California Rental Market Trends in 2025

California lives large in the American consciousness due to its scenic beauty and significant contributions to U.S. culture. It’s the third-largest state by size, with 482 cities spread across a diverse range of landscapes, from the Pacific Coast and the Sierra Nevada mountains to the Mojave Desert and the Central Valley. California is the most populous state in the country, and if it were its own nation, it would have the fifth-largest economy in the world.

As a result, growing a business or a portfolio in California can feel daunting. In this post, we wanted to look outside of the state’s two most prominent metro areas, Los Angeles and San Francisco, and instead focus on secondary markets that could present opportunities for property managers and rental property investors looking to expand within California.

While investing and doing business in California offers numerous advantages and upsides, there are a few trends that potential investors should keep in mind:

- High property costs: Purchasing a rental property in California requires a substantial upfront investment, necessitating careful financial planning to achieve profitability.

- Regulatory barriers: In addition to statewide regulations that cap annual rent increases and require just cause for evictions, many local jurisdictions have their own laws.

- Population loss: California has been losing residents for the last several years due to its high cost of living in comparison with states like Texas, Nevada, Arizona, and Oregon.

- Natural disasters: It’s important to be prepared (and insured) for natural disasters like wildfires, earthquakes, and floods if you decide to invest in California.

If you’re looking to grow your property management business or rental portfolio in California, this post will guide you through evaluating 4 leading real estate markets there. We’ll share rental market statistics for each city, including inventory growth, rent growth, vacancy rates, cap rates, and property price appreciation. We’ll also highlight economic and demographic trends in each market.

Top 4 Rental Markets in California for 2025

Without further ado, here are 4 California rental markets where growth opportunities may lie in 2025.

Market #1: San Diego, CA

San Diego is California’s second-most populous city, with 3,269,973 people calling its metro area home. Located in Southern California close to the U.S. border with Mexico, it’s known for its picturesque location along the Pacific coast and its Mediterranean climate.

Residents and visitors have plenty to do in San Diego. Within Balboa Park alone, they can visit the San Diego Museum of Art, the Natural History Museum, and 15 other museums, as well as multiple performing arts venues and botanical gardens. The San Diego Zoo, the U.S.S. Midway Museum, SeaWorld, and La Jolla Playhouse are several other popular attractions located throughout the city. Visitors also enjoy exploring the historic Old Town and the Gaslamp neighborhoods. Those who gravitate to the outdoors will appreciate San Diego’s beaches, with La Jolla and Coronado being two of the most well known, as well as recreational areas such as Torrey Pines State Reserve.

The Navy has had a significant presence in San Diego for more than a century, and today, the Naval Base San Diego remains the city’s largest employer. Other major employers in San Diego fall within the education, healthcare, and government sectors, including the University of California in San Diego, Sharp HealthCare, the city and county governments of San Diego, San Diego Unified School District, and Scripps Health. In addition to UCSD, there are a number of higher education institutions located in San Diego, such as the University of San Diego, San Diego State University, and the San Diego Community College District.

San Diego’s property prices give this city a high barrier to entry for real estate investors, resulting in compressed cap rates in comparison with many of the cities selected for Buildium’s list of 2025 up-and-coming real estate markets. However, San Diego’s robust economy, natural beauty, and strong home price appreciation hold continued appeal, resulting in its inclusion on the Wall Street Journal and Realtor.com’s housing market rankings, as well as PwC and ULI’s rankings of real estate markets to watch in 2025.

San Diego, California Rental Market Statistics

- Rental Inventory (Q3-’24): 281,246

- Units Added Since Q3-’23: +564

- Asking Rent Growth Since Q3-’23: 0.2%

- Asking Rent (Q3-’24): $2,497

- Effective Rent (Q3-’24): $2,476

- Multifamily Vacancy Rate (Q3-’24): 5.2%

- Multifamily Cap Rate (Q3-’24): 4.7%

Source: National Association of Realtors

San Diego, California Housing Market Statistics

- Median Home Price (Q3-’24): $1,010,000

- Home Price Appreciation Since Q3-’23: 3.2%

Source: National Association of Realtors

San Diego, California Economic Statistics

- Population Growth (2023): -0.2%

- GDP Growth (2023): 6.2%

- Job Growth (Q3-’24): 0.8%

Source: National Association of Realtors

Lists That Mention San Diego, California

- Overall Real Estate Prospects (PwC/ULI): #21

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #64

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #44

- Best Real Estate Markets – Large Cities (WalletHub): #18

- Best Places to Live (U.S. News): #46

Market #2: Sacramento, CA

Sacramento is the capital city of California, located at the intersection of the Sacramento and American Rivers. 2,420,608 people live in the Sacramento-Roseville-Folsom metro area, making it the fourth-most populous metro area in the state, and among the most diverse cities in the country.

Known as the “City of Trees,” Sacramento claims to have more tree cover than any other U.S. city, and its extensive urban parks, bike trails, and rivers make it a great destination for those who love outdoor recreation. Located in Northern California, it’s within driving distance of the Bay Area, Napa Valley, Lake Tahoe, and Yosemite National Park, making Sacramento a great home base for day-trippers as well.

Cultural attractions in Sacramento include the Sacramento Zoo, the California State Capitol Museum, Crocker Art Museum, and the California State Railroad Museum. Residents and visitors can also catch a show or basketball game at Golden 1 Center, or explore the Gold Rush-era Old Sacramento Waterfront. Sacramento is also known for its “farm-to-fork” dining scene, with an abundance of farmers’ markets, restaurants, and festivals celebrating locally-sourced ingredients.

Sacramento’s economy has historically centered around the state and federal government, which employed more than 130,000 local residents as of 2023. But in recent years, the city’s economy has grown more diverse, with new jobs appearing primarily in the healthcare, technology, and manufacturing sectors. Top employers outside of the government include UC Davis Health, Kaiser Permanente, Sutter Health, Dignity Health, and Intel.

Sacramento is a more affordable market for property investors than many others in California, landing it on the Wall Street Journal and Realtor.com’s housing market rankings, as well as PwC and ULI’s rankings of real estate markets to watch. It’s also seen slow growth in a time when many cities in California are experiencing population loss. Overall, Sacramento’s relative affordability and strong economy may present an appealing picture to real estate investors.

Sacramento, California Rental Market Statistics

- Rental Inventory (Q3-’24): 144,330

- Units Added Since Q3-’23: +1,083

- Asking Rent Growth Since Q3-’23: 1.8%

- Asking Rent (Q3-’24): $1,847

- Effective Rent (Q3-’24): $1,833

- Multifamily Vacancy Rate (Q3-’24): 6.6%

- Multifamily Cap Rate (Q3-’24): 5.4%

Source: National Association of Realtors

Sacramento, California Housing Market Statistics

- Median Home Price (Q3-’24): $560,000

- Home Price Appreciation Since Q3-’23: 3.3%

Source: National Association of Realtors

Sacramento, California Economic Statistics

- Population Growth (2023): 0.2%

- GDP Growth (2023): 6.9%

- Job Growth (Q3-’24): 1.4%

Source: National Association of Realtors

Lists That Mention Sacramento, California

- Overall Real Estate Prospects (PwC/ULI): #43

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #97

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #85

- Best Real Estate Markets – Large Cities (WalletHub): #30

- Best Places to Live (U.S. News): #116

Market #3: San Jose, CA

Located an hour from San Francisco in Northern California, the San Jose-Sunnyvale-Santa Clara metro area’s 1,945,767 residents make this the third-most populous city in the state.

San Jose has earned the nickname “The Capital of Silicon Valley” due to its high concentration of tech companies: Adobe, Apple, Cisco Systems, eBay, Google, PayPal, and Zoom are all headquartered in the San Jose metro area, while companies like Hewlett Packard, IBM, Kaiser Permanente, Samsung, and countless others have major facilities there. Though San Jose’s economy is primarily known for its tech sector, it also attracts companies specializing in manufacturing (particularly for high-tech products), education, healthcare, and professional services.

San Jose’s Mediterranean climate allows residents to enjoy the outdoors year-round at destinations like Los Gatos Creek Trail, Alum Rock Park, the San Jose Municipal Rose Garden, and the Japanese Friendship Garden in Kelley Park. Cultural attractions are also abundant in San Jose, including the Tech Interactive, the San Jose Museum of Art, and the Rosicrucian Egyptian Museum. Popular annual festivals include the Cinequest Film Festival and the San Jose Jazz Festival.

As with the other California rental markets covered in this post, San Jose was mentioned in the Wall Street Journal and Realtor.com’s 2024 rankings of U.S. housing markets. It’s among the most expensive real estate markets in the U.S., but also has steady demand due to the high volume of tech professionals drawn to the area’s job market. So, it’s important to ensure that high upfront costs are balanced by rental yields when investing in San Jose.

San Jose, California Rental Market Statistics

- Rental Inventory (Q3-’24): 159,897

- Units Added Since Q3-’23: +874

- Asking Rent Growth Since Q3-’23: 3.0%

- Asking Rent (Q3-’24): $3,079

- Effective Rent (Q3-’24): $3,055

- Multifamily Vacancy Rate (Q3-’24): 5.0%

- Multifamily Cap Rate (Q3-’24): 4.6%

Source: National Association of Realtors

San Jose, California Housing Market Statistics

- Median Home Price (Q3-’24): $1,900,000

- Home Price Appreciation Since Q3-’23: 2.7%

Source: National Association of Realtors

San Jose, California Economic Statistics

- Population Growth (2023): 0.4%

- GDP Growth (2023): 6.5%

- Job Growth (Q3-’24): 0.6%

Source: National Association of Realtors

Lists That Mention San Jose, California

- Overall Real Estate Prospects (PwC/ULI): #60

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #94

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #69

- Best Real Estate Markets – Large Cities (WalletHub): #20

- Best Places to Live (U.S. News): #70

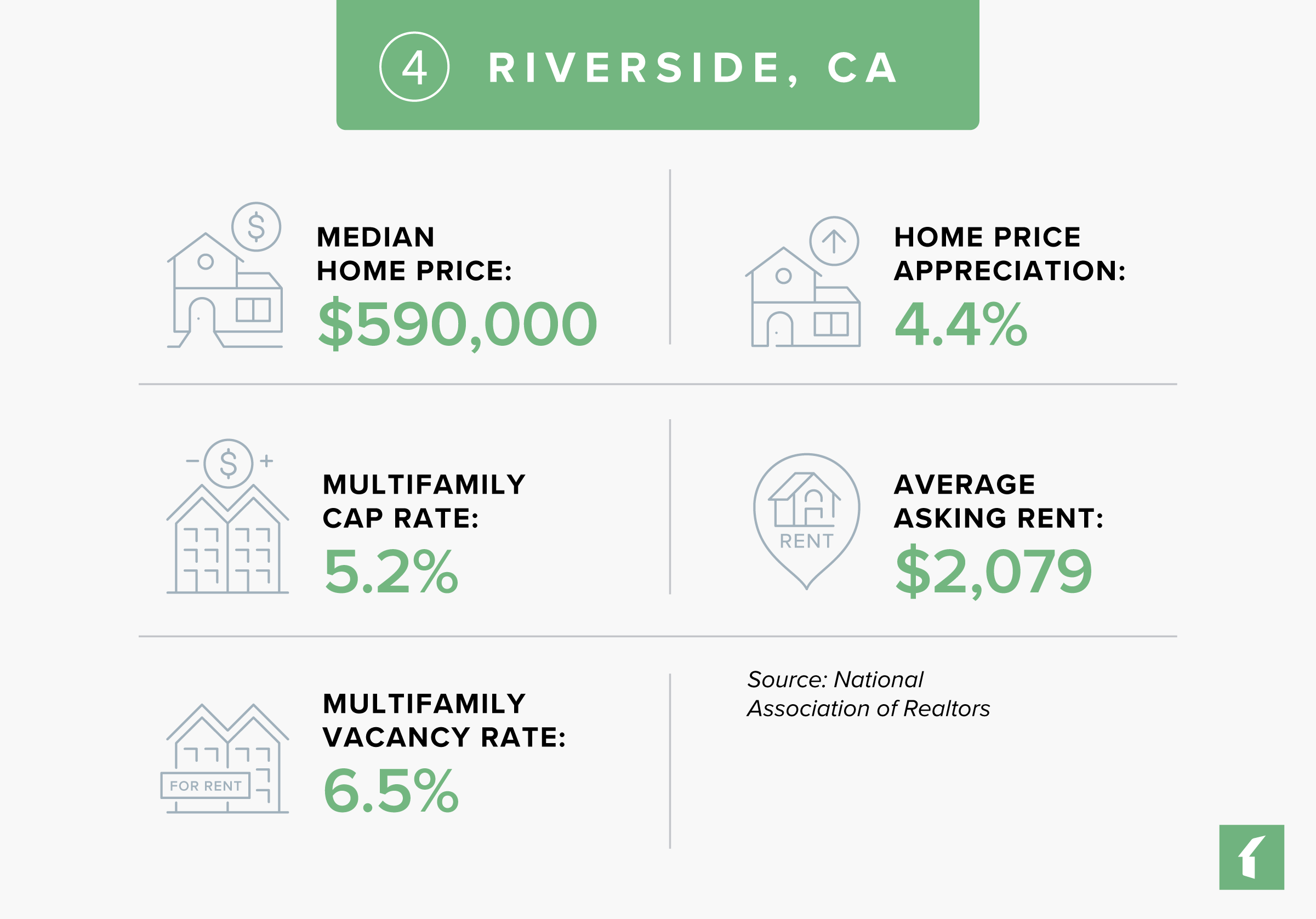

Market #4: Riverside, CA

Riverside is a city in southern California, located an hour east of Los Angeles along the Santa Ana River. 4,688,053 residents live in the Riverside–San Bernardino–Ontario metro area (also known as the Inland Empire).

Riverside was once famous for its role in California’s citrus industry. Today, it boasts a diverse and growing economy that offers numerous opportunities for residents and businesses across the education, healthcare, manufacturing, logistics, and professional services sectors. The city’s location near major transportation routes makes it a hub for logistics and distribution for companies like Amazon. Other major employers include the local government, March Air Force Reserve, the University of California at Riverside, Kaiser Permanente, and Riverside Unified School District.

As with other California destinations, Riverside’s mild climate allows residents to enjoy outdoor activities all year long at destinations like Mount Rubidoux, Riverside Botanic Gardens, and the Santa Ana River Trail. Riverside residents and visitors also enjoy cultural attractions like the Riverside Art museum, the California Museum of Photography, the Riverside Metropolitan Museum, and Fox Performing Arts Center.

As much of the state is losing residents, Riverside is currently experiencing slow population growth due to its strong job market and relative affordability. This makes it appealing to residents and investors alike. Though property prices are high compared to much of the U.S., they’re more attainable than many other California real estate markets, making Riverside a potential option for investors looking to expand within the state.

Riverside, California Rental Market Statistics

- Rental Inventory (Q3-’24): 177,566

- Units Added Since Q3-’23: +1,682

- Asking Rent Growth Since Q3-’23: 1.3%

- Asking Rent (Q3-’24): $2,079

- Effective Rent (Q3-’24): $2,064

- Multifamily Vacancy Rate (Q3-’24): 6.5%

- Multifamily Cap Rate (Q3-’24): 5.2%

Source: National Association of Realtors

Riverside, California Housing Market Statistics

- Median Home Price (Q3-’24): $590,000

- Home Price Appreciation Since Q3-’23: 4.4%

Source: National Association of Realtors

Riverside, California Economic Statistics

- Population Growth (2023): 0.4%

- GDP Growth (2023): 6.2%

- Job Growth (Q3-’24): 1.4%

Source: National Association of Realtors

Lists That Mention Riverside, California

- Overall Real Estate Prospects (PwC/ULI): #62

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #188

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #280

- Best Real Estate Markets – Large Cities (WalletHub): #41

How Do We Identify the Best Rental Markets in California?

We use the following sources to help us ascertain the best rental markets in the U.S. across five different categories.

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home price appreciation, as measured by the National Association of Realtors

- Markets with affordable monthly mortgage payments relative to income, as measured by the National Association of Realtors

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

- States with the most economic activity, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the National Association of Realtors

- The fastest-growing real estate markets, as measured by U.S. News

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News

Climate Indicators

Measures of climate vulnerability:

- Markets with the lowest risk of natural disasters and extreme conditions, as measured by the Federal Emergency Management Agency

60 Up-and-Coming Real Estate Markets in 2025

In Buildium’s annual Up-and-Coming Real Estate Markets list, we analyzed 175 metro areas across the U.S. to determine which cities show promise for rental investors and property managers in the year ahead. Wondering where else can rental investors and property managers find more growth opportunities in 2025? View the full list of emerging markets we’ve identified across the country.

Read more on Industry Research