Flexible rent payment options have become more than a convenience—they’re something today’s residents actively look for when choosing where to live. Many renters are seeking property managers who provide more flexibility in how and when rent is paid.

For property managers, offering flexible rent payment options can help reduce late payments, retain more tenants, and keep revenue consistent. Best of all, the right tools make it easier than ever to offer these options without increasing your workload.

In this post, we’ll dive into six flexible rent payment options worth considering, which ones deliver the most value, and how to offer them simply and effectively with the help of software.

Why Offer Flexible Rent Payment Options?

Offering flexible rent payment options certainly helps your residents, but it’s also a strategic move that can benefit your operations and bottom line. From improving rent collection to strengthening owner and resident relationships, payment options create real value. Here’s how:

Incentivizing Better Payment Habits

Flexible payments give tenants the ability to plan ahead and pay on time, even if their pay schedule doesn’t line up with the first of the month. That means fewer late payments for you to track down and more consistent rent collection.

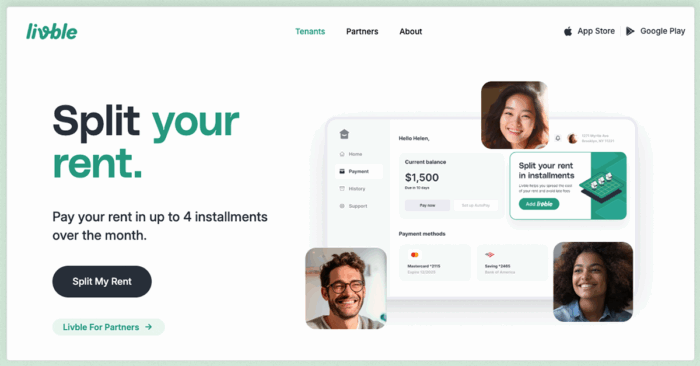

Flexible rent payment options also allow you to offer structured plans for residents who need a little extra support, helping them stay on track without disrupting your cash flow. In fact, services such as Livble® ensure that you get paid in full on-time, not when the installments come in from renters, making this option a win win for most property management companies

Attracting More Tenants

Renters are doing more research than ever when choosing where to live, and payment flexibility can make your properties more attractive. Offering alternatives to rigid payment terms helps you appeal to a wider range of renters, from gig workers and hourly employees to families managing tight budgets.

You can also highlight your payment options, alternatives, and incentives in your listings or leasing materials as a differentiator. In competitive rental markets, that added layer of convenience can help you fill vacancies faster.

Pro tip: If you’re looking for other ways to appeal to renters, security deposit alternatives are worth considering. They can reduce move-in costs for tenants and lower vacancy time.

Creating a Reputation for Standout Service

Offering flexible rent payment plans shows both tenants and owners that you’re paying attention to changing needs and responding in ways that are practical and supportive. When owners see you putting tools in place that improve tenant satisfaction, reduce turnover, and keep revenue steady, it helps position you as a service-first property manager.

6 Flexible Rent Payment Options You Should Consider

Not all flexible rent payment features are created equal. Below are the most effective options to consider offering, depending on your tenants and goals.

1. Split Payments

Split payments let tenants divide rent into two or more smaller installments, typically aligned with their pay schedule. For example, a tenant could pay half of their rent on the first day of the month and the other half on the 15th.

This option is especially helpful for renters who are paid biweekly or semimonthly. It reduces financial strain and makes budgeting easier while helping you maintain consistent cash flow.

2. Flexible Due Dates and Grace Periods

Some property managers allow tenants to choose from a small selection of rent due dates based on when they get paid—such as the 1st, 5th, or 10th of the month—to accommodate their financial situation while still keeping revenue flows reliable. Short grace periods to accommodate small delays are also common practice.

This little shift can go a long way in helping residents avoid penalties and stay on track, especially during months with unexpected expenses.

3. Custom Rent Payment Plans

By allowing residents to spread out rent or catch up over time, custom rent payment plans can support them when facing a temporary financial challenge such as a big medical bill or job change.

Unlike the other options we covered above, this is usually a short-term solution meant to accommodate a specific tenant’s situation. Instead of dealing with the work and potential disputes involved with issuing and collecting late fees, you can take this step to create a temporary, manageable plan that benefits both sides.

4. Early Payment Discounts

Offering a small incentive, such as $25 off for tenants who pay rent a few days early, can encourage proactive payment habits and reduce last-minute delays.

It’s a win-win because tenants appreciate the reward and you gain access to funds earlier in the month.

5. Housing Assistance Options

Many tenants qualify for housing assistance programs, but may not know where to start. By providing information or assisting with documentation, you can help residents access support and reduce the risk of missed payments.

Consider offering a resource sheet or email with links to local and federal rent assistance programs, nonprofits, and emergency relief options.

6. Incentive Programs

Consider offering incentives such as gift cards, credits, or entries into a monthly raffle to tenants who pay rent on time consistently. These programs not only improve payment behavior but boost retention and resident satisfaction, as well.

Software to Introduce Flexible Rent Payment Options Easily

Introducing these flexible rent payment options doesn’t necessarily mean creating more work for your team or setting up new, complex systems. Features within property management software and purpose-built services can help you make it set up, manage, and scale flexible payment plans and incentives across your entire portfolio.

Here are three platforms to consider:

Livble: Give Tenants Options without Risk or Extra Effort

Livble is a fully embedded rent payment solution that empowers residents to split their rent into smaller, manageable installments—without requiring you to change how you collect payments or take on any financial risk.

Once a tenant is approved (typically in under 60 seconds), Livble pays the full rent amount directly to you up front. That means you get paid in full and on time while Livble handles the rest, including installment tracking, collections, and communication.

For tenants, the experience is just as seamless, especially if you already use Buildium’s property management software. Livble is built right into Buildium’s Resident Center, so they never leave the platform to enroll or make payments. They can align their rent schedule with their income cycle and pay in 2–4 installments each month. There are no late fees or interest charges. Tenants simply pay based on when they enroll and how many installments they choose.

For property managers, Livble is entirely hands-off. You don’t need to monitor split payments or follow up with tenants. The company assumes 100% of the non-payment risk, and payments post instantly to Buildium ledgers for full financial visibility.

Gravy: Incentivizing Tenant Habits That Grow Revenue

Gravy® helps property managers improve rent collection and retention by rewarding tenants for paying on time. Once residents enroll, they earn Gravy Rewards each month they pay rent through the Resident Center. Rewards can be redeemed for gift cards, used toward future rent, or saved for move-out costs.

Tenants also get access to savings tools that help them plan ahead and build better financial habits. It’s easy to enroll, and it all works through the existing Buildium platform.

For property managers, Gravy is fully automated. You don’t have to track rewards or manage redemptions.

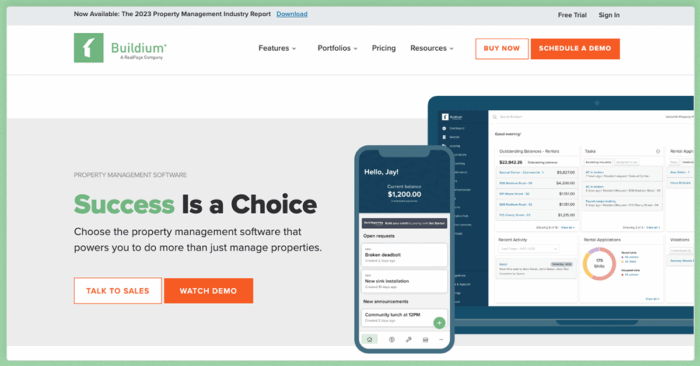

Buildium: Manage Payments, Tenants, and Your Entire Business Intuitively

Buildium gives you everything you need to automate and simplify rent collection across your entire portfolio. Tenants can pay rent directly through the Resident Center via ACH, credit card, or debit card. You can also automate reminders, late fees, and grace periods while tracking and reconciling payments in real time from within the platform.

For property managers, this means faster payments, fewer manual tasks, and better financial visibility. Buildium also integrates seamlessly with Livble and Gravy, so you can offer tenants more payment options while keeping your operations connected.

Choosing Which Flexible Rent Payment Options to Implement

Offering flexible rent payment options is an easy way to support your tenants, and one that has direct, tangible benefits for renters. When planning which options to implement, be sure to keep a few things in mind:

- The payment services and strategies you choose should reflect the types of tenants you have and their financial situations.

- Be sure to clearly highlight your payment options even before sending a lease agreement. They can often be valuable for marketing your properties.

- Tools such as Buildium, Livble, and Gravy can cut down the admin workload and let you roll out services you may not otherwise be able to.

To make collecting payments, managing leasing, and supporting your entire business more straightforward, consider testing out Buildium’s comprehensive property management platform out for yourself with a no-risk 14-day free trial or by scheduling a guided demo.

With Buildium, you can bring all your operations—managing rent collection, resident communications, rent service integrations, and more—together in one powerful, easy-to-use system. It lets you focus on providing the kind of services to tenants that builds long-term retention and sets you apart.

Frequently Asked Questions

What types of rent payment options are out there and why are they growing in popularity?

Flexible rent payment options include split payments, flexible due dates, early payment incentives, and custom payment plans. These options are growing in popularity because they help renters manage budgets and reduce financial stress—while supporting consistent rent collection for property managers.

What are the main benefits of flexible rent payments for property managers?

Flexible options can reduce late payments, improve tenant satisfaction, and help retain residents longer. They also help differentiate your services to both renters and rental property owners.

How hard is it to implement different types of rent payment?

With software like Livble, Gravy, and Buildium, implementing flexible rent payments is simple. These tools automate the process, manage communication, and track payments so you don’t have to do everything manually.

What specific tools can help with implementing flexible rent payments?

Livble offers split payments and custom plans, Gravy helps reward good payment behavior, and Buildium brings it all together with integrated rent tracking, automation, and tenant communication.

Are there any fees associated with using flexible rent payments?

Fees may vary depending on the platform and plan, but many flexible rent payment tools are included as part of your property management software subscription or offered at low cost to tenants.

Read more on Leasing