All of the familiar patterns of leasing season were broken in the first half of 2020.

Chart of Accounts

Want clearer, cleaner books? What about a more useful view into your properties or just easier accounting in general?

Get the GuideIn late March, rather than searching for a new place to live, renters in many cities were hunkered down in their current homes, focused on weathering the pandemic and mass layoffs.

Conflicting signals have left property managers feeling confused and concerned about leasing demand: Will larger numbers of renters decide to stay put this year, or are they still interested in moving, but were delayed by shelter-in-place orders? What will it take to attract renters to fill vacancies—is it all about affordability now that we’re in a recession, or are some renters still drawn to amenity-rich communities? How will demand vary in primary versus secondary markets, downtown neighborhoods versus the suburbs, or single- and multifamily homes versus apartment buildings?

To answer these questions, we’ll start by taking a look at the market shifts we’ve seen during the 2020 leasing season so far.

New Lease Signings, Retention & Occupancy Rates During COVID-19: Market Update

New lease signings reached a low point in the last week of March, decreasing by 46% year over year. April saw a retention rate of 57.9%—the highest it’s been in at least two decades as renters were unwilling or unable to move. Retention was highest in Class C properties (59.7%), followed by Class B (56.4%); and was lower in Class A properties, though the retention rate of 50.6% still represented a record high.

The effects of record-high retention this spring weren’t uniformly positive for property managers and rental owners, however. The length of the average renewal lease term dropped to a six-year low of 11.3 months, reflecting property managers’ efforts to accommodate residents’ needs with short-term lease extensions. The average new lease term rose to 12.2 months as property managers offered concessions for renters willing to commit to longer lease terms. Rental revenues also fell as some property managers responded to residents’ financial difficulties by keeping rents flat for lease renewals, even for renters transitioning to short-term leases.

By late spring, as shelter-in-place orders were lifted across the country, leasing activity seemed to be picking up. In fact, in the last week of May, new lease signings had grown by 19% year over year, particularly in Sun Belt markets like Memphis, San Antonio, Fort Worth, and Virginia Beach. But behind this temporary spike in activity was pent-up demand that seemed to have been satisfied in a matter of weeks.

Overall, leasing demand in Q2 was about one-quarter of what we’d expect based on the five-year average, particularly in expensive coastal markets like New York City, San Francisco, Los Angeles, and Boston. Because a majority of leasing activity occurs during this time of year, this impact will be felt throughout 2020.

And because some residents did end up moving out once they felt it was safe to do so, the occupancy rate fell to 95.2% in May. This number is low in comparison with 2019, but it’s in keeping with the 5-year average. What’s unusual is that occupancy hasn’t dropped between March and May since the Great Recession. Residents have moved to new rentals, to homes they purchased, or to family members’ homes due to the financial crisis. As a result, New York City, Los Angeles, and San Francisco each experienced a net loss of several thousand renter households from expensive, dense downtown neighborhoods.

Overall, however, turnover is expected to remain low throughout 2020, in line with the previous recession—which is good news for property managers, though it likely means that rent growth will stay suppressed for the time being.

Leasing Demand During COVID-19: What Our Data Reveals

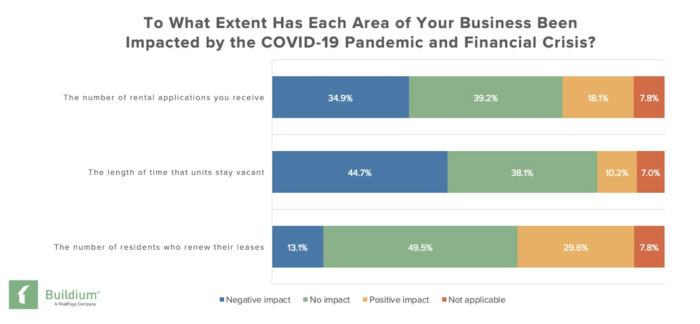

Next, we’ll look at results from our recent survey of 1,200 property managers to determine the impact that the pandemic has had on leasing demand, and the actions that property managers have taken in response. Our survey tracked three indicators: The number of rental applications property managers have received for vacant units; the rate at which their current residents are renewing their leases; and the length of time that a rental unit stays vacant.

Renewal Rates

50% of property managers say that COVID-19 has had no impact on renewal rates, while 30% say that more residents are renewing their leases, and 13% say that fewer residents are renewing their leases.

Property managers are adopting new strategies to keep residents in place. 36% of property managers said they were keeping rents flat or offering a concession upon lease renewal. 30% were extending leases that expired during shelter-in-place efforts; 23% of property managers have allowed residents to revoke their notice to move out; and 7% were staggering lease expiration dates to avoid too many move-outs at once.

Vacancy Length

45% of property managers say that COVID-19 has resulted in longer vacancies, while 38% say that it’s had no impact on the amount of time it takes to fill vacancies in their properties, and 10% say that it’s resulted in shorter vacancies.

Rental Applications

39% of property managers say that COVID-19 hasn’t impacted rental application volume in their properties, while 35% say they’re receiving fewer rental applications, and 18% say they’re receiving more than in the past.

28% of property managers are keeping rents flat on new leases or offering other concessions to attract new residents in this time.

Our analysis of how leasing demand differs in 2020 continues in our report.

We dig into how property managers’ use of technology has changed as leasing operations have gone virtual, and how different property types have been differentially impacted by COVID-19 and the recession. You can download your free copy of the report here.

Read more on Leasing