Massachusetts Rental Market Trends in 2025

Though Massachusetts may be small in size, the state is known for its outsized historical, economic, and scientific contributions to the U.S. As the birthplace of the American Revolution, Massachusetts has been a center of innovation since the country’s early days. The state’s diverse economy, driven by sectors such as education, healthcare, technology, and finance, drives steady demand for rental properties.

Property prices in Massachusetts can be steep, so it’s important to know that you’re selecting the right property in the right location before expanding your business in the state. This post will guide you through evaluating 5 up-and-coming real estate markets in Massachusetts. We’ll share rental market statistics for each city, including inventory growth, rent growth, vacancy rates, cap rates, and property price appreciation. We’ll also highlight economic and demographic trends in each market.

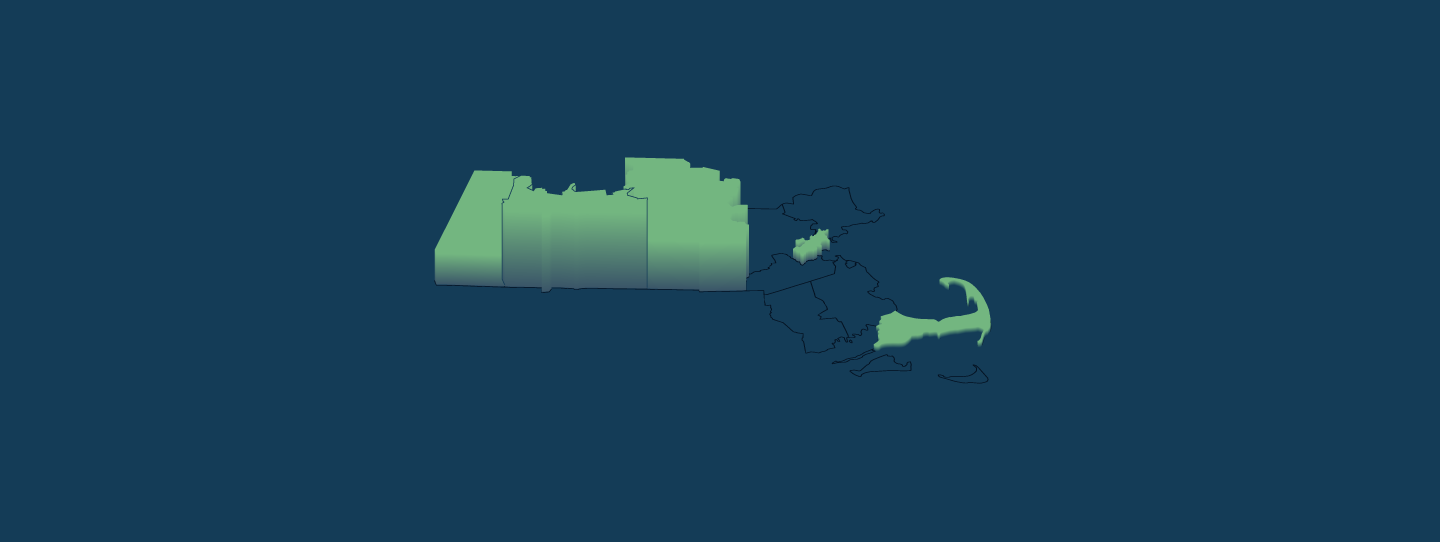

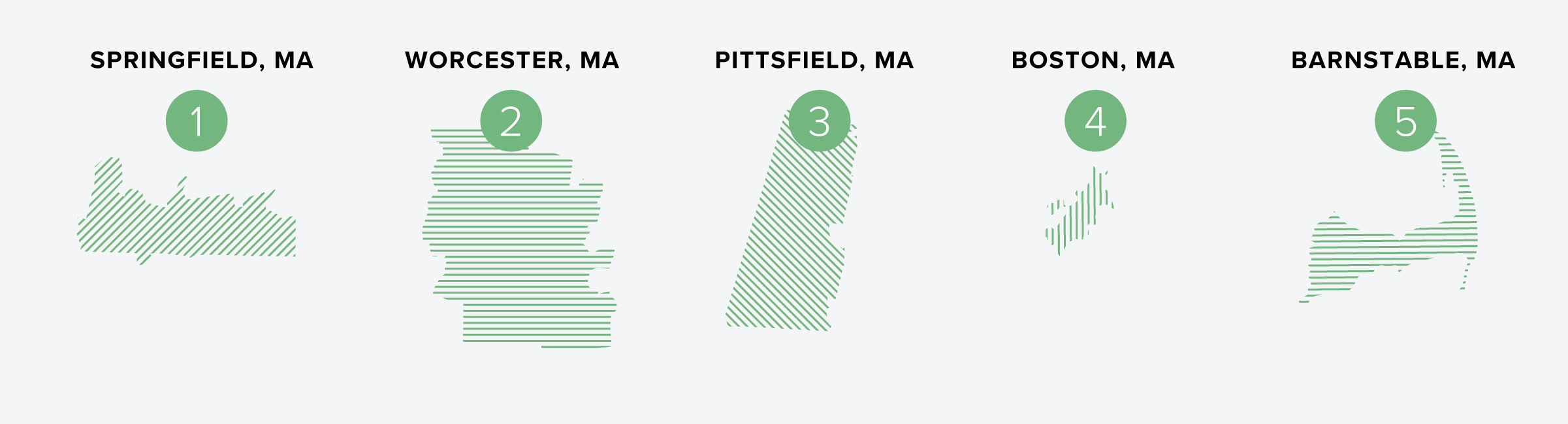

Top 5 Rental Markets in Massachusetts for 2025

Without further ado, here are 5 Massachusetts rental markets where our research indicates growth opportunities lie in 2025.

Market #1: Springfield, MA

Springfield is the third-most populous city in Massachusetts and the largest in Western New England, with 460,291 residents living in its metro area. Its position along major transportation routes like the Massachusetts Turnpike and Interstate 91 makes this city a smart choice for commuters as well as logistics businesses. Springfield is located about an hour and a half west of Boston, MA and half an hour north of Hartford, CT.

The area between Hartford and Springfield has been referred to as the Knowledge Corridor due to the concentration of universities and businesses located in the region. There are more than 30 higher education institutions located there, including the University of Massachusetts Amherst and the University of Connecticut, as well as 17 preparatory schools. Many companies are based in the region as well, including Fortune 500 companies like Aetna, Cigna, and MassMutual, with healthcare and insurance being two leading sectors in the area. MassMutual, in addition to Baystate Health, Smith & Wesson, Merriam-Webster, and multiple other businesses, is headquartered in Springfield itself.

There are a number of cultural attractions that draw people to Springfield: The Basketball Hall of Fame, the Springfield Armory National Historical Site, MGM Springfield, and Six Flags New England, among others. There’s an area known as the Quadrangle where 5 museums are located, including the Museum of Fine Arts, the Amazing World of Dr. Seuss Museum, and the Springfield Science Museum. Forest Park is an appealing destination for those who like to spend time outdoors, with over 700 acres of walking trails and gardens, as well as a zoo. A diverse range of festivals and parades are also held in the city each year, including the Pioneer Valley Jewish Film Festival and the Hoop City Jazz Festival.

Springfield offers relatively affordable housing in comparison with other Massachusetts cities, with rental demand being driven by the preponderance of companies and schools located in its metro area. It is worth noting, however, that Springfield’s population has decreased since its peak in the 1960s, as the decline of the manufacturing industry led to job losses and economic instability in the second half of the twentieth century. Today, Springfield still struggles with a relatively high poverty rate and a higher unemployment rate than the national average. But the city is undergoing revitalization projects to improve its infrastructure, housing, and community amenities, which could lead to improved living conditions for residents and increased property values for rental owners.

Springfield ranked high on Buildium’s list of up-and-coming real estate markets in 2025 in position #11. This high score was due to the city’s strong rent growth, home price appreciation, cap rates, and vacancy rates over the last two years. Springfield also ranked in the top 30 on the Wall Street Journal and Realtor.com’s list of emerging housing markets in all four quarters of 2024. If you or your owner clients are looking for a more affordable market in which to expand in Massachusetts in 2025, you may want to consider adding Springfield to your list.

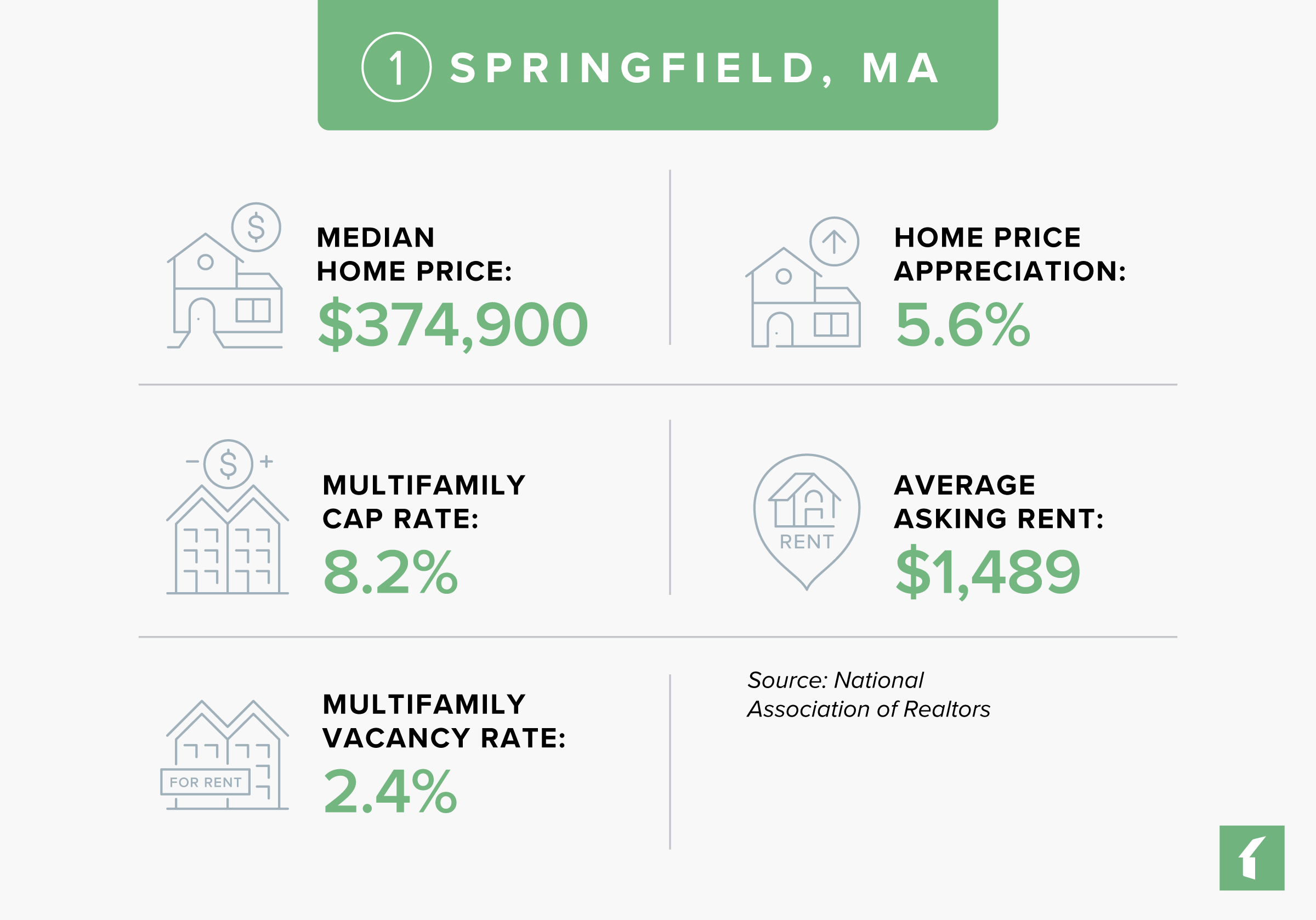

Springfield, Massachusetts Rental Market Statistics

- Rental Inventory (Q3-’24): 23,932

- Units Added Since Q3-’23: +22

- Asking Rent Growth Since Q3-’23: 4.6%

- Asking Rent (Q3-’24): $1,489

- Effective Rent (Q3-’24): $1,484

- Multifamily Vacancy Rate (Q3-’24): 2.4%

- Multifamily Cap Rate (Q3-’24): 8.2%

Source: National Association of Realtors

Springfield, Massachusetts Housing Market Statistics

- Median Home Price (Q3-’24): $374,900

- Home Price Appreciation Since Q3-’23: 5.6%

Source: National Association of Realtors

Springfield, Massachusetts Economic Statistics

- Population Growth (2023): Unavailable

- GDP Growth (2023): 5.8%

- Job Growth (Q3-’24): 0.6%

Source: National Association of Realtors

Lists That Mention Springfield, Massachusetts

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #41

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #11

- Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #20

- Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #6

- Best Real Estate Markets – Mid-Sized Cities (WalletHub): #89

- Best Places to Live (U.S. News): #138

Market #2: Worcester, MA

With 866,866 residents living in its metro area, Worcester is the second-most populous city in Massachusetts. It’s located in the center of the state about an hour west of Boston, with some Worcester residents commuting to Boston for work, and is connected to surrounding communities by interstates such as 90, 190, 290, and 495.

Historically, Worcester functioned as a manufacturing hub for New England. However, the city lost a significant percentage of its population between 1950 and 1980 as the economy began to deindustrialize, and as the suburbs drew residents away from the city. But Worcester’s focus on economic growth, housing development, and quality of life improvements over the last few decades have resulted in a resurgence in population. In particular, the affordability of housing in comparison with Boston has attracted residents to the city.

Toward the end of the twentieth century, Worcester’s economy began to diversify from manufacturing into biotechnology, healthcare, and education. Today, top employers in the city include UMass Memorial Health Care, Reliant Medical Group, and Saint Vincent Hospital. There are also a number of higher education institutions located in Worcester, including UMass Medical School, Worcester Polytechnic Institute, the College of the Holy Cross, Clark University, and Worcester State University.

Worcester has a vibrant culture, with residents enjoying a great food scene as well as attractions like the Worcester Art Museum, Hanover Theatre for the Performing Arts, Worcester Historical Museum, the EcoTarium, Salisbury Mansion, and ArtsWorcester. Though the city has snowy winters, there are plenty of outdoor activities for residents to enjoy during the warmer months, such as Broad Meadow Brook Conservation Center & Wildlife Sanctuary, Green Hill Park, Elm Park, Institute Park, Salisbury Park and Bancroft Tower, and Cascading Waters.

Worcester ranked in position #15 on Buildium’s list of up-and-coming real estate markets in 2025 due to its strong economy as well as its healthy rent growth, vacancy rates, cap rates, and home price appreciation over the last two years. Worcester also appeared in the top 40 on the Wall Street Journal and Realtor.com’s rankings of emerging housing markets in the U.S. in 2024. Rental property owners and property managers interested in getting their foot in the door in Massachusetts will find plenty of opportunities in Worcester.

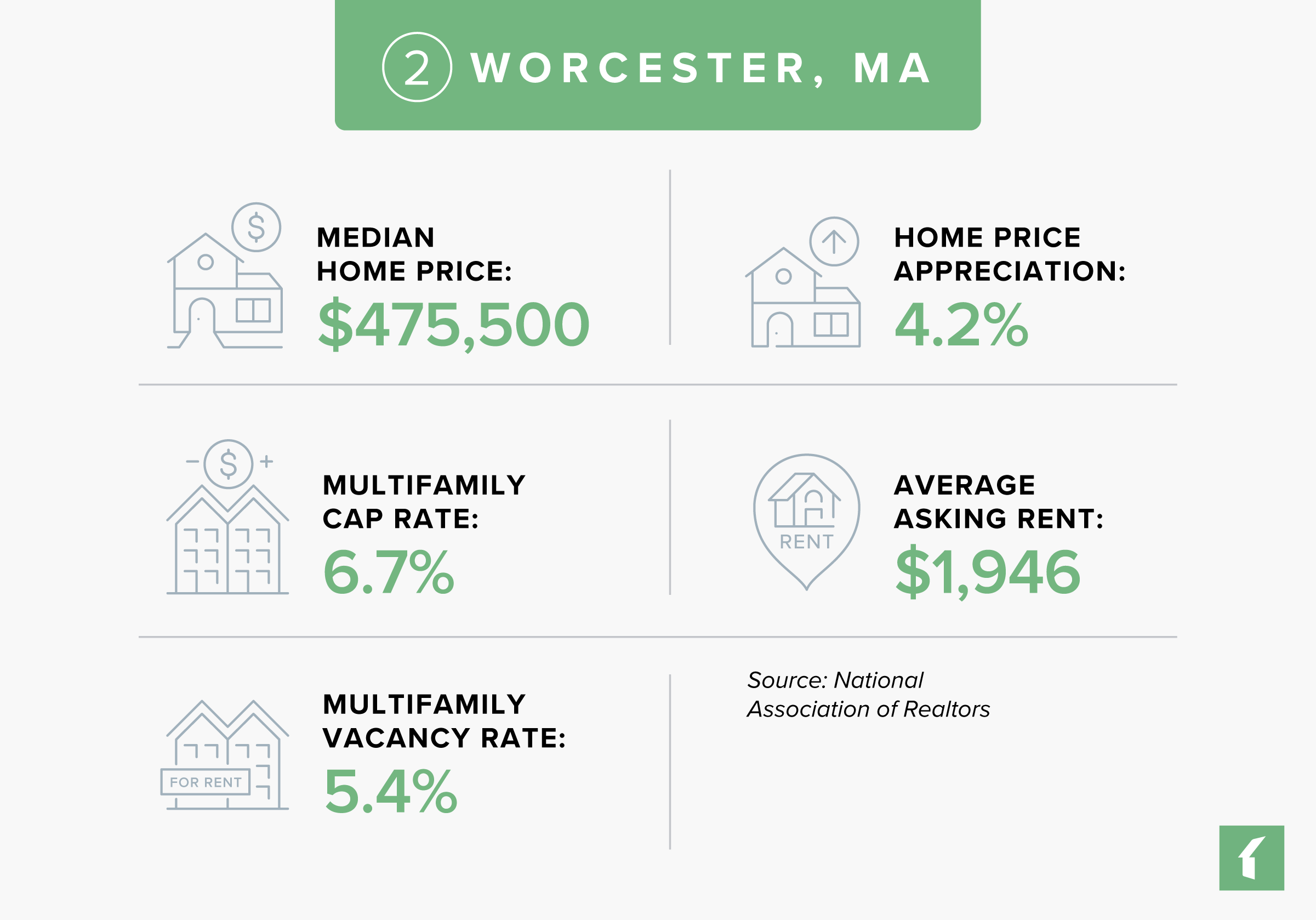

Worcester, Massachusetts Rental Market Statistics

- Rental Inventory (Q3-’24): 32,333

- Units Added Since Q3-’23: 383

- Asking Rent Growth Since Q3-’23: 2.7%

- Asking Rent (Q3-’24): $1,946

- Effective Rent (Q3-’24): $1,932

- Multifamily Vacancy Rate (Q3-’24): 5.4%

- Multifamily Cap Rate (Q3-’24): 6.7%

Source: National Association of Realtors

Worcester, Massachusetts Housing Market Statistics

- Median Home Price (Q3-’24): $475,500

- Home Price Appreciation Since Q3-’23: 4.2%

Source: National Association of Realtors

Worcester, Massachusetts Economic Statistics

- Population Growth (2023): Unavailable

- GDP Growth (2023): 5.3%

- Job Growth (Q3-’24): 1.5%

Source: National Association of Realtors

Lists That Mention Worcester, Massachusetts

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #27

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #14

- Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #17

- Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #8

- Best Real Estate Markets – Mid-Sized Cities (WalletHub): #58

- Best Places to Live (U.S. News): #136

Market #3: Pittsfield, MA

Pittsfield is located close to Massachusetts’ border with New York, 100 miles west of Worcester. It’s considered the hub of the Berkshires, with 126,818 residents living in the Pittsfield metro area.

Pittsfield was originally an agricultural city due to its location along the Housatonic River, its landscape dotted with mills producing lumber, grist, paper, and textiles. In the late 19th century, the Electric Manufacturing Company was relocated to Pittsfield from Great Barrington—the company that would later become General Electric. GE’s success brought tens of thousands of residents to Pittsfield. However, many of these residents later left the area when two of the company’s divisions were relocated.

Today, many of the properties formerly occupied by GE are home to the defense contractor General Dynamics, a major (and growing) source of employment in Pittsfield. Other leading employers include Berkshire Health Systems, Berkshire Bank, and Berkshire Insurance Group, with the city’s economy now centered around healthcare, education, and tourism. Berkshire Community College is located in Pittsfield as well.

Pittsfield’s residents enjoy a number of cultural attractions, including the Berkshire Museum, Colonial Theatre, and Barrington Stage Company. The Upstreet cultural district is home to many galleries, open studios, and public art, and also hosts annual events like the Pittsfield CityJazz Festival. During the warmer months, residents and visitors are drawn to the Berkshire Mountains as well as Pittsfield State Forest for hiking and other recreational activities. The Hancock Shaker Village, a living history museum with 20 historic buildings and extensive gardens, hosts workshops, concerts, and seasonal events.

Pittsfield made it into position #53 on Buildium’s list of up-and-coming real estate markets in 2025. Investors and property managers should be aware that Pittsfield’s population has been decreasing since 1970, though its rate of decline has slowed in recent years. One of Pittsfield’s primary challenges has been the loss of manufacturing plants that left environmental issues in their wake. Aging infrastructure and properties are also a concern. However, with its healthy cap rates, rent growth, and vacancy rates over the last two years, the right property in Pittsfield could make a smart investment in 2025, particularly considering the low cost of entry in comparison with the rest of Massachusetts.

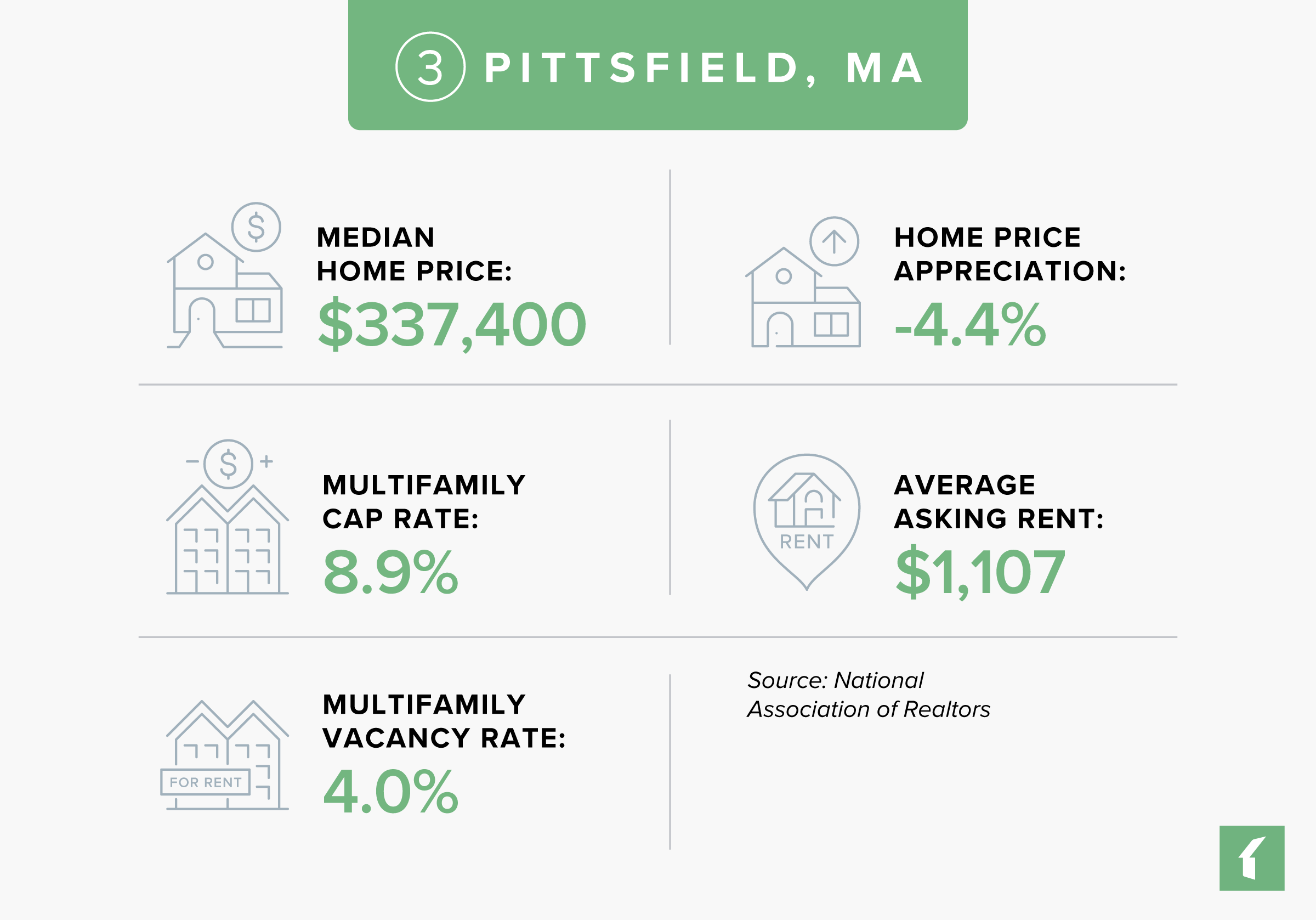

Pittsfield, Massachusetts Rental Market Statistics

- Rental Inventory (Q3-’24): 2,137

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 2.9%

- Asking Rent (Q3-’24): $1,107

- Effective Rent (Q3-’24): $1,102

- Multifamily Vacancy Rate (Q3-’24): 4.0%

- Multifamily Cap Rate (Q3-’24): 8.9%

Source: National Association of Realtors

Pittsfield, Massachusetts Housing Market Statistics

- Median Home Price (Q3-’24): $337,400

- Home Price Appreciation Since Q3-’23: -4.4%

Source: National Association of Realtors

Pittsfield, Massachusetts Economic Statistics

- Population Growth (2023): -0.8%

- GDP Growth (2023): 7.0%

- Job Growth (Q3-’24): 1.5%

Source: National Association of Realtors

Lists That Mention Pittsfield, Massachusetts

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #111

- Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #20

- Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #6

Market #4: Boston, MA

As the most populous city in Massachusetts, Boston’s metro area is home to 4,919,179 people. Boston is also the state’s capital and the economic and cultural hub of the New England region.

Founded in 1630, Boston is a city rich with history and culture. Residents and tourists alike enjoy visiting the Museum of Fine Arts, the New England Aquarium, Boston Public Library, and the Isabella Stewart Gardner Museum. Many visitors to the city choose to walk the Freedom Trail, which connects 16 historically significant sites like Old North Church and Paul Revere’s house, and can also learn about early American history at the Boston Tea Party Ships & Museum. There are a variety of musical and theatrical venues in Boston, including Symphony Hall, the Boston Opera House, and the Boch Center; as well as sports venues like Fenway Park. Bostonians can spend some time outside at the Charles River Esplanade or the Emerald Necklace, a series of parks that include Boston Common and the Public Garden.

Boston has a robust and diverse economy that’s evolved across the centuries—from a colonial trading hub to an industrial powerhouse, and now to a global center of healthcare, education, finance, and technology. Medical centers like Brigham and Women’s Hospital, Dana Farber Cancer Institute, and Massachusetts General Hospital represent the city’s top employers. Greater Boston houses a number of Fortune 500 companies, including General Electric, State Street, and Liberty Mutual. Many of the nation’s leading universities are also located in or near the city, including Harvard University, the Massachusetts Institute of Technology, and Tufts University.

Though Boston isn’t an under-the-radar market like many of those on Buildium’s list of up-and-coming real estate markets, it’s consistently considered one of the top 10 best cities for investors when it comes to overall real estate prospects, according to PwC and ULI’s 2025 Emerging Trends in Real Estate report. When it comes to investing in the Boston rental market, the challenge is cost, with a median home price that’s higher than any other city in New England. However, vacancy rates and rent growth have been relatively strong over the last two years due to Boston’s housing shortage. So, if you or your clients are looking to expand into a well-established primary market in 2025, Boston may be just the place.

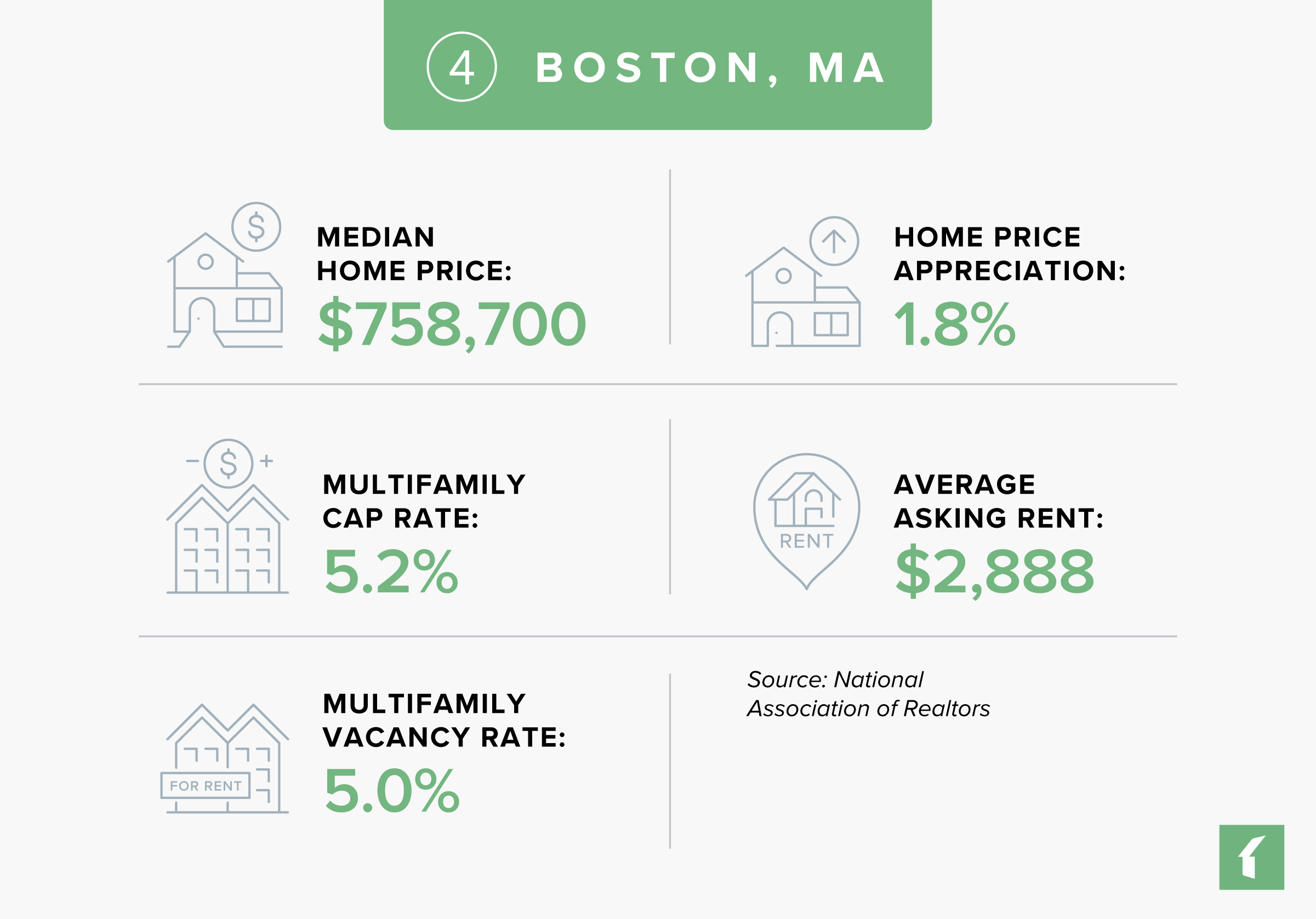

Boston, Massachusetts Rental Market Statistics

- Rental Inventory (Q3-’24): 280,618

- Units Added Since Q3-’23: +1,420

- Asking Rent Growth Since Q3-’23: 2.8%

- Asking Rent (Q3-’24): $2,888

- Effective Rent (Q3-’24): $2,865

- Multifamily Vacancy Rate (Q3-’24): 5.0%

- Multifamily Cap Rate (Q3-’24): 5.2%

Source: National Association of Realtors

Boston, Massachusetts Housing Market Statistics

- Median Home Price (Q3-’24): $758,700

- Home Price Appreciation Since Q3-’23: 1.8%

Source: National Association of Realtors

Boston, Massachusetts Economic Statistics

- Population Growth (2023): 0.4%

- GDP Growth (2023): 6.0%

- Job Growth (Q3-’24): 0.5%

Source: National Association of Realtors

Lists That Mention Boston, Massachusetts

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #31

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #27

- Best Real Estate Markets – Large Cities (WalletHub): #32

- Best Places to Live (U.S. News): #88

- Markets to Watch – Overall Real Estate Prospects (PwC/ULI): #8

Market #5: Barnstable, MA

Barnstable, Massachusetts is located on Cape Cod, about an hour and a half from Boston. It’s technically a city, but has chosen to retain its designation as a town. Barnstable is made up of seven different villages, of which Hyannis has the most residents and businesses located there, as well as the local airport. From Hyannis, visitors can also travel to Nantucket and Martha’s Vineyard, two islands located nearby. Centerville, another of Barnstable’s villages, is where many of the town’s single-family homes are located.

Barnstable’s metro area has 231,735 residents, making it the largest community on the Cape. The local economy is supported by the tourism, healthcare, and education sectors, with top employers in Barnstable including Cape Cod Healthcare, the Barnstable town and county governments, Cape Cod Community College, and Cape Air. The town’s population swells significantly with seasonal residents, visitors, and workers during the summer months, contributing to the community’s vibrant atmosphere as well as its economy. Approximately one in three homes in Barnstable are vacation homes.

Many people visit Barnstable for its beaches, such as Craigville Beach in Centerville. But there are also a number of cultural attractions in Barnstable, including the Cape Cod Maritime Museum, the Cahoon Museum of American Art, the Coast Guard Heritage Museum, the Barnstable Comedy Club, and the Mass Audubon Long Pasture Wildlife Sanctuary. The historic Kennedy family home is also located in Hyannis Port.

Barnstable didn’t make it onto Buildium’s list of up-and-coming real estate markets due to its high property prices, slow pace of rent growth, and moderately high vacancy rates. However, its cap rates and property price appreciation could make this an attractive market for real estate investors or property managers interested in doing business in an area with a high number of vacation properties, though it’s worth noting that the competition in the summer months can be steep.

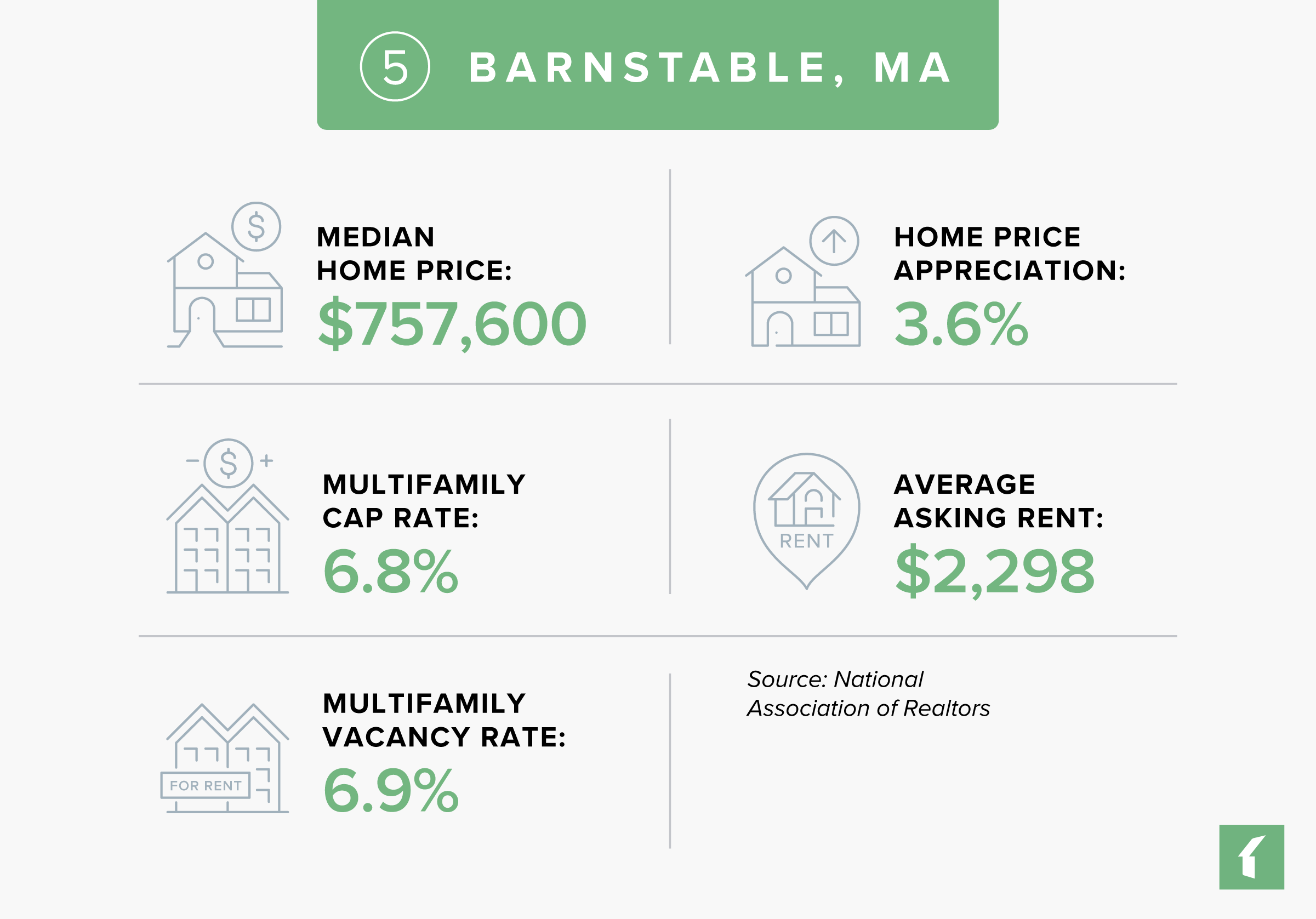

Barnstable, Massachusetts Rental Market Statistics

- Rental Inventory (Q3-’24): 1,900

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 0.2%

- Asking Rent (Q3-’24): $2,298

- Effective Rent (Q3-’24): $2,295

- Multifamily Vacancy Rate (Q3-’24): 6.9%

- Multifamily Cap Rate (Q3-’24): 6.8%

Source: National Association of Realtors

Barnstable, Massachusetts Housing Market Statistics

- Median Home Price (Q3-’24): $757,600

- Home Price Appreciation Since Q3-’23: 3.6%

Source: National Association of Realtors

Barnstable, Massachusetts Economic Statistics

- Population Growth (2023): -0.3%

- GDP Growth (2023): 7.9%

- Job Growth (Q3-’24): 2.9%

Source: National Association of Realtors

Lists That Mention Barnstable, Massachusetts

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #103

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #93

How Do We Identify the Best Rental Markets in Massachusetts?

We use the following sources to help us ascertain the best rental markets in the U.S. across five different categories.

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home price appreciation, as measured by the National Association of Realtors

- Markets with affordable monthly mortgage payments relative to income, as measured by the National Association of Realtors

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

- States with the most economic activity, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the National Association of Realtors

- The fastest-growing real estate markets, as measured by U.S. News

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News

Climate Indicators

Measures of climate vulnerability:

- Markets with the lowest risk of natural disasters and extreme conditions, as measured by the Federal Emergency Management Agency

60 Up-and-Coming Real Estate Markets in 2025

In Buildium’s annual Up-and-Coming Real Estate Markets list, we analyzed 175 metro areas across the U.S. to determine which cities show promise for rental investors and property managers in the year ahead. Wondering where else can rental investors and property managers find more growth opportunities in 2025? View the full list of emerging markets we’ve identified across the country.

Read more on Industry Research