Filing taxes is always top of mind at the beginning of the year, but even after April has come and gone, the money you and your owners can save through deductions should always be on your radar.

No-Fuss Financials

Automated bookkeeping to simplify accounting a grow your business.

Learn MoreSmall changes to your tax filing strategy can actually lead to significant cost savings in just a short period of time. Knowing about the right deductions (and the right tools to report them easily) can help you keep money in your pocket (and save you hours of time).

Bonus depreciation is one such deduction that can reduce your tax burden significantly and immediately, rather than giving you smaller benefits over time.

Let’s take a look at what bonus depreciation actually means for property managers, what qualifies for a deduction, and the easiest way to start saving.

Disclaimer: Always speak with a CPA or other qualified accounting professional for the most accurate advice for your specific business and location.

What Is Depreciation in Real Estate?

Real estate depreciation is a tax deduction that allows property owners to write off the cost of rental properties over their “useful life” (27.5 years for residential rentals). This happens because the IRS recognizes that properties lose value over time due to wear and tear, along with other factors.

Property owners can get even more benefit through cost segregation. A certified specialist identifies different property elements and provides accelerated depreciation timelines.

Key property elements for cost segregation:

- Roofing systems

- Windows and doors

- Flooring and carpeting

- HVAC components

How does this benefit you as a property manager? That’s where bonus depreciation kicks in.

What Is Real Estate Bonus Depreciation?

Bonus depreciation is an IRS tax code that allows you to depreciate the value of certain assets that make up a rental property more quickly than normal. Instead of getting a tax write off over the useful life of a property, you’ll be able to get a larger deduction in the first year the asset was placed in service.

By depreciating the cost of eligible assets up front, you can free up cash flow, reduce the tax liability for your business, and possibly even qualify for a lower tax bracket.

Here’s how it works: When you purchase a new piece of property or make improvements to existing property, you can depreciate the cost over a period of time. Under the bonus depreciation rule, you can take an additional deduction of 100% of the cost of eligible assets in the first year of ownership. That can result in significant tax savings.

You can even use bonus depreciation to create a net operating loss, which you can carry forward to offset future income.

Recent Updates and Current Rates for Bonus Depreciation

The Tax Cuts and Jobs Act of 2017 initially offered 100% bonus depreciation from 2018 through 2022, but this rate began phasing down by 20 percentage points each year. For property placed in service in 2023, the rate was 80%, dropping to 60% in 2024 and 40% in 2025.

However, the One Big Beautiful Bill Act, signed into law in May 2025, has restored 100% bonus depreciation retroactively for property placed in service after December 31, 2024, and extends this full deduction through December 31, 2029. This means property managers can once again take advantage of the full first-year deduction for eligible assets.

Always check the latest IRS guidelines for the most current information and consult with your tax professional to maximize these benefits.

What Property Managers Should Know About Bonus Depreciation

Before jumping into the specifics of how to file for deductions using bonus depreciation, you should know which assets qualify and the limitations around certain asset times.

Here are the types of purchases and improvements eligible for bonus depreciation that both property owners and property managers should know.

Qualified Property for Bonus Depreciation

Property that qualifies for bonus depreciation must have a useful life of between one and 20 years.

But wait, we just said that residential rental property has a useful life of 27.5 years.

A residential rental property itself does not qualify. But there are several other asset types that you can claim bonus depreciation on. These fall into two main categories: personal property and land improvements.

Personal Property and Bonus Depreciation

You can deduct any tangible property that you’ve purchased for business use, including use within a rental property. This can include both new and newly acquired used property, so long as the owner hasn’t personally used the item before placing it in the rental.

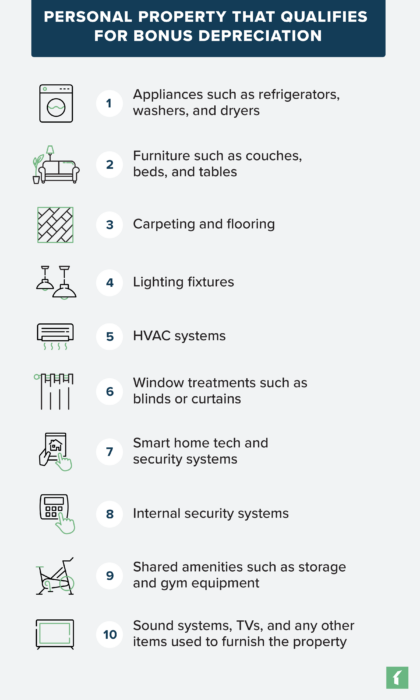

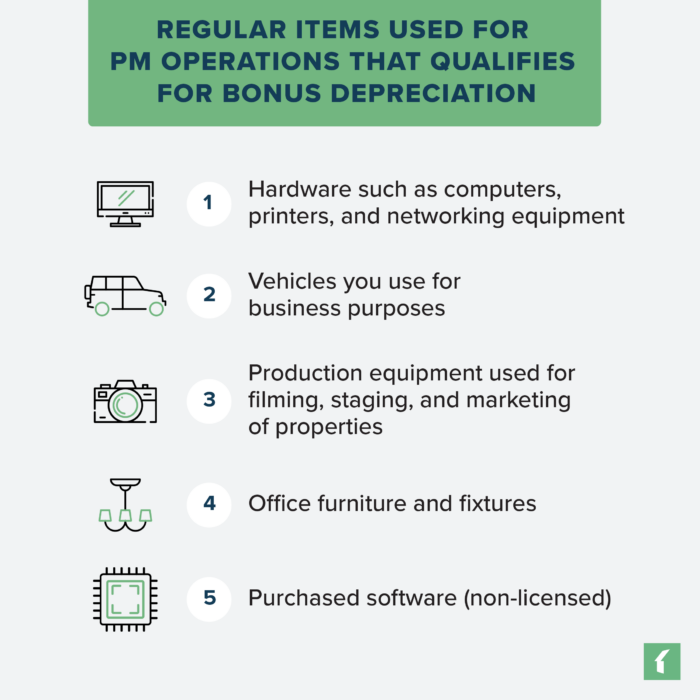

The list of personal property that qualifies for bonus depreciation is extensive, but some of the most common items include:

Items you use for your regular property management operations also qualify for bonus depreciation. Here are some examples:

Land Improvements and Bonus Depreciation

This is where things get a little tricky. While the land a property sits on does not qualify for standard depreciation under tax law, land improvements that have a 15-year useful life (a.k.a a recovery period) do qualify for bonus depreciation. These can include upgrades or work done to the following outdoor assets:

Rental Property Bonus Depreciation vs. Section 179

Many investors are unclear about the differences between bonus depreciation and Section 179 of the Internal Revenue Code (IRC).

While both types of incentives allow you to take upfront deductions on the purchase price of equipment, bonus depreciation has fewer limitations. Most importantly, there is no limit to the annual profit of a business to qualify for bonus depreciation—as opposed to Section 179—so you can still claim a deduction and carry it forward, even if you’re recording a net loss for that year.

The main benefit of Section 179 over bonus depreciation is that it offers greater flexibility. You can pick and choose which assets and how much of the cost of each asset you’d like to cover, saving the rest for future tax breaks. But keep in mind that the maximum deduction under Section 179 is $1,220,000 as of the 2025 tax year, with a phase-out threshold beginning at $3,050,000 in equipment purchases.

Neither option is a one-size-fits all solution, and you can actually combine bonus depreciation with Section 179. Under the One Big Beautiful Bill Act (OBBBA), signed into law in May 2025, you can now maximize your tax benefits by first applying Section 179 to select assets and coverage amounts you want, then using the restored 100% bonus depreciation for any remaining eligible costs. Any deduction amount over the Section 179 limit is then eligible to be received through bonus depreciation, giving you powerful flexibility in managing your tax strategy.

How to Calculate Bonus Depreciation

As outlined in the One Big Beautiful Bill Act, 100% bonus depreciation has been restored retroactively for property placed in service after December 31, 2024, and extends this full deduction through December 31, 2029. This makes calculating bonus depreciation easier than in the past and means you can once again take advantage of the full first-year deduction for eligible assets.

The first step is surveying your rental property for eligible assets. Only a certified professional can conduct the necessary cost segregation survey.

Why the upfront cost pays off:

- Larger portfolios: Savings multiply across multiple properties

- Multifamily properties: More assets typically qualify for depreciation

- Tax bracket benefits: Can lower your overall tax burden significantly

The benefits of tax savings from entering a lower tax bracket or carrying forward deductions in the event of a net operating loss are hard to overstate.

Electing Out of Bonus Depreciation

To opt out of bonus depreciation, you must file an election statement. Here’s the process:

- Timing: Attach statement to your timely filed return

- Separate statements: Required for each asset class (5-year, 7-year, etc.)

- Required info: Election type, useful life period, and asset class

Here’s an example statement:

“Taxpayer hereby elects out of bonus for tax year 2025 for its 10-year and 15-year asset classes.”

Electing out late or attempting to revoke an election you’ve made can be a time-consuming process with additional forms involved and without any guarantee of success. Be accurate and sure of your decision before making the choice to elect out.

Is There Bonus Depreciation Software That Can Help?

At this point, you might be looking for ways to minimize your effort while still getting all the benefits of bonus depreciation. There isn’t software that can directly calculate bonus depreciation for rental properties (you’ll need to go through a certified professional for that), but there are easy-to-use tools that can simplify your entire property management accounting process.

The best part? Tools may already be at your disposal if you’re using property management software for the rest of your operations.

Buildium, for example, comes equipped with a whole suite of accounting tools and tax prep features that automate accounting and help you reconcile your books with pinpoint accuracy.

Buildium’s accounting features integrate with online rent payments and reporting within its all-in-one platform, which also includes built-in messaging tools, saving you even more time. This means you’ll be able to create and share reports in just a few clicks, using numbers you can trust.

Maximizing Your Tax Savings Through Bonus Depreciation

Understanding bonus depreciation gives you another powerful tool to manage your business’s finances and improve cash flow. By strategically applying these deductions, you can make a real impact on your bottom line. And with the right accounting software, tracking these assets and preparing for tax time becomes much simpler.

Key takeaways:

- 100% bonus depreciation is back: The One Big Beautiful Bill Act restored full first-year deductions for eligible property placed in service after December 31, 2024, through 2029.

- Personal property and land improvements qualify: From appliances and furniture to parking lots and fencing, numerous assets can accelerate your tax savings.

- Combine strategies for maximum benefit: Use Section 179 alongside bonus depreciation to optimize your deductions and manage cash flow effectively.

- Professional guidance is essential: Work with certified specialists for cost segregation surveys and consult tax professionals to ensure you’re maximizing available benefits.

- The right tools simplify the process: Property management software with integrated accounting features can streamline tracking and reporting, making tax preparation far less stressful.

Want to see how Buildium can streamline your financial management? You can schedule a guided demo to explore all the features with an expert, or start your free trial today to see how our accounting tools can help organize your financial data and make tax season easier.

Frequently Asked Questions About Bonus Depreciation

Is 100% Bonus Depreciation Coming Back?

Yes. The One Big Beautiful Bill Act (OBBBA), signed into law in May 2025, has restored 100% bonus depreciation retroactively for property placed in service after December 31, 2024, and extends this full deduction through December 31, 2029. This means property managers can once again take advantage of the full first-year deduction for eligible assets. Always consult with your tax professional to ensure you’re maximizing these benefits for your specific situation.

What Are the Main Downsides of Using Bonus Depreciation?

The primary downside is that you lose future depreciation deductions for the same asset, which could hurt you in lower-income years when those deductions might be more valuable. Additionally, taking large upfront deductions may trigger recapture taxes if you sell the property before the end of its useful life. It’s important to consider your long-term tax strategy before maximizing bonus depreciation.

Can I Use Bonus Depreciation on Used Equipment?

Yes, you can use bonus depreciation on used equipment, as long as the property is new to your business and wasn’t previously owned by you. The key requirement is that it must be your first time placing that specific asset into service. This flexibility allows property managers to take advantage of bonus depreciation even when purchasing pre-owned items.

Does Bonus Depreciation Apply to State Taxes?

Not always—many states “decouple” from federal bonus depreciation rules and have their own depreciation schedules. This means you may need to make adjustments on your state tax return even if you claim bonus depreciation federally. Always check your specific state’s tax laws and consult with a tax professional to understand how bonus depreciation impacts your state tax liability.

Read more on Accounting & Reporting