Below are five options to consider using in your property management business.

1. Surety Bonds

A surety bond works similarly to a bail bond. In this case, the tenant will pay an upfront deposit on the bond, typically 17.5% to 20% of its value. Then, if there is damage to the property at the end of the lease term, you place a claim with the surety bond company, who will then compensate you for the work and seek reimbursement from your former tenant.

Pros

- Prompt payment: Many surety bond companies will pay out quickly for claims, allowing you to turn over the property sooner.

- Additional screening: Most surety bond companies will complete their own additional tenant screening processes before agreeing to issue the bond.

- Less administrative burden: In this case, the surety bond company handles the collection process and, usually, any litigation that arises as a result of disputes.

Cons

- Limited coverage: As with any insurance policy, surety bonds have a scope of coverage that’s limited by the terms of their agreements. If your claim falls outside that scope, it may not be covered.

- Lower incentive for tenants: Residents won’t get their bond deposit back at the end of the lease, potentially giving them less incentive to take good care of the property during the lease term.

- Higher costs after claims: If you make a claim against a surety bond, securing future bonds may come at a higher cost or approval may be more difficult.

When to use surety bonds

Surety bonds are often seen in high-cost areas, where making a full security deposit would be cost prohibitive for the majority of renters. They’re also used in situations where potential residents may have fewer financial resources, such as student housing arrangements.

2. Third-Party Security Deposit Alternative Services

Some third-party platforms focus specifically on security deposit alternatives. While their models may vary, the goal is the same: reduce upfront costs for renters while protecting the property.

For example, Obligo doesn’t utilize a claims process like a surety bond. Instead, it leverages bank-issued lines of credit for each renter and then initiates a draw against the line of credit in the event of damages or unpaid rent. An ACH transfer is sent to the property manager to cover the damages and the tenant’s payment method on file is charged to settle the costs of the draw.

Pros

- Enhanced renter experience: Third-party services gives renters greater flexibility and (in the case of Obligo) can even reduce the total costs renters have to pay while still giving property managers the same level of protection.

- Automated processes: Third-party platforms often automate their processes, reducing the amount of time spent dealing with deposits for both property managers and their tenants.

- Quick access to funds: These platforms often offer fast access to funds without having to go through a lengthy claims process.

- Less liability: Since you’re not responsible for handling the security deposit when you work with a third-party provider, you’ll face less liability overall.

Cons

- Limited service area: Not every third-party provider is available in all states. Be sure to check with any providers you’re considering to make sure that they provide service in your area and comply with local and state regulations.

- Tenant hesitancy: Most platforms require the tenant to enroll with them and may impose additional requirements, such as authorization for an automatic withdrawal. Some residents may be hesitant to comply. This makes it important to make the value of these options clear when promoting them to renters. Drawing from the third-party service’s own marketing material is an easy way to do this.

- Added fees: Use of a third-party platform sometimes comes at a cost. Do your due diligence to make sure any provider you choose fits comfortably within your budget. Consider offsetting any costs by offering this option as an add-on service with a fee attached for customers or tenants.

When to use third-party services

Since most third-party platforms are digital, they will likely work best if the majority of your residents are younger and fairly tech-savvy. They’re also a good fit for property managers looking to reduce manual admin work.

3. Security Deposit Insurance

Security deposit insurance works like any other insurance policy—with one big exception: tenants are expected to take out a policy with a security deposit insurance provider and pay a monthly premium to keep their policy active.

The biggest difference is that the policy isn’t meant to protect the tenant as the policyholder. Instead, it’s meant to protect the landlord and the property manager in the event that the tenant doesn’t fulfill their obligations under the lease. The property manager is the one who has the right to file claims, and the tenant is responsible for paying back the insurance company if they need to initiate a payout.

Pros

- Policies may cover unpaid rent: In some states, property managers aren’t allowed to take unpaid rent out of a security deposit. However, unpaid rent may be covered under a security deposit insurance policy.

- Claims can be filed before move out: With a traditional security deposit, property managers can’t deduct losses until the tenant moves out of the property. But security deposit insurance providers allow you to file a claim at any point in the lease term.

- Provider makes decisions: The policy provider is the one who makes the final decision on any disputes, leading to less potential for tension between the tenant and the property manager or landlord.

Cons

- Claims can be rejected: There is a risk that the insurance company will reject your claim, leaving you or your landlord responsible for paying to fix any damages.

- Lengthy claims process: Depending on the company and the complexity of the claims process, it could take a while to receive the funds from a payout.

- Reluctance to report issues: Residents may be reluctant to report issues with the property in order to avoid having to reimburse the insurance company for a claim.

When to use security deposit insurance

Security deposit insurance is typically a smart option if you tend to have shorter-term tenancies. The cost of carrying this type of insurance policy can add up over time, making it less attractive to long-term renters.

4. Lease Guarantee Programs

Similar to an individual co-signer, a lease guarantee program is a third-party service that agrees to take full responsibility for a tenant’s obligations in the event that the tenant defaults on their lease. The tenant pays to maintain a policy with the lease guarantee program. If they default, the guarantor program pays rent to the property management company until the lease expires or the property is re-rented and charges the tenant for reimbursement.

Pros

- Increased rent protection: Lease guarantee programs allow you to continue to collect rent even if the tenant stops paying.

- Vacancies don’t affect profits: Since rental income is still coming in, a vacancy won’t affect your bottom line.

- Peace of mind: This guarantee provides an added level of security, especially for residents who may struggle to meet your qualifications on their own.

Cons

- Residents must be approved: In order to use a lease guarantee program, residents must meet the program’s eligibility criteria. Not every tenant will qualify.

- Policies can be costly: Because of the enhanced level of protection offered by lease guarantee programs, they can often be expensive for the tenant.

- Lengthy claims process: Depending on the program, it can take a long time to receive any rental income that you’re owed.

When to use lease guarantee programs

Lease guarantee programs are common in high-cost areas, where even residents with strong financial profiles may struggle to meet a property’s income or credit requirements. They’re especially useful when you want to keep standards high without limiting your pool of qualified applicants.

5. Pay-Per-Damage Programs

Pay-per-damage programs don’t charge the tenant anything upfront. Instead, the tenant is only charged if any damages occur during their stay. If they do, a third-party provider manages a secured account that lets the landlord bill the tenant for the cost of damages (up to a pre-determined limit).

Pros

- Wider pool of applicants: Since pay-per-damage programs come with no upfront costs, you should be able to access a much larger pool of applicants than if you were collecting a traditional security deposit.

- Potential for higher use rates: These programs often boast features that make it attractive for residents to buy-in, including the limit on how much you can charge for damages and the ability to pay for any repair bills in installments.

- Incentive to take care of the property: Since the tenant won’t be charged anything at all if they keep the property in pristine condition, they have more incentive to abide by the lease terms.

Cons

- Limit how much you can charge: Assessing the cost of damages is often subjective and these programs often place limits around how much you can bill a tenant for if damages do occur.

- Increased risk: Each program has its own dispute resolution procedures. There’s a chance that your damage claim could be denied and your company could be forced to shoulder the cost of repairs.

- May impose transaction fees: Since no premium is collected upfront, pay-per-damage companies often impose transaction fees each time you make a claim.

When to use pay-per-damage programs

Pay-per-damage programs are most often used in short-term rental settings, such as Airbnb or Vrbo, where collecting a traditional security deposit isn’t practical. They’re a good fit when guests stay briefly and turnover is high.

Software to Help Roll Out Security Deposit Alternatives

Offering security deposit alternatives can help property managers fill units faster and simplify day-to-day operations. By making rentals more accessible to a wider range of applicants, these programs can reduce vacancy rates and ease the administrative workload that comes with traditional deposits.

The right property management software can make rolling out these alternatives even easier. Platforms such as Buildium bring flexibility and convenience to the entire leasing process, for both property managers and tenants.

If you’re ready to see how Buildium can help you level up your leasing, get started with a 14-day free trial (no credit card required) or schedule a personalized demo today.

Read more on Leasing