You’ve probably heard the old adage: “Measure twice, cut once.”

Well, my dad—being my dad—insisted on putting his own spin on things. He used to quip, “I don’t get it. I cut it twice and it’s still too short.” He’d say this over and over in the oddest situations: when we’d drive to the hardware store to get another 2×4, or when he’d find a typo in my English essay, or when he’d find a glitch in my algebra homework.

It wasn’t until high school that I figured out that he meant I should be more careful and double check my work. And unlike the more common adage to “measure twice and cut once,” my dad wanted me to recognize the importance of spotting mistakes before it’s too late. It was the same message, but delivered in my dad’s manner: Less preachy and more “told ya so.”

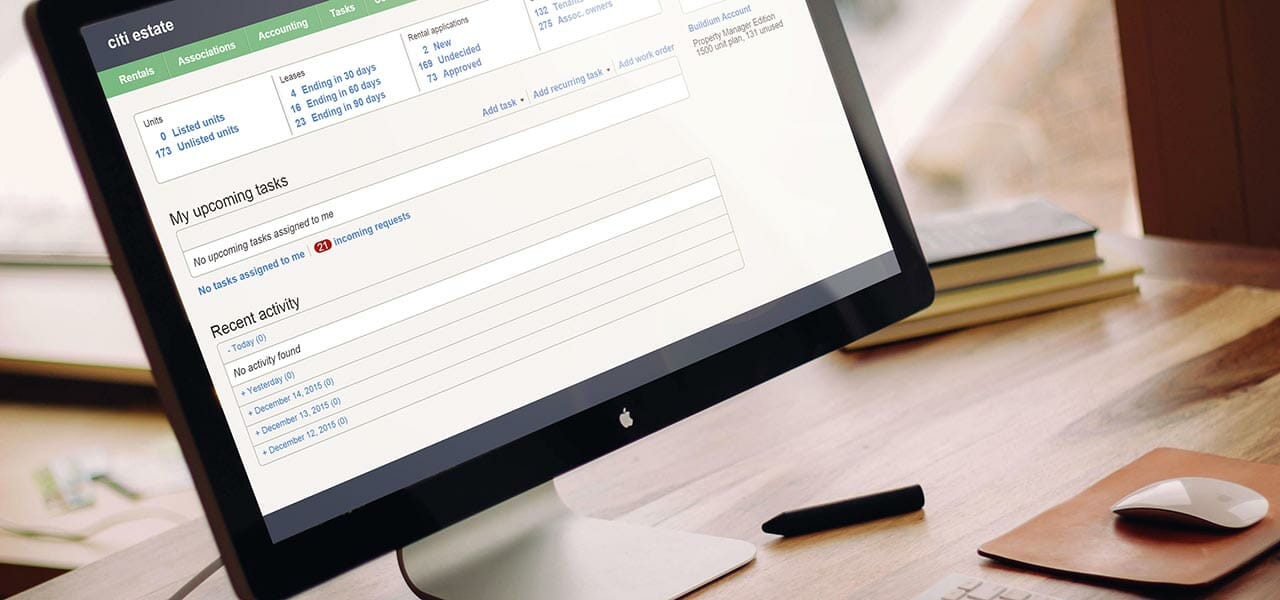

Fast forward to my first gig here at Buildium: Customer care agent. I ended up answering a lot of questions like:

- Why does my rental owner statement show double income this month?

- How come my owner draw is a different amount this month?

- My client wants to see the monthly reports, what should I give them?

At some point, I realized that a lot of those problems could be solved by applying my dad’s wisdom. If folks checked their work, a lot of the mistakes sort of bubble to the top faster and are easily fixed.

Bank reconciliation is a process that compares the transactions that have cleared the bank to those in Buildium. When Check #101 for $1,000 shows up on your bank statement, you find it in Buildium, make sure it was recorded as a $1,000 transaction, and check it off.

Bank reconciliation is essentially the business equivalent of balancing your checkbook. It’s a safeguard against inaccurate reporting, helps you sniff out typos, transpositions, and duplicate or missing transactions. And it’s usually the first requirement from big customers and real estate commission auditors. Ideally, bank reconciliation is done monthly.

And it only takes a couple hours per bank account, depending on amount of activity.

Too much time? No problem. Buildium’s bank reconciliation feature has filters and sorting capabilities to help you knock that time down to less than an hour!

Still not good enough? “Bank reconciliation is too gosh darn tedious for me,” you say?

Well, we’ve you covered. Buildium’s automatic bank reconciliation feature downloads data from your bank into Buildium and matches up the transactions for you while you’re sleeping. You’ll need just a couple minutes a month to finalize the report.

This feature is so quick and easy, you won’t even realize you’re reconciling. It’s automagical.

- Automation: We link up with your real-world bank account, downloading bank data to Buildium as they’re processed by the bank.

- Set-up is simple: We’ve got a wizard that’ll help you find your bank and link your real-world and Buildium accounts.

- Buildium’s wicked-smart matching logic: As we download transactions from your bank, we look for similar transactions already in your account and match them up. If there’s an exact match, we’ll show you. (If you like, we’ll even clear the transaction automatically.) If there’s a bunch of possibilities, we make it easy for you to pick the right one. And if there’s nothing obvious, you can create a transaction on the fly.

- Audit-friendly bank reconciliation reports: Buildium produces a standard bank reconciliation report for you. We’ll even remind you when it’s time to produce the report. Used in conjunction with our trust reconciliation package, you’ll be ready for any audits in your future.

- Printer friendly reports: Some companies need to file away hard copies of these reports. That’s why we produce this printable version for the file cabinet.

Need to do bank reconciliation but could live without the tedium of doing it manually? Buildium’s Automatic Bank Reconciliation is the perfect medicine. To get started, simply go to the “Accounting” menu, then go to the “Banking” page and click on your bank account. Click on “Reconciliations,” and then click on the “Link Account” button. This allows you to “link” your Buildium account to your bank account, allowing us to download your bank data to use in the bank reconciliation, and it’s where the automagic begins.

Read more on Accounting & Reporting