Tax season is coming. And being a property manager means you’ll have to navigate tax responsibilities like deductions and tax credits unique to the business. While most of us are scrambling to get our books in order, there’s a much easier way to manage your taxes – and it doesn’t have to be that complicated!

In this article, we’ll equip you with the right knowledge and tools so you can effectively get your taxes in order ahead of time and focus on growing your business.

Pro Tip: You can also download our full 2024 Tax Guide for Property Managers for free. The guide contains all the information you need on deductions, expense reporting, regulatory updates, and important calendar dates.

Property Management Tax Reporting Made Easy: Article Guide

Property Management Tax Deductions

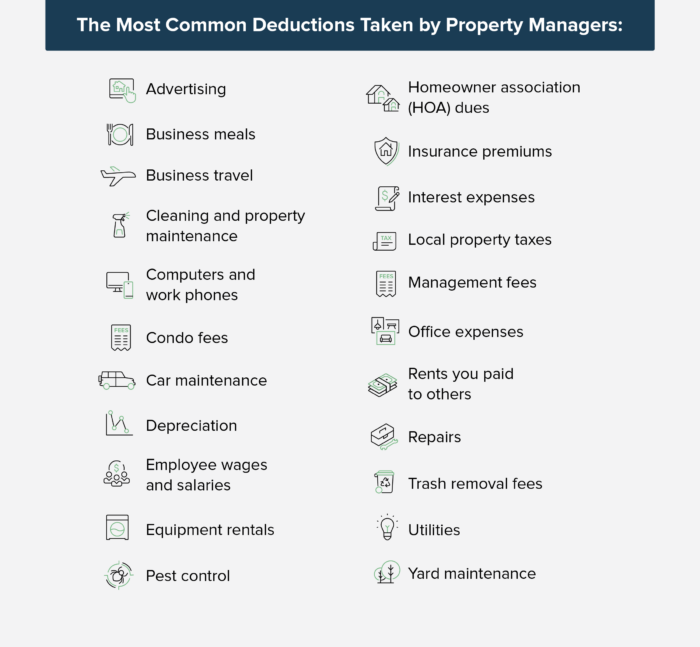

Property managers have various tax deductions available to them that are worth exploring. Here are some to look out for to make sure you’re not leaving money on the table.

It Starts with Good Bookkeeping

Property managers can reduce their taxes by keeping detailed, organized records of transactions related to their property management business. You’ll be able to file taxes faster and not miss out on any credits or deductions available to your business.

The catch is that good bookkeeping can be a headache and take too much time away from other jobs throughout the workweek. Using purpose-built accounting software is one way to make things simple, but, whatever your approach, make it a habit to calculate your taxable income accurately and claim all eligible deductions.

It’s important to consult with a tax professional or refer to the IRS website for specific guidance on how to report income and claim deductions properly. Additionally, staying up to date with any changes to tax laws affecting property managers can help ensure that they are taking full advantage of all available deductions.

Explore further: Take advantage of these 10 property management tax deductions

Tax Cuts and Jobs Act (TCJA)

The Tax Cuts and Jobs Act (TCJA) is a tax reform law that was passed by the U.S. Congress in 2017 and took effect in 2018. It made significant changes to the U.S. tax code, including reducing tax rates for individuals and businesses, increasing the standard deduction, and revising certain deductions.

Most notably, this includes a pass-through deduction for property managers. Companies that qualify can reduce their effective income tax rate by up to 20%.

First, your business has to be registered as one of the following:

- Sole proprietorship

- Partnership

- S corporation (S Corp)

- Limited liability company (LLC)

- Limited liability partnership (LLP)

Second, you’re required to have qualified business income (QBI). This is the profit your business earns in a year, not including short-term or long-term capital gain or loss, dividend income, interest income, guaranteed payments, business income earned outside of the United States. If you have qualified business loss (zero or less profit) you do not qualify.

Finally, you need taxable income, which is calculated by combining your business and investment income minus your deductions.

Employees, independent contractors, and C-corporations (C Corps) unfortunately do not qualify for the pass-through deduction.

Rental Property Bonus Depreciation

Typically, when a business creates or purchases an asset, the tax liability decreases over time.

Rental property bonus depreciation, also known as the additional first-year depreciation deduction, is a tax incentive that allows businesses to deduct large percentages of certain assets instead of writing them off over the “useful life” of the asset.

More specifically, for assets put into service in 2024, the bonus depreciation allows for 60% upfront deductibility of depreciation. Unless the law is changed by Congress, the deductible percentage will decrease to 40% in 2025, 20% in 2026, and then be phased out in 2027. Businesses can file using IRS Form 4562 to record their rental property bonus depreciation along with other depreciation and amortization.

Property Management Tax Credits

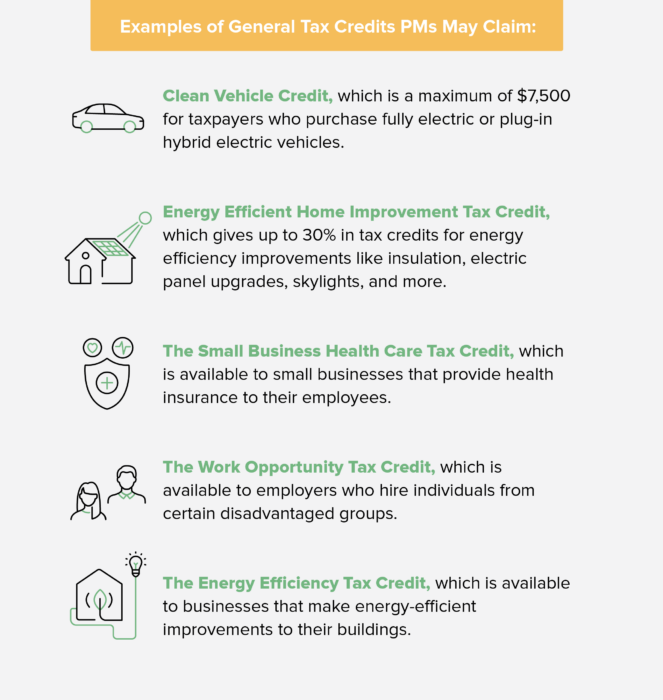

There are a number of tax credits that property managers in the United States may be eligible to claim. And unlike deductions, tax credits are the exact dollar amount you do not have to pay in taxes. So if you have $10,000 in tax credit, your tax bill will be $10,000 lower than what you owe.

Some examples of general tax credits that property managers may be able to claim include:

Filing Tax Returns

Property managers can file their tax returns by completing the appropriate tax forms and submitting them to the IRS. The specific forms that property managers will need to complete and file will depend on their business structure, income, and expenses.

Filing as a Sole Proprietorship or Single-Member Liability Company (LLC)

Property managers whose businesses are registered as single-member limited liability companies (LLC), you’re treated as a sole proprietor and must schedule a schedule C, Profit or Loss statement, along with your tax return and IRS Form SE.

LLC and Partnership

Limited liability company (LLC) owners that have two or more owners, you’re taxed the same way as a partnership. The business entity is a pass-through entity for taxes, which means income must be reported, and tax is collected if the business has made a profit. This calculation is based on their ownership share on their individual tax returns.

And unlike sole proprietorships, a partnership files its own tax return on IRS Form 1065.

S Corporations and C Corporations

S corporations are taxed like a partnership, which serves as a pass-through entity. Income and losses are passed through the owner’s personal tax returns at their personal tax rates. S corps must file Form 1120S and must provide a Schedule K-1 as well. Shareholders file Schedule E with their personal tax returns.

C corporations are businesses that do not serve as a pass-through entity and are taxed separately for the business owner. C corps file income taxes on their next income and their own tax return using Form 1120 or Form 1120-A.

The flat tax rate is 21% on all profits, which is lower than most individual tax brackets. However, you C corp owners must pay tax on all of its income and the owner must pay income tax when it’s distributed to you as a salary, bonus, or dividend. Property managers must file Forms 1099 and failure to do so will result in a $280 fine for each unfiled form, which may rise to $500 if deemed intentional by the IRS.

Filing IRS Forms 1099-MISC and 1099-NEC

Form 1099-MISC and Form 1099-NEC are tax forms used by businesses to report income to the IRS. Form 1099-MISC is used to report miscellaneous income, such as income from freelance work, rent, or other non-employee compensation.

Independent contractors who made more than $600 in income must be reported using the form 1099-NEC, which was introduced in 2020. Non-business related services, payment to corporations, merchandise, telephone bills, freight, storage, and similar items are not required to be reported on the 1099-NEC.

All 1099-NEC forms must be filed by the IRS by February 1, 2025. All 1099-MISC forms must be filed by March 1, by mail or by March 31 if filed electronically. Note that, starting in 2024, you must file all 1099 forms electronically if your business files ten or more information returns of any kind.

To make life easier, purpose-driven property management software like Buildium can help you create 1099s in minutes and file them online. We provide e-Filing tools weeks before filing officially opens with the IRS and all your financial data is dynamically updated from the software throughout the year.

1031 Exchanges

A 1031 exchange can help property managers defer taxes and increase their cash flow and investment returns. It’s a tax deferment tactic where you reinvest the proceeds from a sale of a business or investment property into a like-kind investment.

In order to take advantage of a 1031 exchange, the proceeds of a sale must be held in escrow by a third party. The property being exchanged must also fall into IRS’s criteria of what a like-kind property is, which may not be allowed for vacation homes.

After selling the original property, the property manager must identify a replacement property within 45 days and purchase the replacement property within 180 days.

The new property must be equal or more valuable than the original, and 100% of the proceeds from the sale must be invested into the new property.

Important Filing Dates

Organizing and filing your taxes early ensures you have enough time to gather all the important documents and information you need to file your taxes accurately. The more proactive you are, the more mistakes and errors you can prevent (and avoid any future headaches with the IRS).

So take out your calendar and mark these important filing dates to prepare you for tax season:

Keep in Mind That Taxes Vary by State

You’re responsible for filing taxes for properties in every state that you manage, and the tax laws are going to be different in each. For example, states can charge a percentage of income based on your federal income return, which can range from 3% all the way to 12%.

A great place to get state and local-specific information is through the IRS’s government website directory.

You’ll also have to file an annual state income tax return with your state tax department. In all but five states—Delaware, Hawaii, Iowa, Louisiana, and Virginia—the return must be filed by April 15, the same deadline as your federal tax return.

Taxes and the Inflation Reduction Act (IRA)

The $740 billion Inflation Reduction Act (IRA) was signed into law on August 16, 2022 as a measured attempt to address climate change and stimulate the economy. The law includes numerous tax incentives, grants, and rebates that property managers can take full advantage of in 2025 including:

- Up to $7,500 in tax breaks to purchase electric vehicles

- Up to $14,000 in rebates to purchase heat pumps and energy efficient appliances

- Over $9,000 in savings and a 30% tax credit to install solar panels

Property managers should be aware of these incentives so they can strategies with owners and consider if their own businesses qualify.

Taxes and Disasters

While some are more predictable than others, no rental property owner is fully immune to natural disasters. Generally, rental property may qualify for tax relief if affected by natural disasters including deductions for losses on the property in addition to credits to help with rebuilding Here’s what you should know to work with owners and get the most relief during these scenarios.

Tax Deadlines Are Extended for Disasters

When affected by a natural disaster, the last thing you want to worry about is filing your taxes on time. If there is a silver lining in this scenario, it’s that you won’t have to ask the IRS for a deadline extension. The IRS automatically extends deadlines for property located in major disaster areas declared by FEMA.

Deducting Losses

While insurance is the first line of defense to recovering the damages from a natural disaster, there’s never a guarantee of how much will actually be covered. Depending on your policy, you may still be liable to repair, rebuild, and replace the rental property.

Uninsured casualty losses are deductible by property owners, which is defined by damage, destruction, or loss of property due to an unexpected, sudden, and unusual event like fires, floods, earthquakes, terrorist attacks, and volcanic eruptions.

How to Calculate Deductions

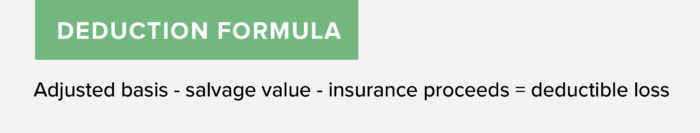

There’s a simple formula to calculate how much you can deduct depending on the severity of your losses:

Every casualty loss must be calculated separately as its own line item. Appraisals help determine the reduction of fair market value and salvage value of your damaged property The cost of reconstruction can be used to measure the decrease in fair market values if met by the following criteria:

- Repairs are actually made

- The repairs are necessary to return to original condition of the property

- The repairs are made at a fair market rate

- Repairs are only for the damages caused by natural disaster

- Value of the property after the repair is not greater than before the casualty

It’s Time to Simplify Your Taxes

There are many ways you can reduce your tax burden, but exponentially more ways to overcomplicate it. The most efficient and more accurate way to manage your bookkeeping is by using purpose-built accounting software that covers your bases for you year round while automatically tracking each that flows in and out of your business.

Buildium makes it easy to stay one step ahead with your company’s finances. You’ll be ready for tax season, and anything else that comes your way.