Texas Rental Market Trends in 2026

With its robust economic growth, diverse population, and thriving job market, the state of Texas has attracted countless new residents and businesses in recent years. In fact, Texas has gained the most new residents of any state since 2000, with 9 million additional people calling Texas home in 2022, according to the Census Bureau. That’s out of a total of 30.5 million residents spread across more than 1,200 municipalities, making Texas the second-most-populous state in the U.S. What’s driving this growth is Texas’ business-friendly reputation and strong job creation across sectors like technology, healthcare, and energy.

This influx of new residents fuels demand for rental properties; and as a result, tens of thousands of rental units were constructed in cities like Austin, Dallas, and Houston over the last several years. Due to this flood of new construction, rent growth and occupancy rates floundered in these big-name cities. But as of 2026, the tide is gradually turning: Supply growth is slowing considerably, giving these markets time to absorb excess inventory. While challenges remain, the slowdown in development combined with continued job and population growth could indicate that these cities are beginning to enter a recovery phase. Meanwhile, smaller markets throughout Texas avoided these oversupply challenges and continue to offer steady rent growth and attractive investment fundamentals.

This post will dig into 5 up-and-coming real estate markets where the data suggests there’s an opportunity for rental investors and property managers who are looking to expand into or within Texas in 2026. To help you assess the opportunity, we’ll share rental market statistics for each city, including inventory growth, rent growth, vacancy rates, cap rates, and home value appreciation; plus, figures that point to economic and demographic trends in each market.

Top 5 Rental Markets in Texas for 2026

Without further ado, here are 5 Texas rental markets where growth opportunities lie in 2026.

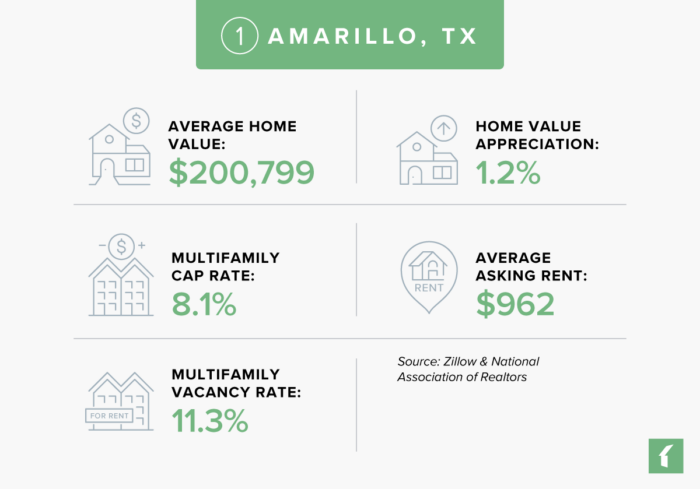

Market #1: Amarillo, Texas

Located in the Texas panhandle, the Amarillo, Texas metro area is home to 273,100 people, making it the sixteenth-largest city in the state. The area is known for meat-packing and agriculture, with Tyson Foods being the area’s largest employer, followed by the Amarillo Independent School District. Amarillo College is located here, as well as several university branch locations.

Amarillo ranked in position #37 on Buildium’s up-and-coming markets list this year due to its strong cap rates and moderate rent growth. The city has seen less construction in comparison with larger Texas metros, so although vacancy remains elevated, potential tightening may be ahead. Amarillo’s home prices are also more affordable than cities like Austin and Houston for investors looking to expand into a new locale in 2026.

Amarillo, Texas Rental Market Statistics

- Rental Inventory (Q3-’25): 15,616

- Units Added Since Q3’24: +0

- Asking Rent Growth Since Q3’24: 3.4%

- Asking Rent (Q3-’25): $962

- Effective Rent (Q3-’25): $954

- Multifamily Vacancy Rate (Q3-’25): 11.3%

- Multifamily Cap Rate (Q3-’25): 8.1%

Source: National Association of Realtors

Amarillo, Texas Housing Market Statistics

- Average Home Value (Q4’25): $200,799

- Home Value Appreciation Since Q4-’24: 1.2%

Source: Zillow

Amarillo, Texas Economic Statistics

- Population Growth (2025): 1.9%

- GDP Growth (2023): 3.9%

- Job Growth (Q3-’25): 0.8%

Source: National Association of Realtors

Lists That Mention Amarillo, Texas

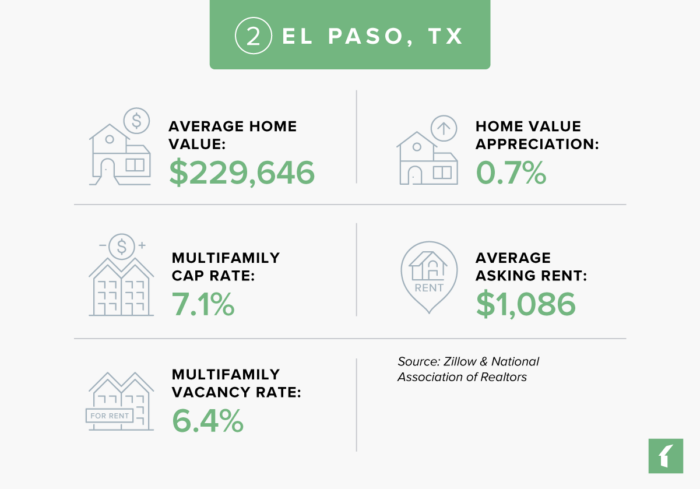

Market #2: El Paso, Texas

872,063 people reside in the El Paso, Texas metro area, which is located along the United States-Mexico border. More than 70 Fortune 500 companies are located in El Paso, including Boeing and Hoover; though the metro’s leading employer is Fort Bliss, bringing a large military presence to the city. The University of Texas also has a satellite location in El Paso.

Though El Paso is the sixth-most-populous city in Texas, it’s had comparatively few rental units added over the last several years. As a result, its moderately strong vacancy rates and rent growth in comparison with other Texas cities caused it to rank in position #49 on Buildium’s list of up-and-coming markets this year. El Paso cap rates are also stronger than in larger cities like Austin and Houston while homes remain more affordable, lending this metro some investor appeal.

El Paso, Texas Rental Market Statistics

- Rental Inventory (Q3-’25): 47,341

- Units Added Since Q3-’24: +276

- Asking Rent Growth Since Q3-’24: 1.1%

- Asking Rent (Q3-’25): $1,086

- Effective Rent (Q3-’25): $1,078

- Multifamily Vacancy Rate (Q3-’25): 6.4%

- Multifamily Cap Rate (Q3-’25): 7.1%

Source: National Association of Realtors

El Paso, Texas Housing Market Statistics

- Average Home Value (Q4-’25): $229,646

- Home Value Appreciation Since Q4-’24: 0.7%

Source: Zillow

El Paso, Texas Economic Statistics

- Population Growth (2025): 0.7%

- GDP Growth (2023): 6.1%

- Job Growth (Q3-’25): 1.0%

Source: National Association of Realtors

Lists That Mention El Paso, Texas

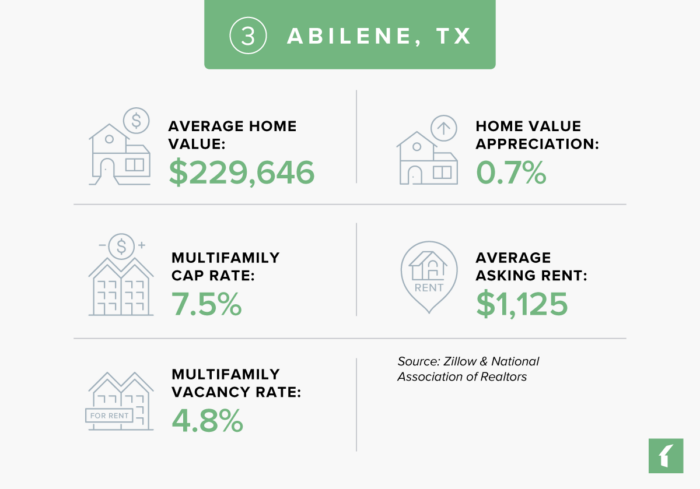

Market #3: Abilene, Texas

The Abilene, Texas metro area is home to 180,224 residents and is located close to the center of the state, about 150 miles from both Fort Worth and Midland. Major employers in Abilene include Dyess Air Force Base, Hendrick Health System, and Abilene Independent School District. There are also three universities located here: Abilene Christian University, McMurry University, and Hardin-Simmons University.

Abilene first appeared on Buildium’s up-and-coming markets list in 2024 due to its strong rent growth compared to larger Texas markets—a trend that continued in 2025, causing it to rank in spot #52. What’s helped Abilene achieve this kind of growth is the lack of apartment construction occurring here in comparison with other Texas metros. Also catching investors’ eye are the city’s appealing cap rates and relatively affordable home prices.

Abilene, Texas Rental Market Statistics

- Rental Inventory (Q3-’25): 8,755

- Units Added Since Q3-’24: +0

- Asking Rent Growth Since Q3-’24: 11.3%

- Asking Rent (Q3-’25): $1,125

- Effective Rent (Q3-’25): $1,120

- Multifamily Vacancy Rate (Q3-’25): 4.8%

- Multifamily Cap Rate (Q3-’25): 7.5%

Source: National Association of Realtors

Abilene, Texas Housing Market Statistics

- Average Home Value (Q4-’25): $229,646

- Home Value Appreciation Since Q4-’24: 0.7%

Source: Zillow

Abilene, Texas Economic Statistics

- Population Growth (2025): 1.0%

- GDP Growth (2023): 3.3%

- Job Growth (Q3-’25): 1.4%

Source: National Association of Realtors

Lists That Mention Abilene, Texas

- Best Places to Live (U.S. News): #120

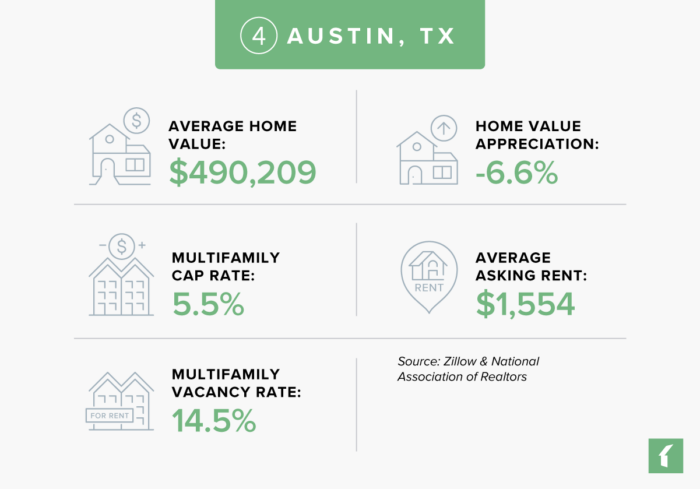

Market #4: Austin, Texas

Austin is often recognized as Texas’ technology hub and cultural capital, with 2,473,275 residents living in its metro area. Known for its vibrant music scene, outdoorsy lifestyle, and the presence of strong educational institutions like the University of Texas, Austin attracts young professionals, families, and businesses alike. Its reputation as a center for innovation has drawn major employers across the technology and healthcare sectors, including well-known companies like Amazon, Apple, Dell, and Tesla, fueling steady population, employment, and GDP growth.

This year, Austin ranked #55 on Buildium’s list of up-and-coming markets—the first time that it’s made an appearance since 2022. That’s because the local housing market saw an aggressive influx of new construction, causing rents to soften and vacancy rates to rise. Now, however, with the market having had some time to absorb this inventory—and with population growth in Austin remaining strong—investors are beginning to envision long-term opportunity here once again.

Austin, Texas Rental Market Statistics

- Rental Inventory (Q3-’25): 331,158

- Units Added Since Q3-’24: +3,822

- Asking Rent Growth Since Q3-’24: -4.3%

- Asking Rent (Q3-’25): $1,554

- Effective Rent (Q3-’25): $1,518

- Multifamily Vacancy Rate (Q3-’25): 14.5%

- Multifamily Cap Rate (Q3-’25): 5.5%

Source: National Association of Realtors

Austin, Texas Housing Market Statistics

- Average Home Value (Q4-’25): $490,209

- Home Value Appreciation Since Q4-’24: -6.6%

Source: Zillow

Austin, Texas Economic Statistics

- Population Growth (2025): 3.1%

- GDP Growth (2023): 4.5%

- Job Growth (Q3-’25): 0.9%

Source: National Association of Realtors

Lists That Mention Austin, Texas

- Markets to Watch (PwC/ULI): #30

- Best Real Estate Markets (WalletHub): #18

- Best Places to Live (U.S. News): #164

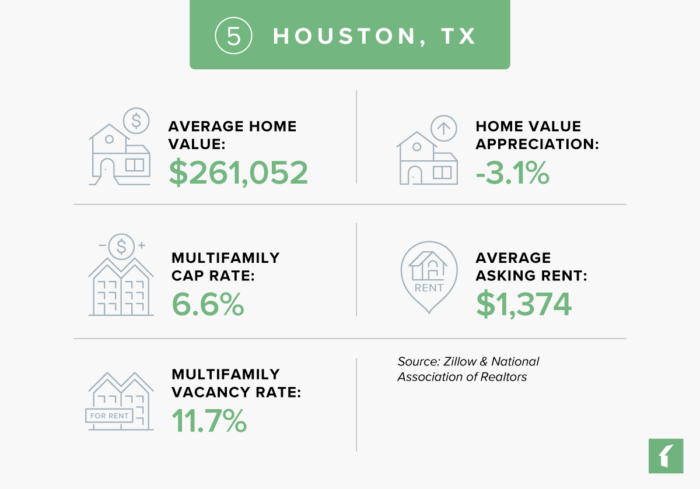

Market #5: Houston, Texas

Houston is known as the energy capital of the U.S., home to a diverse economy that spans oil and gas, healthcare, aerospace, and manufacturing. The metro area has 7,510,252 residents. Its affordability compared to many other major metros, combined with leading medical facilities and a thriving cultural scene, make Houston appealing to new residents. The metro’s population continues to grow at a steady clip, supported by job creation and economic expansion, and signaling ongoing demand for housing.

While vacancy rates are elevated and rents have dipped slightly, causing Houston to just miss Buildium’s list of up-and-coming markets for 2026, the slowdown in new construction is setting the stage for recovery. Strong demographic trends and healthy investment fundamentals make Houston an attractive market for those seeking long-term gains as supply and demand rebalance.

Houston, Texas Rental Market Statistics

- Rental Inventory (Q3-’25): 735,980

- Units Added Since Q3-’24: +4,790

- Asking Rent Growth Since Q3-’24: -0.6%

- Asking Rent (Q3-’25): $1,374

- Effective Rent (Q3-’25): $1,355

- Multifamily Vacancy Rate (Q3-’25): 11.7%

- Multifamily Cap Rate (Q3-’25): 6.6%

Source: National Association of Realtors

Houston, Texas Housing Market Statistics

- Average Home Value (Q4-’25): $261,052

- Home Value Appreciation Since Q4-’24: -3.1%

Source: Zillow

Houston, Texas Economic Statistics

- Population Growth (2025): 3.8%

- GDP Growth (2023): 5.4%

- Job Growth (Q3-’25): 0.7%

Source: National Association of Realtors

Lists That Mention Houston, Texas

How Do We Identify the Best Rental Markets in Texas?

We use the following sources to help us ascertain the best rental markets in the U.S. across five different categories.

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home value appreciation, as measured by Zillow

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the U.S. Census Bureau

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News

Climate Indicators

Measures of climate vulnerability:

- Markets with the lowest risk of natural disasters and extreme conditions, as measured by the Federal Emergency Management Agency

60 Up-and-Coming Real Estate Markets in 2026

In Buildium’s annual Up-and-Coming Real Estate Markets list, we analyzed 175 metro areas across the U.S. to determine which cities show promise for rental investors and property managers in the year ahead. View the full list of emerging markets we’ve identified across the country.

Read more on Industry Research