If your goals this year include more doors, stronger margins, and happier clients, you’re in good company. Most property management companies are gearing up for growth in 2026, with portfolio expansion topping their list of strategies to generate more revenue—and they’re turning to technology to keep costs in check and service levels strong as they scale.

The catch? Investor uncertainty could slow third-party property managers’ momentum, so companies are diversifying their growth strategies to stay ahead.

In this post, we’ll break down three growth-focused findings from our 2026 State of the Property Management Industry Report, showing how companies are approaching portfolio expansion in a more sustainable way this year. Want the full picture of what the coming months hold, as well as expert perspectives and practical tips to put these trends to work in your business? Download your free copy of our Industry Report now.

Trend #1: Expansion Remains Central, Execution is the Differentiator

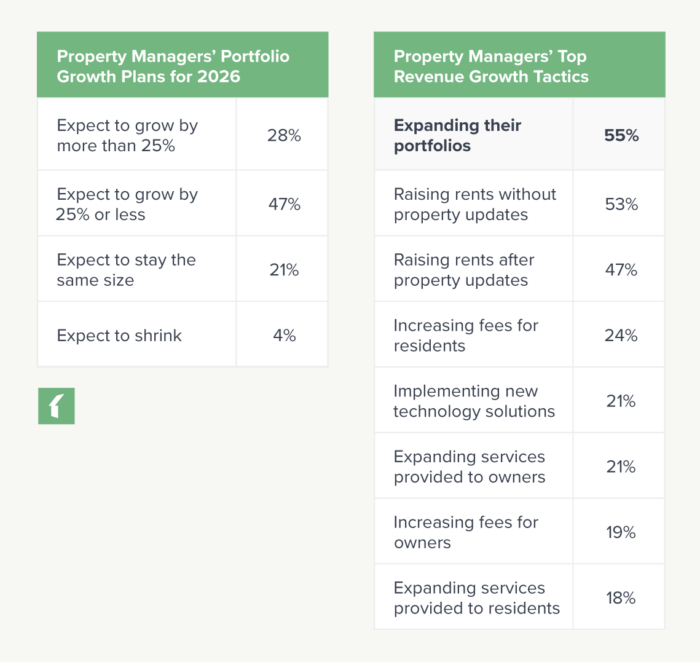

For the eighth year running, growth tops property management companies’ list of priorities. 3 in 4 businesses plan to expand in 2026, with most targeting modest gains of 25% or less—though it’s worth mentioning that more than a third plan to grow by more than 25%.

Companies that plan to grow largely plan to double down on small rental properties:

- 76% will add single-family rental homes

- 64% will add multifamily rental homes

- 48% will add apartment buildings

- 11% will add homeowners associations, and 10% will add condos

As one respondent told us, “My greatest opportunity is to expand [our] services to underserved or self-managed HOAs and single-family communities in the area. With our reputation for personalized service, community involvement, and strong compliance knowledge, we are well-positioned to attract communities that feel overlooked by larger firms. Continuing to leverage our community presence—through local events, outreach, and real estate education—we can help build trust and increase our referral base.”

Portfolio growth isn’t just about size—it’s also companies’ #1 source of revenue growth. So, efficiency matters, especially when it comes to keeping businesses’ costs down as they grow. That’s where the right technology comes into play—both adopting new tools and better using current ones.

Turn Insight into Action:

- Evaluate Your Client List: Once per quarter, identify clients who require a disproportionate amount of your resources and offboard those who don’t align, freeing up your capacity for growth.

- Grow Where You’re Strongest: Expand in areas where your team excels, such as single-family homes and underserved HOAs, through client referrals and local events.

- Scale with Custom Fields: Capture the accounting and property details that are essential to your portfolio. Next, surface them in your workflows and reports to communicate better and bridge efficiency gaps.

Trend #2: Investor Hesitation: How Uncertainty is Reshaping Expansion

As businesses put their growth plans into action in 2026, third-party property managers might find that some rental investors are hesitant to expand their portfolios. In addition to high property prices, elevated interest rates, and rising property costs, uncertainty in the economy has set many rental owners back on their heels.

As one rental owner explained, “Maintenance costs continue to increase faster than the equity of the property. I want to maintain my current portfolio and then reassess after all the economic turmoil calms.”

Shifting attitudes among rental investors could be one of the reasons why we see a gap between how much growth property management companies have planned, and how much growth they actually achieved: 75% plan to grow in the next year, but just 55% grew over the past year.

Nearly 1 in 5 property managers say that it’s primarily clients’ acquisition of new properties that fuels their growth—making it clear that setting realistic targets and diversifying revenue streams is key in 2026.

Turn Insight into Action:

- Set Realistic Growth Targets: Align expansion plans with investor sentiment to avoid overextension and maintain service quality, examining planned growth vs. past growth data.

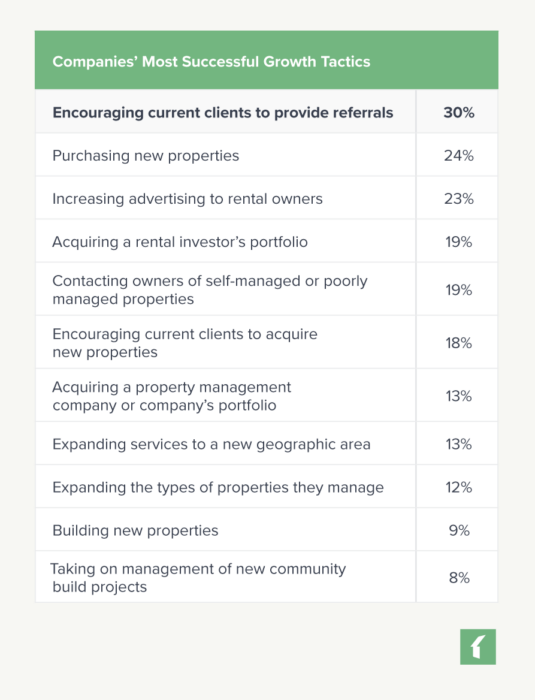

- Leverage Referrals to Grow: Incentivize client referrals and facilitate property sales between clients to retain management and deepen trust.

Trend #3: Scaling Without Slipping: Service Quality in a Time of Growth

Growth brings new challenges for property management businesses—and chief among them is maintaining their service quality as they expand. Referrals from satisfied clients are still companies’ #1 source of growth, so you can’t afford to let service levels slip.

Technology can help companies bridge the gap as they grow their portfolios faster than they’re able to expand their teams—for example, by helping property managers cut down the time they spend on repetitive tasks (like rent collection) so they can divert their resources toward improving their customer experience.

Technology also gives residents and owners self-service capabilities through online portals, and makes it possible for companies to meet increased customer demands by streamlining their communication.

As one respondent put it: “The greatest challenge [our company] anticipates in the coming year is balancing personalized service with scalable growth, especially as we continue to expand our portfolio in a competitive rental market. We pride ourselves on being responsive and approachable—qualities that can become harder to maintain as we grow. We are also navigating pressures from property owners and tenants for faster, tech-driven communication while still delivering the personal touch that defines our brand.”

Turn Insights into Action:

- Balance Tech & Personalization: Use portals and automation to increase efficiency, but keep outreach personal for onboarding, renewals, and conflict resolution.

- Use Metrics to Guide Service: Monitor response times, ticket resolution, and satisfaction scores as you scale, using dashboards to flag service dips before they impact retention.

Growth in 2026 isn’t just about adding doors—it’s about strategic scaling. The most successful companies are pairing portfolio expansion with tech-driven efficiency to keep costs down and service levels high. They’re also setting realistic targets and diversifying their revenue streams to navigate investor caution and economic uncertainty.

To benchmark your plans against industry leaders and uncover actionable strategies for sustainable growth, download our 2026 State of the Property Management Industry Report.