Boston: home to Buildium HQ and more than 250,000 college students.

That said, we know more than most what a big business student housing can be—but we know it can be risky, too. Students generally have little to no income and mostly non-existent credit.

The easiest way to protect yourself when renting to students or other lower-income applicants is by requiring a cosigner. Ultimately, if they can’t afford to pay their rent or fees, you’ll still be paid by the cosigner.

The good news is that with our latest updates, you can keep track of apartment cosigners right from Buildium.

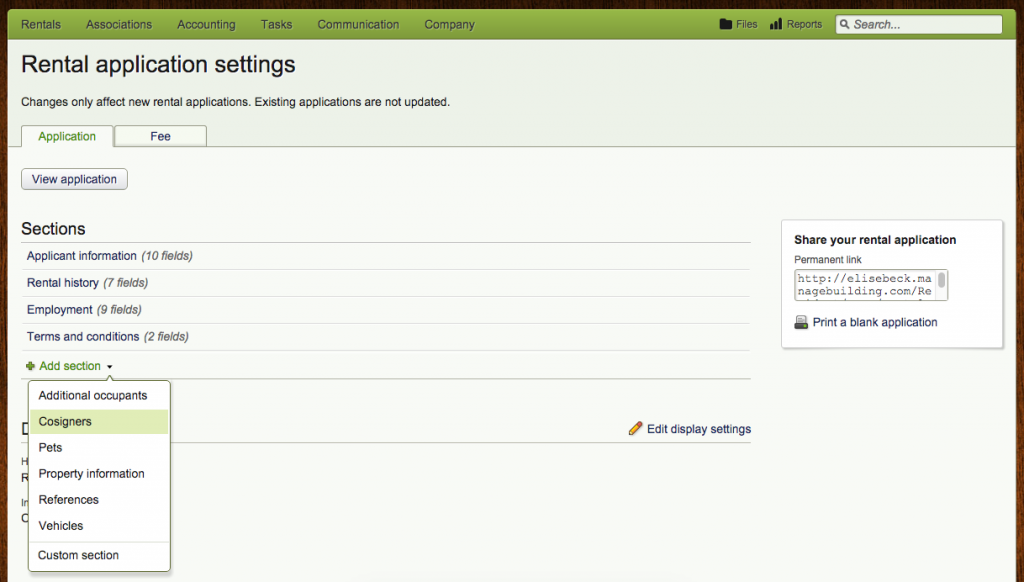

Customize the application to include cosigners

Add custom fields like occupation, current employer, and current salary to the application.

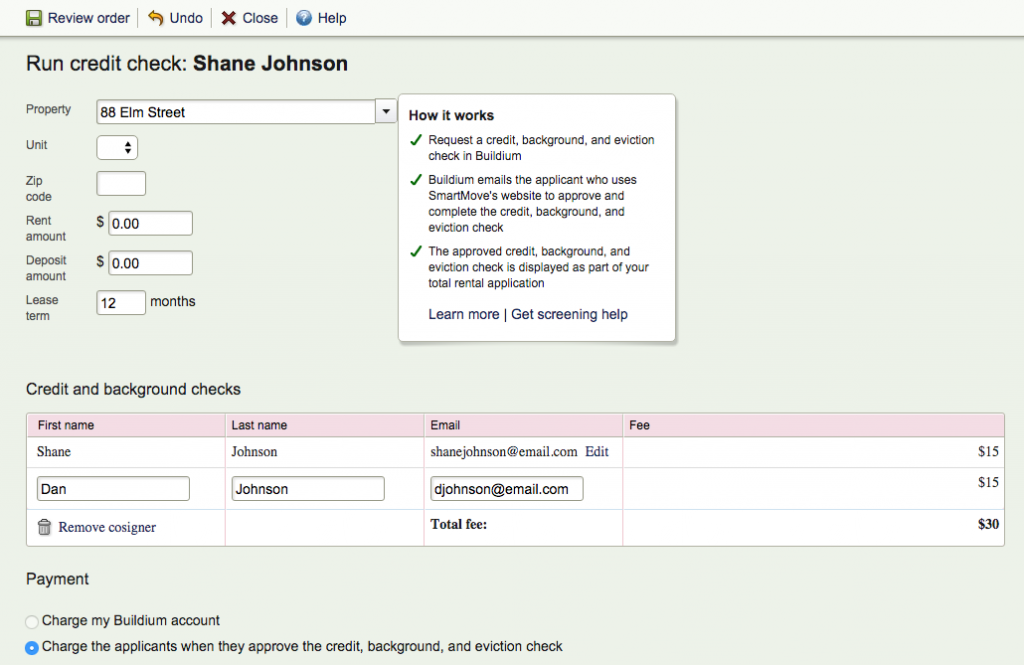

Screen your cosigners

When you screen an applicant in Buildium, you’re leveraging that applicant’s credit, criminal, and eviction history to decide whether or not they’re someone you’d like to have as a tenant. When a cosigner is involved, you can screen them, too. Afterall, a cosigner with poor credit isn’t much assurance when renting to a tenant with poor credit.

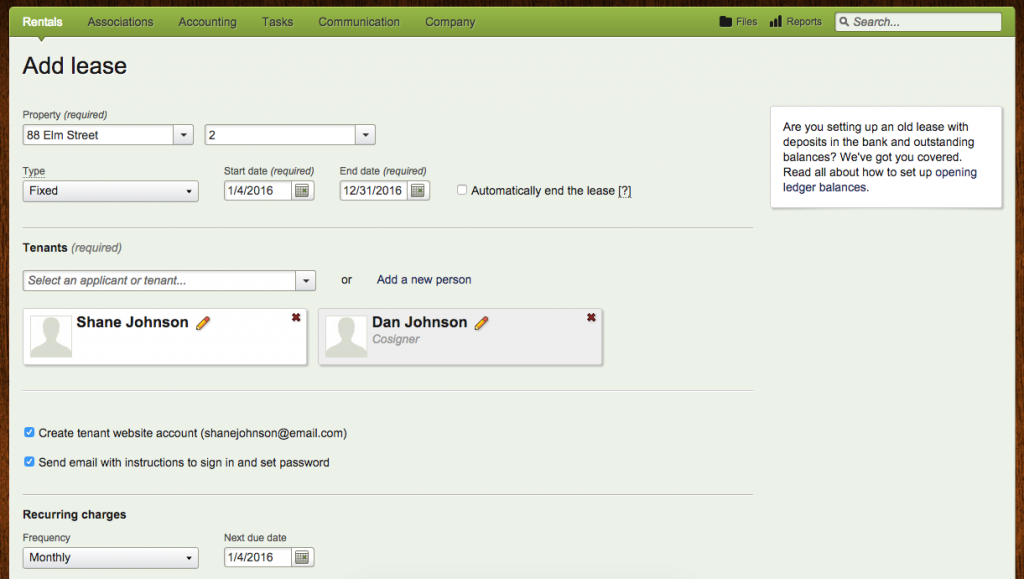

Contact cosigners in case of delinquency

We hope that you never have to use this function, but we know that delinquent payment situations come up. When you move-in an applicant, their cosigner’s information will be automatically saved to the lease ledger, so it’s easy to contact them for payment.

Whether you’re dealing with students or simply looking for added reassurance, requiring a cosigner can save the day. Do you currently require a cosigner? What’s your policy? Share your thoughts in the comments section.

Read more on Leasing