New research shows that property management companies are renewing their commitment to the long-term health of their business after making it through the chaos of the last few years. But just because they’re refocusing on expansion and efficiency doesn’t mean that they expect the headwinds of the current rental market to disappear. Instead, it means that they plan to shift their strategies for growth once again, drawing on the same ingenuity and determination they’ve shown throughout the pandemic.

How do we know that? We survey thousands of property management professionals each year to find out how much growth their companies have planned for the year to come, and the tactics they’ll draw on to turn those plans into action. This year’s survey found that small property management companies anticipate more portfolio growth in the next two years than they’ve projected since 2017, and that their revenue growth expectations are higher than they’ve been since 2018.

Achieving growth on this scale will require a deep understanding of the economic and demographic forces behind current rental market conditions, including compressed margins, increased competition, and the ongoing labor shortage.

How can property management companies anticipate the challenges and opportunities that the 2023 rental market holds?

The 2023 Property Management Industry Report is here to help. We crafted our eighth annual Industry Report to allow property management professionals to learn precisely how other companies plan to execute on their growth plans in the coming year; how their customers’ expectations have shifted over the past year; and how technology can help their teams do more with less in the current environment.

2023 Property Management Industry Report

It's here! Read our definitive guide on the property management industry and how to succeed in 2023.

Get the GuideIn this post, we’ll share three of the property management industry trends that we expect to exert major influence over the way in which small and mid-sized companies do business in 2023 and beyond, taken straight from this year’s Industry Report. For significantly more information on these three trends and countless others, be sure to download your free copy of the report.

Trend #1: Property Management Portfolio Growth

Small property management companies plan to double down on portfolio expansion in 2023.

Our 2022 survey of property management industry professionals found the highest portfolio growth expectations that we’ve seen since 2017, illustrating just how dramatic the improvement in small property management companies’ outlook has been since the start of the pandemic. Looking specifically at small property management companies who manage rental properties owned by third parties, 92% plan to add new doors to their portfolios in 2023 and 2024. And as you can see in the chart below, a majority of respondents said their companies plan to grow by a significant amount—a term that most respondents defined as an increase in the size of their portfolios by between 26% and 50%.

But it isn’t just the number of property management companies who plan to grow—or even the scale at which they plan to do so—that makes their current plans so significant in comparison with past years. It’s that their growth plans represent a return to a more normal state of business than we’ve seen since the pandemic began.

We can see evidence of this shift in property management companies’ top priorities for the coming year. For the second year in a row, our survey respondents told us that portfolio expansion would be their number one area of focus. But as you can see in the next chart, efficiency and profitability took second and third place—two priorities that had fallen down the list during the pandemic as issues related to rental owners and renters took priority.

Behind this change is a great deal of determination on the part of small property management companies to get the health of their business back on track in 2023. Respondents told us that they remain as committed as ever to creating a positive experience for customers interacting with their team, but that they’ll be more intentional in their efforts to balance renter and owner-related concerns with issues related to their growth and operations.

Small property management companies finally have the space to think about expanding their business in a way that’s sustainable, efficient, and profitable; and they primarily plan to do so by recruiting new clients, which 77% of respondents agree will be the focus of their growth strategy for the next two years. However, there’s more competition in the property management space than in the past, so companies are devoting extra energy to finding new owner clients and differentiating their offerings from larger competitors in the area.

But finding new clients isn’t the only way that property management companies plan to grow. 51% of our survey respondents said that encouraging and supporting their current clients’ growth would be key to their company’s expansion strategy for the next two years. This has been a challenge for small property management companies during the pandemic, with the labor shortage straining teams’ ability to scale as they take on new properties; and with record-high home prices motivating some rental owners to sell, and others to acquire new properties at a slower-than-expected rate. However, growth may come more easily in 2023 as the real estate and labor markets cool in comparison with the last two years.

Trend #2: Demand for Property Management Services

Rental owners’ demand for property managers’ expertise remains elevated above the pre-pandemic period.

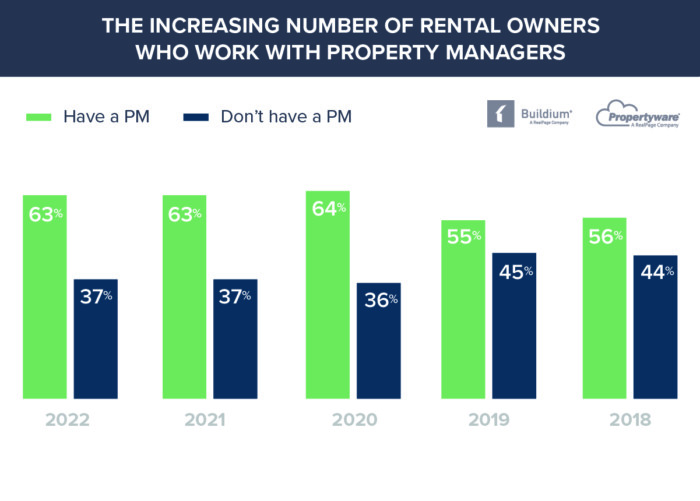

Starting with the onset of the pandemic, our surveys recorded a significant uptick in the number of small real estate investors working with a property manager to operate their rental properties. The number of rental owners who reported that they currently had a property manager jumped from 55% in 2019 to 64% in 2020, and held steady at 63% throughout 2021 and 2022.

Though the rental market isn’t in outright crisis to the degree that it was during the first year of the pandemic, many aspects of rental property ownership remain more complex, more expensive, and involve greater legal risk than they used to. The good news is that our surveys have found that for small real estate investors, enlisting an expert’s help in these areas dramatically reduces their stress levels. So, in spite of the temptation to keep costs low by managing their properties themselves, Small-Portfolio Investors and Accidental Landlords alike continue to see the value in professional property management services. Our survey found that this is particularly true when it comes to collections, maintenance, leasing, regulatory compliance, financial reporting, and local market expertise.

Even though small real estate investors are seeking out property management services at higher rates, small property management companies are still under immense pressure to prove the value of their services to current and prospective clients. Our survey found that only a third of small real estate investors consistently earn a profit from their properties, and many of these rental owners are dependent on their monthly rental income to pay their mortgage and maintain their property. To keep their properties financially solvent, rental owners are cutting unnecessary costs wherever they can—and that includes questioning the value of services that cut into their rental income.

But we also found that most small real estate investors don’t have the desire or the ability to deal with every issue that pops up at their property, or to navigate the growing number of regulations with which their rentals now need to comply. As a result, more small real estate investors than ever before are turning to property managers for help; and the property management companies that can prove the tangible effect of their services on customers’ stress levels and financial health will win the game.

Trend #3: Competition in the Property Management Industry

Technology is helping small property management companies stay competitive and profitable during the labor shortage.

The rental demand and price growth that we’ve seen throughout the pandemic has made property management seem like a smart business to get into, especially for existing real estate brokerages. National firms and institutional investors have expanded into popular markets—particularly in the Sun Belt—to seize the opportunity that those appealing cities present, often acquiring local property management companies for their portfolios.

This has been particularly stressful for small property management companies, who have less room to compete on price than larger firms do. It’s their ability to provide exceptional, personalized customer service that differentiates boutique property management companies from their competitors. However, it’s incredibly challenging to maintain the same level of service for their current customers—while simultaneously taking on new clients and properties—when they’re operating with a smaller team due to the labor shortage.

It’s also challenging to stay profitable when rental property margins are tighter than ever. As a result, small property management companies are on the hunt for service offerings that can diversify their income streams—while differentiating them from the competition—by adding tangible value to renters’ and rental owners’ experiences with their business. But property management professionals also told us that technology is an equally important component of their companies’ revenue generation strategy for 2023.

How, exactly, is technology helping small property management companies bridge the gap created by the labor shortage; maintain their service quality; and improve their margins? Property management professionals told us that digitizing and automating processes in areas of the business like as leasing, collections, communication, and reporting (among others) has given them the efficiency they need to grow and run a profitable and sustainable business. In particular, respondents told us that technology has allowed their companies to:

- Take on more properties than they otherwise would have been able to

- Focus more of their energy on relationships, helping them to attract higher-quality, longer-term clients and tenants

- Get rid of their offices, allowing them to reduce their costs significantly while increasing their organization, efficiency, and consistency

- Improve team members’ enjoyment of their jobs, allowing them to spend less time on repetitive tasks so they can focus on more impactful and fulfilling work

Here are a few quotes from our respondents on how technology has made a difference in their business over the past year:

The 2023 State of the Property Management Industry Report

This post previewed just three of the many property management industry trends we delve into in our 2023 State of the Property Management Industry Report. Download your free copy of the report to dig into our intensive (yet easy-to-understand) market research, combined with the experiences of thousands of property management professionals, plus feedback from thousands of renters and rental owners. You’ll learn:

- The tools that are helping companies scale their processes as they expand their portfolios, without increasing headcount

- The strategies that small property management companies will use to win new business in a hyper-competitive, low-margin environment

- Opportunities for service-oriented property management companies to create loyal customers and surpass the competition

- The economic and demographic trends that continue to drive rental demand, and how they’re shaping property managers’ focus