Florida Rental Market Trends in 2025

With its warm climate and thriving economy, Florida stands out as one of the fastest-growing states in the U.S. Already the nation’s third-most-populous state, the Census Bureau estimates that Florida experienced a net gain of more than 1 million residents between 2020 and 2023. And Florida’s favorable tax policies and regulations are also attracting businesses to the state: Companies like Apple, Amazon, Goldman Sachs, and Citadel have all increased their presence in Miami.

While investing and doing business in Florida offers numerous advantages, there are a few trends that potential investors should keep in mind:

- Moderating population growth: A rising cost of living, as well as a smaller number of Baby Boomers entering retirement, are two factors expected to slow population growth in Florida in the coming years.

- Extreme weather events: Florida’s vulnerability to hurricanes and rising sea levels has raised insurance premiums and made it more difficult to find an insurance provider within the state.

- New condo regulations: Condo buildings that are at least 30 years old are facing new requirements to undergo inspections and repairs, as well as set aside funds for future maintenance.

If you’re a real estate investor or property manager looking to expand within Florida, this post will guide you through evaluating up-and-coming real estate markets within the state for 2025. We’ll share rental market statistics for each city, including inventory growth, rent growth, vacancy rates, cap rates, and property price appreciation. Additionally, we’ll highlight economic and demographic trends in each market.

Top 5 Rental Markets in Florida for 2025

Without further ado, here are 5 Florida rental markets where our research indicates growth opportunities lie in 2025.

Market #1: Tallahassee, Florida

Tallahassee, Florida’s capital, is the largest city in the Florida Panhandle and Big Bend regions. The metro area is home to approximately 6,183,199 people, making it the eighth-largest city in the state. This dynamic city offers a unique blend of government, education, and healthcare sectors, which contribute to its strong economy and stable job market.

Tallahassee is a college town, hosting several prominent institutions of higher education, including Florida State University, Florida A&M University, and Tallahassee Community College. The student, faculty, and staff population contributes to a reliable rental market, particularly for properties near these campuses.

Tallahassee’s economy is diverse and growing at a faster rate than the national average. The city’s largest employers include Florida State University, the state government, and Tallahassee Memorial Hospital. These institutions provide a stable employment base, which in turn supports the local housing market. Overall, Tallahassee ranked #44 on our national shortlist of up-and-coming real estate markets for 2025.

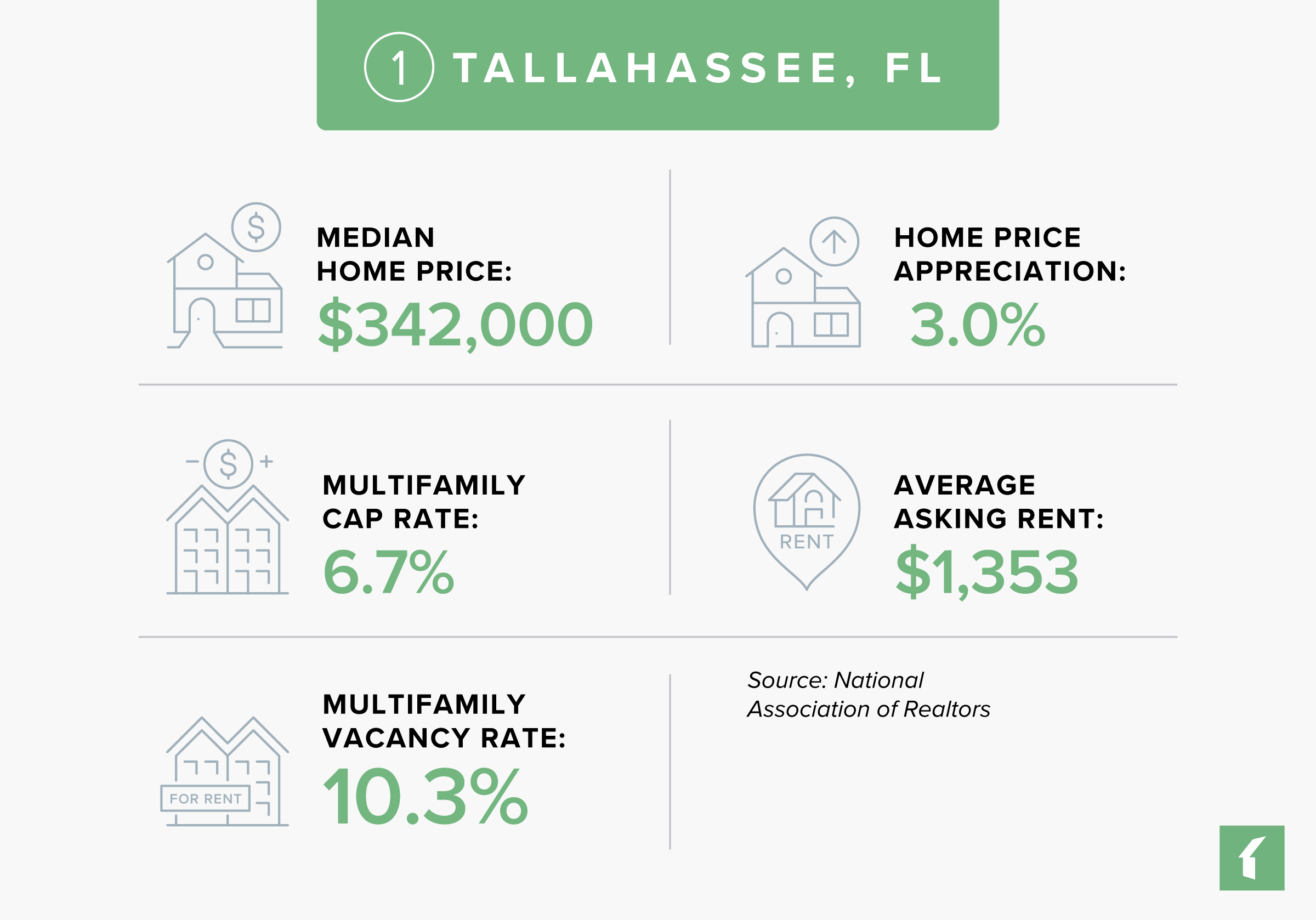

Tallahassee, Florida Rental Market Statistics

- Rental Inventory (Q2-’24): 23,843

- Units Added Since Q2-’23: +906

- Asking Rent Growth Since Q2-’23: 2.8%

- Asking Rent (Q2-’24): $1,353

- Effective Rent (Q2-’24): $1,340

- Multifamily Vacancy Rate (Q2-’24): 10.3%

- Multifamily Cap Rate (Q2-’24): 6.7%

Source: National Association of Realtors

Tallahassee, Florida Housing Market Statistics

- Median Home Price (Q2-’24): $342,000

- Home Price Appreciation Since Q2-’23: 3.0%

Source: National Association of Realtors

Tallahassee, Florida Economic Statistics

- Population Growth (2022): 1.2%

- GDP Growth (2022): 9.8%

- Job Growth (Q2-’24): 3.8%

Source: National Association of Realtors

Lists That Mention Tallahassee, Florida

- Overall Real Estate Prospects (PwC/ULI): #69

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #122

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #130

- Best Real Estate Markets – Mid-Sized Cities (WalletHub): #62

- Best Places to Live (U.S. News): #75

Market #2: Miami, Florida

Miami, located near Florida’s southern tip, ranks as the state’s second-largest city. Its vibrant cultural scene and beachside location have drawn a diverse population of 6,183,199 people to the metro area, in addition to the city’s economy and job market, both of which are growing at a faster rate than the rest of the country.

Miami’s economy is bolstered by a variety of sectors, including education, government, and international business. Many multinational corporations locate their Latin American operations in Miami due to its strategic international connections. Companies like Walmart, Microsoft, Visa, and American Airlines have significant operations here. Additionally, Miami’s port, the busiest in the world, supports a thriving tourism industry, with several major cruise lines based in the city. The presence of numerous colleges and universities, such as Miami Dade College, Florida International University, and the University of Miami, further enhances the city’s economic stability.

Miami’s real estate market is characterized by strong property price appreciation. This makes the city an attractive option for investors, along with its unique combination of cultural vibrancy, economic opportunity, and international appeal. However, high property prices can also act as a barrier to entry for some. In addition, the reality of rising sea levels and increasing hurricane severity can impact property values and insurance rates; so, it’s important to keep this in mind as you look to expand your real estate business into Miami.

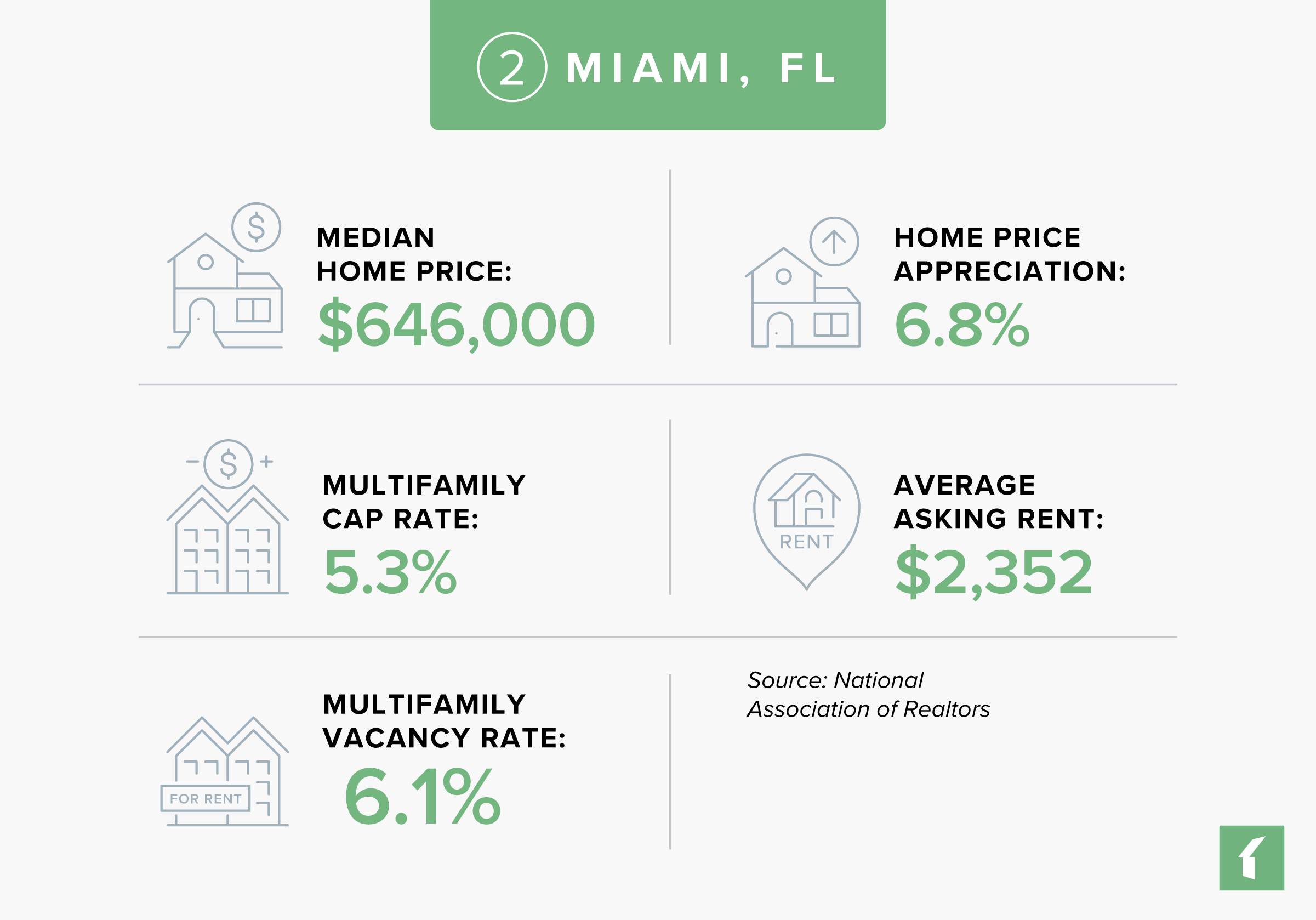

Miami, Florida Rental Market Statistics

- Rental Inventory (Q2-’24): 192,924

- Units Added Since Q2-’23: +3,055

- Asking Rent Growth Since Q2-’23: 2.4%

- Asking Rent (Q2-’24): $2,352

- Effective Rent (Q2-’24): $2,331

- Multifamily Vacancy Rate (Q2-’24): 6.1%

- Multifamily Cap Rate (Q2-’24): 5.3%

Source: National Association of Realtors

Miami, Florida Housing Market Statistics

- Median Home Price (Q2-’24): $646,000

- Home Price Appreciation Since Q2-’23: 6.8%

Source: National Association of Realtors

Miami, Florida Economic Statistics

- Population Growth (2022): 0.8%

- GDP Growth (2022): 11.6%

- Job Growth (Q2-’24): 2.7%

Source: National Association of Realtors

Lists That Mention Miami, Florida

- Overall Real Estate Prospects (PwC/ULI): #2

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #268

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #190

- Best Real Estate Markets – Large Cities (WalletHub): #21

- Best Places to Live (U.S. News): #123

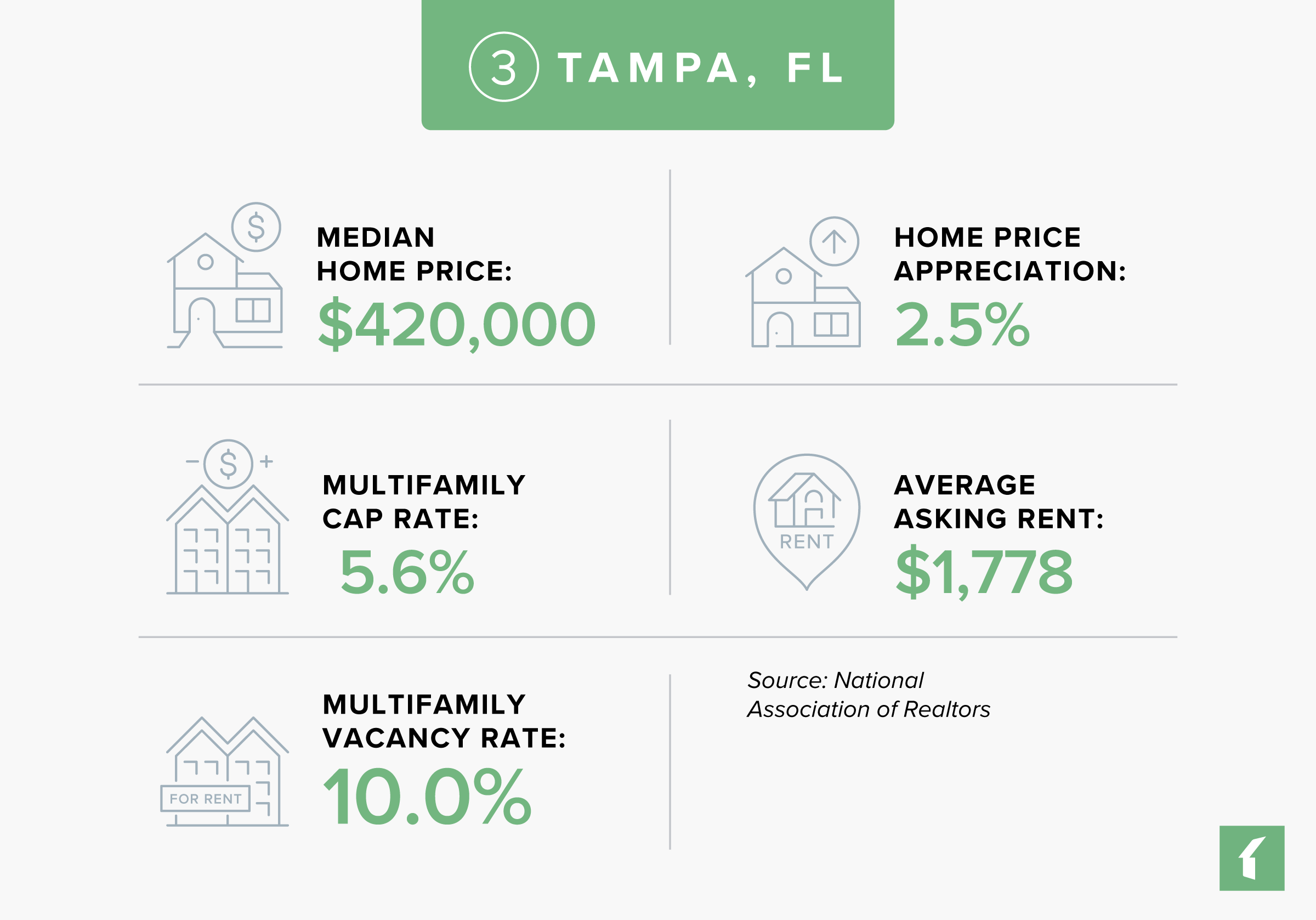

Market #3: Tampa, Florida

Tampa, located on the Gulf Coast of Florida, is the third-most populous city in the state, with 3,342,963 people residing in the metro area. Tampa presents an appealing lifestyle with its warm climate, beautiful beaches, and active cultural scene. The city also boasts a robust economy, with its GDP growing faster than the national average.

Tampa’s diverse and thriving economy is supported by major employers such as BayCare Health System, Publix Super Market, and HCA West Florida. The presence of several universities, including the University of South Florida and the University of Tampa, contributes to a steady influx of students and professionals, further driving demand for rental properties.

Tampa didn’t make our short list for 2025, partially due to its negative rent growth last year. However, its affordability relative to larger cities like Miami—in addition to its strong economic growth, diverse population, and thriving real estate market—will continue to draw residents and investors alike.

Tampa, Florida Rental Market Statistics

- Rental Inventory (Q2-’24): 229,292

- Units Added Since Q2-’23: +2,836

- Asking Rent Growth Since Q2-’23: -1.6%

- Asking Rent (Q2-’24): $1,778

- Effective Rent (Q2-’24): $1,751

- Multifamily Vacancy Rate (Q2-’24): 10.0%

- Multifamily Cap Rate (Q2-’24): 5.6%

Source: National Association of Realtors

Tampa, Florida Housing Market Statistics

- Median Home Price (Q2-’24): $420,000

- Home Price Appreciation Since Q2-’23: 2.5%

Source: National Association of Realtors

Tampa, Florida Economic Statistics

- Population Growth (2022): 2.2%

- GDP Growth (2022): 11.2%

- Job Growth (Q2-’24): 1.4%

Source: National Association of Realtors

Lists That Mention Tampa, Florida

- Overall Real Estate Prospects (PwC/ULI): #4

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #163

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #150

- Best Real Estate Markets – Large Cities (WalletHub): #7

- Best Places to Live (U.S. News): #35

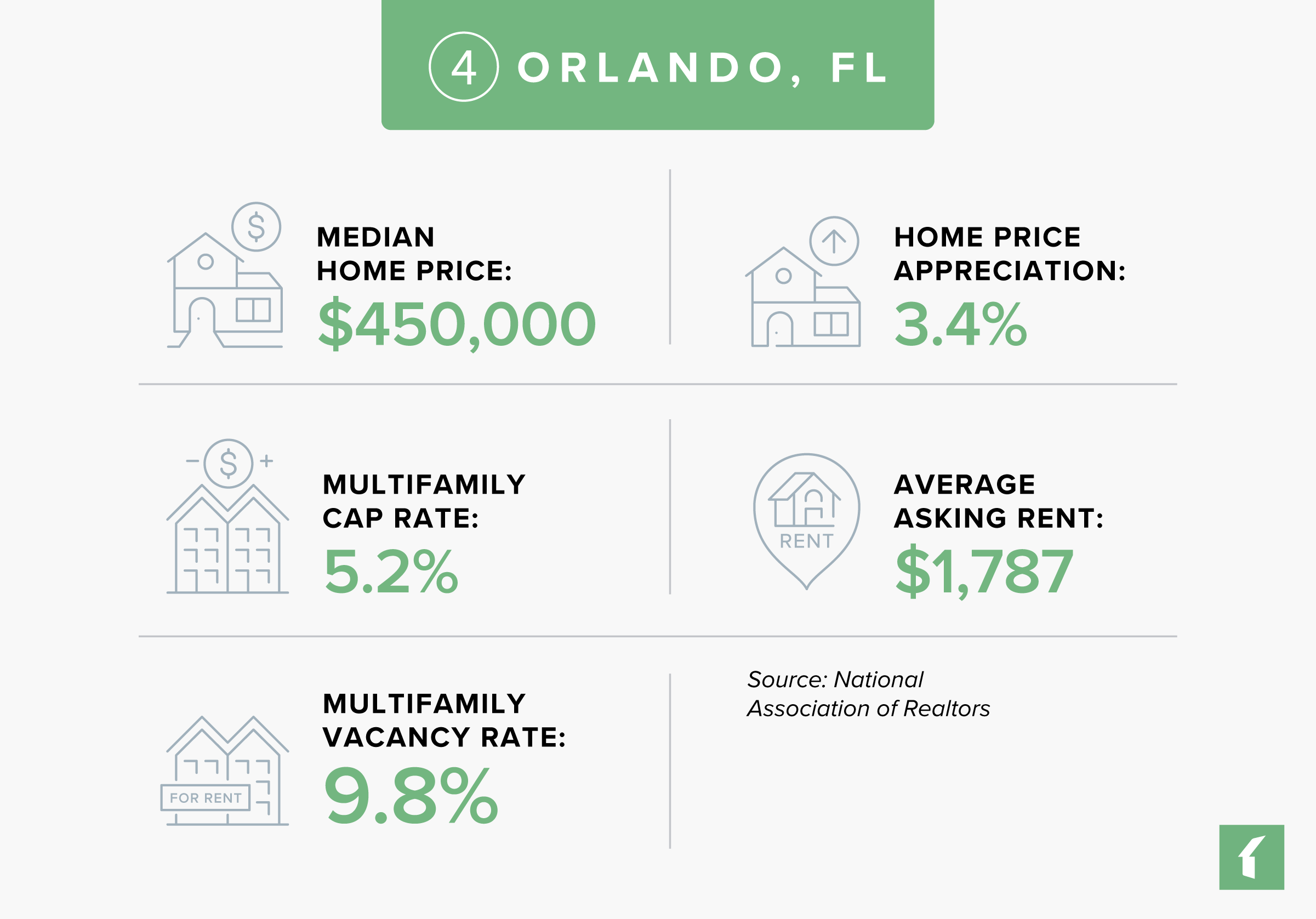

Market #4: Orlando, Florida

Located in central Florida, Orlando ranks as Florida’s fourth-most populous city, with its metro area being home to 2,817,933 people. Known for its world-famous theme parks like Disney World and Universal Studios, Orlando attracts over 2 million additional tourists each year, significantly boosting the local economy.

Orlando’s economy is diverse and thriving, with major employers spanning various sectors. Disney World and Universal Studios are two of the largest employers, providing a stable employment base and driving demand for rental properties. Other significant employers include AdventHealth, Orlando Health, Lockheed Martin, and the University of Central Florida. The proximity to Cape Canaveral, Kennedy Space Center, and Patrick Space Force Base further enhances the region’s economic stability and job market.

Like Tampa, Orlando didn’t make our short list this year, partially due to its negative rent growth in 2024. However, its affordability compared with Miami and other large cities—in addition to its appealing lifestyle and economic opportunities—continues to attract residents and investors to the area. This has resulted in even greater population growth here than in the other Florida markets mentioned in this post.

Orlando, Florida Rental Market Statistics

- Rental Inventory (Q2-’24): 221,706

- Units Added Since Q2-’23: +2,343

- Asking Rent Growth Since Q2-’23: -1.5%

- Asking Rent (Q2-’24): $1,787

- Effective Rent (Q2-’24): $1,765

- Multifamily Vacancy Rate (Q2-’24): 9.8%

- Multifamily Cap Rate (Q2-’24): 5.2%

Source: National Association of Realtors

Orlando, Florida Housing Market Statistics

- Median Home Price (Q2-’24): $450,000

- Home Price Appreciation Since Q2-’23: 3.4%

Source: National Association of Realtors

Orlando, Florida Economic Statistics

- Population Growth (2022): 2.7%

- GDP Growth (2022): 12.9%

- Job Growth (Q2-’24): 1.5%

Source: National Association of Realtors

Lists That Mention Orlando, Florida

- Overall Real Estate Prospects (PwC/ULI): #6

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #184

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #160

- Best Real Estate Markets – Large Cities (WalletHub): #15

- Best Places to Live (U.S. News): #68

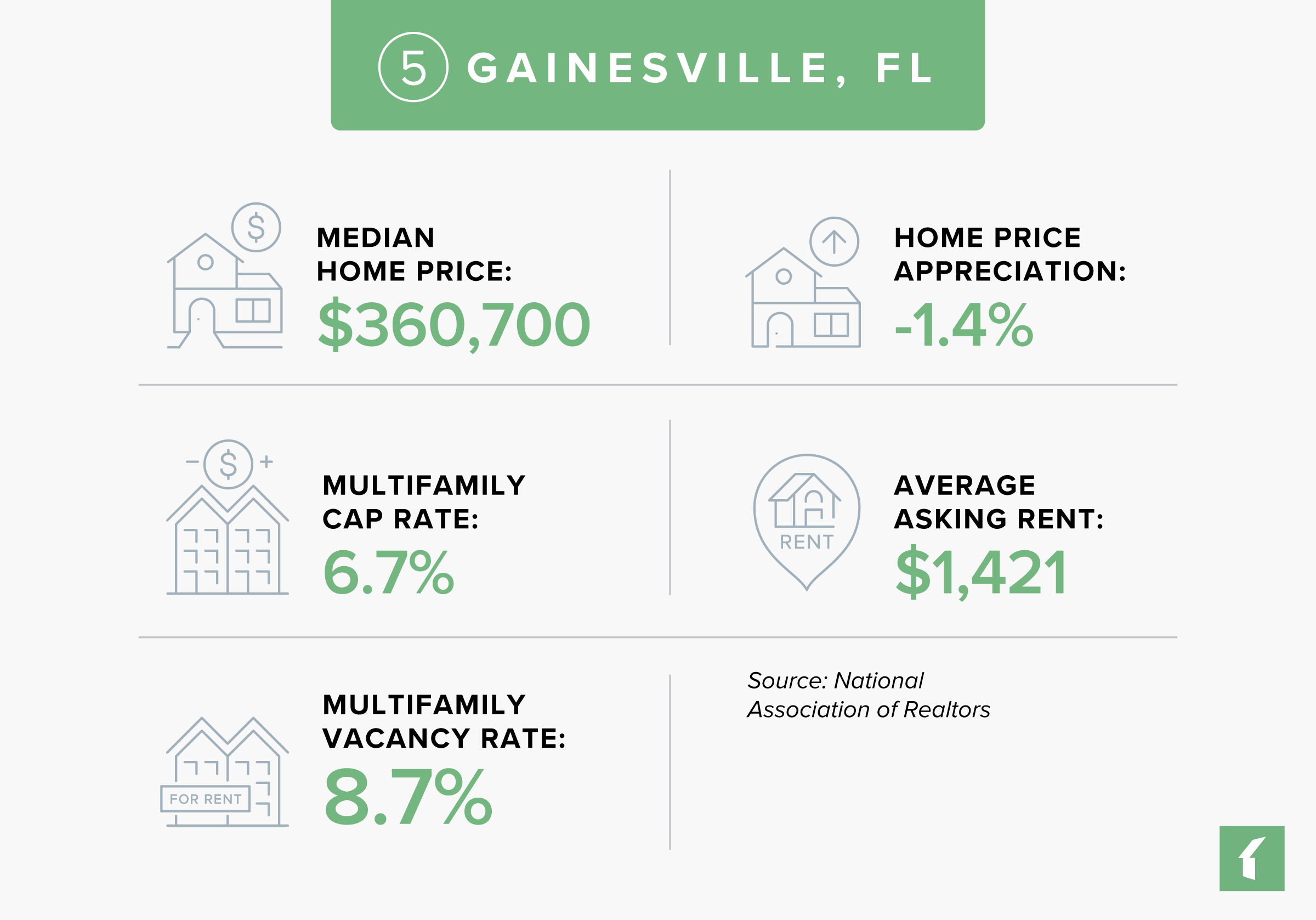

Market #5: Gainesville, Florida

Gainesville, located in north central Florida, is smaller than the other Florida real estate markets on our list, with 350,203 people living in its metro area. But despite its smaller size, Gainesville’s affordability and steady demand for rental housing offers opportunities for rental property investors and property managers.

Gainesville is home to the University of Florida, one of the largest public universities in the country and the area’s largest employer. This institution not only attracts a significant student population but also employs thousands of faculty and staff, creating a stable demand for rental properties.

Other major employers in Gainesville include UF Health Shands Hospital, Alachua County School Board, and the U.S. Department of Veterans Affairs. These institutions provide a solid employment base, contributing to the city’s economic stability. It is worth noting, however, that the city’s economy is growing at a slower rate than the U.S. overall, though its job growth is right on par with the rest of the country.

Gainesville, Florida Rental Market Statistics

- Rental Inventory (Q2-’24): 26,438

- Units Added Since Q2-’23: +235

- Asking Rent Growth Since Q2-’23: 0.6%

- Asking Rent (Q2-’24): $1,421

- Effective Rent (Q2-’24): $1,407

- Multifamily Vacancy Rate (Q2-’24): 8.7%

- Multifamily Cap Rate (Q2-’24): 6.7%

Source: National Association of Realtors

Gainesville, Florida Housing Market Statistics

- Median Home Price (Q2-’24): $360,700

- Home Price Appreciation Since Q2-’23: -1.4%

Source: National Association of Realtors

Gainesville, Florida Economic Statistics

- Population Growth (2022): 1.7%

- GDP Growth (2022): 7.8%

- Job Growth (Q2-’24): 1.7%

Source: National Association of Realtors

Lists That Mention Gainesville, Florida

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #205

- Best Real Estate Markets – Small Cities (WalletHub): #73

How Do We Identify the Best Rental Markets in Florida?

We use the following sources to help us ascertain the best rental markets in the U.S. across five different categories.

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home price appreciation, as measured by the National Association of Realtors

- Markets with affordable monthly mortgage payments relative to income, as measured by the National Association of Realtors

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

- States with the most economic activity, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the National Association of Realtors

- The fastest-growing real estate markets, as measured by U.S. News

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News

Climate Indicators

Measures of climate vulnerability:

- Markets with the lowest risk of natural disasters and extreme conditions, as measured by the Federal Emergency Management Agency

60 Up-and-Coming Real Estate Markets in 2025

In Buildium’s annual Up-and-Coming Real Estate Markets list, we analyzed 175 metro areas across the U.S. to determine which cities show promise for rental investors and property managers in the year ahead. Where else can rental investors and property managers find more growth opportunities in 2025? View the full list of emerging markets we’ve identified across the country.

Read more on Industry Research