How can property management companies deliver customer service that feels tailored for each of their clients, without overtaxing their time-strapped teams?

According to Buildium’s research, one method that can be helpful is identifying which rental investor types fit your clients, revealing patterns in the kind of assistance they’ll need with their properties.

So, what are those rental investor types, and what do they expect from their property management company in the current rental market? That’s exactly what we’ll cover in this blog post, based on our surveys of 275 small-portfolio rental owners.

We’ll first detail the preferences of the three main investor types: Intentional Investors, Accidental Landlords, and Unintentional Investors. Then, we’ll share six subtypes that will enable you to get even more granular in identifying which rental owners comprise your client base.

For even more insights on how you can retain and attract rental owners based on the investor category they fall into, check out our new report: 9 Types of Rental Property Investors, and How Property Managers Can Attract & Retain Them.

Rental Property Investor Type #1: The Intentional Investor

Who Are Intentional Investors?

Intentional Investors purchased rental property as an investment from the start. They’re the most likely to own multiple units and to be actively adding new properties to their portfolio, though some are more interested in enhancing the profitability of their current properties more than expansion.

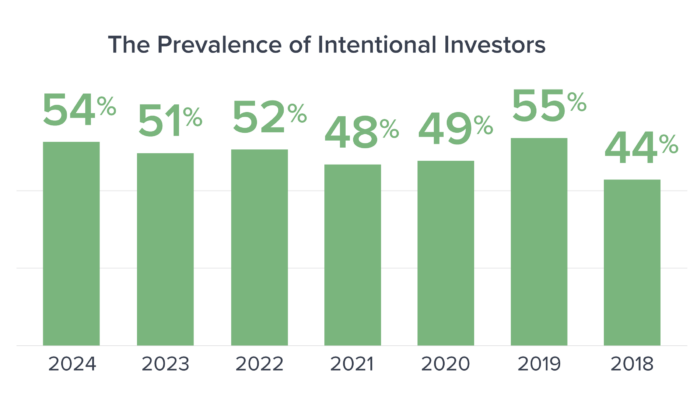

54% of small-portfolio rental owners currently identify as Intentional Investors, an increase of 10 percentage points since 2018.

What Distinguishes Intentional Investors from Other Rental Owners

In comparison with other rental owners, Intentional Investors are:

- Most likely to own multiple rental units

- Most likely to be leveraging their properties as a stream of income

- Most likely to be retired

- Most likely to plan to grow their portfolios in the next 2 years

- Most likely to own rental properties across multiple regions of the U.S.

- Most likely to have owned rental property for more than 20 years

How Property Managers Can Work Effectively with Intentional Investors

Determine the level of involvement they’d like to have, whether they prefer a hands-off approach or active participation in decision-making.

Align your strategy with each client’s goals, whether they aim to acquire new properties or maximize the profitability of their current portfolio.

Share your expertise on local market performance, regulations, and leasing trends to add value for investors who may otherwise be tempted to self-manage.

Prove you’ve got things under control to enable them to focus on growth, particularly for the 50% of Intentional Investors who own properties in markets they don’t live in.

Provide them with insight into their individual properties and their overall portfolios, in a format they can access on their own on at least a monthly basis.

Rental Property Investor Type #2: The Accidental Landlord

Who Are Accidental Landlords?

Accidental Landlords came to own rental property for personal or circumstantial reasons—for example, a home that they inherited or used to live in, but aren’t yet ready to sell. They don’t consider themselves investors, and are unlikely to plan on acquiring additional rental properties.

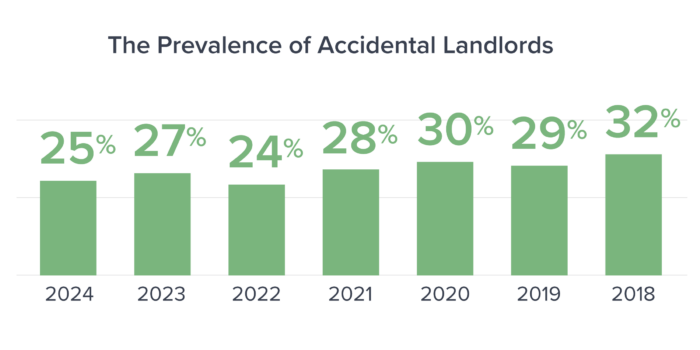

25% of small-portfolio rental owners currently identify as Accidental Landlords, a decrease of 7 percentage points since 2018. Although their population overall has decreased over the last few years, property managers have likely noticed that there has also been an influx of new Accidental Landlords into the market—just not enough to outweigh the number of existing Accidental Landlords who have chosen to sell off their properties.

What Distinguishes Accidental Landlords from Other Rental Owners

In comparison with other rental owners, Accidental Landlords are:

- Most likely to own a single rental unit

- Most likely to own their property for sentimental reasons

- Most likely to have acquired their rental property in the last 2 years

- Most likely to plan to downsize their portfolios in the next 2 years

- Least likely to own rental properties across multiple metro areas

- Least likely to be leveraging their properties as a stream of income

How Property Managers Can Work Effectively with Accidental Landlords

Find out what their property means to them—for example, a home that they or a family member once lived in—to understand the emotions driving their decisions.

Don’t forget that their property is also a passive source of income. Though sentimental reasons for owning rental property are common, 1 in 2 own it for the income it provides.

Identify their primary stressors, such as addressing maintenance issues and filling vacancies with high-quality tenants, to understand how they’ll evaluate your success.

Give peace of mind from afar for the half of Accidental Landlords who don’t live near their rental properties, deftly preventing issues and handing any that do arise.

Ask whether selling is on their mind to help them think through the pros and cons, position their property for sale, and refer them to other real estate professionals in your network.

Rental Property Investor Type #3: The Unintentional Investor

Who Are Unintentional Investors?

Back in 2018, Unintentional Investors emerged from Buildium’s survey data as a category of rental owners distinct from Intentional Investors and Accidental Landlords. Like Accidental Landlords, they came to own rental property for circumstantial reasons; but they now consider themselves investors, and nearly half plan to add new properties to their portfolios in the next 2 years.

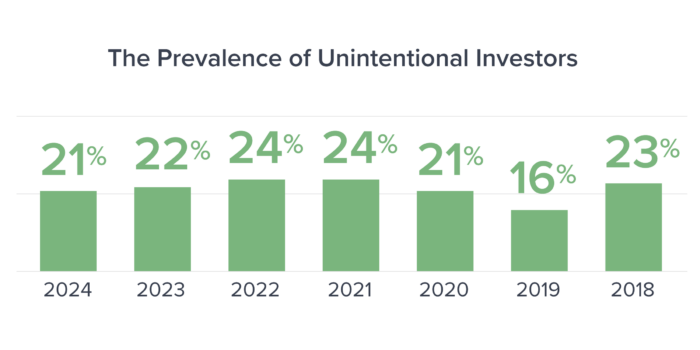

21% of small-business rental owners currently identify as Unintentional Investors, a decrease of 2 percentage points since 2018.

What Distinguishes Unintentional Investors from Other Rental Owners

In comparison with other rental owners, Unintentional Investors are:

- Most likely to live in a different city than where they own rental property

- Most likely to have a full-time job that’s unrelated to their rental properties

- Most likely to own rental properties across multiple metro areas within the same region

- Least likely to plan to sell off properties in the next 2 years

How Property Managers Can Work Effectively with Unintentional Investors

Find out their short- and long-term goals, whether they’re focused on increasing their profitability, shoring up their retirement savings, or acquiring more properties.

Fill in the gaps in their expertise, helping them run their properties profitably, efficiently, and in compliance with changing regulations and market conditions.

Ask how often they want to receive updates on their properties and on which topics they’d like to be consulted, versus those they’d be happy to let you handle on your own.

Connect them with high-quality vendors to help with maintenance, repairs, and renovations, or advise them on buying and selling rental properties (or offer these services yourself).

Provide financial insights beyond sending over a basic report each month—many will be eager for your opinion on improving their properties’ profitability and efficiency.

The 6 Subtypes of Rental Property Investors & Landlords

In addition to the 3 main investor types, we discovered 6 subtypes of rental property investors and landlords. We’ll go through each subtype one at a time.

The Growth-Focused Investor

Growth-Focused Investors are rental owners who identify as investors and are actively acquiring new properties. 32% of small-business rental owners fit this profile in 2024, a number that’s risen and fallen over time as investors’ desire to acquire new properties has shifted with property prices and availability as well as mortgage rates.

The DIY Landlord

DIY Landlords are rental owners who are running their rental properties without the assistance of a property manager. 31% of small-business rental owners fit this profile, a slight increase over the last few years as the number of rental owners seeking out property managers’ services has fluctuated.

The Single-Unit Owner

Single-Unit Owners are rental owners who own a single unit and have no plans to grow in the near future. 37% of small-business rental owners fit this profile, an increase over the last few years.

The Absentee Landlord

Absentee Landlords are rental owners who need a property manager’s help in looking after their rental property because they don’t live nearby. They aren’t actively acquiring new properties. 20% of small-business rental owners fit this profile, a decrease over the last few years as some rental owners in this position have sold off their properties.

The Distance Investor

Distance Investors are rental owners who are actively growing their portfolios and need a property manager’s help in looking after the rental properties they don’t live near. 10% of small-business rental owners fit this profile, a number that’s stayed relatively steady over the last few years.

The Profit-Conscious Investor

Profit-Conscious Investors are rental owners who want a property manager’s help increasing their properties’ profitability. 9% of small-business rental owners fit this profile, a number that’s stayed relatively steady over the last few years.

For even more insights on how you can retain and attract rental owners based on the investor category they fall into, check out our new report: 9 Types of Rental Property Investors, and How Property Managers Can Attract & Retain Them.

Read more on Growth