Filing taxes is always top of mind at the beginning of the year, but even after April has come and gone, the money you and your owners can save through deductions should always be on your radar.

No-Fuss Financials

Automated bookkeeping to simplify accounting a grow your business.

Learn MoreSmall changes to your tax filing strategy can actually lead to significant cost savings in just a short period of time. Knowing about the right deductions (and the right tools to report them easily) can help you keep money in your pocket (and save you hours of time).

Bonus depreciation is one such deduction that can reduce your tax burden significantly and immediately, rather than giving you smaller benefits over time.

Let’s take a look at what bonus depreciation actually means for property managers, what qualifies for a deduction, and the easiest way to start saving.

What Is Depreciation in Real Estate?

Depreciation is one of the major reasons why individuals choose to invest in real estate. In the eyes of the IRS, many assets, including rental properties, depreciate over time due to wear and tear, along with other factors. Because of that, you can write off the cost of the property over the course of its “useful life” (27.5 years in the case of a residential rental property).

Property owners can get even more benefit from these deductions through cost segregation. A certified cost segregation specialist can conduct a cost segregation study on a property that identifies its different elements—like roofing, windows, and floors—and provides an accelerated depreciation timeline for each.

How does this benefit you as a property manager? That’s where bonus depreciation kicks in.

What Is Real Estate Bonus Depreciation?

Bonus depreciation is an IRS tax code that allows you to depreciate the value of certain assets that make up a rental property more quickly than normal. Instead of getting a tax write off over the useful life of a property, you’ll be able to get a larger deduction in the first year the asset was placed in service.

By depreciating the cost of eligible assets up front, you can free up cash flow, reduce the tax liability for your business, and possibly even qualify for a lower tax bracket.

Here’s how it works: When you purchase a new piece of property or make improvements to existing property, you can depreciate the cost over a period of time. Under the bonus depreciation rule, you can take an additional deduction of 100% of the cost of eligible assets in the first year of ownership. That can result in significant tax savings.

You can even use bonus depreciation to create a net operating loss, which you can carry forward to offset future income.

What Property Managers Should Know about Bonus Depreciation

Before jumping into the specifics of how to file for deductions using bonus depreciation, you should know which assets qualify and the limitations around certain asset times.

Here are the types of purchases and improvements eligible for bonus depreciation that both property owners and property managers should know.

Qualified Property for Bonus Depreciation

Property that qualifies for bonus depreciation must have a useful life of between one and 20 years.

But wait, we just said that residential rental property has a useful life of 27.5 years.

A residential rental property itself does not qualify. But there are several other asset types that you can claim bonus depreciation on. These fall into two main categories: personal property and land improvements.

Personal Property and Bonus Depreciation

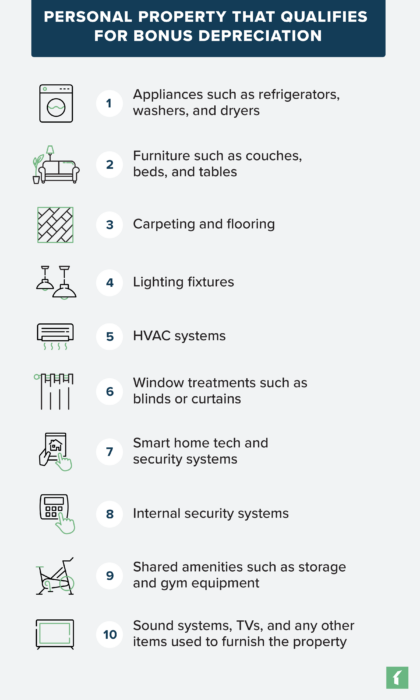

You can deduct any tangible property that you’ve purchased for business use, including use within a rental property. This can include both new and newly acquired used property, so long as the owner hasn’t personally used the item before placing it in the rental.

The list of personal property that qualifies for bonus depreciation is extensive, but some of the most common items include:

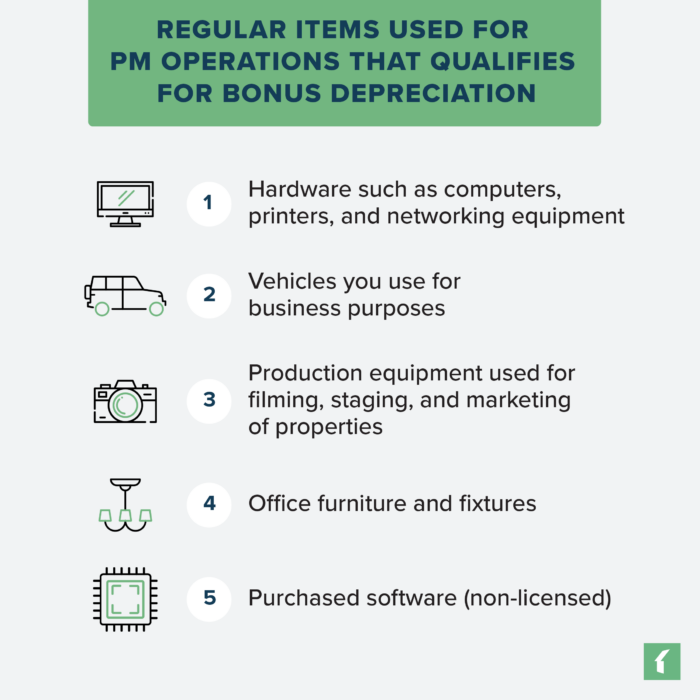

Items you use for your regular property management operations also qualify for bonus depreciation. Here are some examples:

Land Improvements and Bonus Depreciation

This is where things get a little tricky. While the land a property sits on does not qualify for standard depreciation under tax law, land improvements that have a 15-year useful life (a.k.a a recovery period) do qualify for bonus depreciation. These can include upgrades or work done to the following outdoor assets:

Rental Property Bonus Depreciation vs. Section 179

Many investors are unclear about the differences between bonus depreciation and Section 179 of the Internal Revenue Code (IRC).

While both types of incentives allow you to take upfront deductions on the purchase price of equipment, bonus depreciation has fewer limitations. Most importantly, there is no limit to the annual profit of a business to qualify for bonus depreciation—as opposed to Section 179—so you can still claim a deduction and carry it forward, even if you’re recording a net loss for that year.

The main benefit of Section 179 over bonus depreciation is that it offers greater flexibility. You can pick and choose which assets and how much of the cost of each asset you’d like to cover, saving the rest for future tax breaks. But keep in mind that the maximum deduction under Section 179 is $1,160,000 as of the 2024 tax year.

Neither option is a one-size-fits all solution, and you can actually combine bonus depreciation with Section 179. To do that you have to apply Section 179 selecting the assets and percentage of coverage you want. Any deduction amount over the Section 179 limit is then eligible to be received through bonus depreciation.

Electing Out of Bonus Depreciation

If you want to change course and opt out of bonus depreciation for an asset already elected for bonus depreciation, you’ll have to affirmatively elect out. That involves attaching a statement to a timely filed return for each asset, indicating the type of election (in this case, bonus depreciation, or simply bonus) and the useful life period, or asset class.

You’ll have to elect out separately for each asset class with a separate statement (i.e. a 5-year asset class, a 7-year asset class, etc.). Here’s an example of one such statement:

“Taxpayer hereby elects out of bonus for tax year 2022 for its 10-year and 15-year asset classes.”

Electing out late or attempting to revoke an election you’ve made can be a time-consuming process with additional forms involved and without any guarantee of success. Be accurate and sure of your decision before making the choice to elect out.

How to Calculate Bonus Depreciation

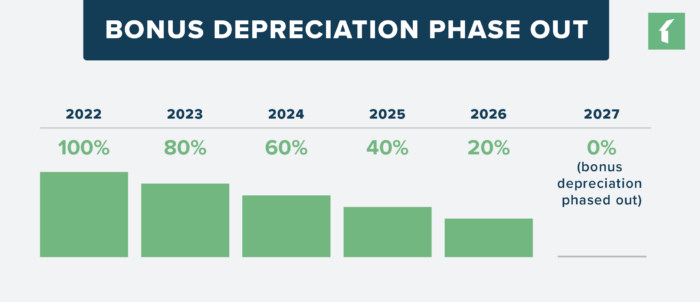

As outlined in the 2017 Tax and Jobs Act, eligible property could origninall be deducted at 100% of the cost. That percentage has changed and will continue to change in the subsequent tax years, however. In the 2024 tax year, the rate for bonus depreciation will be lowered to 60%. That rate will be lowered further to 40% in 2025, and 20% in 2026. Bonus depreciation will finally be phased out in the 2027 tax year.

With those rates in mind, the first step is to survey your rental property for eligible assets. Only a certified professional can conduct the on-site cost segregation survey necessary to identify the components of a rental property that qualify for bonus depreciation.

While it may seem like a lot of work, the upfront cost and effort are often dwarfed by the savings bonus depreciation can bring. That’s especially true if you’re managing a larger portfolio of properties or if you’re managing larger, multifamily properties in general.

The benefits of tax savings from entering a lower tax bracket or carrying forward deductions in the event of a net operating loss are hard to overstate.

Is There Bonus Depreciation Software That Can Help?

At this point, you might be looking for ways to minimize your effort while still getting all the benefits of bonus depreciation. There isn’t software that can directly calculate bonus depreciation for rental properties (you’ll need to go through a certified professional for that), but there are easy-to-use tools that can simplify your entire property management accounting process.

The best part? Tools may already be at your disposal if you’re using property management software for the rest of your operations.

Buildium, for example, comes equipped with a whole suite of accounting tools that automate accounting and help you reconcile your books with pinpoint accuracy.

Because Buildium also helps you manage your business as a whole, accounting features connect seamlessly with rent payments, messaging, and reporting tools, saving you even more time. This means you’ll be able to create and share reports in just a few clicks, using numbers you can trust.

If you’re ready to simplify property management accounting, take a peek at our features and take Buildium for a spin with a free, 14-day trial—no credit card required.

Frequently Asked Questions

What is bonus depreciation and how does it work?

Bonus depreciation allows property managers to deduct a larger portion of the cost of a property in the year it was purchased, rather than spreading the deduction over several years. This can significantly reduce taxable income, making it an attractive option for property managers looking to maximize their tax savings.

Which properties qualify for bonus depreciation?

A range of items used for property management operations, personal property, and land improvements qualify for bonus depreciation. This may include items such as appliances, carpeting, and landscaping, to name a few. For a more detailed list, check out the earlier sections of this post.

Are there any limitations on bonus depreciation?

While bonus depreciation offers great benefits, it only applies to new properties or those new to you as the property manager. It does not apply to properties you have already owned and used. Stay informed about any changes to tax laws that might affect this.

How do I claim bonus depreciation on my taxes?

To claim bonus depreciation, fill out Form 4562 when filing your tax return. Make sure to keep thorough records of all property purchases and improvements to support your claims. Always double-check the latest IRS guidelines or consult with a tax professional.

Can I combine bonus depreciation with other tax benefits?

Yes, property managers can combine bonus depreciation with other tax benefits such as Section 179 expensing. However, it’s important to understand the specific rules and limitations of each to maximize your tax benefits effectively.

Is bonus depreciation available every year?

The availability and percentage rates for bonus depreciation can change based on tax laws. Under the bonus depreciation rule, you can take an additional deduction of 100% of the cost of eligible assets in the first year of ownership.