When you think of a rent roll and rent roll analysis, you probably think of investment opportunities. But a rent roll isn’t for investors only. Property managers—particularly those looking to grow—can use a rent roll to keep track of money collected from residents, look for potential problems with vacancies or turnover, compare rent and fees to market prices, and look for opportunities to increase revenue from individual units or even entire properties.

Chart of Accounts

Want clearer, cleaner books? What about a more useful view into your properties or just easier accounting in general?

Get the GuideA rent roll analysis on multi-family properties is especially helpful, since it allows you to look at multiple units all at once.

In this article, we’ll discuss what a rent roll is, exactly, and how property managers can use it to get the most ROI out of their current properties and grow their portfolio by bringing on new owners or by investing in properties of their own.

What Is a Rent Roll?

A rent roll is a record of rent revenue for all of your properties with valid leases. It shows you all the information having to do with rent for each unit you manage or own.

If you or one of your owners is looking to invest in new properties—or even sell a current property—a rent roll is used by investors, lenders, and mortgage brokers to assess the current and potential value of a multi-family property and to verify rent income. By doing so, they can determine whether a property would bring in a good ROI and help secure a good mortgage rate.

Property managers can use a rent roll, as well, to find ways to increase revenue or reduce cost. For example, they can look for issues such as high turnover and vacancy rates and use the information to improve leasing processes. If you’re using a fee system to increase revenue, you can look for units that aren’t taking advantage of fee-based services and reach out to make sure those renters are aware of your offerings.

What Should Be on a Rent Roll?

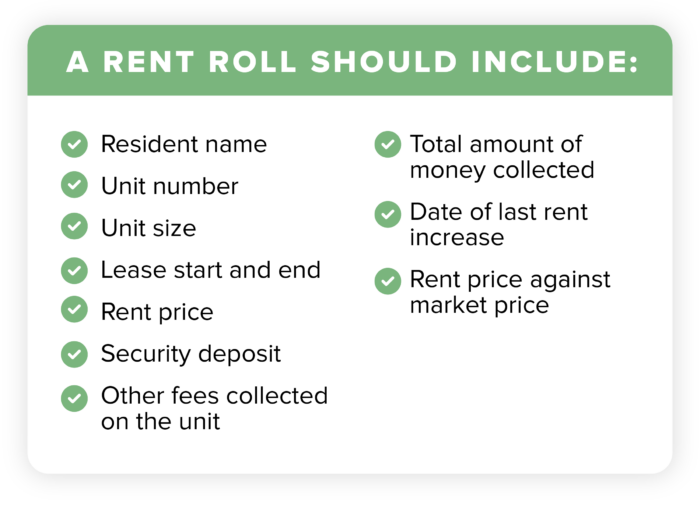

To do a proper analysis, however, a rent roll should include the following:

Why Is a Rent Roll Analysis Important?

A rent roll is a tool used by different parties for different reasons. In the end, it all comes down to one analysis, however: assessing the value of a multifamily property. What is the value of the property itself, how much revenue is it generating now, and does it have the potential to make more?

Investing in a New Multifamily Property

If you or one of your owners are looking to invest in new properties, a rent roll will help you:

- Verify the current revenue from rent of a multi-family property: A rent roll shows you rent revenue on a unit-by-unit basis. You can use that information to verify the revenue by comparing it to income statements.

- Assess the gross scheduled income: The gross scheduled income refers to the amount of money a property generates when it’s at capacity. This will be the total amount of money all of the units generate together.

- Determine the revenue potential of a property in the future: It will also show you revenue potential, particularly if you look at rent rolls from previous years and compare them to the current year.

Assessing a Property You Currently Manage

Rent roll analysis isn’t just for potential investment opportunities. Property managers should be looking at them on a monthly and quarterly basis to help them keep their properties on track. Here’s what a property manager can do with a good rent roll analysis.

Rent Increase Potential

It can be hard to keep track of rent increases in multifamily properties. A rent roll analysis will help you determine which units are below market price and which just haven’t had a rent increase in a while.

You may find that the same resident has been living in a unit for several years. When you’d normally raise rent when a unit turns over, it’s important to make sure long-term residents are paying the same rent, as well.

High Vacancy and Turnover

Performing a rent roll analysis will give you a big-picture idea of how many vacancies you have had over the course of a year, and for how long. You can also get an idea of your turnover rate over the course of a year, two years, or further back.

By performing that analysis, you can pinpoint the properties that have a lag in occupancy or a lot of turnover. You can then investigate why that particular property is having issues. It could be as simple as maintenance problems that just need to be fixed, or more complicated such as a weak market for that particular type of property, or a problem with the neighborhood.

Refinancing

To refinance a loan or mortgage on a property, a bank or mortgage broker will probably ask to see the rent roll. They’ll use it to determine both the current and potential value of the properties.

Forecasting for the Future

Finally, analyzing rent rolls done over a few years can help you or your owners plan for the future, especially when you compare it to current market prices. By doing that, you can determine how much you can expect to make in the coming months, quarters, or year. You can also figure out where you can add revenue, particularly if your rents or fees are lower than market price.

Examples of Rent Roll Analyses

Setting up a rent roll analysis is pretty simple. You can use any spreadsheet program and create columns using the list we discussed above. Make sure each unit has its own row or column so you can analyze rent income for each. With a couple of basic formulas, you can set up a separate row or column at the end to calculate total rent and fees collected, as well as total money outstanding.

Here are a few examples to get you started.

A Rent Roll Analysis for a Three-Family Home

Of course, it’s easier to keep track of rent and fees with a smaller multifamily property. Still, a detailed rent roll is important to keep. Here is an example.

The rent roll analysis above is a simple spreadsheet for a one-year lease. If an investor or property manager was to look at this, they could see how much money each unit is generating. They could then compare it to market prices and even dig deeper into the kinds of fees being charged to determine if other fees could be added.

Finally, a property manager or investor could see that one tenant, Michael Erlich, is not up-to-date with all of his rent and fees. They could then investigate what’s happening with that resident, and determine if there is a problem they can help Mr. Erlich fix.

A Rent Roll Analysis for a 10-Unit Apartment Complex

It gets more complicated the more units and the more time you add to your rent roll analysis.

In this example, everyone in the building has re-signed their lease for the next year and they have paid their rent and fees on time.

But if you were an investor looking closely at this rent roll, you’d notice Harvey Leonard’s rent went up by $100 this past June. Meanwhile, the rent for the other two-bedroom apartments remained the same. Why was his rent the only one to increase? Should the other two-bedrooms be brought up to the same price next year?

You’ll also notice that the most expensive units, the four-bedrooms for $3,000 didn’t rent out until July, one month after the rest of the leases started. There could be a few reasons for that. It could be that the higher price with the same number of bedrooms as the 1800-square-foot apartments made it difficult to rent them. This is another issue the rent roll allows you to investigate.

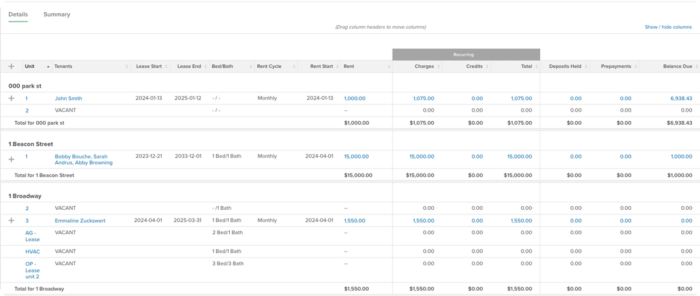

Pro tip: Property management software can give you a real-time rent roll, as well as reporting, that’s tied directly to your property accounting—eliminating manual processes and the error-prone nature of spreadsheets.

Above: The rent roll section of Buildium that allows property managers to track leasing across their entire portfolio with visual tags to identify the status of each property and actions required.

Rent Roll KPIs

Taking a look at the top-level KPIs that drive your rent roll is important, as well. Four KPIs that property managers can use to size up the big picture of their leasing performance are listed and defined below.

Gross potential rent: Total market rent for all leased and vacant rental units across your portfolio

Potential rent: Total market rent for all the leased units during the period they are occupied

Gain/loss to lease: Gain or loss to revenue calculated by taking the actual rent and subtracting the market rent

Loss to vacancy: Total market rent for the total vacant units during the period that they are vacant

Pro tip: Buildium includes Leasing Performance in its Analytics and Insights, which gives property managers an even deeper understanding of the leasing KPIs mentioned above in real-time, as well as direct rent comparisons within their local market.

If you’re looking to get a sense of how well your leasing is performing while identifying problems and new opportunities, a habitual rent roll scan is absolutely essential. It’s the best tool to verify current revenue, assess gross scheduled income, and look for revenue potential inside (and outside) your portfolio.

Read more on Accounting & Reporting