Whether you’re a real estate broker looking to branch out, or completely new to the rental market, the property management hustle can offer lucrative, consistent opportunities. Like any business, though, it’s important to have a clear understanding of the potential income and expenses that come with managing properties.

Chart of Accounts

Want clearer, cleaner books? What about a more useful view into your properties or just easier accounting in general?

Get the GuideYou can think of property management income and expenses as the fundamentals of property management accounting; a report that keeps your owners’ bottom lines—and that of your company’s—in the black. In this post (and in the video below), we’ll explore:

- How keeping an accurate profit and loss (or P&L) statement is important to make sure your income outweighs your expenses

- The kinds of income and expenses property managers can expect

- Some unique ways to add to the income side of your P&L

Property Management Income and Expenses: Your P&L Statement

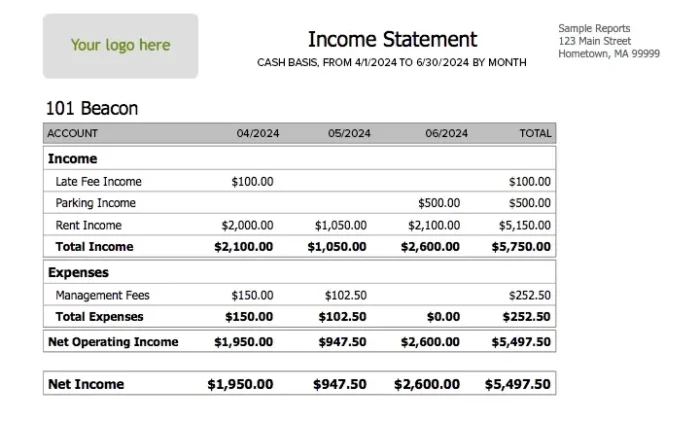

Put simply, the key to a profitable business is making sure that you’re always bringing in more money than you’re spending. To track this, you should set up a P&L for each of your owners, as well as for your own company. A profit and loss statement helps you enumerate money coming in and money going out, ensuring your net income—or your income after expenses are subtracted—is positive, rather than negative.

A P&L statement is not quite as detailed as a chart of accounts. While a chart of accounts includes assets and liabilities, a P&L will generally include only money you brought in and money you spent over a given period of time. It’s a quick way to see how your business is faring, financially, over a month, quarter, year, or even year over year.

Net income is sometimes called the “bottom line” because it’s the grand total and shows up at the bottom of the report. (Accountants and bookkeepers are a literal bunch.) Let’s take a closer look at that bottom line and the kinds of fees you can charge to keep it on the positive side.

Property Management Income

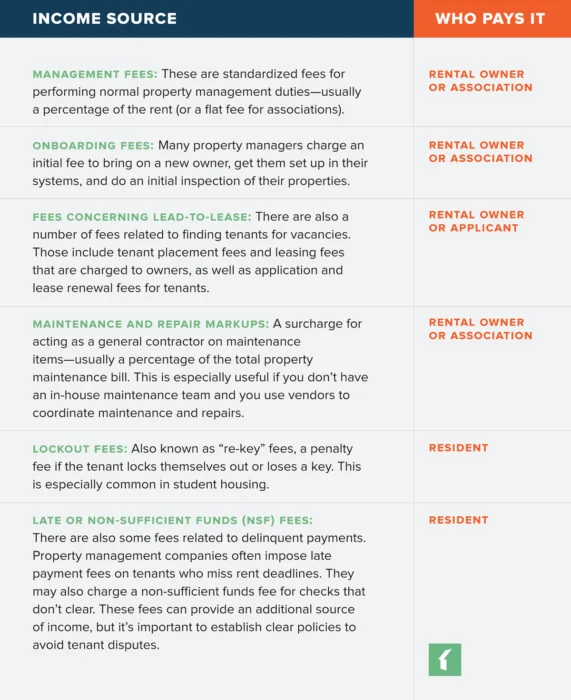

Property management companies have several sources of revenue that feed the top line of their income statement. Depending on where you’re located, some of those income sources might have rules and regulations. For example, late fees are highly regulated. That includes if or when they can be charged, how they should be structured, who keeps them, and how much they can be. While many fees are paid by owners, there are just as many that tenants and community residents pay, as well, including late fees, amenity fees, and pet fees.

Keep in mind that different rental markets have different trends and different laws. What works in Boston, MA might not work in Portland, OR. Regardless of where you operate, here are the main sources of income to be aware of before drilling down to the finer details:

Management fees: These are standardized fees for performing normal property management duties—usually a percentage of the rent (or a flat fee for associations).

Onboarding fees: Many property managers charge an initial fee to bring on a new owner, get them set up in their systems, and do an initial inspection of their properties.

Fees Concerning Lead-to-Lease: There are also a number of fees related to finding tenants for vacancies. Those include tenant placement fees and leasing fees that are charged to owners, as well as application and lease renewal fees for tenants.

Maintenance and repair markups: A surcharge for acting as a general contractor on maintenance items—usually a percentage of the total property maintenance bill. This is especially useful if you don’t have an in-house maintenance team and you use vendors to coordinate maintenance and repairs.

Lockout fees: Also known as “re-key” fees, a penalty fee if the tenant locks themselves out or loses a key. This is especially common in student housing.

Late or non-sufficient funds (NSF) fees: There are also some fees related to delinquent payments. Property management companies often impose late payment fees on tenants who miss rent deadlines. They may also charge a non-sufficient funds fee for checks that don’t clear. These fees can provide an additional source of income, but it’s important to establish clear policies to avoid tenant disputes.

However, particularly after the pandemic, some property managers aren’t so quick to charge a late fee. Instead, they work with their tenants or residents and ensure clear communication from the beginning. It’s also important to check with your local and state laws concerning late fees.

Other fees: There are other fees property managers can charge to add new sources of revenue. For example, if you allow pets, you could charge a pet fee to cover the cost of potential damage. Or you could offer an amenities package for an extra fee. Amenities can cover anything from regular HVAC filter replacement to package lockers. If you have parking spots, you could charge a parking fee. And if you offer online rent payments, you could charge a convenience fee for that like Buildium’s ePay allows you to do.

This list just scratches the surface of potential revenue streams for property managers. If you’d like to learn more, check out our guide: “Generate Revenue Without Adding New Doors.”

Property Management Expenses

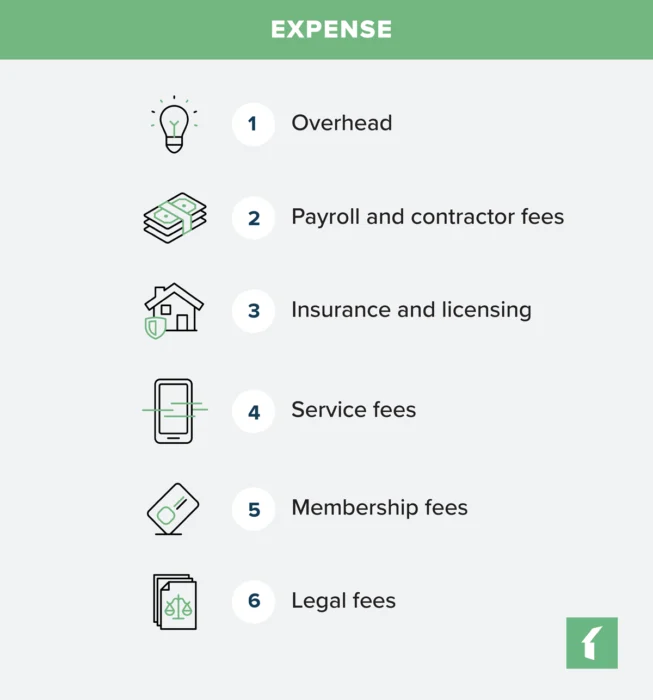

Of course, you can’t measure the success of your owners—or your own success—solely on the money you bring in. You also have to take into account the money flowing out of your business. Let’s take a look at some of the more common property management expenses:

Overhead: There are several expenses that fall under the umbrella of overhead. Basically, it’s the money spent to keep the lights on and the office running. Those costs can include rent and utilities for your office space, supplies, which includes everything from computer equipment to paper, and costs for any vehicles your company owns.

Payroll and contractor fees: Payroll includes the base salary paid to employees along with any benefits, bonuses, overtime pay, training, and development costs. Contractor fees include the service fees that contractors charge along with any additional fees they may charge, such as materials and permit costs.

Insurance and licensing: Depending which state you operate in, you may have to get licensed as a property manager, or even as a realtor. To learn more, you can check out our post on property management licenses and certifications. Property managers also need adequate insurance coverage, including liability insurance and errors and omissions (E&O) insurance.

Service fees: These are costs for software and other services that can span different areas of your business, from project management tools and property management software to tenant screening and marketing services.

Membership fees: If you’re a member of a professional organization that charges dues, such as NARPM or a chamber of commerce, you should account for those expenses as well.

Legal fees: You’re probably going to need a lawyer for drafting lease agreements, handling eviction proceedings, and addressing other legal matters that can arise in property management, so factor a lawyer’s fees into your expenses.

Property Management Income and Expenses Best Practices

Now that we’ve covered the basics of property management income and expenses, let’s walk through some best practices. Now that we’ve covered the basics of property management income and expenses, let’s walk through some best practices.

#1: Maintain an Accurate Chart of Accounts

You should be vigilant about keeping up-to-speed on your net income (revenue minus expenses). Watching this figure on a monthly basis makes for good fiscal hygiene, as does maintaining an effective chart of accounts. Many accounting software solutions include a chart of accounts feature that then pulls the entries into a P&L and calculates your net income automatically.

Buildium includes powerful accounting features, such as automatic bank reconciliation, built-in calculators to manage your accounts, custom and industry-specific fields, 1099 e-filing, and full visibility into every transaction your business makes. Integrated seamlessly with rent payment, vendor management, and reporting tools, you’ll be able to get a better handle not only on your books, but every aspect of your operations.

#2: Keep an Eye on Your Bottom Line

Having accurate, up-to-date numbers are only good if you’re keeping an eye on them. Keep tabs on your bottom line to make sure it’s not starting to slip. If it does, jump into your accounting software to see where the problem is. That way, you can fix it before it becomes a real problem.

Property management software is useful here, too. Buildium lets you refresh your numbers in real time on a platform that’s easy to navigate, so you can find the details you need quickly.

#3: Work with a Growth Mindset

Even if your numbers are in good shape, you never know when an owner may leave your services or simply sell off their properties, or even when the market may turn. Nothing hurts the top line of an income statement like fewer clients; so, hedge against that outcome by focusing on where your business can grow.

Use your chart of accounts, as well as your net income to determine when to add new clients and how many to bring on. Determine your growth plans for the next few years—aggressive or not—and use your income and expenses, as well as your staff headcount, to determine when and how to implement it.

#4: Find New Streams of Revenue

A P&L statement as well as an accurate chart of accounts can help you find cost savings as well as new revenue opportunities. If you manage HOAs, for example, you may find your staff is spending a lot of time and money collecting and sending out disclosure documents for properties on the market.

There could be an opportunity, here, to save money and perhaps even add revenue by bringing on a service such as HomeWiseDocs, which facilitates that process for you, allowing you to charge residents for the service.

Stay in the Black and Grow Your Property Management Income

At the end of the day, you’ve got a business to run and bookkeeping isn’t always the most rewarding or revenue generating part of the job. The right tech stack can automate much of the process and make it easier to share vital details on the health of your properties—and the value that you’re adding—with owners.

With the knowledge above and the property management tools available to you, you’ll know just what line items to look out for and how to track them with less effort.

To learn more about Buildium, sign up for a free, 14-day trial, no credit card required, or schedule a demo.

Frequently Asked Questions

What are the main sources of income for property managers?

Property managers typically earn income through management fees, which are usually a percentage of the rent collected. Additional sources include leasing fees for finding new tenants, maintenance fees for coordinating repairs, and sometimes, late payment fees charged to tenants.

How can property managers accurately track expenses?

Utilize property management software to log all expenses in real-time. Be diligent about recording every transaction, from maintenance costs to administrative expenses. This practice will make it easier to generate accurate financial reports and keep an eye on the budget. Purpose-built software, such as Buildium, handles much of the time intensive tracking work for you, keeping your books accurate and easy to access.

What types of expenses should property managers expect?

Property managers should anticipate several types of expenses, including maintenance and repair costs, property insurance, utilities, taxes, and administrative costs. Regular expenses also involve marketing and advertising for vacancies and legal fees for lease agreements and disputes.

How can property managers reduce operating costs?

Consider conducting regular property inspections to identify issues before they become costly repairs. Negotiating better rates with vendors and contractors can also help. Energy-efficient upgrades, like LED lighting or smart thermostats, can reduce utility bills over time.

How should property managers handle unexpected expenses?

Set aside a contingency fund specifically for unexpected costs such as emergency repairs or sudden vacancies. Being proactive in managing finances helps property managers address unforeseen expenses without significant disruption to cash flow.

Read more on Accounting & Reporting